Deliver differentiated customer experiences

The Microsoft Cloud for Financial Services offers a comprehensive reference architecture that caters to the needs of multiple personas within financial institutions, including relationship managers, customer service representatives, and loan specialists.

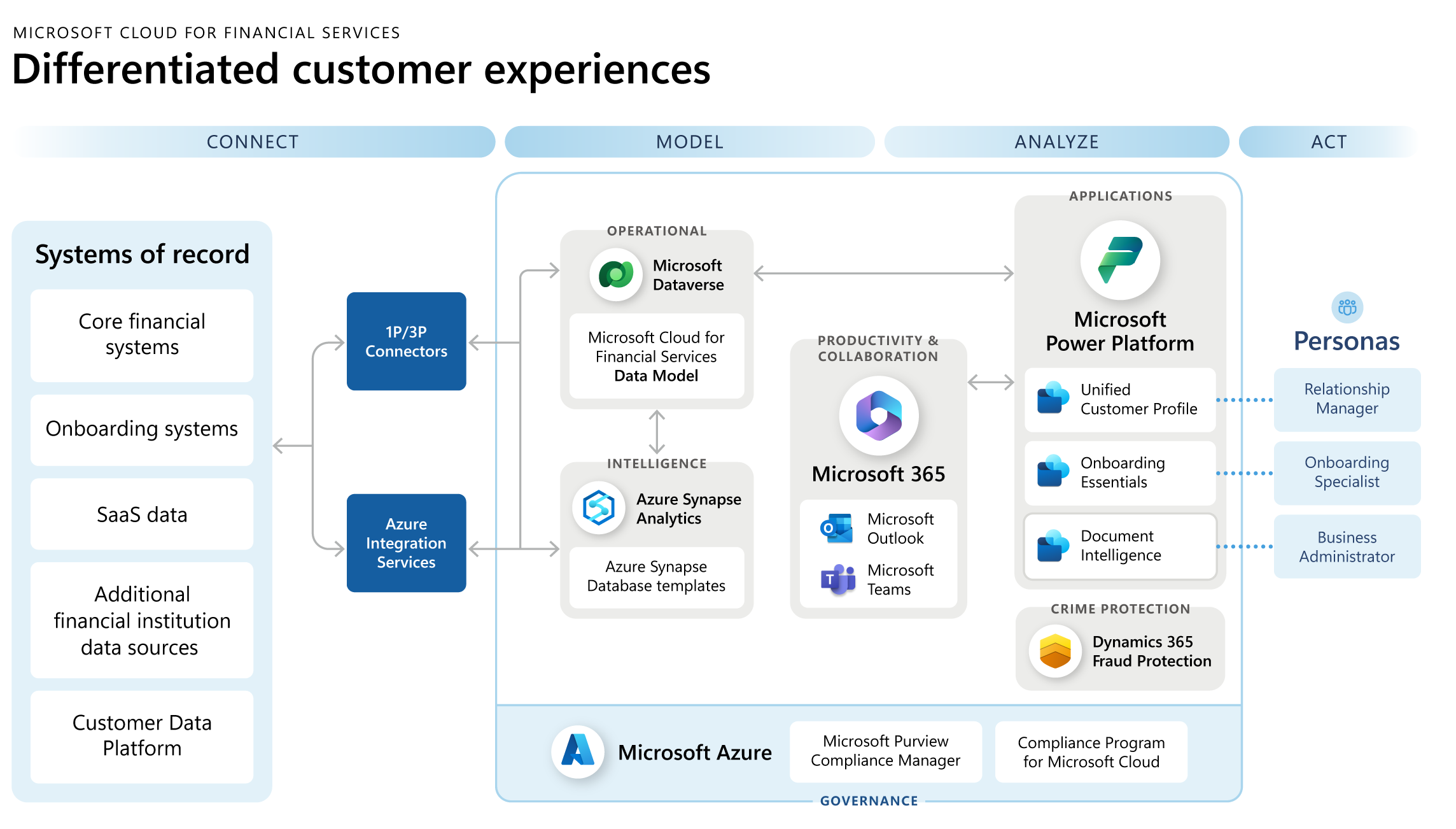

The following reference architecture depicts the four interconnected stages: Connect, Model, Analyze, and Act, each designed to empower users and deliver seamless customer experiences.

