Tax invoice for goods delivered for free

This article describes how to manage goods that were delivered free of charge. The functionality that is available through the Tax invoice for goods delivered for free feature lets you generate invoices that include the words "Free invoice." The total of these invoices equals the tax amount only.

To generate these invoices, set up delivery reasons that can be used in the sales order.

These invoices can be used in two cases, depending on who pays the taxes on the items:

- Your company pays the sales tax, and the system generates a self-invoice and accounting entries for the payment.

- The customer pays the sales tax.

The delivery reason on the invoice determines which case you use.

Prerequisites

- The primary address of the legal entity must be in Italy.

- In the Feature management workspace, turn on the Tax invoice for goods delivered for free feature. For more information, see Feature management overview.

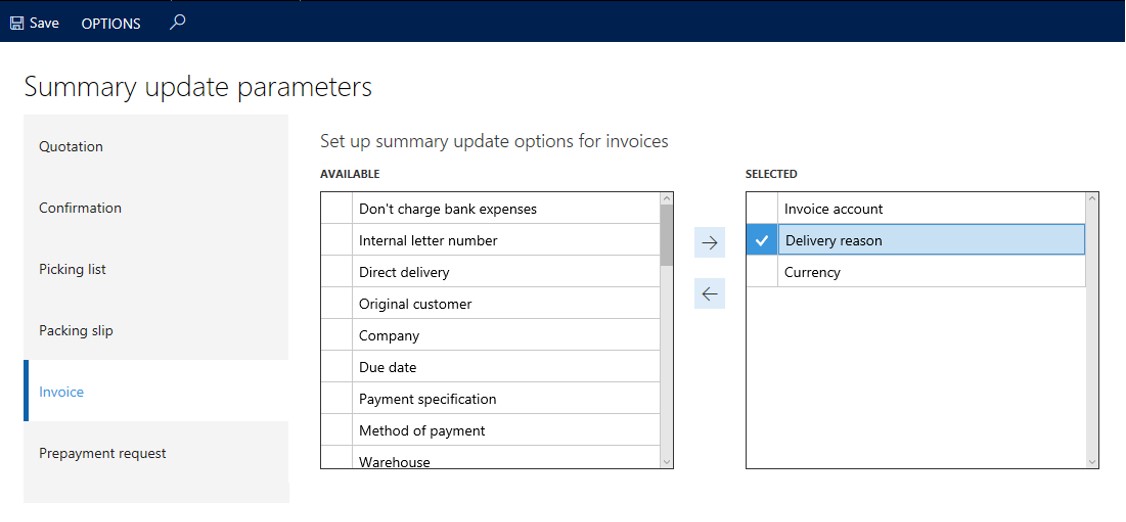

Set up the summary update parameters

You can set up the summary update parameters only if a delivery reason is available for both the packing slip and the invoice.

- Go to Accounts receivable > Setup > Accounts receivable parameters.

- On the Summary update tab, select Summary update parameters.

- The Delivery reason summary update parameter must be selected for both packing slips and invoices. On the Invoice tab, in the Available list, select Delivery reason.

- Select the right arrow button to move Delivery reason to the Selected list. Repeat this step on the Packing slip tab.

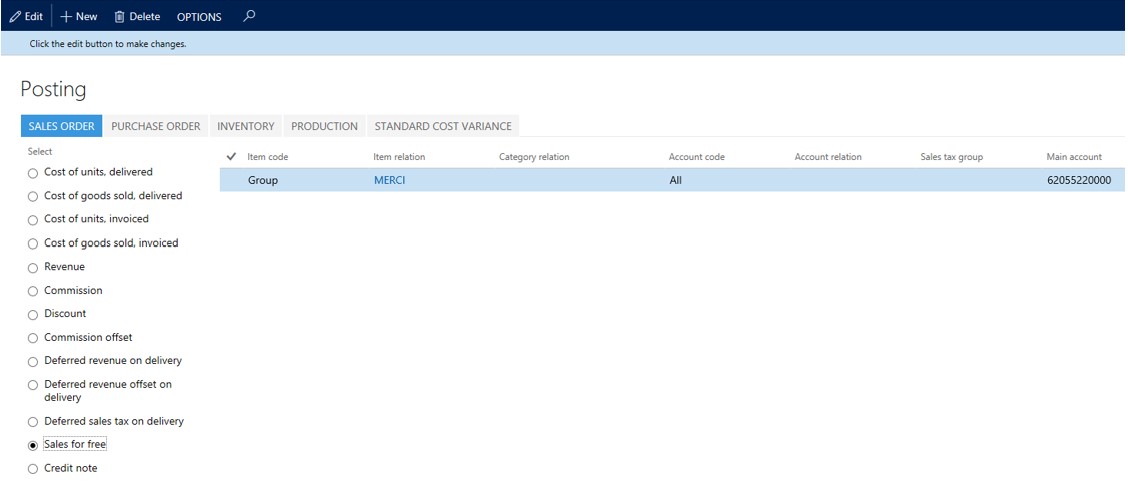

Set up a Sales for free account

Follow these steps to set up the accounting account for free sales.

