Belgium Intrastat

You can use the Intrastat page to generate and report information about trade among European Union (EU) countries/regions. The Belgium Intrastat declaration contains information about the trade of goods for reporting.

The following fields are included in the Belgium Intrastat declaration.

| Field on the Intrastat declaration | Corresponding field on the Intrastat journal page | Description | Arrivals | Dispatches |

|---|---|---|---|---|

| EXTRF | Direction | The record type.

|

X | X |

| EXCNT | Country/region (in the Dispatch/destination section) | The International Organization for Standardization (ISO) code for the country or region of the partner (counterparty). | X | X |

| EXTTA | Transaction code (in the Codes section) | The code that indicates the nature of the transaction. Companies in Belgium use two-digit transaction codes. | X | X |

| EXREG | No corresponding field | The state/province code in the main address of the legal entity. | X | X |

| EXTGO | Commodity (in the Codes section) | The commodity code, which is an eight-digit Intrastat nomenclature code. | X | X |

| EXWEIGHT | Weight (in the Data section) | The net mass in kilograms. The unit itself ("kg") isn't printed. | X | X |

| EXUNITS | Quantity of additional units (in the Unit section) | For some commodities, you must report the supplementary unit. The unit itself (for example, "pairs" or "dozens") isn't reported. | X | X |

| EXTXVAL | Invoice value (in the Invoice value section) | The invoice value in euros. | X | X |

| EXCNTORI | Country/region of origin (in the Country/region of origin section) | The ISO code of the country or region where the commodities were produced or manufactured. | Not applicable | X |

| PERTNERID | Tax exempt number (in the General section) | The customer's foreign value-added tax (VAT) number in an EU member state. | Not applicable | X |

For declarations that exceed the total limit that has been set by the authorities, an extended report should be declared that includes the following additional fields.

| File field name | Intrastat journal field | Description | Arrivals | Dispatches |

|---|---|---|---|---|

| EXTPC | Transport (in the Codes section) | The Intrastat code for the transport mode. | X | X |

| EXDELTRM | Delivery terms (in the Codes section) | The Intrastat code for the delivery terms. | X | X |

For more information, go to www.intrastat.be.

Set up Intrastat

Import Electronic reporting configurations

To set up Intrastat, import the latest version of the following Electronic reporting (ER) configurations:

- Intrastat model

- Intrastat report

- Intrastat (BE)

For more information, see Download ER configurations from the Global repository of Configuration service.

Set up foreign trade parameters

- In Microsoft Dynamics 365 Finance, go to Tax > Setup > Foreign trade > Foreign trade parameters.

- On the Intrastat tab, on the Electronic reporting FastTab, in the File format mapping field, select Intrastat (BE)

- In the Report format mapping field, select Intrastat report.

- On the Commodity code hierarchy FastTab, in the Category hierarchy field, select Intrastat.

- In the Transaction code field, select the transaction code for property transfers. You use this code for transactions that produce actual or planned transfers of property against compensation (financial or otherwise). You also use it for corrections. Belgium companies use two-digit transaction codes. For more information, see Intrastat - Info.

- In the Credit note field, select the transaction code for the return of goods.

- On the Country/region properties tab, in the Country/region field, list all the countries or regions that your company does business with. For each country that is part of the EU, select EU in the Country/region type field, so that the country appears on your Intrastat report.

- On the Number sequences FastTab, set the number sequences for the Intrastat archive ID and XML file number references.

Set up an address format

To set up an address format that includes state or province information, follow these steps.

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the Address format tab, select New to create new address format. To update an existing format, select it in the grid.

- In the Configure address component section, select Add.

- In the Address application object field, select State/province. Then activate the corresponding box in the New line column.

- Add the address objects that are required by the authorities.

- On the Country/region tab, in the grid, select BEL.

- In the Address format field, select the address format that you created earlier.

Set up province Intrastat codes

Go to Organization administration > Global address book > Addresses > Address setup.

On the State/province tab, create regions for Belgium. Here are some examples.

Region Intrastat code Flemish region 1 Walloon region 2 Brussels region 3

Set up the product parameters for the Intrastat declaration

- Go to Product information management > Products > Released products.

- In the grid, select a product.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select a commodity code.

- In the Origin section, in the Country/region field, select the product's country or region of origin.

- On the Manage inventory FastTab, in the Net weight field, enter the product's weight in kilograms.

Set up the transport method and mode of delivery

Set up transport codes.

- Go to Tax > Setup > Foreign trade > Transport method.

- On the Action Pane, select New.

- In the Transport field, enter a unique code. Belgium companies use one-digit transport codes.

Set up mode of delivery Intrastat codes.

- Go to Procurement and sourcing > Setup > Distribution > Terms of delivery.

- In the grid, select a set of terms of delivery.

- On the General FastTab, in the Intrastat code field, enter a unique code.

Go to Tax > Setup > Foreign trade > Compression of Intrastat, and select the fields that should be compared when Intrastat information is summarized. For Belgium Intrastat, select the following fields:

- Commodity

- Transaction code

- Country of origin/destination

- State

- Country/region of origin

- Direction

- Country/region

- Country/region of sender

- Transport

- Delivery terms

- Correction

- Invoice

Set up the VAT number of the trading partner

- Go to Accounts receivable > Customers > All customers.

- In the grid, select a customer.

- On the Action Pane, on the Customer tab, in the Registration group, select Registration IDs.

- On the Registration ID FastTab, select Add to create a registration ID.

- In the Registration type field, select VATID.

- In the Registration number field, enter the company's VAT number.

- On the Action Pane, select Save. Then close the page.

- On the customer's page, on the Invoice and delivery FastTab, in the Sales tax section, in the Tax exempt number field, select the registration ID that you created earlier.

For more information about registration IDs, see Registration IDs.

Intrastat transfer

On the Intrastat page, on the Action Pane, you can select Transfer to automatically transfer the information about intracommunity trade from your sales orders, free text invoices, purchase orders, vendor invoices, vendor product receipts, project invoices, and transfer orders. Only documents that have an EU country as the country or region of destination (for dispatches) or consignment (for arrivals) will be transferred.

Alternatively, you can manually enter transactions by selecting New on the Action Pane.

Generate an Intrastat report

- Go to Tax > Declarations > Foreign trade > Intrastat.

- On the Action Pane, select Output > Report.

- In the Intrastat Report dialog box, enter the start and end dates for the report.

- Set the Generate file option to Yes to generate a .xml file, and then enter the name of the .xml file for the Intrastat report.

- Set the Generate report option to Yes to generate an .xlsx file, and then enter a name for the file.

- In the Direction field, select Arrivals if the report is about intracommunity arrivals, Dispatches if the report is about intracommunity dispatches, or Both if the report combines information about intracommunity arrivals and dispatches.

- In the File format mapping section, in the Declaration type field, select Replace for an original declaration and for corrections that should overwrite the information that has already been reported for the selected reporting period. Select Append for corrections that should be added to the information that has already been reported in the reporting period.

- In the Email field, enter your email address. The response will be sent to this address.

- In the Reporting date field, select the report creation date and time.

- In the Language field, enter nld, fra, or deu to indicate the language for the response.

- Set the Extended report option to Yes to generate the extended report if the report's totals exceed the total limit that has been set by the authorities.

- Select OK, and review the generated reports.

Review an Intrastat archive

On the Action Pane, select Intrastat archive, and then select the report.

Select the General tab to view the file information.

Field Description Intrastat archive ID The unique sequence number for the Intrastat report. File name The name that the user specified for the Intrastat file report. Created date and time The date and time when the Intrastat declaration was created. Number of lines The total number of lines on the Intrastat report. Extended reporting A value of Yes indicates that the user set the Extended report option to Yes when they created the Intrastat report. User ID The unique ID of the user who created the Intrastat report. On the Action Pane, select Details to review the lines for the selected Intrastat report.

Example

The following example shows how to set up Belgium Intrastat and create the Intrastat report. It uses the DEMF legal entity.

Go to Organization administration > Organization > Legal entities, and select the DEMF legal entity.

On the Addresses FastTab, select Edit.

In the Country/region field, select BEL (Belgium).

Import the latest version of the following ER configurations:

- Intrastat model

- Intrastat report

- Intrastat (BE)

Set up an address format

To set up an address format that includes county information, follow these steps.

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the Address format tab, in the grid, select 0001.

- In the Configure address component section, verify that the Address application object field is set to State or province, and the corresponding box in the New line column is activated.

- On the Country/region tab, in the grid, select BEL.

- In the Address format field, select 0001.

Set up state/province Intrastat codes

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the State/province tab, select New.

- In the Country/region field, select BEL.

- In the State field, enter Brussels.

- In the Intrastat code field, enter 3.

- Go to Organization administration > Organization > Legal entities, and select the DEMF legal entity.

- On the Addresses FastTab, select Edit.

- In the State field, select Brussels. The code for this state/province will be printed in the Code of region of origin/destination section of the Intrastat report.

Set up posting journals

- Go to General ledger > Journal setup > Posting journals.

- On the Action Pane, select Create.

Set up foreign trade parameters

- Go to Tax > Setup > Foreign trade > Foreign trade parameters.

- On the Intrastat tab, on the General FastTab, in the Transaction code field, select 11.

- On the Electronic reporting FastTab, in the File format mapping field, select Intrastat (BE).

- In the Report format mapping field, select Intrastat Report.

- On the Commodity code hierarchy FastTab, verify that the Category hierarchy field is set to Intrastat.

- On the Country/region properties tab, select New.

- In the Party country/region field, select BEL. Then, in the Country/region type field, select Domestic.

- In the Party country/region field, select DEU (Germany). Then, in the Country/region type field, select EU.

Set up product information

- Go to Product information management > Products > Released products.

- In the grid, select D0001.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select 100 200 30.

- In the Origin section, in the Country/region field, select BEL.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 2.

- On the Action Pane, select Save.

- In the grid, select D0003.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select 100 200 30.

- In the Origin section, in the Country/region field, select DEU.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 5.

- On the Action Pane, select Save.

Change the site address

- Go to Warehouse management > Setup > Warehouse > Sites.

- In the grid, select 1.

- On the Addresses FastTab, select Edit.

- In the Edit address dialog box, in the Country/region field, select BEL.

- Select OK to close the Edit address dialog box.

Set up a transport method

Create a new transport method.

- Go to Tax > Setup > Foreign trade > Transport method.

- On the Action Pane, select New.

- In the Transport field, enter 3.

- In the Description field, enter Road transport.

Assign the transport method to the mode of delivery. In this way, you set up the default values that are used for the transport method when the corresponding mode of delivery is selected.

- Go to Procurement and sourcing > Setup > Distribution > Modes of delivery.

- In the grid, select 10.

- On the Foreign trade FastTab, in the Transport field, select 3.

Select the default mode of delivery for a customer.

- Go to Accounts receivable > Customers > All customers.

- In the grid, select DE-016.

- On the Invoice and delivery FastTab, in the Mode of delivery field, select 10.

Select the default mode of delivery for a vendor.

- Go to Accounts payable > Vendors > All vendors.

- In the grid, select DE-001.

- On the Invoice and delivery FastTab, in the Mode of delivery field, select 10.

Set up codes for terms of delivery

Set up the Intrastat code for the terms of delivery.

- Go to Procurement and sourcing > Setup > Distribution > Terms of delivery.

- In the grid, select CIF.

- On the General FastTab, in the Intrastat code field, enter CIF.

Select the default delivery terms for a customer.

- Go to Accounts receivable > Customers > All customers.

- In the grid, select DE-016.

- On the Invoice and delivery FastTab, in the Delivery terms field, select CIF.

Select the default delivery terms for a vendor.

- Go to Accounts payable > Vendors > All vendors.

- In the grid, select DE-001.

- On the Invoice and delivery FastTab, in the Delivery terms field, select CIF.

Verify the EU customer's tax-exempt number code

- Go to Accounts receivable > Customers > All customers.

- In the grid, select DE-016.

- On the Invoice and delivery FastTab, in the Sales tax section, verify that the Tax exempt number field is set to DE9012.

Create a sales order with an EU customer

- Go to Accounts receivable > Orders > All sales orders.

- On the Action Pane, select New.

- In the Create sales order dialog box, on the Customer FastTab, in the Customer section, in the Customer account field, select DE-016.

- On the General FastTab, in the Storage dimensions section, in the Site field, select 1.

- In the Warehouse field, select 11.

- On the Address tab, verify that the Address field is set to Teichgasse 12, Kiel, 24103, DEU, because the vendor is from Germany.

- Select OK.

- On the Header tab, on the Delivery FastTab, verify that the Delivery terms field is set to CIF.

- On the Lines tab, on the Sales order lines FastTab, in the Item number field, select D0001. Then, in the Quantity field, enter 8.

- On the Line details FastTab, on the Foreign trade tab, verify that the Transaction code field is set to 11, the Transport field is set to 3, the Commodity field is set to 100 200 30, and the Country/region of origin field is set to BEL.

- On the Action Pane, select Save.

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Posting invoice dialog box, on the Parameters FastTab, in the Parameter section, in the Quantity field, select All.

- Select OK to post the invoice.

Transfer the transaction to the Intrastat journal and review the result

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, in the Parameters section, set the Customer invoice option to Yes.

Select Filter.

In the Intrastat Filter dialog box, on the Range tab, select the first line, and verify that the Field field is set to Date.

In the Criteria field, select the current date.

Select OK to close the Intrastat Filter dialog box.

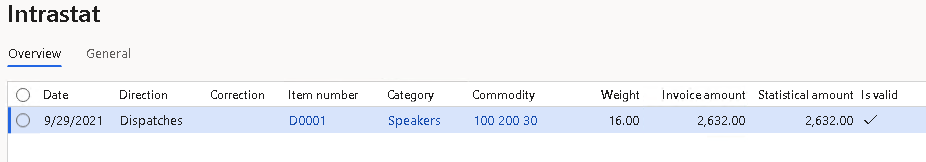

Select OK to close the Intrastat (Transfer) dialog box, and review the result. The line represents the sales order that you created earlier.

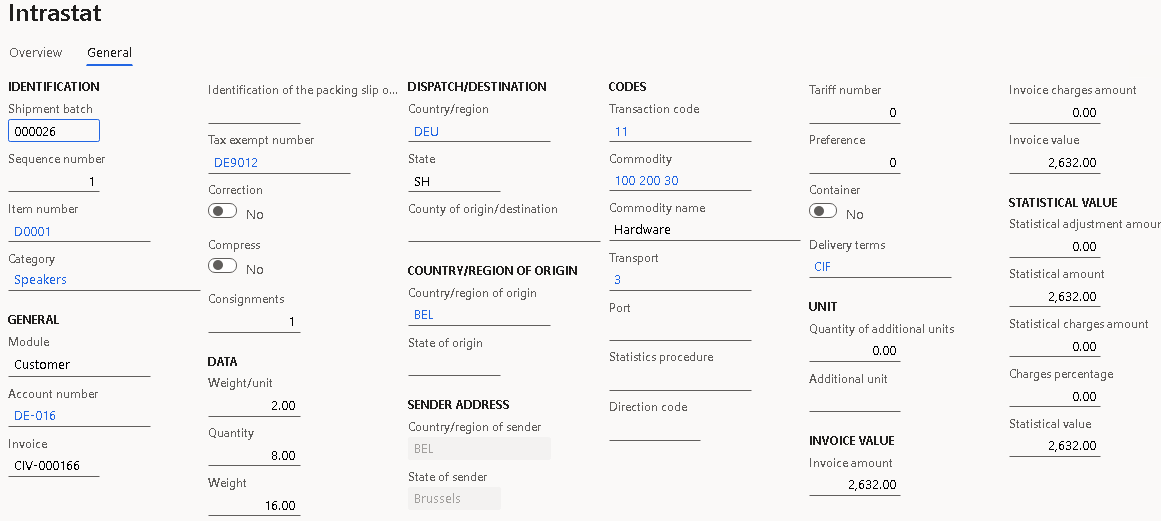

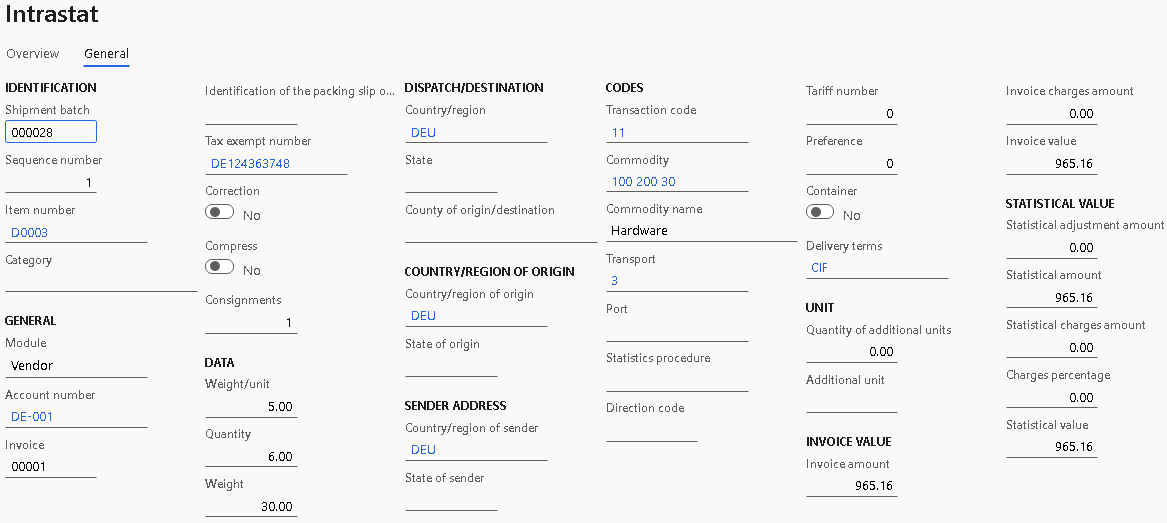

Select the transaction line, and then select the General tab to view more details.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, on the Parameters FastTab, in the Date section, select the month of the sales order that you created.

In the Export options section, set the Generate file option to Yes. Then, in the File name field, enter the required name.

Set the Generate report option to Yes. Then, in the Report file name field, enter the required name.

In the Direction field, select Dispatches.

Set the Extended report option to Yes.

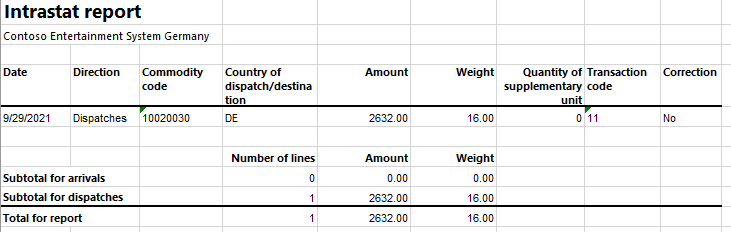

Select OK, and review the report in text format that is generated. The following table shows the values in the example report.

Record type Partner country/region Transaction code Code of region of origin/destination Commodity codes Net mass Invoice value Country/region of origin Customer's VAT number Mode of transport Delivery terms 29 DE 11 3 10020030 16 2632 BE DE9012 3 CIF

Note

The Code of region of origin/destination field is set to the Intrastat code of the state or province in the main address of the legal entity. In this example, the code 3 represents the Brussels state/province.

Review the generated report file.

Create a purchase order

- Go to Accounts payable > Purchase orders > All purchase orders.

- On the Action Pane, select New.

- In the Create purchase order dialog box, in the Vendor account field, select DE-001.

- In the Site field, select 1.

- In the Warehouse field, select 11.

- Select OK.

- On the Header Tab, on the Delivery FastTab, verify that the Mode of delivery field is set to 10, and the Delivery terms field is set to CIF.

- On the Lines tab, on the Purchase order lines FastTab, in the Item number field, select D0003. Then, in the Quantity field, enter 6.

- On the Line details FastTab, on the Foreign trade tab, verify that the Transaction code is set to 11, the Transport field is set to 3, the Commodity field is set to 100 200 30, and the Country/region of origin field is set to DEU.

- On the Action Pane, on the Purchase tab, in the Actions group, select Confirm.

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- On the Action Pane, select Default from. In the Default quantity for lines field, select Ordered quantity. Then select OK.

- On the Vendor Invoice header FastTab, in the Invoice identification section, in the Number field, enter 00001.

- On the Action Pane, select Post to post the invoice.

Create an Intrastat declaration for arrivals

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, set the Vendor invoice option to Yes.

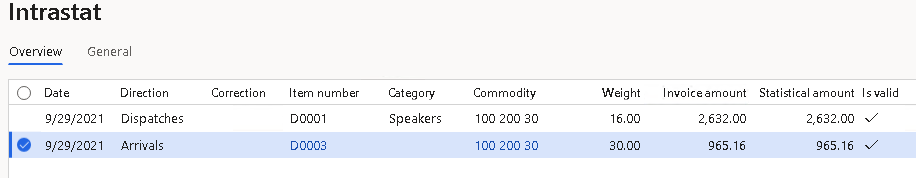

Select OK to transfer the transactions, and review the Intrastat journal.

Review the General tab for the purchase order.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, on the Parameters FastTab, in the Date section, select the month of the purchase order that you created.

In the Export options section, set the Generate file option to Yes. Then, in the File name field, enter the required name.

Set the Generate report option to Yes. Then, in the Report file name field, enter the required name.

In the Direction field, select Arrivals.

Set the Extended report option to Yes.

Select OK, and review the report in text format that is generated. The following table shows the values in the example report.

Record type Partner country/region Transaction code Code of region of origin/destination Commodity codes Net mass Invoice value Mode of transport Delivery terms 19 DE 11 3 10020030 30 965 3 CIF

Note

The Code of region of origin/destination field is set to the Intrastat code of the state or province in the main address of the legal entity. In this example, the code 3 represents the Brussels state/province.

Review the generated Excel report.

反馈

即将发布:在整个 2024 年,我们将逐步淘汰作为内容反馈机制的“GitHub 问题”,并将其取代为新的反馈系统。 有关详细信息,请参阅:https://aka.ms/ContentUserFeedback。

提交和查看相关反馈