Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

This part of the documentation contains information about entering analysis information for transactions in Microsoft Dynamics GP. This information includes the following topics:

Chapter 4, “General Ledger Transactions” describes how to enter analysis information for General Ledger transactions. It also explains how you can adjust analysis information for posted journal entries.

Chapter 5, “Payables Management Transactions” explains how to enter analysis information for Payables Management transactions.

Chapter 6, “Purchase Order Processing Transactions” explains how to enter analysis information for Purchase Order Processing transactions.

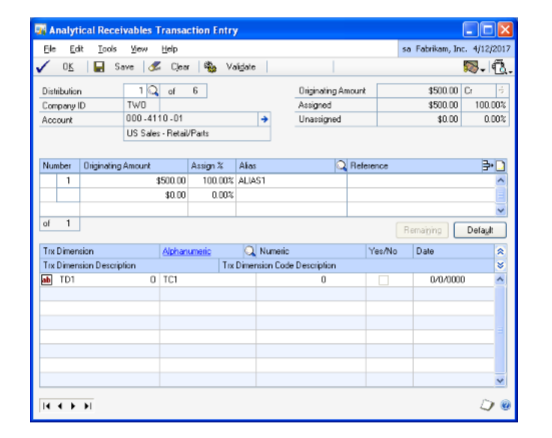

Chapter 7, “Receivables Management Transactions” describes how to enter analysis information for Receivables Management transactions.

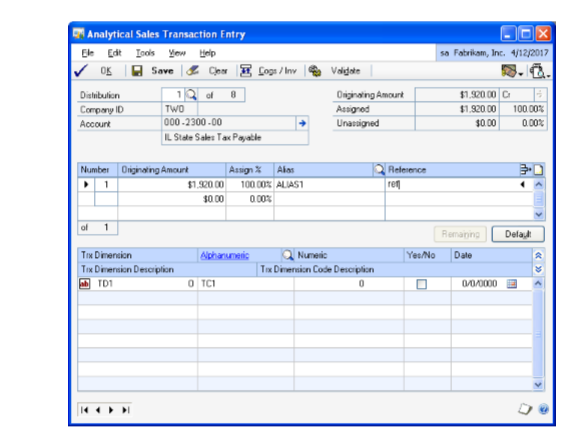

Chapter 8, “Sales Order Processing Transactions” explains how to enter analysis information for transactions in Sales Order Processing.

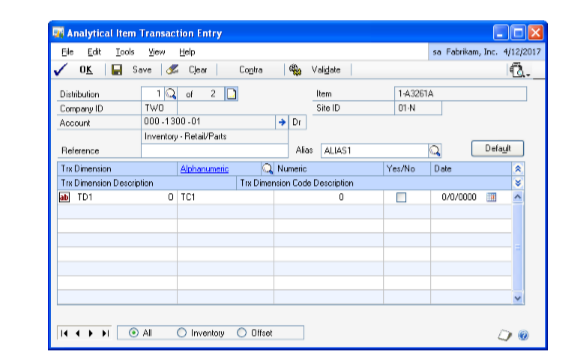

Chapter 9, “Inventory Transactions” explains how to enter analysis information for Inventory transactions.

Chapter 10, “Fixed Asset Transaction” explains how to enter analysis information for Fixed Asset Transactions

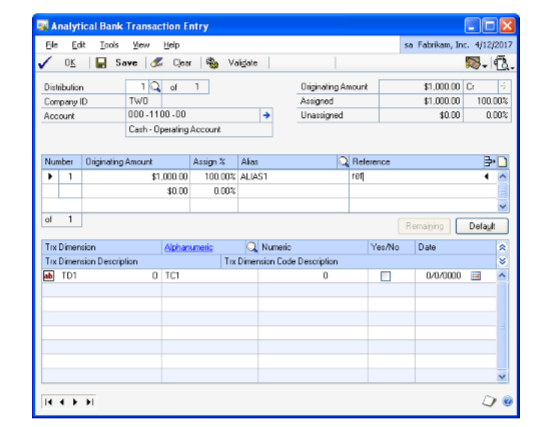

*Chapter 11, “Bank Reconciliation Transactions”*explains how to enter analysis information for Bank Reconciliation transactions.