- Go to Inventory management > Setup > Posting > Posting.

- Select the Sales for free option.

- Set up the main account by selecting the required relations and account codes.

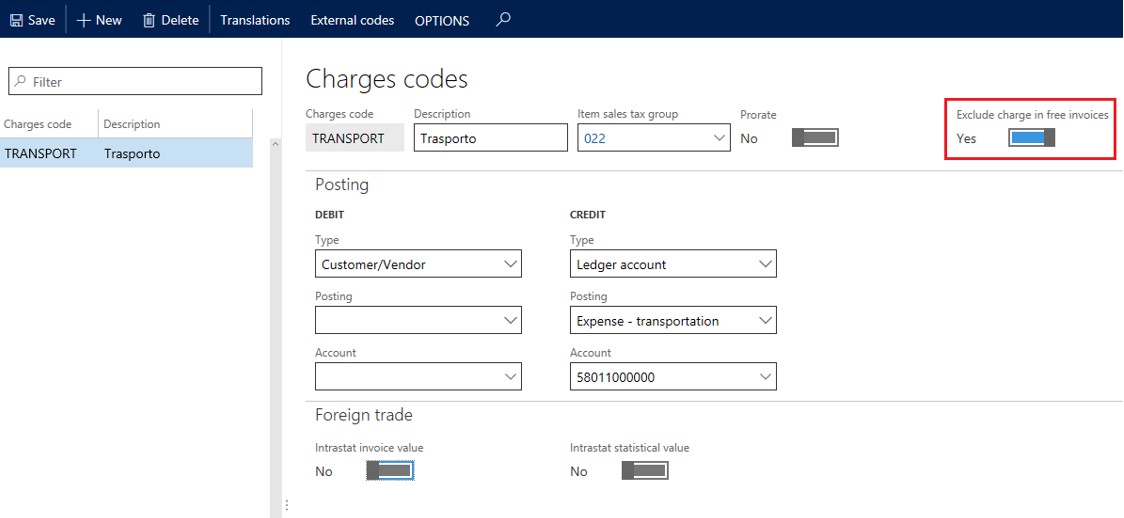

Set up miscellaneous charges

Miscellaneous charges aren't always required or wanted when free sales invoices are issued. Follow these steps to exclude miscellaneous charges when they are automatically generated.

- Go to Accounts receivable > Charges setup > Charges code.

- Create or select an existing charges code.

- Set the Exclude charge in free invoices option to Yes.

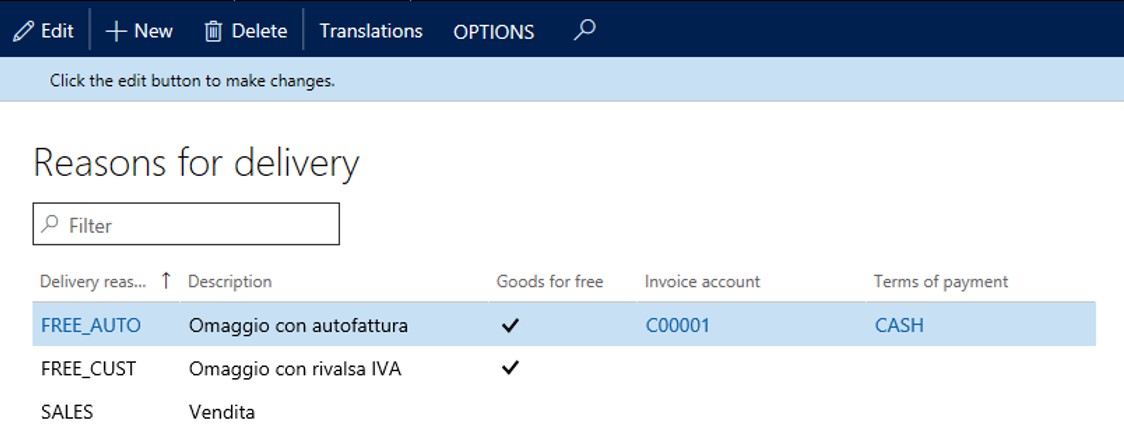

Set up delivery reasons

- Go to Sales and marketing > Setup > Distribution > Reasons for delivery.

