Use salvage value

Salvage value represents the residual value of a fixed asset when it can no longer be used. You can post the salvage value of an asset from a purchase invoice or from the FA journal when you post the acquisition cost.

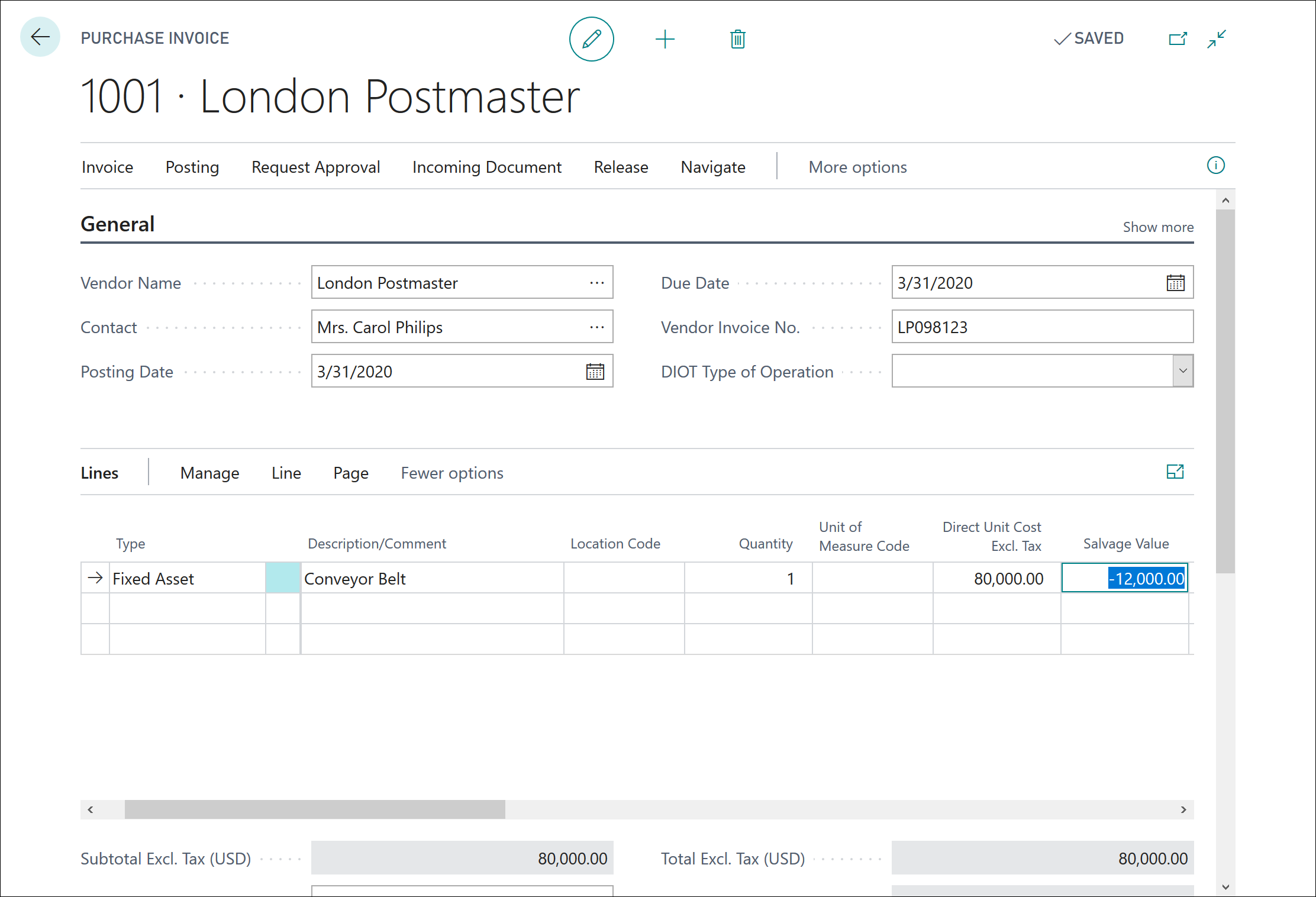

To post salvage value from a purchase invoice, add the Salvage Value field to the Purchase Invoice Lines FastTab in the development environment.

Enter the salvage value in the field as a negative amount, and then post the invoice as usual.

The salvage value reduces the depreciation base and therefore reduces all depreciation amounts. The final rounding amount reduces only the last depreciation amount. For example, a fixed asset costs USD 4,800 today. After four years of use, its salvage value is defined as 800. When you use the Straight-line depreciation method for calculating depreciation, this asset is depreciated at 1,000 each year. If no salvage value existed, the depreciation would be 1,200 for each year rather than 1,000. Therefore, the salvage value has caused a reduction in the yearly depreciation of 200 each year.

You can calculate depreciation below the book value of zero. To accomplish this task, select the Allow Depr. below Zero check box in the depreciation book.

This approach enables the Calculate Depreciation batch job to continue calculating depreciation, even if the book value of a fixed asset is zero or below zero.

To calculate depreciation below zero, set the values for the specific fields in the individual FA depreciation books, such as Depr. below Zero % or Fixed Depr. Amount below Zero.

When you reach the period where the book value is slightly above zero, and you want to calculate depreciation for the period so that the system can depreciate below zero, be aware that Business Central can't calculate the depreciation from book value above zero to book value below zero in one step. Instead, you need to run the Calculate Deprecation batch job twice. The system can calculate depreciation only from above zero to zero or from zero to below zero.

For example, an asset has a book value of 800 and you want to calculate depreciation below zero:

In the FA depreciation book for the asset, in the Fixed Depr. Amount below Zero field, enter 1000.

Run the Calculate Depreciation batch job for the asset. The program calculates the depreciation as 800, which makes the book value zero.

Run the Calculate Depreciation batch job for the asset for the next period. The program calculates the depreciation as 1,000, which makes the book value -1,000.