Download a printable PDF of this diagram.

Stage 1: Connect

In the Connect stage, the architecture describes how the Microsoft Cloud for FSI allows the establishment of robust connections with various systems of record. This includes Core Banking, Loan Management Systems, Policy Admin Systems, and other data sources. Financial institutions can access data from these systems in real time by applying a combination of first-party (1P) and third-party (3P) connectors, APIs, and Azure data integration services. This step ensures that all stakeholders, such as relationship managers and onboarding specialists, have a unified and up-to-date view of customer data and interactions.

Stage 2: Model

The Model stage focuses on creating a holistic view of customers by modeling its data elements using Microsoft Cloud for Financial Services data models. This integrated approach enables relationship managers and customer service representatives to gain valuable insights into customer preferences, behavior, and financial needs. By having a single source of truth, financial institutions can enhance their ability to deliver personalized and targeted services to customers.

Stage 3: Analyze

In the Analyze stage, the architecture describes how our Microsoft Cloud for FSI offering allows customers and partners to apply advanced analytics to generate a 360-degree view of customers. This stage uses built-in configurable industry specific PCF controls, presenting their holdings and connections comprehensively. The architecture is also extensible to support custom business intelligence scenarios with the use of built-in Azure Synapse templates.

Using data visualization tools and AI-driven insights, financial institutions can understand customers' financial health, identify potential opportunities for cross-selling or up-selling, and detect patterns that aid in predicting customer behavior. This valuable information empowers relationship managers and loan specialists to make data-driven decisions, ultimately fostering stronger customer relationships.

Stage 4: Act

In the Act stage, the architecture describes how the Microsoft Cloud for FSI combined with Microsoft’s horizontal offerings and end-user experiences equips advisors with the tools they need to take meaningful actions and collaborate based on the insights gathered during the previous stages. The platform provides first-party starter apps and building blocks, such as customer onboarding and banking engagement solutions, which streamline and facilitate customer interactions.

Relationship managers can use these applications to efficiently onboard new customers, collaborate with internal teams using the native integration with Outlook and Teams, and provide personalized financial advice. The Act stage's seamless integration with the earlier stages ensures that the actions taken are well-informed and aligned with the customer's financial journey.

Leverage fraud protection, security, and compliance

To ensure the highest level of security and compliance, the Microsoft Cloud for Financial Services integrates with robust fraud protection, security, and compliance capabilities. Advanced technologies like artificial intelligence (AI), robotic process automation (RPA), and natural language processing (NLP) enhance financial crime protection w/o infringing on productivity.

Leading edge 3P solutions use Microsoft technology significantly reduce false positives while safeguarding both, customers and financial institutions from potential threats. The described architecture also adheres to industry-leading security practices that enables secure data storage, data access controls, and encryption to protect sensitive customer information.

Furthermore, Microsoft compliance offerings assist financial institutions in navigating the complex regulatory landscape. With a focus on regulatory and compliance data management, these offerings help institutions to stay ahead of changing regulatory requirements. Proactively addressing compliance challenges allows financial institutions to address compliance risks and to strengthen their risk management posture while improving overall operational efficiency.

In conclusion, the Microsoft Cloud for Financial Services reference architecture seamlessly integrates the Connect, Model, Analyze, and Act stages to empower multiple personas within financial institutions. By providing a sound foundation for advanced analytics, personalized applications, and cutting-edge security, the platform enables relationship managers, customer service representatives, and loan specialists to deliver exceptional customer experiences, drive business growth, and uphold the highest standards of security and compliance.

Next steps

For more information, see: