Purchase Order Processing Part 3: Receipts

This part of the documentation explains how to enter and manage receipts. The data entry windows were designed to resemble actual receipt documents, with vendor, line item, and totals information. Receipts can be saved, edited if necessary, and then posted so that they become part of your permanent accounting records. Posting receipts also updates inventory quantities. If your system includes General Ledger, you can update the balances of your posting accounts, as well.

Following is a list of topics that are discussed:

Chapter 12, "Receipt batches," explains how to use batches to group purchasing documents for posting.

Chapter 13, "Shipment and in-transit inventory receipt entry," describes how to enter shipment, shipment/invoice, and in-transit inventory receipts.

Chapter 14, "Shipment receipt entry for projects," describes how to enter shipment and shipment/invoice receipts for projects.

Chapter 15, "Shipment receipt detail entry," describes how to enter detailed information about a document, line item, or other elements of a transaction.

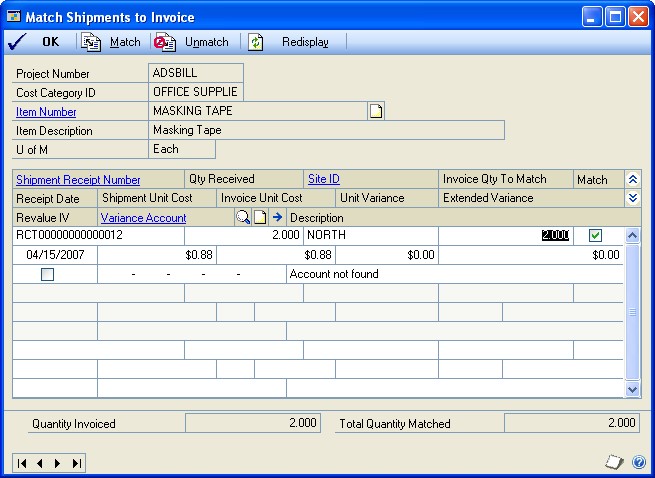

Chapter 16, "Invoice receipt entry," explains how to enter invoice receipts and match them to shipment receipts.

Chapter 17, "Invoice receipt entry for projects," explains how to enter invoice receipts and match them to shipment receipts for projects.

Chapter 18, "Invoice receipt detail entry," describes how to enter detailed information about a document, or other elements of a transaction.

Chapter 19, "Landed costs for receipts," describes how to enter, apportion, and match landed costs.

Chapter 20, "Taxes for receipts," explains how tax is calculated, modified, and distributed for receipts.

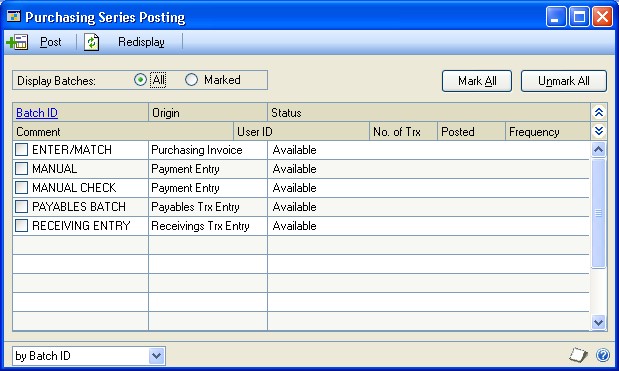

Chapter 21, "Receipt posting," describes the methods of posting transactions in Purchase Order Processing.

Chapter 22, "Receipt maintenance," includes procedures for correcting, deleting, and voiding shipment, in-transit inventory, and invoice receipts.

Chapter 12: Receipt batches

All receipt document types can be entered in a batch. Batches are groups of transactions, identified by a name or a number, that are used for identification purposes and to make the posting process easier. You can enter receipts in batches to group similar transactions during data entry and review them before posting at a later time. Batches can be identified as a group of transactions entered by a specific employee, or a group of transactions entered on a particular date.

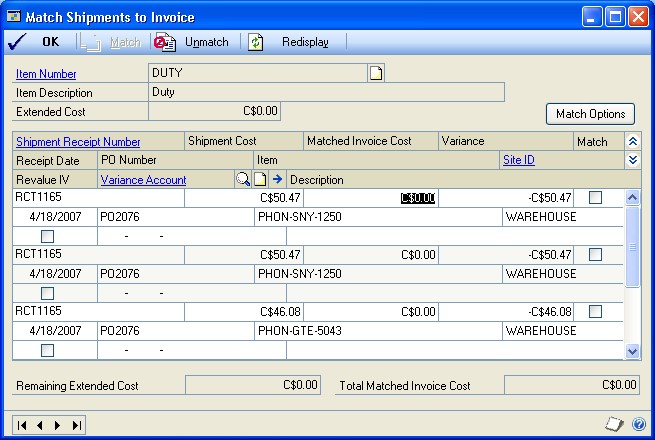

To post invoice receipts in a batch if you are using vendor approval workflow, the vendors assigned to invoice receipts must have the workflow status of Approved or No Approval Needed. If you post a batch and a vendor isn't approved, invoice receipts for that vendor aren't posted and remain in the batch. For more information about vendor approval workflow, see Vendor approval workflow.

This information is divided into the following sections:

Using batches to group receipts

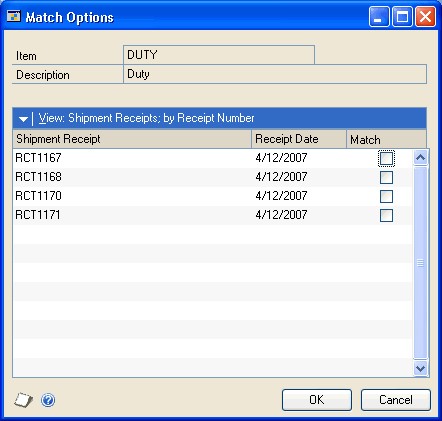

Creating a receipt batch

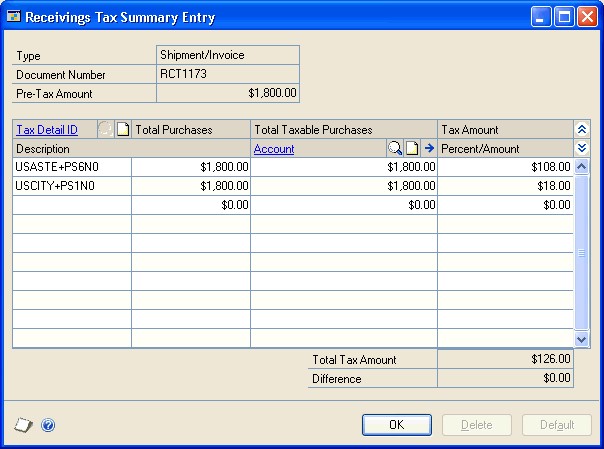

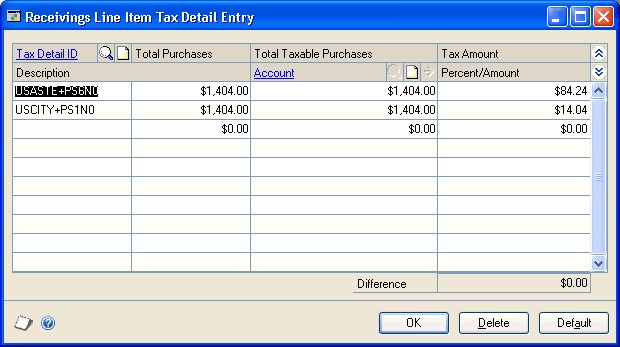

Modifying or deleting a batch

Using batches to group receipts

Receipts can be entered individually or in batches. Individual transactions are entered and posted immediately, so your records are always up to date. You can't print edit lists for transactions that aren't entered in a batch. Batches can be used to group and save transactions, which allows you to review the transactions and make corrections before they're posted. More than one person can enter transactions in the same batch; however, a batch can't be posted if anyone is making changes to it.

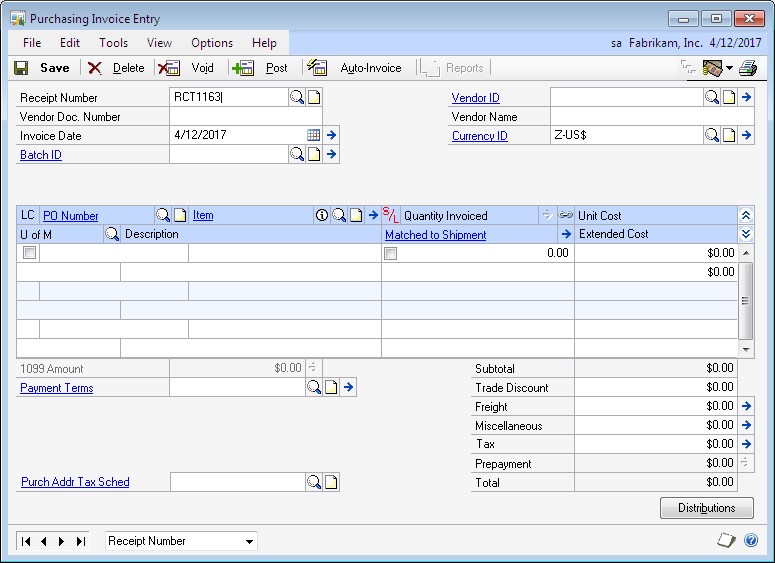

Purchase Order Processing batches originate in either the Receivings Transaction

Entry window or the Purchasing Invoice Entry window. A batch with a Receivings Transaction Entry origin can contain a mix of different receipt document types. A batch with a Purchasing Invoice Entry origin can contain only invoice receipt documents. Since batches can have only one origin, you can have batches with the same name, but different origins.

For information about entering transactions with the Receivings Transaction Entry origin, see Chapter 13, "Shipment and in-transit inventory receipt entry."

For information about entering transactions with the Purchasing Invoice Entry origin, see Chapter 16, "Invoice receipt entry."

Creating a receipt batch

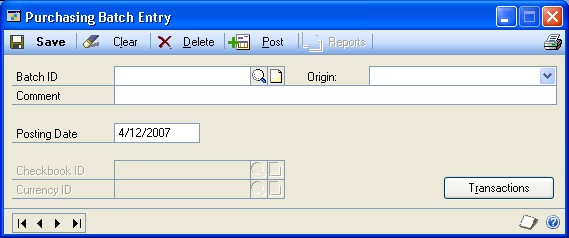

Use the Purchasing Batch Entry window to create a receipt batch. Each transaction in the batch must have the same origin.

To create a receipt batch:

Open the Purchasing Batch Entry window. (Purchasing >> Transactions >> Purchasing Batches)

Enter a batch ID to identify the batch.

Select a batch origin.

Enter a batch comment.

Enter a posting date.

This field is available only if, in the Posting Setup window, Batch is selected in the Posting Date From field.

The posting date you enter here is the date that General Ledger files are updated. Your records in Purchase Order Processing are updated using the receipt date you enter in the Receivings Transaction Entry window or the invoice date you enter in the Purchasing Invoice Entry window.

If the batch contains multicurrency transactions whose exchange rates expired before the batch posting date, you will be able to save but not post those transactions.

When you have entered and saved all transactions for a batch, choose File >> Print to verify your entries with a Receivings Edit List or a Purchasing Invoice Edit List.

Modifying or deleting a batch

Use the Purchasing Batch Entry window to change or delete an unposted batch. See Chapter 22, "Receipt maintenance," for information about changing the transactions in a batch.

To modify or delete a batch:

Open the Purchasing Batch Entry window. (Purchasing >> Transactions >> Purchasing Batches)

Enter or select a batch ID. If you enter a batch, you also must enter the batch origin before information about the batch will be displayed.

If you select a batch that has been marked for posting, you won't be able to edit it.

To correct the batch, replace the incorrect information with correct information. Choose Save to save your changes. To delete the batch, choose Delete.

Chapter 13: Shipment and in-transit inventory receipt entry

A shipment receipt is a document used to record shipments received for purchase orders. You can enter two types of shipment receipts in Purchase Order Processing: shipment/invoice and shipment. Enter a shipment/invoice receipt to record the receipt of goods and services accompanied by an invoice. Enter a shipment receipt to record the receipt of goods and services without an invoice. You can enter receipt transactions in a batch or enter and post them individually. Receipts can't be saved unless they're in a batch.

If you are transferring material from one site to another and want to use a via site, you can enter in-transit transfers in Inventory Control. A via site is an interim location to prevent the material from being sold while the material is in-transit. After you post the in-transit transfer, you can use the Receivings Transaction Entry window to enter an in-transit inventory receipt. An in-transit inventory receipt is a document used to record the receipt of the material into the final destination site.

If you are using Project Accounting and want to enter shipment/invoice receipts or shipment receipts for projects, see Chapter 14, "Shipment receipt entry for projects."