*Chapter 12, “Cashbook Bank Management Transactions”*describes how to enter analysis information for Cashbook Bank Management transactions.

*Chapter 13, “Electronic Bank Management.”*describes how to enter analysis information for Electronic Bank Management transactions.

*Chapter 14, “Direct Debits And Refunds Transactions”*describes the analysis information that is created for Direct Debits and Refunds transactions.

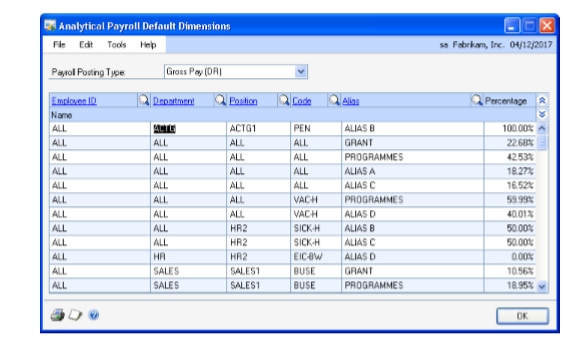

Chapter 15, “Analysis information for U.S. Payroll transactions” describes the analysis information that is created for U.S. Payroll transactions.

Chapter 4: General Ledger Transactions

The various procedures involved in entering analysis information for General Ledger transactions are explained here. You can enter analysis information for distribution accounts that are linked to an account class. You can also adjust analysis information for posted journal entries. Also, you can view the analysis information for a selected account or journal entry.

The reports generated using the Distribution and Multilevel queries display analysis information entered in General Ledger.

You can open the Analytical Transaction Entry window only if Analytical

Accounting has been activated. Refer to Activating Analytical Accounting for more information.

This information is divided into the following sections:

Entering analysis information for General Ledger transactions

Validating transactions and correcting errors

Entering analysis information for Quick Journals

Entering analysis information for Miscellaneous Checks

Analysis information in batches

Voiding an unposted transaction

Backing out a posted transaction

Backing out and correcting a posted transaction

Copying a posted transaction

Voiding a Quick Journal entry

Analysis information for writeoffs

Series posting and master posting

Adjusting analysis information in posted transactions

Validating adjustments and correcting errors

Viewing detail journal entries with analysis information

Viewing journal entries with analysis information

Analytical Accounting check links

Copying Analytical Accounting Information for General Journal

Entering analysis information for General Ledger transactions

Use the following information to enter analysis information for distribution accounts that are linked to an account class. You can save transactions individually or in a batch with or without analysis information.

The Analytical General Transaction Entry window opens automatically when you press TAB from a field in the Transaction Entry window (Transactions >> Financial >> General) in the following instances:

If an account is linked to an account class and no analysis information has been entered for the account earlier.

If changes are made to a distribution line that affects analysis information entered previously for the line. These include changing the account, amount or debit to credit or vice versa, as this will delete the previously entered analysis information and create a single assignment of 100 percent.

If the option Calculate Taxes in General Ledger is marked in the Company

Setup Options window (Administration >> Setup >> Company >> Company >> Options), you may need to enter analysis information for distribution accounts that are created from the Tax Entry window. If any of the new distribution accounts are linked to an account class, after the tax transactions are created from the Tax Entry window, the Analytical General Transaction Entry will open automatically from the general Transaction Entry window. If the Analytical General Transaction Entry window has been opened earlier for the distribution accounts, it displays the first of the new distribution accounts that are linked to an account class (as per the distribution sequence). If not, the first of the previous distribution accounts linked to an account class will be displayed.

If you delete a transaction in the General Ledger Transaction Entry window, any analysis information entered for the transaction is also deleted.

For multicurrency transactions, a change in the transaction date re-creates distribution amounts due to a change in the exchange rate. If the transaction date is modified, analysis information created previously is deleted when the distribution amounts are re-created.

To enter analysis information for General Ledger transactions:

Open the Analytical General Transaction Entry window. (Transactions >>Financial >> General >> Enter account/amount >> Choose the Analytical Accounting button)

(Transactions >>Financial >> General >> Enter account/amount >> Additional >> Analytical Transaction or CTRL+T)The Analytical General Transaction Entry window displays the distribution account selected in the General Transaction Entry window. To view the other distributions for the transaction, enter or select a distribution number.