- Select the Goods for free check box.

- In the Invoice account field, select the customer account that represents your company.

- In the Terms of payment field, specify cash terms of payment.

Note

The company issues a self-invoice to account for required taxes for goods that are delivered for free. In addition to the invoice posting, the accounting entries for the payment must be generated. To make that process available, you must have a customer account that represents your company. In this case, the invoice account on a sales order will be set to the company customer account by default. Therefore, the invoice that is issued will be a self-invoice. When you specify cash term of payments, the payment occurs in addition to the self-invoice. Finally, the customer transaction is closed, and the amount is posted to the cash account that is specified in the Terms of payment field. This field will be also set by default on a sales order header.

If your customer pays the taxes, the Invoice account and Terms of payment fields must be left blank.

Posting tax invoices for goods delivered for free

When you create a sales order for goods that are delivered for free, the specified delivery reason determines whether a self-invoice is generated for your company, or whether an invoice is generated for your customer. If you use cash terms of payment, payment accounting entries will also be created when you post the sales invoice.

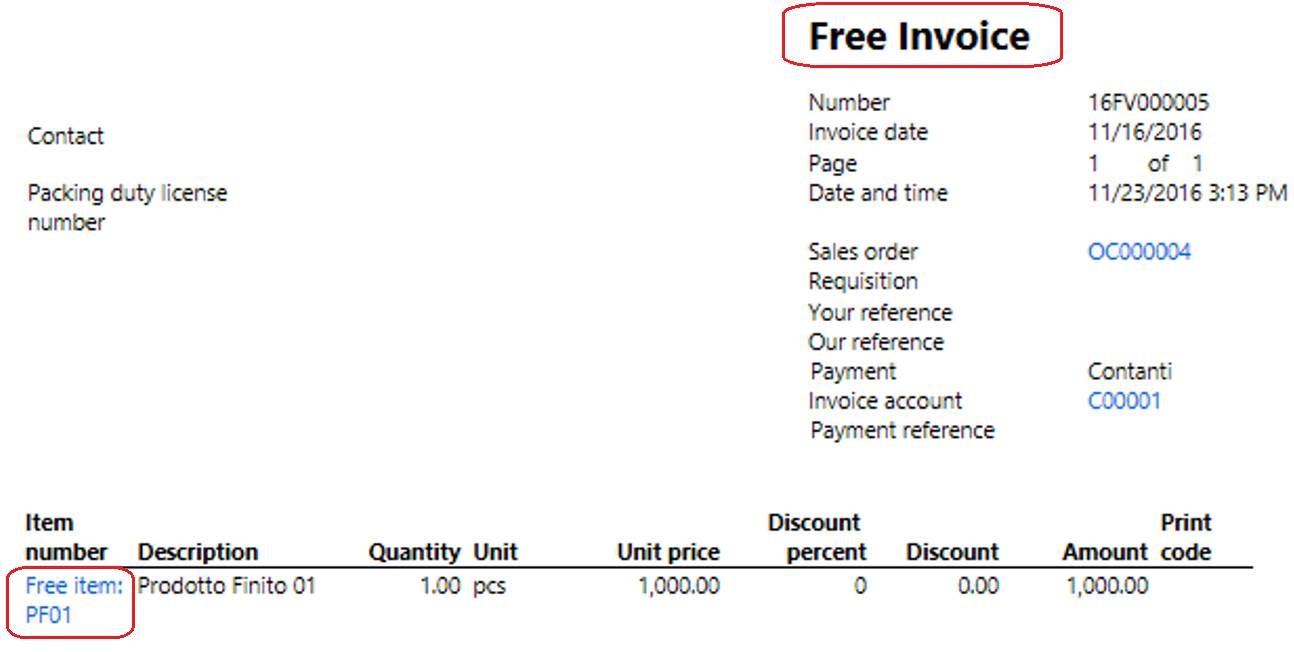

Printing tax invoices for goods delivered for free

The invoice printout will show the title Free invoice. Additionally, items will be prefixed with Free item: if the Goods for free flag is active on the delivery reason that is used for the order.