This information is divided into the following sections:

Receiving a shipment/invoice

Receiving a shipment

Receiving items without a purchase order

Receiving items using the Select Purchase Order window

Using the Select Purchase Order Items window

Receiving items from multiple purchase orders

Receiving items from a purchase order

Entering an in-transit inventory receipt

Using the Select In-Transit Items window

Receiving items from in-transit transfers

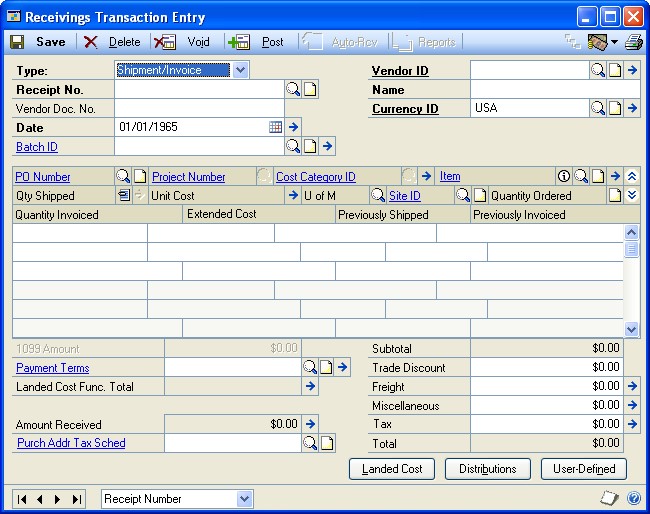

Receiving a shipment/invoice

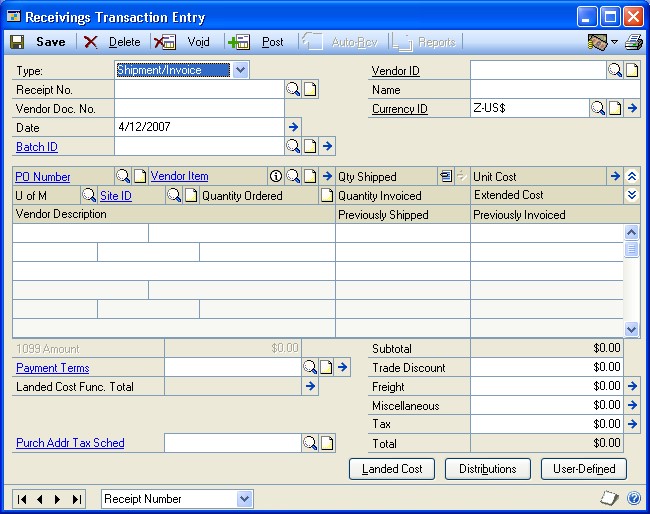

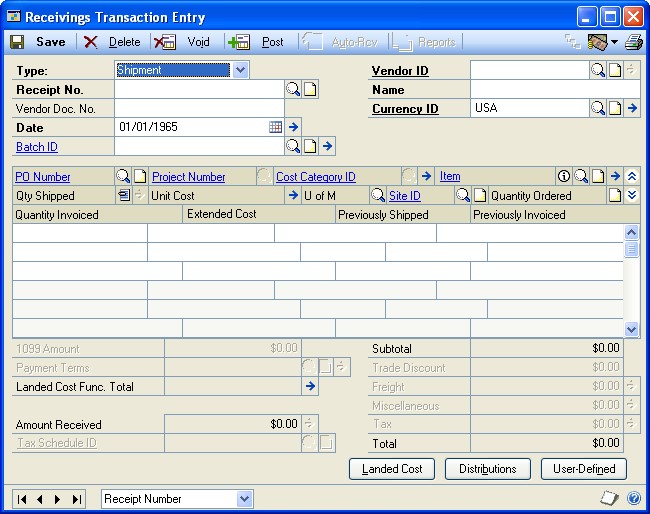

Use the Receivings Transaction Entry window to record a shipment/invoice if you've received an invoice and merchandise at the same time. The inventory quantity on hand will be updated for the items received and the vendor's account will be increased. You can include items from multiple purchase orders (from a single vendor) on a shipment/invoice receipt.

You can receive against line items with New, Released, Change Order, or Received statuses; however, only active items can be entered. You can continue processing if the item is inactive, but you can't change the quantity.

If you are using Workflow, the purchase order must be approved before you can receive against the purchase order. You can receive against purchase orders that don't need approval.

You can't enter a shipment/invoice receipt for a purchase order that is on hold. If a purchase order is placed on hold after its shipment/invoice receipt is saved to a batch, the receipt for that purchase order will not be posted and will remain in the batch.

If you are using Project Accounting, you can enter a shipment/invoice for blanket purchase orders. The Project Number field and the Cost Category ID field will be displayed in the Receivings Transaction Entry window, but you can't enter project information. To enter a shipment/invoice for a purchase order with project information, see Chapter 14, "Shipment receipt entry for projects."

You can use the View >> Currency menu option or the currency list button to view currency amounts in the Receivings Transaction Entry window in the originating or functional currency.

To receive a shipment/invoice:

In the navigation pane, choose the Purchasing button, and then choose the Purchase Order Transactions list.

In the New group or its overflow menu, choose Shipment and Invoice Receipt to open the Receivings Transaction Entry window.

Enter a vendor document number.

Enter the receipt date.

Note

To enter a General Ledger posting date that is different from the transaction date, choose the Date expansion button; the Receivings Date Entry window will open, where you can enter date information.

For multicurrency transactions, the document date determines which exchange rate is used, based on the currency ID and the associated rate type entered for the transaction.

Enter or select a batch ID (optional).

In multi-currency transactions, if the batch posting date does not fall on or before the exchange rate's expiration date, you will receive a message. Choose Yes to open the Batch Entry window and change the batch posting date. If you choose No, you will be able to save but not post the receipt. See Creating a receipt batch for more information.

Enter or select a vendor ID.

Enter or select a currency ID. If a currency ID is assigned to the vendor you select, it will appear in the Currency ID field. The currency ID assigned to the shipment/invoice must match the currency ID of the purchase orders being received against.

Enter or select the purchase order number for which you're receiving a shipment/invoice. You can receive items from multiple purchase orders by entering or selecting a different purchase order number in a new row. See Receiving items from multiple purchase orders for more information.

If the Allow Receiving Without a Purchase Order option is marked in Purchase Order Processing Setup, you can leave the PO Number field blank.

Before you can receive against the purchase order that has an unposted prepayment, you must post the prepayment or remove the prepayment from the purchase order.

Enter items using either the vendor's item number or your company's item number. You also can enter a non-inventoried item.

You can display the vendor's item number by marking Options >> Display Vendor Item. If the option is not marked, your company's item number will be displayed. You can change this selection at any time.

To add an attachment to the item, select the item and choose the Attachment Management icon to open the Document Attachment Management window.

Enter the quantity shipped.

Note

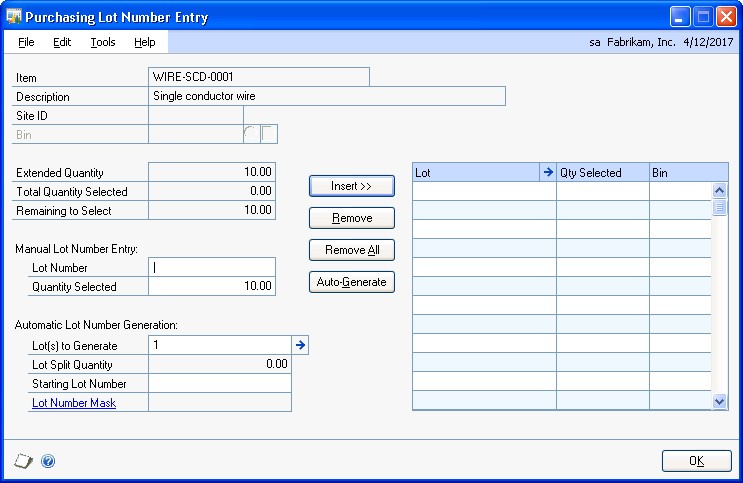

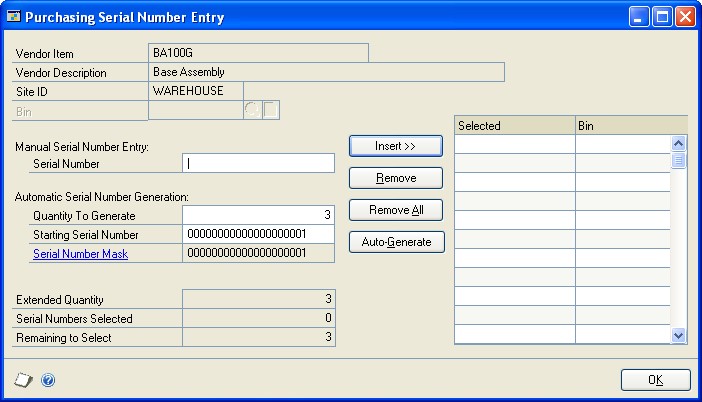

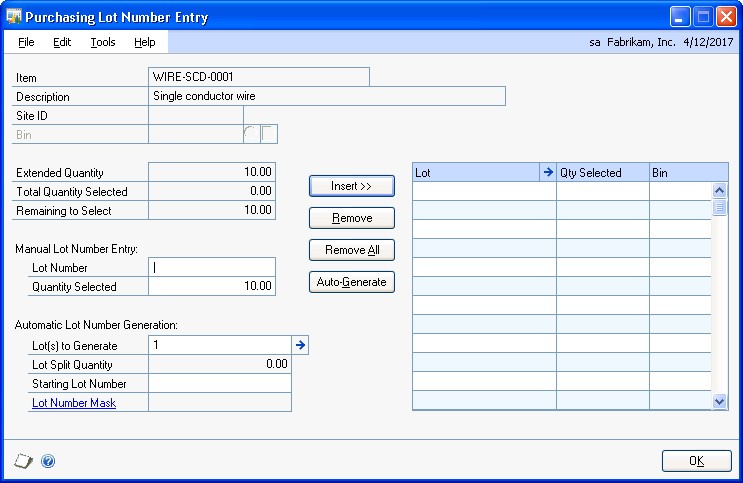

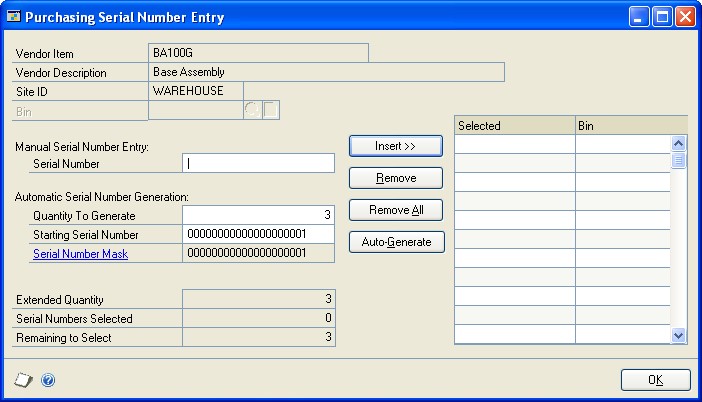

The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open if the item requires that you assign lot or serial numbers. If you are using multiple bins, you also can enter a bin number for the serial or lot number. The Bin Quantity Entry window will open if an item that isn't tracked by lot or serial numbers requires that you enter bin information.

An icon will be displayed in the Qty Shipped field for purchase order line items with sales commitments. Select a line item and choose the button next to the Qty Shipped heading to view or prioritize commitments in the Sales Commitments for Purchase Order window. For more information, see Committing purchase orders to sales documents.

If you're using multiple bins and you change the quantity shipped or the unit of measure after selecting bins for an item, you might have to modify the bin information.

You can change the site ID to receive line items to a location other than the location specified on the purchase order, if the option is marked in Purchase Order Processing Setup. Changing the site on the receipt will not change the site on the purchase order.

If you are using multiple bins and you change the site ID, the default purchase receipts bin assigned to the new site ID will replace your previous bin selections. If the item is tracked by serial or lot numbers, your previous lot number or serial number selections are removed. The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open for you to assign lot numbers or serial numbers. You can change the bin.

You can edit the unit cost or extended cost, if the Allow Editing of Costs in Receiving option is marked in the Purchase Order Processing Setup window.

Enter the quantity invoiced, which is the number of items on the vendor's invoice.

Enter trade discount, freight, miscellaneous, and tax amounts.

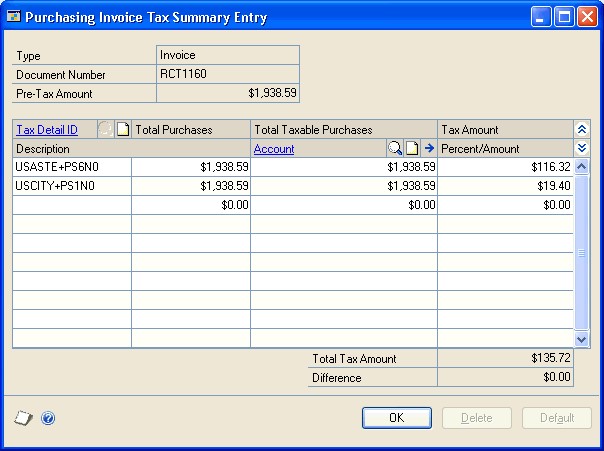

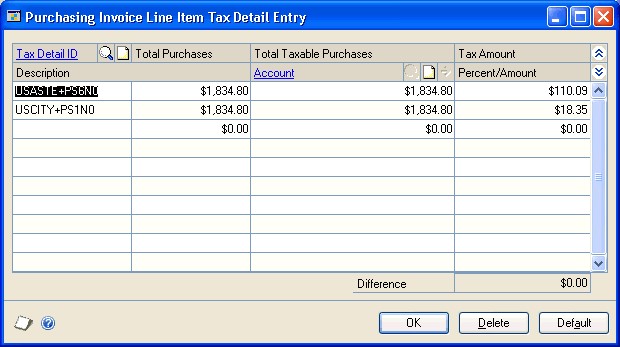

Taxes will be calculated automatically as you enter items. For more information about tax calculations, see Chapter 20, "Taxes for receipts." If you want to change the tax amounts for the document, see Calculating and distributing summary taxes for shipment/invoice receipts. If you want to change the tax amounts for a line item, see Calculating and distributing detail taxes for shipment/invoice line items.

The Prepayment field displays the total of all posted prepayments consumed for the purchase orders you are receiving against. The prepayment amount is recalculated if you change the quantity shipped, quantity invoiced, unit cost, or extended cost for a line item. The prepayment amount is also recalculated if you change the trade discount.

If a purchase order has a posted prepayment, you can use the Prepayment expansion button to open the Purchasing Prepayment Summary Inquiry window. You can use this window to view the total amount of the prepayments applied and the prepayment applied amount for each purchase order assigned to the shipment/invoice.

Enter or accept the 1099 amount, if applicable.

Enter or accept the payment terms and tax schedule ID.

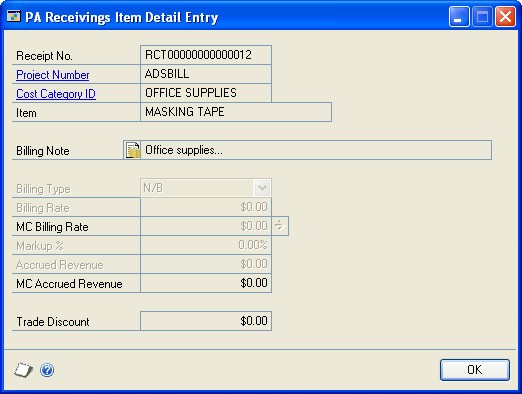

If you are using Project Accounting, choose the Amount Received expansion button to open the PA Receivings Amount Received Entry window, where you can enter an amount received. You can enter the amount you're paying by cash, check, or credit card.

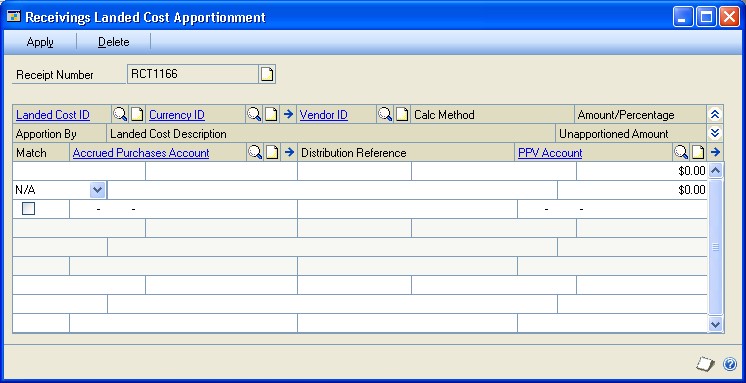

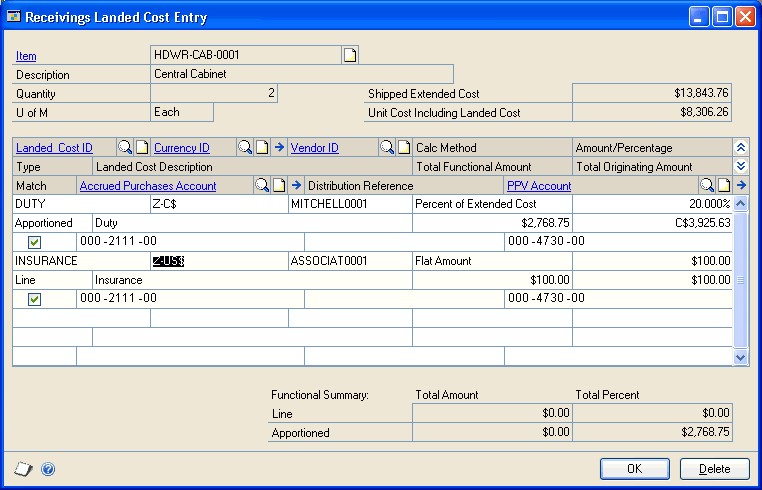

If you are using landed costs, choose Landed Cost to open the Receivings Landed Cost Apportionment Entry window, where you can add landed costs to all line items on a receipt. See Entering landed costs for a shipment receipt for more information. If you want to enter landed costs for an item, see Entering landed costs for a shipment item.

Choose the Attachment Management icon to attach documents to the shipment, if applicable.

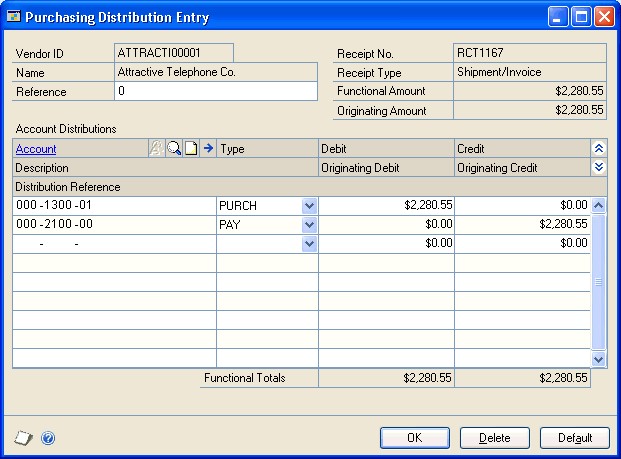

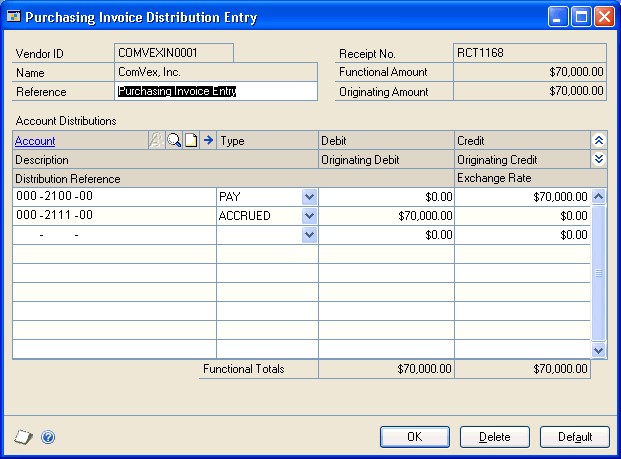

Choose Distributions to open the Purchasing Distribution Entry window, where you can make changes to account distributions other than the PURCH type distribution.

To add additional accounts, select the account and enter an amount.

To remove an account in the scrolling window, select the row containing the account and choose Edit >> Delete Row.

To restore the original distributions, choose Default.

If you are using landed costs, the distributions for a landed cost won't be displayed in the Purchasing Distribution Entry window. To view landed cost distributions, print the Receivings Edit List.

See Distributing transaction amounts for shipment receipts for more information.

Choose User-Defined to open the Receivings User-Defined Fields Entry window, where you can enter user-defined information for this receipt.

Choose Save or Post. If you post the receipt, one or more posting journals and distribution breakdown registers may be printed, depending on the options selected in the Posting Setup window.

If you've entered a batch ID, you can't post the transaction individually; you must use batch posting, series posting, or master posting. For more information, see Chapter 12, "Receipt batches."

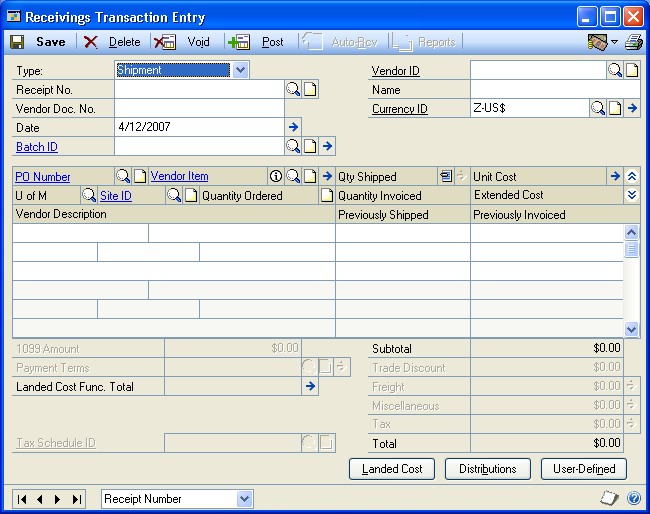

Receiving a shipment

Use the Receivings Transaction Entry window to record a shipment if you've received merchandise but haven't received the invoice for the merchandise. A shipment transaction will increase the quantity on hand for the items received for sales and discontinued item types. You can include items from multiple purchase orders (from a single vendor) on a shipment receipt.

You can receive against line items with New, Released, Change Order, or Received statuses.

If you are using Workflow, the purchase order must be approved before you can receive against the purchase order. You can receive against purchase orders that don't need approval.

You can't enter a shipment receipt for a purchase order that is on hold. If a purchase order is placed on hold after its shipment receipt is saved to a batch, the receipt for that purchase order will not be posted and will remain in the batch.

If you are using Project Accounting, you can enter a shipment for blanket purchase orders. The Project Number field and the Cost Category ID field will be displayed in the Receivings Transaction Entry window, but you can't enter project information. To enter a shipment for a purchase order with project information, see Chapter 14, "Shipment receipt entry for projects."

You can use the View >> Currency menu option or the currency list button to view amounts in the Receivings Transaction Entry window in originating or functional currency.

To receive a shipment:

In the navigation pane, choose the Purchasing button, and then choose the Purchase Order Transactions list.

In the New group or its overflow menu, choose Shipment Receipt to open the Receivings Transaction Entry window.

Enter a vendor document number (optional).

Enter the receipt date.

Note

To enter a General Ledger posting date that is different from the transaction date, choose the Date expansion button; the Receivings Date Entry window will open, where you can enter date information.

For multicurrency transactions, the document date determines which exchange rate is used, based on the currency ID and associated rate type that's entered for the transaction.

Enter or select a batch ID (optional). See Creating a receipt batch for more information.

In multicurrency transactions, if the batch posting date does not fall on or before the exchange rate's expiration date, you will receive a message. Choose Yes to open the Batch Entry window and change the batch posting date. If you choose No, you will be able to save but not post the receipt.

Enter or select the vendor ID.

Enter or select a currency ID. If a currency ID is assigned to the vendor you select, it will appear in the Currency ID field. The currency ID assigned to the invoice must match the currency ID of the purchase order being received against.

Enter the purchase order number for which you're receiving a shipment. You can receive items from multiple purchase orders by entering or selecting a different purchase order number in a new row. See Receiving items from multiple purchase orders for more information.

If the Allow Receiving Without a Purchase Order option is marked in Purchase Order Processing Setup, you can leave the PO Number field blank.

Before you can receive against the purchase order that has an unposted prepayment, you must post the prepayment or remove the prepayment from the purchase order.

Enter items using either the vendor's item number or your company's item number. You also can enter a non-inventoried item.

You can display the vendor's item number by marking Options >> Display Vendor Item. If the option is not marked, your company's item number will be displayed. You can change this selection at any time.

To add an attachment to the item, select the item and choose the Attachment Management icon to open the Document Attachment Management window.

You can change the site ID to receive line items to a location other than the location specified on the purchase order, if the option is marked in Purchase Order Processing Setup. Changing the site on the receipt will not change the site on the purchase order.

If you are using multiple bins and you change the site ID, the default purchase receipts bin assigned to the new site ID will replace your previous bin selections. If the item is tracked by serial or lot numbers, your previous lot number or serial number selections are removed. The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open for you to assign lot numbers or serial numbers. You can change the bin.

Enter the quantity shipped.

Note

The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open if the item requires that you assign lot or serial numbers. If you are using multiple bins, you also can enter a bin number for the serial or lot number. The Bin Quantity Entry window will open if an item that isn't tracked by lot or serial numbers requires that you enter bin information.

An icon will be displayed in the Qty Shipped field for purchase order line items with sales commitments. Select a line item and choose the button next to the Qty Shipped heading to view or prioritize commitments in the Sales Commitments for Purchase Order window. For more information, see Committing purchase orders to sales documents.

If you're using multiple bins and you change the quantity shipped or the unit of measure after selecting bins for an item, you might have to modify the bin information.

You can edit the unit cost or extended cost, if the Allow Editing of Costs in Receiving option is marked in Purchase Order Processing Setup.

If you are using landed costs, choose Landed Cost to open the Receivings Landed Cost Apportionment Entry window, where you can add landed costs to all line items on a receipt. See Entering landed costs for a shipment receipt for more information. If you want to enter landed costs for an item, see Entering landed costs for a shipment item.

Choose the Attachment Management icon to attach documents to the shipment, if applicable.

Choose Distributions to open the Purchasing Distribution Entry window, where you can make changes to account distributions.

To add additional accounts, select the account and enter an amount.

To remove an account in the scrolling window, select the row containing the account and choose Edit >> Delete Row.

To restore the original distributions, choose Default.

If you are using landed costs, the distributions for a landed cost won't be displayed in the Purchasing Distribution Entry window. To view landed cost distributions, print the Receivings Edit List.

See Distributing transaction amounts for shipment receipts for more information.

Choose User-Defined to open the Receivings User-Defined Fields Entry window, where you can enter user-defined information for this receipt.

Choose Save or Post. If you post the receipt, one or more posting journals and distribution breakdown registers may be printed, depending on the options selected in the Posting Setup window.

If you've entered a batch ID, you can't post the transaction individually; you must use batch posting, series posting, or master posting. For more information, see Chapter 12, "Receipt batches."

Receiving items without a purchase order

In the Receivings Transaction Entry window, you have the option to receive items that weren't included on the original purchase order or receive items without a purchase order.

To set up this option, you must select to allow receiving items without a purchase order in the Purchase Order Processing Setup window. You may assign a password that must be entered before entering a line item not assigned to a purchase order.

If you are using Project Accounting, you can receive items without project information. The Project Number field and the Cost Category ID field will be displayed in the Receivings Transaction Entry window. To enter a shipment/invoice or shipment with project information, see Chapter 14, "Shipment receipt entry for projects."

To receive items without a purchase order:

Open the Receivings Transaction Entry window. (Purchasing >> Transactions >> Receivings Transaction Entry)

Select the appropriate document type for the transaction.

Enter the receipt number, vendor document number, date, and vendor ID.

To add vendor items or items that weren't included on the original purchase order, simply leave the PO number field blank. You don't have to enter a purchase order if you've set up the system to allow receiving items without a purchase order.

Continue entering the receipt.

You must enter the unit cost of non-inventoried items.

In the Receivings Transaction Entry window, save or post the transaction.

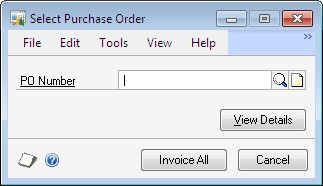

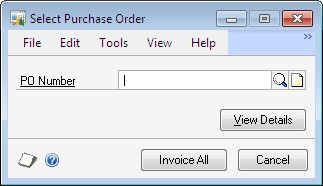

Receiving items using the Select Purchase Order window

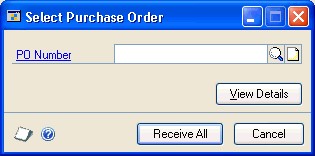

Use the Select Purchase Order window to select a purchase order to quickly enter line items on a shipment or shipment/invoice. See Receiving a shipment or Receiving a shipment/invoice for more information.

If you are using Workflow, the purchase order must be approved before you can receive against the purchase order. You can receive against purchase orders that don't need approval.

If you are using Project Accounting, you can receive items for blanket purchase orders. The Project Number field and the Cost Category ID field will be displayed in the Receivings Transaction Entry window, but you can't enter project information. To receive items for purchase orders with project information, see Chapter 14, "Shipment receipt entry for projects."

To receive items using the Select Purchase Order window:

Open the Receivings Transaction Entry window. (Purchasing >> Transactions >> Receivings Transaction Entry)

Select the appropriate document type for the transaction.

Enter the receipt number, vendor document number, and date. (A vendor document number is required for a shipment/invoice.)

Choose Auto-Rcv to automatically receive items. The Select Purchase Order window will open.

Note

If you entered a vendor ID, the Select Purchase Order Items window will open instead of the Select Purchase Order window.

Enter or select a purchase order for which you want to receive line items.

Choose Receive All in the Select Purchase Order window to automatically receive all items on the selected purchase order.

You cannot receive against a purchase order that has an unposted prepayment. You can remove the prepayment from the purchase order using the Purchase Order Entry window or complete a computer check run for the prepayment.

The control blanket line item for a blanket purchase order or a drop-ship blanket purchase order isn't included when you automatically receive items. Blanket line items with a New status won't be included, either. You can use the Receivings Transaction Entry window to enter blanket line items with a New status.

If you choose to view details in the Select Purchase Order window, the Select Purchase Order Items window will open, and the purchase order line items will be marked to receive. Choose Receive to automatically receive items on the selected purchase order.

Blanket line items with a New status or line items with a New status for a standard purchase order with an expired contract date won't be marked. To receive these items, you must mark the items individually.

In the Receivings Transaction Entry window, continue entering receipt information, if necessary, and save or post the transaction.

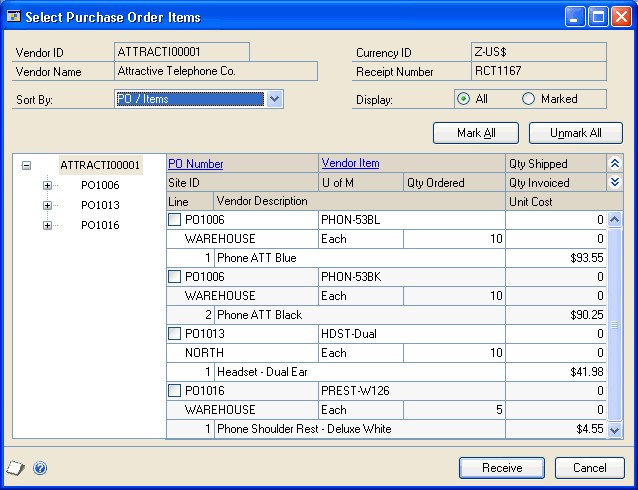

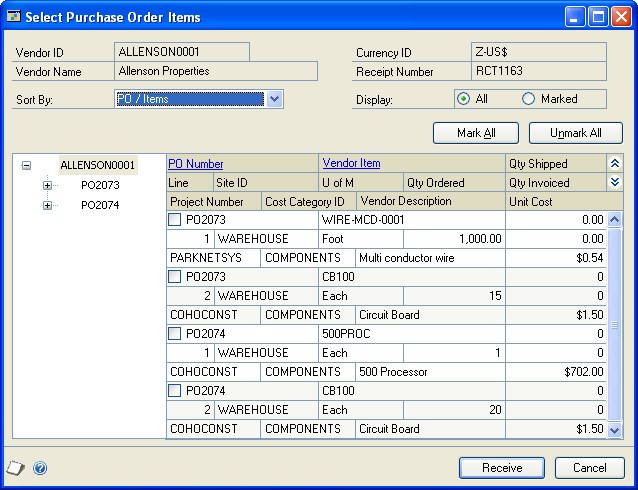

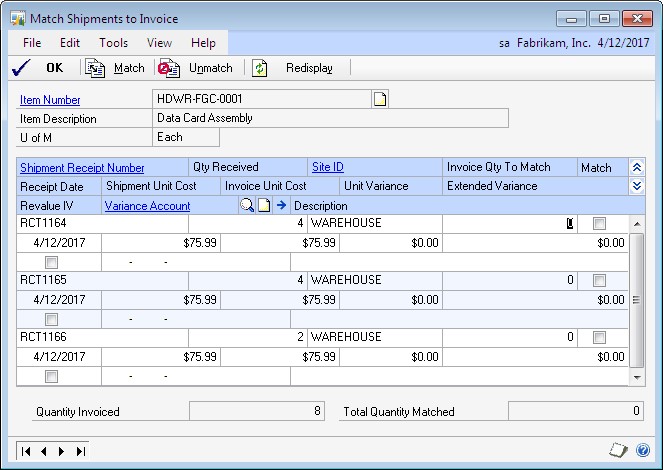

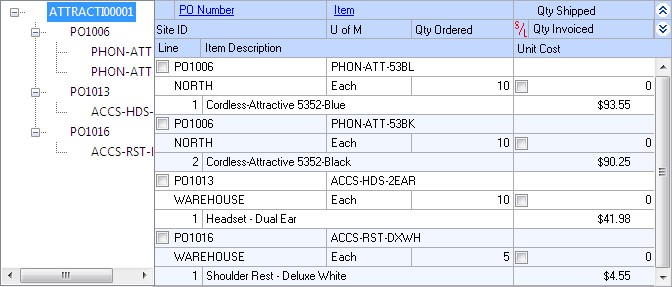

Using the Select Purchase Order Items window

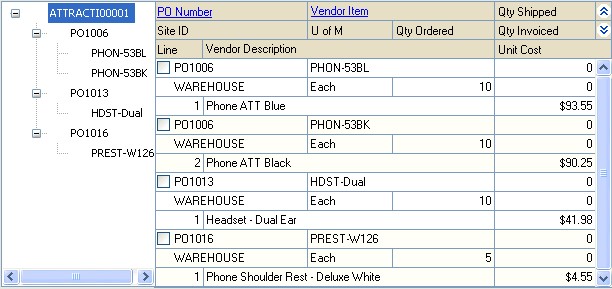

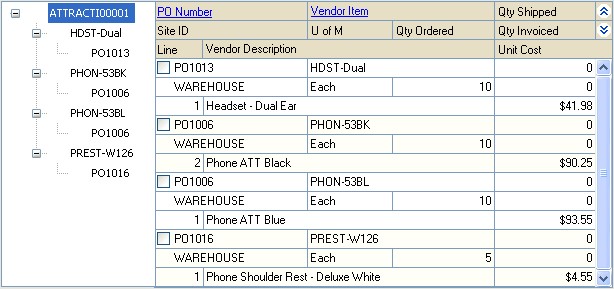

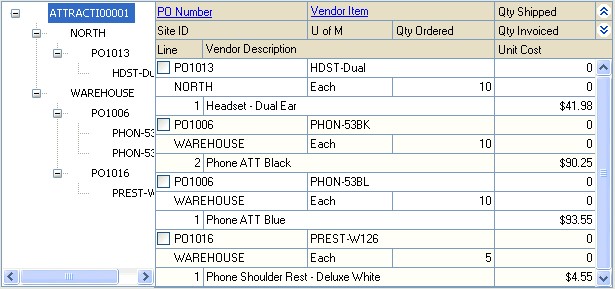

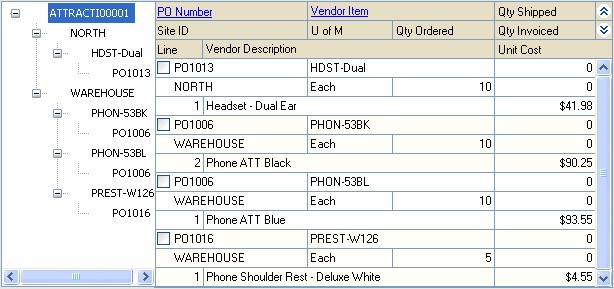

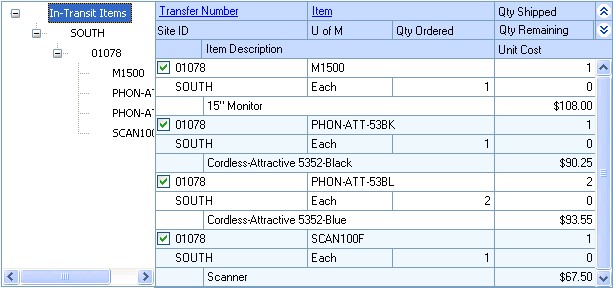

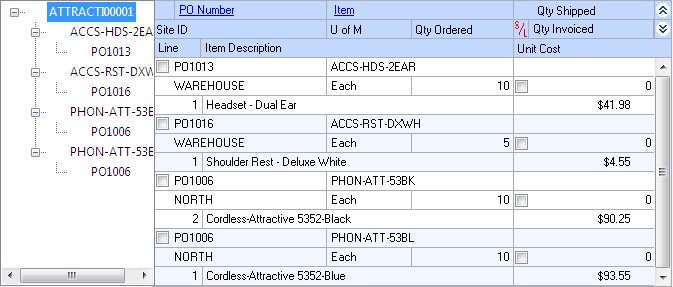

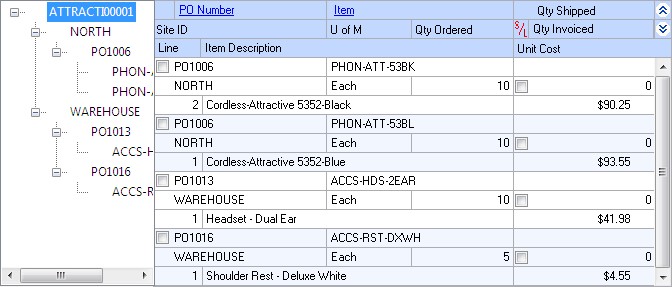

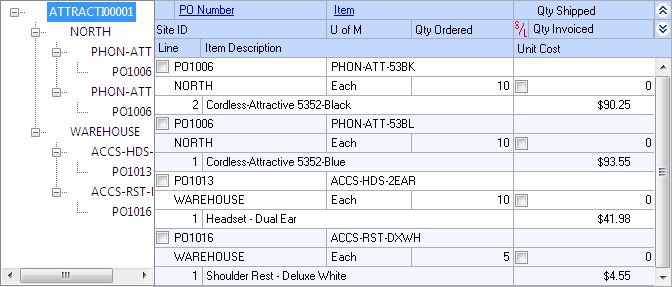

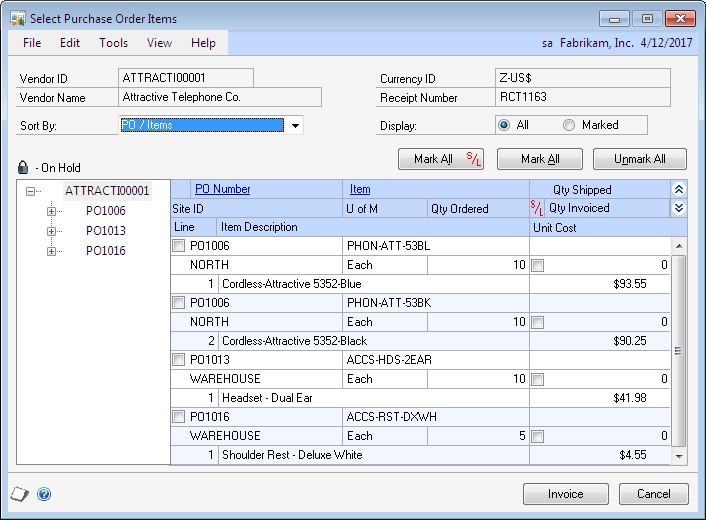

Use the Select Purchase Order Items window to receive line items on multiple purchase orders. In the Select Purchase Order Items window, the tree view and the Sort By option control the information that is displayed. When you change the focus in the tree view, or when you choose a different sorting option, the information in the window is refreshed.

The scrolling window shows detail about the object selected in the tree view. When you highlight a different object in the tree view, such as a purchase order or a site, only the information about that object is displayed in the scrolling window. To display all information for a vendor, you must select the vendor ID in the tree view.

If you are using Project Accounting, the Project Number field and the Cost Category ID field will be displayed in the Select Purchase Order Items scrolling window.

The sorting option you select determines the order in which objects appear in the tree view and the scrolling window. You can sort objects in four ways:

PO/Items Objects in the tree view and scrolling window are sorted first by purchase order number, then by the order items were entered on the purchase orders.

Item Number/PO Objects in the tree view and scrolling window are sorted first by item number, then by purchase order number under each item.

Site/PO/Item Number Objects in the tree view and scrolling window are sorted first by site, then by purchase order number under each site, then by item number under each purchase order.

Site/Item Number/PO Objects in the tree view and scrolling window are sorted first by site, then by item number under each site, then by purchase order number under each item.

Receiving items from multiple purchase orders

Use the Select Purchase Order Items window to receive line items on multiple purchase orders. New, Released, or Change Order purchase orders that have one or more items with a quantity remaining to receive will be displayed. See Receiving a shipment or Receiving a shipment/invoice for more information.

If you are using Workflow, purchase orders must be approved before you can receive against them. You can receive against purchase orders that don't need approval.

If you are using Project Accounting, the Project Number field and the Cost Category ID field will be displayed in the Select Purchase Order Items window. To receive items from purchase orders with project information, see Chapter 14, "Shipment receipt entry for projects."

To receive items from multiple purchase orders:

In the navigation pane, choose the Purchasing button, and then choose the Purchase Order Transactions list.

In the New group or its overflow menu, choose the appropriate document type for the transaction to open the Receivables Transaction Entry window.

Enter the vendor document number, and date. (A vendor document number is required for a shipment/invoice.)

Enter or select a vendor ID. The currency ID assigned to the vendor will be the default currency ID for the receipt.

Choose the Auto-Rcv button. The Select Purchase Order Items window will open.

New, Released, or Change Order purchase orders that have one or more items with a quantity remaining to receive will be displayed. The control blanket line item for a blanket purchase order or a drop-ship blanket purchase order isn't included when you automatically receive items.

If only a Vendor ID is displayed, the selected vendor does not have any New, Released, or Change Order purchase orders with items to receive. Only purchase orders with currency IDs that match the receipt will be displayed. Purchase orders with posted prepayments that have currency IDs that match the receipt will be displayed.

Note

If you know the purchase order number but not the vendor ID, you can choose AutoRcv without entering a vendor ID. The Select Purchase Order window will open. The vendor and currency ID for the receipt will come from the purchase order you select.

Select a sorting option.

Mark the check boxes next to the items you want to receive. To select all items displayed in the scrolling window, choose Mark All.

Blanket line items with a New status or line items with a New status for a standard purchase order with an expired contract date won't be marked. To receive these items, you must mark the items individually.

Note

When you choose Mark All or Unmark All in the Select Purchase Order Items window, only items displayed in the scrolling window will be marked or unmarked. For example, if a purchase order is selected in the tree view, only items from that purchase order will be displayed in the scrolling window, and only those items will be marked when you choose Mark All. To mark or unmark all items for a vendor, the vendor ID must be selected in the tree view.

Select whether to display all items or only items marked to receive.

Edit Quantity Shipped, Quantity Invoiced (for shipment/invoice receipts) and Unit Cost amounts, if necessary. If you edit an item in the scrolling window, it will be marked to receive.

Choose the Receive button to add the items to your receipt. The Select Purchase Order Items window will close, and the items will appear in the Receivings Transaction Entry window. Taxes are calculated at this time.

To cancel your selections, choose Cancel. To revert all displayed items to unmarked, choose Unmark All.

In the Receivings Transaction Entry window, save or post the receipt.

Receiving items from a purchase order

Use the Select Purchase Order Items window and the Receivings Transaction Entry window to receive items. After you enter or select a standard or blanket purchase order with a New, Released, or Change Order status in the Purchase Order Entry window, you can select to receive items or receive and invoice items. From the Actions button, you can select the Receive the PO Items option to enter a shipment receipt. You can select the Receive and Invoice the PO Items option to enter a shipment/invoice receipt for a purchase order. If you are using Workflow, the purchase order must be approved before you can receive against it. You can receive against a purchase order that doesn't need approval.

For more information about a shipment receipt or a shipment/invoice receipt, see Receiving a shipment or Receiving a shipment/invoice. For more information about the Select Purchase Order Items window, see Using the Select Purchase Order Items window.

If you are using Project Accounting, the Project Number field and the Cost Category ID field will be displayed in the Select Purchase Order Items window and the Receivings Transaction Entry window. To receive items with project information, see Chapter 14, "Shipment receipt entry for projects."

To receive items from a purchase order:

Open the Purchase Order Entry window. (Purchasing >> Transactions >> Purchase Order Entry)

Enter or select a standard or blanket purchase order that has one or more items with a quantity to receive.

Choose Actions, and then select one of the following options.

If you are receiving goods and services without an invoice, select Receive the PO Items.

If you are receiving goods and services accompanied by an invoice, select Receive and Invoice the PO Items.

The Select Purchase Order Items window and the Receivings Transaction Entry window will open.

In the Select Purchase Order Items window, New, Released, or Change Order purchase orders that have one or more items with a quantity remaining to receive will be displayed. The purchase order that you entered in the Purchase Order Entry window will be selected in the tree view. Each item on the purchase order that is available to be received in the scrolling window is marked, except for blanket line items that have a status of New. The control blanket line item for a blanket purchase order isn't included when you receive items.

Select a sorting option.

Mark the check boxes next to the items to receive. To select all items displayed in the scrolling window, choose Mark All.

Blanket line items with a New status or line items with a New status for a standard purchase order with an expired contract date won't be marked. To receive these items, you must mark the items individually.

Note

When you choose Mark All or Unmark All, only items displayed in the scrolling window will be marked or unmarked. For example, if a purchase order is selected in the tree view, only items from that purchase order will be displayed in the scrolling window, and only those items will be marked when you choose Mark All. To mark or unmark all items for a vendor, the vendor ID must be selected in the tree view.

Select whether to display all items or only items marked to receive.

Modify the quantity shipped, quantity invoiced (for shipment/invoice receipts) and unit cost amounts, if necessary. If you edit an item in the scrolling window, it will be marked to receive.

Choose Receive to add the items to your receipt. The Select Purchase Order Items window will close, and the items will appear in the Receivings Transaction Entry window. Taxes are calculated at this time.

To cancel your selections, choose Cancel. To revert all displayed items to unmarked, choose Unmark All.

In the Receivings Transaction Entry window, continue entering receipt information, if necessary, and save or post the transaction. For a shipment/invoice, you must enter the vendor document number.

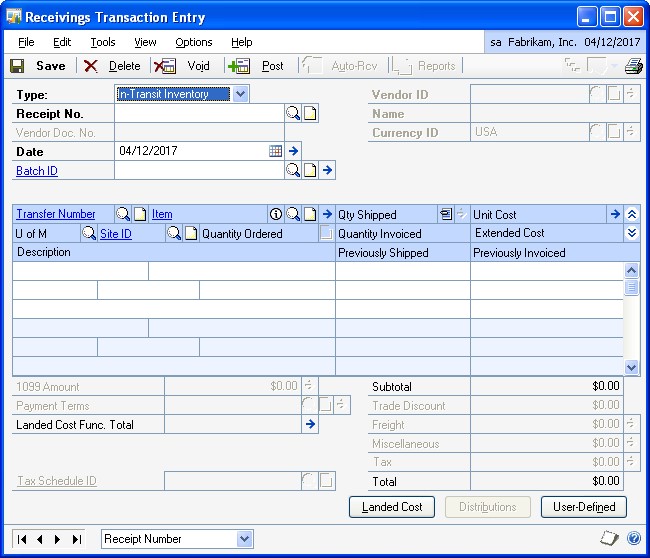

Entering an in-transit inventory receipt

If you've entered an in-transit transfer transaction in Inventory Control, you can record the receipt of the material into the final destination site using an in-transit inventory receipt type in the Receivings Transaction Entry window. Any landed costs incurred as a result of the in-transit transfer can be recorded on the in-transit inventory receipt, as well. After you post the in-transit inventory receipt, the goods are removed from the via site and placed in the final destination site. Landed costs from in-transit transfer receipts can be invoiced just like landed costs incurred on shipments or shipment invoices in the Purchasing Invoice Entry window.

If you are using Project Accounting, the Project Number field and the Cost Category ID field are displayed in the Receivings Transaction Entry window, but you can't enter project information for an in-transit inventory receipt.

To enter an in-transit inventory receipt:

In the navigation pane, choose the Purchasing button, and then choose the Purchase Order Transactions list.

In the New group or its overflow menu, choose In-Transit Inventory to open the Receivings Transaction Entry window.

Enter the receipt date.

Note

To enter a General Ledger posting date that is different from the transaction date, choose the Date expansion button; the Receivings Date Entry window will open, where you can enter date information.

Enter or select a batch ID (optional).

See Creating a receipt batch for more information.

Enter or select the transfer number for which you're entering a receipt. You can receive items from multiple transfer numbers by entering or selecting a different transfer number in a new row.

Enter items using either the vendor's item number or your company's item number. You also can enter a non-inventoried item.

To add an attachment to the item, select the item and choose the Attachment Management icon to open the Document Attachment Management window.

Enter the quantity shipped.

Note

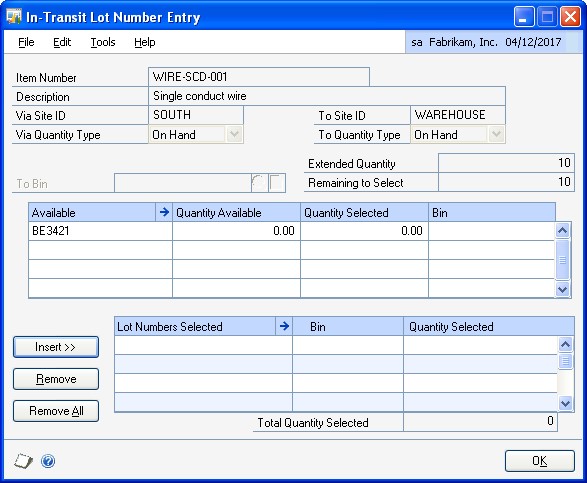

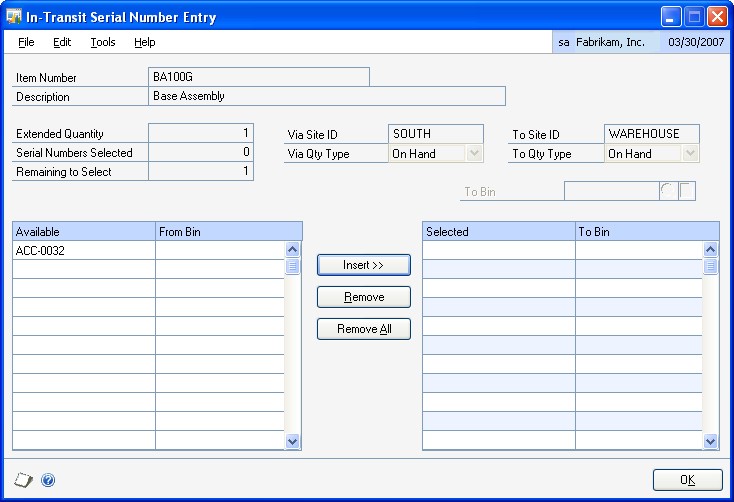

The In-Transit Lot Number Entry window or the In-Transit Serial Number Entry window opens if the item requires that you assign lot or serial numbers. If you are using multiple bins, you also can enter a bin number for the serial or lot number. The Bin Quantity Entry window opens if an item that isn't tracked by lot or serial numbers requires that you enter bin information.

If you're using multiple bins and you change the quantity shipped or the unit of measure after selecting bins for an item, you might have to modify the bin information.

You can change the site ID to receive line items to a location other than the location specified on the in-transit transfer, if the Change Site ID in Receiving option is marked in Purchase Order Processing Setup window. Changing the site on the receipt will not change the site on the in-transit transfer.

If you are using multiple bins and you change the site ID, the default purchase receipts bin assigned to the new site ID will replace your previous bin selections. If the item is tracked by serial or lot numbers, your previous lot number or serial number selections are removed. The In-Transit Lot Number Entry window or the In-Transit Serial Number Entry window will open for you to assign lot numbers or serial numbers. You can change the bin.

If you are using landed costs, choose Landed Cost to open the Receivings Landed Cost Apportionment window, where you can add landed costs to all line items on a receipt. See Entering landed costs for a shipment receipt for more information. If you want to enter landed costs for an item, see Entering landed costs for a shipment item.

Choose the Attachment Management icon to attach documents to the in-transit transfer, if applicable.

Choose User-Defined to open the Receivings User-Defined Fields Entry window, where you can enter user-defined information for this receipt.

Choose Save or Post. If you post the receipt, one or more posting journals and distribution breakdown registers may be printed, depending on the options selected in the Posting Setup window.

If you've entered a batch ID, you can't post the transaction individually; you must use batch posting, series posting, or master posting. For more information, see Chapter 12, "Receipt batches."

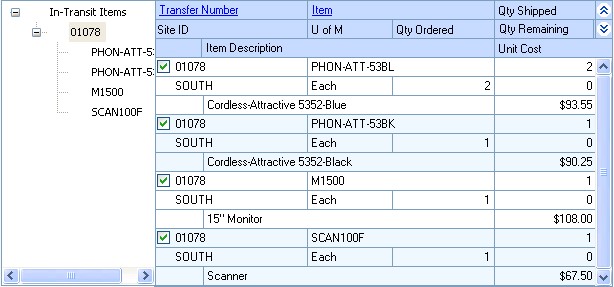

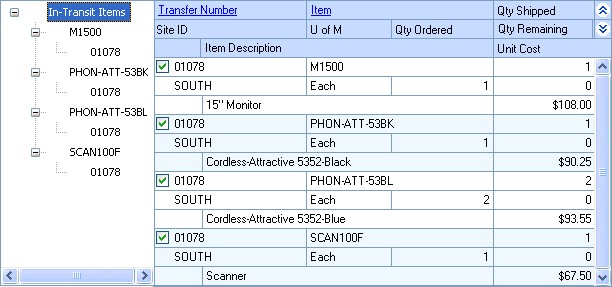

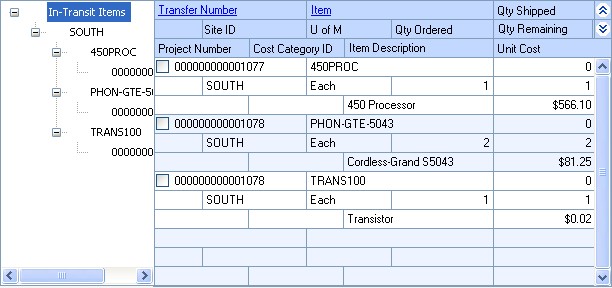

Using the Select In-Transit Items window

Use the Select In-Transit Items window to receive line items on in-transit transfer transactions. In the Select In-Transit Items window, the tree view and the Sort By option control the information that is displayed. When you change the focus in the tree view, or when you choose a different sorting option, the information in the window is refreshed.

The scrolling window shows detail about the object selected in the tree view. When you highlight a different object in the tree view, such as an in-transit item or a site, only the information about that object is displayed in the scrolling window. To display all information for an in-transit transfer, you must select the in-transit transfer in the tree view.

The sorting option you select determines the order in which objects appear in the tree view and the scrolling window. You can sort objects in four ways:

Transfer/Items Objects in the tree view and scrolling window are sorted first by transfer number, then by the order items were entered on the transfers.

Item Number/Transfer Objects in the tree view and scrolling window are sorted first by item number, then by transfer number under each item.

Site/Transfer/Item Number Objects in the tree view and scrolling window are sorted first by site, then by transfer number under each site, then by item number under each transfer.

Site/Item Number/Transfer Objects in the tree view and scrolling window are sorted first by site, then by item number under each site, then by transfer number under each item.

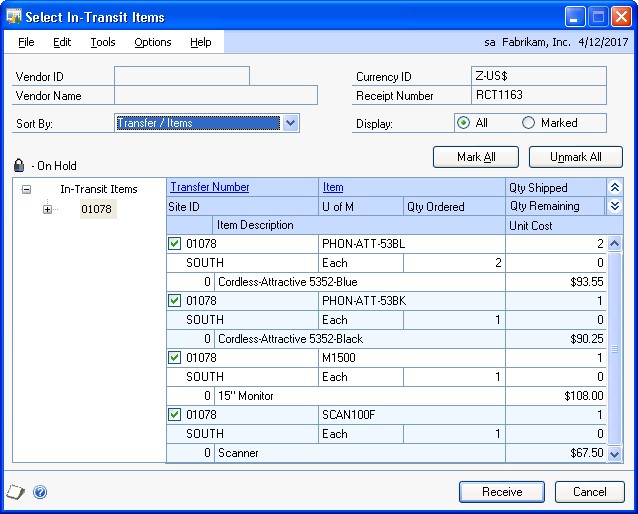

Receiving items from in-transit transfers

Use the Select In-Transit Items window to receive line items on multiple in-transit transfers. In-transit transfers that have one or more items with a quantity remaining to receive will be displayed. See Entering an in-transit inventory receipt for more information.

To receive items from an in-transit transfer:

In the navigation pane, choose the Inventory button, and then choose the InTransit Transfers list.

Mark the in-transit transfers you want to receive against.

In the Actions group, choose Receive Items.

The Select In-Transit Items window and the Receivings Transaction Entry window will open.

In the Select In-Transit Items window, in-transit transfers that have one or more items with a quantity remaining to receive will be displayed. Each item on the in-transit transfer that is available to be received in the scrolling window is marked.

Select a sorting option.

Mark the check boxes next to the items you want to receive. To select all items displayed in the scrolling window, choose Mark All.

Note

When you choose Mark All or Unmark All in the Select In-Transit Items window, only items displayed in the scrolling window will be marked or unmarked. For example, if an in-transit transfer is selected in the tree view, only items from that in-transit transfer will be displayed in the scrolling window, and only those items will be marked when you choose Mark All. To mark or unmark all items, the In-Transit Items must be selected in the tree view.

Select whether to display all items or only items marked to receive.

Edit Quantity Shipped, if necessary. You can't enter a quantity shipped that is greater than the quantity remaining to be received. If you edit an item in the scrolling window, it will be marked to receive.

Choose the Receive button to add the items to your receipt. The Select In-Transit Items window will close, and the items will appear in the Receivings Transaction Entry window.

To cancel your selections, choose Cancel. To revert all displayed items to unmarked, choose Unmark All.

In the Receivings Transaction Entry window, save or post the receipt.

Chapter 14: Shipment receipt entry for projects

If you are using Project Accounting, you can enter a shipment receipt to record shipments received for purchase orders entered for projects. You can enter shipment receipts and shipment/invoice receipts in Purchase Order Processing. Enter a shipment/invoice receipt to record the receipt of goods and services accompanied by an invoice. Enter a shipment receipt to record the receipt of goods and services without an invoice. You can enter receipt transactions in a batch or enter and post them individually. Receipts can't be saved unless they're in a batch.

To enter a shipment/invoice receipt or a shipment receipt for a blanket purchase order, refer to Chapter 13, "Shipment and in-transit inventory receipt entry."

This information is divided into the following sections:

Receiving a shipment/invoice for projects

Receiving a shipment for projects

Receiving project items without a purchase order

Receiving items for projects using the Select Purchase Order window

Receiving items for projects from multiple purchase orders

Receiving items for projects from a purchase order

Receiving a shipment/invoice for projects

Use the Receivings Transaction Entry window to record a shipment/invoice if you've received an invoice and merchandise at the same time. The inventory quantity on hand will be updated for the items received and the vendor's account will be increased. You can include items from multiple purchase orders (from a single vendor) on a shipment/invoice receipt. To enter a shipment/invoice receipt for a blanket purchase order, refer to Chapter 13, "Shipment and in-transit inventory receipt entry."

When you enter a shipment/invoice receipt for a non-inventoried item and then save or post the transaction, the project costs will be updated automatically. For an inventoried item, the actual costs for the item will be updated automatically. You can receive against line items with New, Released, Change Order, or Received statuses.

If you are using Workflow, the purchase order must be approved before you can receive against the purchase order. You can receive against purchase orders that don't need approval.

You can't enter a shipment/invoice receipt for a purchase order that is on hold. If a purchase order is placed on hold after its shipment/invoice receipt is saved to a batch, the receipt for that purchase order will not be posted and will remain in the batch.

You can use the View >> Currency menu option or the currency list button to view currency amounts in the Receivings Transaction Entry window in the originating or functional currency.

To receive a shipment/invoice for projects:

Open the Receivings Transaction Entry window. (Purchasing >> Transactions >> Receivings Transaction Entry)

Select Shipment/Invoice as the document type for the transaction.

Enter or select the receipt number.

Enter a vendor document number.

Enter the receipt date.

Note

To enter a General Ledger posting date that is different from the transaction date, choose the Date expansion button; the Receivings Date Entry window will open, where you can enter date information.

For multicurrency transactions, the document date determines which exchange rate is used, based on the currency ID and the associated rate type entered for the transaction.

Enter or select a batch ID (optional).

In multicurrency transactions, if the batch posting date does not fall on or before the exchange rate's expiration date, you will receive a message. Choose Yes to open the Batch Entry window and change the batch posting date. If you choose No, you will be able to save but not post the receipt.

See Creating a receipt batch for more information.

Enter or select a vendor ID.

Enter or select a currency ID. If a currency ID is assigned to the vendor you select, it will appear in the Currency ID field. The currency ID assigned to the shipment/invoice must match the currency ID of the purchase orders being received against.

Enter or select the purchase order number for which you're receiving a shipment/invoice. You can receive items from multiple purchase orders by entering or selecting a different purchase order number in a new row. See Receiving items for projects from multiple purchase orders for more information.

If the Allow Receiving Without a Purchase Order option is marked in the Purchase Order Processing Setup window, you can leave the PO Number field blank.

You can enter a purchase order that hasn't been printed if the Allow Receiving of Unprinted PO option is marked in the PA Purchase Order Processing Setup Options window.

Enter a project number and cost category ID.

You can't enter a project number or a cost category if the Options >> Display Vendor Item is marked to display the vendor items.

Enter one or more items using your company's item number.s You also can enter non-inventoried items.

Inventoried items entered for a project must be assigned to a cost category in the Budget Detail IV Items window. If the item isn't assigned to a budget, you must add the item to the budget.

To add an attachment to the item, select the item and choose the Attachment Management icon to open the Document Attachment Management window.

Enter the quantity shipped.

Note

The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open if the item requires that you assign lot or serial numbers. If you are using multiple bins, you also can enter a bin number for the serial or lot number. The Bin Quantity Entry window will open if an item that isn't tracked by lot or serial numbers requires you to enter bin information.

If you're using multiple bins and you change the quantity shipped or the unit of measure after selecting bins for an item, you might have to modify the bin information.

You can edit the unit cost or extended cost, if the Allow Editing of Costs in Receiving option is marked in the Purchase Order Processing Setup window.

You can change the site ID to receive line items to a location other than the location specified on the purchase order, if the option is marked in Purchase Order Processing Setup. Changing the site on the receipt will not change the site on the purchase order.

If you are using multiple bins and you change the site ID, the default purchase receipts bin assigned to the new site ID will replace your previous bin selections. If the item is tracked by serial or lot numbers, your previous lot number or serial number selections are removed. The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open for you to assign lot numbers or serial numbers. You can change the bin.

Enter the quantity invoiced, which is the number of items on the vendor's invoice.

Enter trade discount, freight, miscellaneous, and tax amounts.

Taxes will be calculated automatically as you enter items. For more information about tax calculations, see Chapter 20, "Taxes for receipts." You can't change the Tax amount in the Receivings Transaction Entry window even if your system is set up to allow editing summary-level taxes. If you want to change the tax amounts for a line item, see Calculating and distributing detail taxes for shipment/ invoice line items.

Enter or accept the 1099 amount, if applicable.

Enter or accept the payment terms and tax schedule ID.

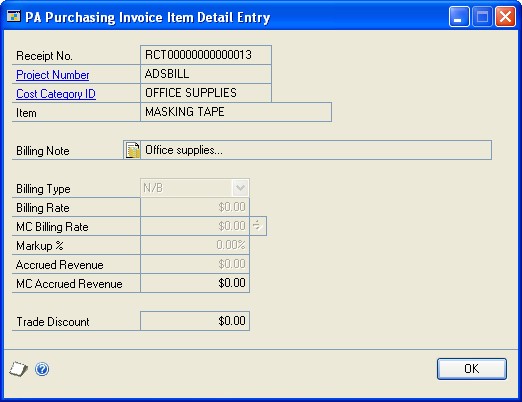

To enter an amount received, choose the Amount Received expansion button to open the PA Receivings Amount Received Entry window. You can enter the amount you're paying by cash, check, or credit card.

Choose the Attachment Management icon to attach documents to the shipment/invoice, if applicable.

If you are using landed costs, choose Landed Cost to open the Receivings Landed Cost Apportionment Entry window, where you can add landed costs to all line items on a receipt. See Entering landed costs for a shipment receipt for more information. If you want to enter landed costs for an item, see Entering landed costs for a shipment item.

Choose Distributions to open the Purchasing Distribution Entry window, where you can make changes to account distributions other than the PURCH type distribution.

To add additional accounts, select the account and enter an amount.

To remove an account in the scrolling window, select the row containing the account and choose Edit >> Delete Row.

To restore the original distributions, choose Default.

If you are using landed costs, the distributions for a landed cost won't be displayed in the Purchasing Distribution Entry window. To view landed cost distributions, print the Receivings Edit List.

See Distributing transaction amounts for shipment receipts for more information.

Choose User-Defined to open the Receivings User-Defined Fields Entry window, where you can enter user-defined information for this receipt.

Choose Save or Post. If you post the receipt, one or more posting journals and distribution breakdown registers may be printed, depending on the options selected in the Posting Setup window.

If you've entered a batch ID, you can't post the transaction individually; you must use batch posting, series posting, or master posting. For more information, see Chapter 12, "Receipt batches."

Receiving a shipment for projects

Use the Receivings Transaction Entry window to record a shipment if you've received merchandise but haven't received the invoice for the merchandise. A shipment receipt will increase the quantity on hand for the items received for sales and discontinued item types. You can include items from multiple purchase orders (from a single vendor) on a shipment receipt. To enter a shipment receipt for a blanket purchase order, refer to Chapter 13, "Shipment and in-transit inventory receipt entry."

When you enter a shipment receipt for a non-inventoried item and then save or post the transaction, the project costs will be updated automatically. For an inventoried item, the actual costs for the item will be updated automatically.

You can receive against line items with New, Released, Change Order, or Received statuses.

If you are using Workflow, the purchase order must be approved before you can receive against the purchase order. You can receive against purchase orders that don't need approval.

You can't enter a shipment receipt for a purchase order that is on hold. If a purchase order is placed on hold after its shipment receipt is saved to a batch, the receipt for that purchase order will not be posted and will remain in the batch.

You can use the View >> Currency menu option or the currency list button to view amounts in the Receivings Transaction Entry window in originating or functional currency.

To receive a shipment for projects:

Open the Receivings Transaction Entry window. (Purchasing >> Transactions >> Receivings Transaction Entry)

Select Shipment as the document type for the transaction.

Enter or select the receipt number.

Enter a vendor document number (optional).

Enter the receipt date.

To enter a General Ledger posting date that is different from the transaction date, choose the Date expansion button; the Receivings Date Entry window will open, where you can enter date information.*

For multicurrency transactions, the document date determines which exchange rate is used, based on the currency ID and associated rate type that's entered for the transaction.

Enter or select a batch ID (optional). See Creating a receipt batch for more information.

In multicurrency transactions, if the batch posting date does not fall on or before the exchange rate's expiration date, you will receive a message. Choose Yes to open the Batch Entry window and change the batch posting date. If you choose No, you will be able to save but not post the receipt.

Enter or select the vendor ID.

Enter or select a currency ID. If a currency ID is assigned to the vendor you select, it will appear in the Currency ID field. The currency ID assigned to the invoice must match the currency ID of the purchase order being received against.

Enter the purchase order number for which you're receiving a shipment. You can receive items from multiple purchase orders by entering or selecting a different purchase order number in a new row. See Receiving items for projects from multiple purchase orders for more information.

If the Allow Receiving Without a Purchase Order option is marked in the Purchase Order Processing Setup window, you can leave the PO Number field blank.

You can enter a purchase order that hasn't been printed if the Allow Receiving of Unprinted PO option is marked in the PA Purchase Order Processing Setup Options window.

Enter a project number and cost category ID.

You can't enter a project number or a cost category if the Options >> Display Vendor Item is marked to display the vendor items.

Enter one or more items using your company's item numbers. You also can enter non-inventoried items.

Inventoried items entered for a project must be assigned to a cost category in the Budget Detail IV Items window. If the item isn't assigned to a budget, you must add the item to the budget.

To add an attachment to the item, select the item and choose the Attachment Management icon to open the Document Attachment Management window.

You can change the site ID to receive line items to a location other than the location specified on the purchase order, if the option is marked in Purchase Order Processing Setup. Changing the site on the receipt will not change the site on the purchase order.

If you are using multiple bins and you change the site ID, the default purchase receipts bin assigned to the new site ID will replace your previous bin selections. If the item is tracked by serial or lot numbers, your previous lot number or serial number selections are removed. The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open for you to assign lot numbers or serial numbers. You can change the bin.

Enter the quantity shipped.

Note

The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open if the item requires that you assign lot or serial numbers. If you are using multiple bins, you also can enter a bin number for the serial or lot number. The Bin Quantity Entry window will open if an item that isn't tracked by lot or serial numbers requires you to enter bin information.

If you're using multiple bins and you change the quantity shipped or the unit of measure after selecting bins for an item, you might have to modify the bin information.

You can edit the unit cost or extended cost, if the Allow Editing of Costs in Receiving option is marked in Purchase Order Processing Setup.

Choose the Attachment Management icon to attach documents to the shipment, if applicable.

If you are using landed costs, choose Landed Cost to open the Receivings Landed Cost Apportionment Entry window, where you can add landed costs to all line items on a receipt. See Entering landed costs for a shipment receipt for more information. If you want to enter landed costs for an item, see Entering landed costs for a shipment item.

Choose Distributions to open the Purchasing Distribution Entry window, where you can make changes to account distributions.

To add additional accounts, select the account and enter an amount.

To remove an account in the scrolling window, select the row containing the account and choose Edit >> Delete Row.

To restore the original distributions, choose Default.

If you are using landed costs, the distributions for a landed cost won't be displayed in the Purchasing Distribution Entry window. To view landed cost distributions, print the Receivings Edit List.

See Distributing transaction amounts for shipment receipts for more information.

Choose User-Defined to open the Receivings User-Defined Fields Entry window, where you can enter user-defined information for this receipt.

Choose Save or Post. If you post the receipt, one or more posting journals and distribution breakdown registers may be printed, depending on the options selected in the Posting Setup window.

If you've entered a batch ID, you can't post the transaction individually; you must use batch posting, series posting, or master posting. For more information, see Chapter 12, "Receipt batches."

Receiving project items without a purchase order

In the Receivings Transaction Entry window, you have the option to receive items that weren't included on the original purchase order or receive items without a purchase order.

To set up this option, you must select to allow receiving items without a purchase order in the Purchase Order Processing Setup window. You may assign a password that must be entered before entering a line item not assigned to a purchase order.

To receive project items without a purchase order:

Open the Receivings Transaction Entry window. (Purchasing >> Transactions >> Receivings Transaction Entry)

Select the appropriate document type for the transaction.

Enter the receipt number, vendor document number, date, and vendor ID.

Enter a project number and cost category ID. If the item that you're receiving isn't assigned to a project because the item isn't assigned to a budget, enter <NONE> or leave the Project No. field blank. If there isn't a project number, you can leave the Cost Category field blank. If the item is assigned to a project, you must enter a cost category.

You can't enter a project number or a cost category if the Options >> Display Vendor Item is marked to display vendor items.

To add items that weren't included on the original purchase order, leave the PO number field blank. You don't have to enter a purchase order if you've set up the system to allow receiving items without a purchase order.

Inventoried items entered for a project must be assigned to a cost category in the Budget Detail IV Items window. If the item isn't assigned to a budget, you must add the item to the budget. You cannot add a new inventoried item if the Allow Entry of New Budgets/Materials option is not marked in the User Purchase Order Settings window. See Inventoried items and non-inventoried items for projects for more information.

Continue entering the receipt.

You must enter the unit cost of non-inventoried items.

In the Receivings Transaction Entry window, save or post the transaction.

Receiving items for projects using the Select Purchase Order window

Use the Select Purchase Order window to select a purchase order to quickly enter line items on a shipment or shipment/invoice. See Receiving a shipment for projects or Receiving a shipment/invoice for projects for more information. To receive items on a blanket purchase order, refer to Chapter 13, "Shipment and intransit inventory receipt entry."

If you are using Workflow, the purchase order must be approved before you can receive against the purchase order. You can receive against purchase orders that don't need approval.

To receive items for projects using the Select Purchase Order window:

Open the Receivings Transaction Entry window. (Purchasing >> Transactions >> Receivings Transaction Entry)

Select the appropriate document type for the transaction.

Enter the receipt number, vendor document number, and date. (A vendor document number is required for a shipment/invoice.)

Choose Auto-Rcv to automatically receive items. The Select Purchase Order window will open.

Note

If you entered a vendor ID, the Select Purchase Order Items window will open instead of the Select Purchase Order window.

Enter or select a purchase order for which you want to receive line items.

Choose Receive All in the Select Purchase Order window to automatically receive all items on the selected purchase order.

If you choose to view details in the Select Purchase Order window, the Select Purchase Order Items window will open, and the purchase order line items will be marked to receive. Choose Receive to automatically receive items on the selected purchase order.

In the Receivings Transaction Entry window, continue entering receipt information, if necessary, and save or post the transaction.

Receiving items for projects from multiple purchase orders

Use the Select Purchase Order Items window to receive line items for projects on multiple purchase orders. New, Released, or Change Order purchase orders that have one or more items with a quantity remaining to receive will be displayed. See Receiving a shipment for projects or Receiving a shipment/invoice for projects for more information.

To receive items from multiple blanket purchase orders, refer to Chapter 13, "Shipment and in-transit inventory receipt entry."

If you are using Workflow, the purchase orders must be approved before you can receive against them. You can receive against purchase orders that don't need approval.

To receive items for projects from multiple purchase orders for projects:

Open the Receivings Transaction Entry window. (Purchasing >> Transactions >> Receivings Transaction Entry)

Select the appropriate document type for the transaction.

Enter the receipt number, vendor document number, and date. (A vendor document number is required for a shipment/invoice.)

Enter or select a vendor ID. The currency ID assigned to the vendor will be the default currency ID for the receipt.

Choose the Auto-Rcv button. The Select Purchase Order Items window will open.

New, Released, or Change Order purchase orders that have one or more items with a quantity remaining to receive will be displayed.

If only a Vendor ID is displayed, the selected vendor does not have any New, Released, or Change Order purchase orders with items to receive. Only purchase orders with currency IDs that match the receipt will be displayed.

Tip

If you know the purchase order number but not the vendor ID, you can choose AutoRcv without entering a vendor ID. The Select Purchase Order window will open. The vendor and currency ID for the receipt will come from the purchase order you select.

Select a sorting option.

Mark the check boxes next to the items you want to receive. To select all items displayed in the scrolling window, choose Mark All.

Note

When you choose Mark All or Unmark All in the Select Purchase Order Items window, only items displayed in the scrolling window will be marked or unmarked. For example, if a purchase order is selected in the tree view, only items from that purchase order will be displayed in the scrolling window, and only those items will be marked when you choose Mark All. To mark or unmark all items for a vendor, the vendor ID must be selected in the tree view.

Select whether to display all items or only items marked to receive.

Modify the quantity shipped, quantity invoiced (for shipment/invoice receipts) and unit cost amounts, if necessary. If you edit an item in the scrolling window, it will be marked to receive.

Choose the Receive button to add the items to your receipt. The Select Purchase Order Items window will close, and the items will appear in the Receivings Transaction Entry window. Taxes are calculated at this time.

To cancel your selections, choose Cancel. To revert all displayed items to unmarked, choose Unmark All.

In the Receivings Transaction Entry window, save or post the receipt.

Receiving items for projects from a purchase order

Use the Select Purchase Order Items window and the Receivings Transaction Entry window to receive items. After you enter or select a standard order with New, Released, or Change Order statuses in the Purchase Order Entry window, you can select to receive items or receive and invoice items. From the Actions button, you can select the Receive the PO Items option from the Actions button to enter a shipment receipt. You can select the Receive and Invoice the PO Items option to enter a shipment/invoice receipt for a purchase order.

If you are using Workflow, the purchase order must be approved before you can receive against the purchase order. You can receive against purchase orders that don't need approval.

For more information about a shipment receipt or a shipment/invoice receipt, see Receiving a shipment for projects or Receiving a shipment/invoice for projects. For more information about the Select Purchase Order Items window, see Using the Select Purchase Order Items window.

To receive items from a blanket purchase order, refer to Chapter 13, "Shipment and in-transit inventory receipt entry."

To receive items for projects from a purchase order:

Open the Purchase Order Entry window. (Purchasing >> Transactions >> Purchase Order Entry)

Enter or select a standard purchase order that has one or more items with a quantity to receive.

Choose Actions, and then select one of the following options.

If you are receiving goods and services without an invoice, select Receive the PO Items.

If you are receiving goods and services accompanied by an invoice, select Receive and Invoice the PO Items.

The Select Purchase Order Items window and the Receivings Transaction Entry window will open.

In the Select Purchase Order Items window, New, Released, or Change Order purchase orders that have one or more items with a quantity remaining to receive will be displayed. The purchase order that you entered in the Purchase Order Entry window will be selected in the tree view. Each item on the purchase order that is available to be received in the scrolling window is marked.

Select a sorting option.

Mark the check boxes next to the items to receive. To select all items displayed in the scrolling window, choose Mark All.

Note

When you choose Mark All or Unmark All, only items displayed in the scrolling window will be marked or unmarked. For example, if a purchase order is selected in the tree view, only items from that purchase order will be displayed in the scrolling window, and only those items will be marked when you choose Mark All. To mark or unmark all items for a vendor, the vendor ID must be selected in the tree view.

Select whether to display all items or only items marked to receive.

Modify the quantity shipped, quantity invoiced (for shipment/invoice receipts) and unit cost amounts, if necessary. If you modify an item in the scrolling window, it will be marked to receive.

Choose Receive to add the items to your receipt. The Select Purchase Order Items window will close, and the items will appear in the Receivings Transaction Entry window. Taxes are calculated at this time.

To cancel your selections, choose Cancel. To revert all displayed items to unmarked, choose Unmark All.

In the Receivings Transaction Entry window, continue entering receipt information, if necessary, and save or post the transaction. For a shipment/invoice, you must enter the vendor document number.

Chapter 15: Shipment receipt detail entry

The Receivings Transaction Entry window is designed to resemble a physical shipment document and includes vendor, line item, and total information. Use the expansion buttons in the Receivings Transaction Entry window to open windows where you can enter detailed information about a line item, lot number, serial number mask, or other elements of a transaction.

This information is divided into the following sections:

Entering detail information for a purchasing receipt

Entering detail information for an in-transit inventory receipt

Entering project item detail information for a purchasing receipt

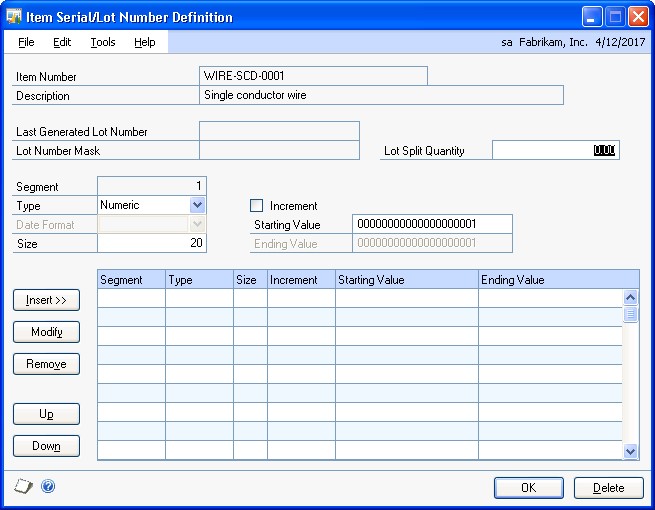

Defining a lot number mask

Generating lot numbers automatically for a shipment or shipment/invoice receipt

Entering lot numbers manually for a shipment or shipment/invoice receipt

Entering lot numbers for an in-transit inventory receipt

Removing lot numbers from a shipment or shipment/invoice receipt

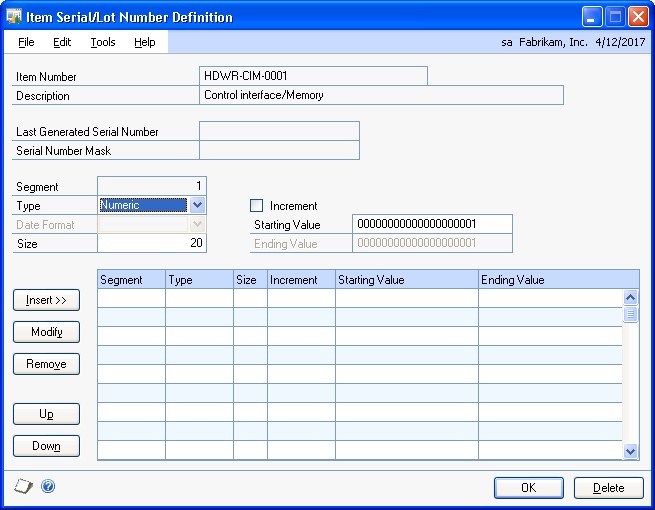

Defining a serial number mask

Generating serial numbers automatically for a shipment or shipment/invoice receipt

Entering serial numbers manually for shipment or shipment/invoice receipt

Entering serial numbers for an in-transit inventory receipt

Removing serial numbers from a shipment or shipment/invoice receipt

Multiple bins in Purchase Order Processing

Changing bins for a receipt

Merging trade discount and purchase distributions

Distributing transaction amounts for shipment receipts

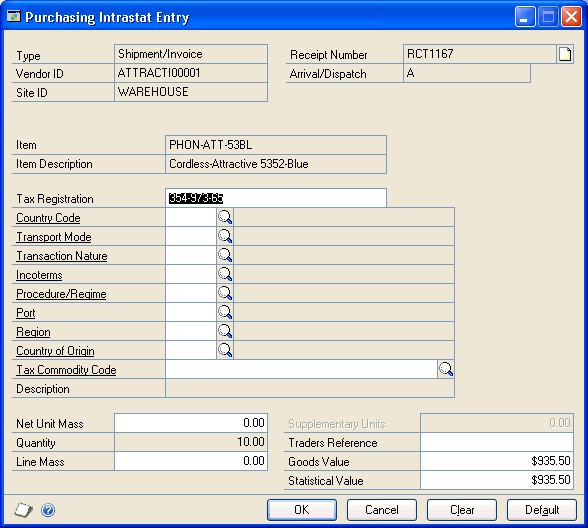

Entering Intrastat trade statistics

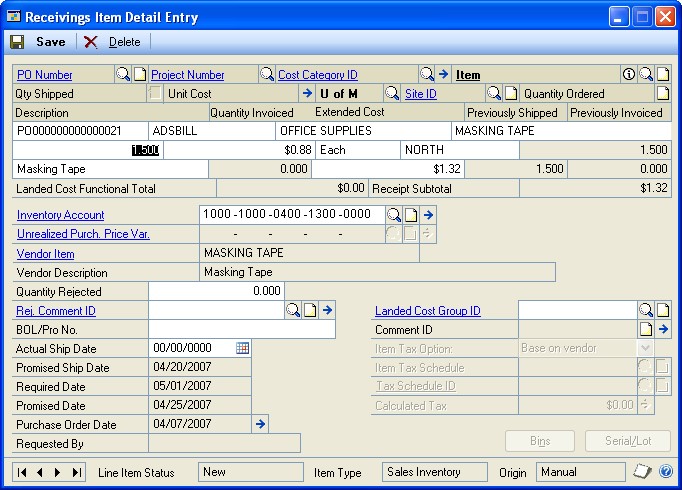

Entering detail information for a purchasing receipt

Use the Receivings Item Detail Entry window to add or modify line item information such as rejected quantities, or to change a line item's posting accounts. If you select an item in the Receivings Transaction Entry window before opening this window, information for that item will be displayed.

If you are using Project Accounting, the Project Number field and the Cost Category ID field will be displayed in the Receivings Item Detail Entry window, but you can't enter project information for blanket purchase order line items. To enter additional information for a line item assigned to a project, see Entering project item detail information for a purchasing receipt.

To enter detail information for a purchasing receipt:

Open the Receivings Transaction Entry window. (Purchasing >> Transactions >> Receivings Transaction Entry)

Enter or select a receipt number and vendor and open the Receivings Item Detail Entry window by choosing the Vendor Item or Item expansion button.

Currency amounts in this window may be displayed in the functional or originating currency, depending on the view selected in the Receivings Transaction Entry window.

Enter the purchase order number for which you're receiving a shipment. You can receive items from multiple purchase orders by entering or selecting a different purchase order number in a new row. See Receiving items from multiple purchase orders for more information.

If the Allow Receiving Without a Purchase Order option is marked in Purchase Order Processing Setup, you can leave the PO Number field blank.

If you are using Workflow, the purchase order must be approved before you can receive against the purchase order. You can receive against purchase orders that don't need approval.

If you are entering an item for a project, assign a project number and cost category ID.

You can't enter a project number or a cost category if the Options >> Display Vendor Item is marked to display the vendor items.

Enter or select the number of the vendor item or item you're receiving. You also can enter a non-inventoried item.

Inventoried items entered for a project must be assigned to a cost category in the Budget Detail IV Items window. If the item isn't assigned to a budget, you must add the item to the budget. See Inventoried items and non-inventoried items for projects for more information.

Enter the quantity shipped.

Note

The Purchasing Lot Number Entry window or the Purchasing Serial Number Entry window will open if the item requires that you assign lot or serial numbers. If you are using multiple bins, you also can enter a bin number for the serial or lot number. The Bin Quantity Entry window will open if an item that isn't tracked by lot or serial numbers requires you to enter bin information. You can't assign serial or lot numbers to a non-inventoried item.

An icon will be displayed in the Qty Shipped field for purchase order line items with sales commitments. Select a line item and choose the button next to the Qty Shipped heading to view or prioritize commitments in the Sales Commitments for Purchase Order window. For more information, see Committing purchase orders to sales documents. If you are using Project Accounting, you can't commit purchase order line items for projects to Sales Order Processing line items.