The sequence of distributions in the Analytical General Transaction Entry window may not correspond to the sequence in the General Transaction Entry window because only accounts linked to an account class are displayed in the Analytical General Transaction Entry window.

The Originating or Functional Amount field displays the distribution amount in the originating or functional currency based on the option selected in the currency view.

Note

You can choose the expansion button to view multicurrency information if the originating currency differs from the functional currency. The currency icon is not displayed if the displayed distribution account is a unit account.

The Company ID field displays the ID for the current company.

The Account field displays the account related to the distribution. The expansion button will open the Microsoft Dynamics GP Account Entry window. The balance type, whether debit or credit, is also displayed.

The Assigned field displays the total distribution amount in value and percentage that has been assigned.

The Unassigned field displays the remaining distribution amount that is to be assigned in value and percentage.

In the assignment list view, an arrow before the Number field indicates that the analysis information displayed is for the selected assignment. Each assignment created for the distribution is displayed separately.

In the list window, enter the transaction distribution amount in functional or originating currency, by value or on a percentage basis.

The Number field displays the number of the assignment.

The Originating or Functional Amount field in the assignment list view, displays the assignment in the originating or the functional currency based on the option you selected in the Currency View. Enter the amount to assign in the Originating/Functional Amount field. Assignments can be entered in the functional or originating currency.

Note

You can enter the assignment either in value or percentage terms.

Enter the assignment in percentage value in the Assign% field. Initially, a single assignment is created by default. You can overwrite the assignment with more than one assignment.

You can save analysis information for a distribution even if the assignment is not 100%. However, you can post a transaction with partial assignments only if you have opted to allow partial assignments during posting for the module you’re working in. Refer to Setting up assignment options for more information.

Select an alias in the Alias field. The Alphanumeric field in the scrolling window displays the transaction dimension codes that are associated with the alias for the transaction dimensions displayed. You can change these codes if required. Refer to Creating an alias for more information.

Enter reference information for the assignment in the Reference field.

Choose Delete Row to delete a single row in the assignment List View. You cannot choose this option if only a single assignment has been entered.

Choose Remaining to add one assignment for the remaining unassigned amount. The new assignment will ensure that the total assigned amount equals the distribution amount. For example, the distribution amount is $100 and you’ve entered four assignments that total $75. When you choose Remaining, a fifth assignment for the remaining value, $25 is created. This button is not available if the distribution field is blank or has a zero value.

Choose Default to load the current setup information specified for the account class in the Accounting Class Maintenance window and create a single assignment. The following processes will occur:

Fixed, Required, and Optional Transaction Dimensions (including hidden transaction dimensions) will be installed.

All the assignments that you have created for the current distribution will be removed and create a single assignment that is equal to the distribution amount will be created.

If the analysis type is changed to or from Not Allowed, transaction dimensions will be added or removed.

Transaction dimensions that have been deleted will be removed.

The Trx Dimension field displays transaction dimensions for the account class that the distribution account is linked to. Only transaction dimensions that have been set as Required, Fixed, or Optional are displayed.

The Transaction Dimension Description field displays the description of the Transaction Dimension that you’ve entered in the Transaction Dimension Maintenance window.

Enter or select the code for each Alphanumeric transaction dimension in the Alphanumeric column. If you’ve marked the Show valid code combinations in trns and budgets option in the Analytical Accounting Options window, then the lookup window will display only those codes that have a valid combination with the codes you have already selected for the transaction.

Note

Security access to use a transaction dimension code is granted automatically to the user who created the code during transaction entry.

Enter a transaction dimension code in the Numeric, Yes/No or Date field for a Numeric, Boolean or Date type Transaction Dimension.

Choose OK to save your changes and close the window. The analysis information that you have entered is validated when you choose OK. Refer to Validating transactions and correcting errors for more information.

Choose Save to save the analysis information you have entered and clear the window. A validation takes place when you choose Save in the Analytical General Transaction Entry window. Refer to Validating transactions and correcting errors for more information. You can save the analysis information with errors or without updating changes made to the account class.

Choose Clear to clear the information from the Analytical General Transaction Entry window.

Choose Validate to validate the analysis information of the distribution displayed in the window. If changes are made to the account class in the Analytical Accounting setup or errors are found during the validation process, the Analytical Accounting Validation Log window will open where you can view the errors or changes. Refer to Validating transactions and correcting errors for more information about validation.

Choose Print to print the error report. Choose OK to close the window and return to the Analytical General Transaction Entry window.

To view the changes to the account class choose the Default button in the Analytical General Transaction Entry window. Double click on an Analytical Accounting error to open the Analytical Accounting General Transaction Entry window where the specific error will be highlighted

Choose the printer icon button to print the Analytical Accounting edit list for the current distribution displayed or for all distributions of the transaction linked to an account class. The Analytical Accounting Validation Log report which describes the Analytical Accounting errors also is printed.

If you post a reversing transaction or reverse an existing transaction, the analysis information is copied from the transaction to the reversed transaction with the change in balance type, whether debit or credit.

If you void a transaction that has been posted to General Ledger, a reversing transaction is created along with any analysis information assigned to the original transaction.

On posting Clearing Journals, analysis information that has been entered for the transactions will not be posted. Also, no validation will take place for the distribution accounts, even if the accounts are linked to an account class. To post analysis information, use the general Transaction Entry window (Transactions >> Financial >> General).

Validating transactions and correcting errors

You can validate a transaction document by selecting the transaction in the relevant

Analytical Accounting Transaction Entry window and choosing Additional >> Run Validation or by pressing CTRL+R. You can validate a transaction distribution by choosing OK, Save or Validate, only if it has an amount.

The validation process verifies the following information:

The assignments that you’ve created conform to the assignment options you have set up for the module.

Codes are specified for all transaction dimensions that have a required status.

The code combinations are valid.

All the alphanumeric codes have access to the relevant user ID and distribution account.

That accounts associated with the transaction are still linked to an account class.

The transaction dimensions and codes have not been deleted from the setup.

The multicurrency information for Analytical Accounting and Microsoft Dynamics GP is the same.

There is a distribution record and at least one assignment record for all the Microsoft Dynamics GP distributions.

All distributions, assignments and codes link to existing Microsoft Dynamics GP distribution.

Changes that were made to the analysis type of the transaction dimension are invalid.

The validation routine takes place in the following stages:

Stage one At the first stage, changes in setup are verified. If any changes have been made, then you must click the Default button in the Analytical Transaction Entry window to update the window with changes.

Stage two At the second stage, the validation routine checks whether code combinations are valid and selected codes exist and have the required access to user ID and account; if codes have been entered for required transaction dimensions and if assignments equal the transaction distribution amount. This part of validation takes place only after all errors that are indicated at the first stage have been corrected.

When you post a general transaction, a validation takes place for the entire document. The document is posted if no errors are found in the transaction.

If errors are found while posting a general entry transaction, the transaction will not be posted. The Analytical Accounting Validation Log window will open. The Microsoft Dynamics GP errors will be listed first in the window and then the Analytical Accounting errors.

We recommend that you resolve the Microsoft Dynamics GP errors before you correct the Analytical Accounting errors.

To correct an Analytical Accounting error, double-click on the relevant error to open the Analytical General Transaction Entry window. The specific distribution where the error exists is displayed.

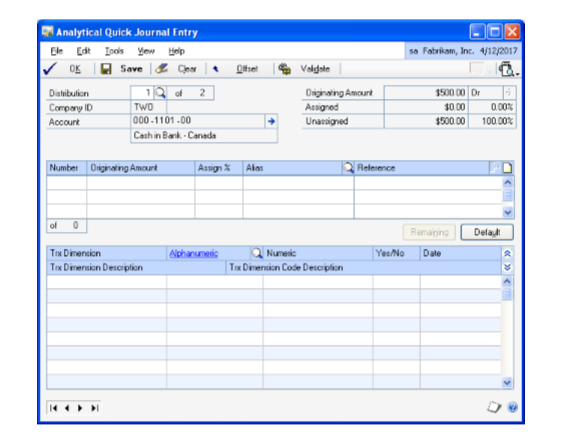

Entering analysis information for Quick Journals

Use the following information to enter analysis information for distribution accounts in the Analytical Quick Journal Entry window. The Analytical Quick Journal window is similar to the Analytical General Transaction Entry window. Refer to Entering analysis information for General Ledger transactions for more information.

To enter analysis information for Quick Journals

Open the Analytical Quick Journal Entry window. (Transactions >> Financial >> Quick Journal >> Choose the Analytical Accounting button)

(Transactions >> Financial >> Quick Journal >> Additional >> Analytical Transaction or CTRL+T)

The Analytical Quick Journal Entry window will open only if you have entered an account and amount in the scrolling window of the Quick Journal Entry window.

The Analytical Quick Journal Entry window displays the first account linked to a class ID in the accounts scrolling window.

Enter or select a distribution number. If you click Offset to open the Analytical Transaction Entry window and lookup, only one distribution is displayed. If the window and lookup window are opened from the main distribution account, then only the main distribution accounts are displayed.

Choose Browse to view the remaining distributions. If you browse when the main account is displayed, you cannot view the control account distribution. Similarly, if you choose to browse when the control account is displayed, you cannot view the main account distribution.

The total number of distributions, including all accounts of the document linked to an account class is displayed in the Distribution of field.

Enter the percentage to assign in the Assign% field. You can view the total of the assignments in percentage. Assignment can be given in amount or percentage.

Select an alias in the Alias field. The Alphanumeric field in the scrolling window displays the transaction dimension codes that are associated with the alias for the transaction dimensions displayed. You can change these codes if required. Refer to Creating an alias for more information.

Enter a reference for the assignment in the Reference field.

Choose Remaining to add one assignment for the unassigned balance amount. You can assign an amount in a new assignment line and you can modify the assignment line.

Choose Default to remove all the assignments for a given distribution line and to create a new assignment amount of 100%. Refer to Entering analysis information for General Ledger transactions for more information about the Default button.

The Trx Dimension field will display transaction dimensions for the account class to which the distribution account is linked. Transaction dimensions that have been set as Required, Fixed, or Optional will be displayed.

The default transaction dimensions are displayed in the Trx Dimension Code field.

Enter the transaction dimension code for an alphanumeric transaction dimension in the Alphanumeric field. You can click the alphanumeric link to open the Transaction Dimension Code window to view information about an existing code. The Alphanumeric column is available only for an alphanumeric transaction dimension

Security access to use a transaction dimension code is granted automatically to the user who created the code during transaction entry.

Enter a transaction dimension code in the Numeric, Yes/No or Date field for a Numeric, Boolean or Date type Transaction Dimension.

Choose the Show button to view the description of the transaction dimensions in the Trx Dimension field. You can view the description of a transaction dimension code in the Trx Dimension Code Description field.

When you open the Analytical Quick Journal Entry window from any distribution line, you can use the Offset Acct. button to assign an Analytical Accounting assignment to an offset account. The Offset Acct. button is not available if the control total is zero. Control total is the net total of debits and credits.

When you click Offset Acct., the Main button becomes available. You can switch between the main and offset accounts and enter Analytical Accounting assignment by clicking this button.

If the offset account is linked to an account class, and the control total is not entered, the control total amount is calculated when you choose Post or Save and the Analytical Transaction Entry window opens.

Choose the printer icon button in the Quick Journal Entry window to print the Quick Journal Entry edit list and the Analytical Accounting edit list. A validation takes place for the entire document before the Analytical Accounting assignment in the distribution accounts is printed. Assignments with errors as well as the ones without errors will be printed.

Choose OK to save the changes and to close the window. Choose Continue to close the window or No to keep the window open.

Choose Clear to clear the entries you’ve made in the window.

When you post a quick journal, a validation takes place for the entire document. The document would be posted if no errors occur in the Microsoft Dynamics GP transaction and in the Analytical Accounting assignments. You can print the Quick Posting Journal and the Analytical Accounting posting journal reports if you close the Quick Journal Entry window after posting. Refer to Validating transactions and correcting errors for more information.

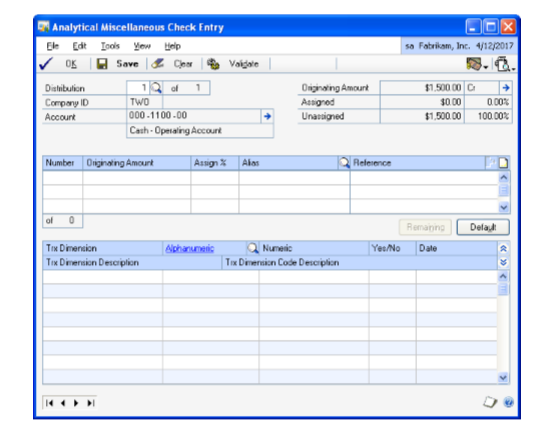

Entering analysis information for Miscellaneous Checks

Use the Analytical Miscellaneous Check Entry window to enter analysis information for the distribution accounts used in miscellaneous checks. You can create assignments, enter transaction dimension codes and references for accounts that are linked to an account class. The Analytical Miscellaneous Check Entry window does not support multicurrency since miscellaneous checks do not support multicurrency.

The Analytical Miscellaneous Check Entry window opens automatically when you press TAB in the Miscellaneous Checks (Transactions >> Financial >> Miscellaneous Checks) window in the following instances:

If an account is linked to an account class and no analysis information has been entered for the account earlier.

If changes are made to a distribution line that affects analysis information such as account or amount or type of amount created previously for such line.

The analysis information is deleted if the distribution line is deleted, and you do not post the document. The analysis information you’ve entered is validated before you post the transaction. Refer to Validating transactions and correcting errors for more information.

Note

The analytical information for miscellaneous checks cannot be voided since you cannot void miscellaneous checks.

To enter analysis information for Miscellaneous Checks:

Open the Analytical Miscellaneous Check Entry window. (Transactions >> Financial >> Miscellaneous Check >> CTRL+T or Additional >>Analytical Transaction)

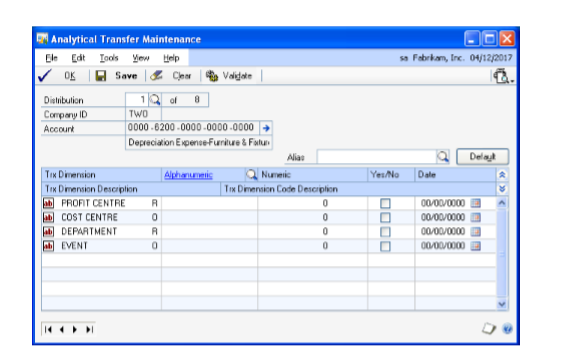

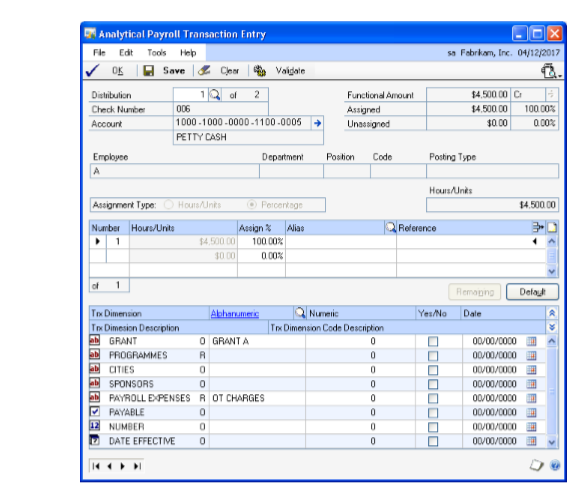

Refer to Entering analysis information for General Ledger transactions for more information.IMAGE – AAMC.jpg

A screenshot of a computer Description automatically generated

- You can also edit the analysis information you’ve entered in the Analytical Miscellaneous Check Entry window before you post the transaction.

Analysis information in batches

The following section deals with information specific to batches. To enter analysis information for individual transactions, refer to Entering analysis information for General Ledger transactions .

To print the Analytical Accounting Edit List and Analytical Accounting error list along with the Microsoft Dynamics GP edit list for a selected batch, choose the printer icon button in the Analytical Transaction Entry window. You can correct the Analytical Accounting errors by selecting the batch and then correcting each of the transactions that have errors.

When you post a batch from the Batch Entry window (Transactions >> Financial >> Batches), a validation will take place for all the transactions saved in the batch. Microsoft Dynamics GP and Analytical Accounting transactions without errors will be posted and the Analytical Accounting General Posting report will be printed along with the Microsoft Dynamics GP reports. If errors are found during the validation process, an error list report is printed listing analysis errors for the transaction distributions in the batch being posted. You can correct the errors by modifying the transactions in the window where the transaction originated from.

If you delete a single or recurring use batch or a transaction within such batches, the analysis information entered for the transaction distributions in the batch or for the transaction also will be deleted.

You can save a transaction in a batch with Analytical Accounting errors but cannot post the transaction.

For a recurring batch, the analysis information of the batch last posted will be retained and will update each subsequent batch that is posted, unless changes are made to the analysis information in the batch.

Analysis information that originated in the subsidiary modules can be viewed in the General Ledger. Such information can be modified prior to updating General Ledger.

Voiding an unposted transaction

You can void a transaction saved in General Ledger using the Transaction Entry window. You also can void transactions that originated in other modules in this window, if you’ve marked the Void/Correcting of Subsidiary Transactions option in the General Ledger Setup window (Administration >> Setup >> Financial >> General Ledger). The analysis information for the transaction voided in the General Ledger will not be updated in the subsidiary module.

When you void a transaction with analysis information and close the Transaction Entry window, the Analytical Accounting Posting Journal will be printed along with the Microsoft Dynamics GP Posting Journal. The Analytical Accounting Posting Journal will only display the journal number and the account for the transaction. When you void a transaction in a batch, the analysis information for the voided transaction will be deleted.

Backing out a posted transaction

You can back out a transaction posted in General Ledger using the General Ledger Transaction Entry window. You also can back out a posted transaction that originated in a subsidiary module using the Transaction Entry window, if you’ve marked the Void/Correcting of Subsidiary Transactions option in the General Ledger Setup window (Administration >> Setup >> Financial >> General Ledger).

When you back out a posted transaction with analysis information, the transaction dimension codes in the posted transaction will be copied from the backed out transaction to the new transaction that is created. You cannot open the Analytical General Transaction Entry window for the backed out transaction. The analysis information will not be validated when you post the backed out transaction.

Backing out and correcting a posted transaction

You can back out and correct a transaction posted in General Ledger using the General Ledger Transaction Entry window. You can also back out and correct a posted transaction that originated in a subsidiary module in this window, if you’ve marked the Void/Correcting of Subsidiary Transactions option in the General Ledger Setup window (Administration >> Setup >> Financial >> General Ledger).

When you back out and correct a posted transaction with analysis information, the transaction dimension codes in the posted transaction will be copied to the reversing transaction that is created. You cannot open the Analytical General Transaction Entry window for the backed out transaction. The analysis information will not be validated when you post the backed out transaction.

Also, a new correcting transaction is created using the debits and credits of the original transaction. However, the analysis information will not be copied to the correcting transaction, which will be treated as a new transaction. You need to enter analysis information for the new transaction in General Ledger. Refer to Entering analysis information for General Ledger transactions for more information.

Copying a posted transaction

When you copy a saved or posted transaction, the analysis information for the source transaction will not be copied to the new transaction. You need to enter analysis information for the new transaction in the General Ledger. Refer to Entering analysis information for General Ledger transactions for more information.

Voiding a Quick Journal entry

You can void a saved Quick Journal entry using the Quick Journal Entry window.

When you void a transaction with analysis information and close the Quick Journal Entry window, the Analytical Accounting Posting Journal will be printed along with the Microsoft Dynamics GP Posting Journal. The Analytical Accounting Posting Journal will display only the journal number and the account for the transaction. When you void a transaction in a batch, the analysis information for the voided transaction will be deleted.

Analysis information for writeoffs

When you process writeoffs for underpayments or overpayments, the Analytical Accounting validation process will take place. If the distribution accounts for the writeoffs are linked to an account class ID, the default analysis codes for the account class will be loaded for the distribution accounts. The Analytical Accounting validation will not run if the distributions are linked to an account class ID, but the default codes for the account class ID to which the distributions are linked are not specified.

The Analytical Transaction Entry window will not open when you process writeoffs from the Write Off Documents window. A single assignment of 100 percent will be created for every distribution account that is linked to an account class.

When you process writeoffs, the Analytical Accounting Posting Journal is printed, along with the Microsoft Dynamics GP Posting Journal, if you have marked the option to print the report in the Posting Setup window (Administration >> Setup >> Posting >> Posting).

If you have marked the Post Through GL option for Receivables Apply Docs in the

Posting Setup window, the Analytical Accounting validation takes place and the

Analytical Accounting Posting Journal is printed along with the Microsoft Dynamics GP Posting Journal when you process a writeoff. If the default codes for the distribution accounts linked to an account class are not entered, the Analytical Validation log will be printed displaying the errors, and the transaction will not be posted to the General Ledger.

Series posting and master posting

When you select multiple batches to post from the Series Posting or Master Posting window, batches with analysis information are validated. If errors are found in the batch, the status of the batch automatically changes to available.

When you choose the Mark All button, only General Ledger batches without Analytical Accounting errors are selected. You can print the Analytical Error Log to view and correct the Analytical Accounting errors in the other General Ledger batches, before you can select them for posting.

The Analytical Accounting Posting Journal is printed for all transactions that have been successfully posted in each batch.

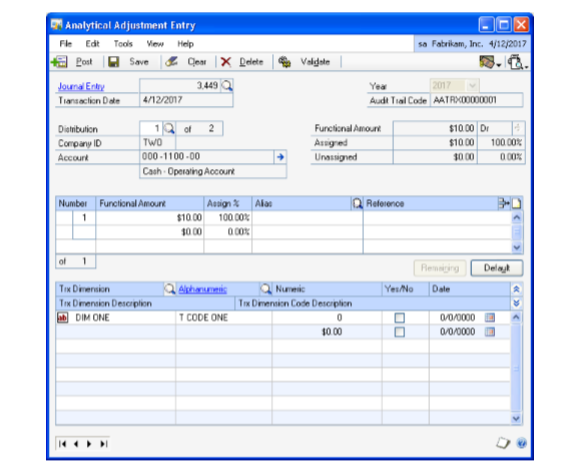

Adjusting analysis information in posted transactions

You can enter or edit analysis information for all journal entries posted from General Ledger, irrespective of their originating module.

In the case of Balance Brought forward journal entries, you can enter the analysis values only for transaction dimensions other than alphanumeric. The analysis data for alphanumeric transaction dimensions is consolidated and brought forward when you perform the year-end close. Refer to Year-end close for Analytical Accounting for more information.

You can also change the number of assignments and the value of each assignment for entries that have existing analysis information. Thus, any analysis information that you have entered for a posted transaction in a module, say, Receivables Management or Payables Management, can be adjusted after you’ve posted the transaction from General Ledger. You can add or remove transaction dimensions, and also change the transaction dimension codes for those dimensions that have the Allow Adjustments option marked on the Transaction Dimension Maintenance window. Refer to Defining transaction dimensions for more information.

You can modify the analysis information for a journal entry as often as required. Once you post an adjustment, the analysis information that you’ve entered will override the previous analysis information.

Note

Analytical information can be adjusted only for those distribution accounts of a journal entry that are linked to an accounting class at the time of adjustment.

To adjust analysis information in posted transactions:

Open the Analytical Adjustment Entry window. (Transactions >> Financial >> Analytical Accounting >> Edit Analysis)

Enter the open year for which to view transactions. All open years for the company are listed in the drop down.

Enter or select the journal entry number for which to enter or edit the analysis information. The following values default on selecting a journal entry:

The Transaction Date field displays the transaction date of the journal entry. Any adjustments to the analysis information will also have the transaction date.

The Audit Trail Code field displays the Analytical Accounting audit trail code if the selected journal entry has existing analysis information. This field is blank if no analysis information exists for the selected journal entry.

The Distribution field displays the first distribution account of the selected journal entry. You can view all distributions for a journal entry, however, you can adjust analysis information only for those distributions that are linked to an accounting class.

The Originating or Functional Amount field displays the distribution amount in the originating or functional currency based on the option selected in the currency view. You cannot edit this amount.

Tip

Choose the expansion button to view multicurrency information if the originating currency differs from the functional currency. If the Analytical Adjustment Entry window is opened for a unit account, the currency icon is not displayed. You cannot edit the multicurrency information, and conversions for adjusted assignments will take place using the same rate.

The Company ID field displays the ID for the current company.

The Account field displays the account related to the distribution. The expansion button will open the Microsoft Dynamics GP Account Entry window. The balance type, whether debit or credit, is also displayed.

The Assigned field displays the total distribution amount in value and percentage that has been assigned. This field is blank if no analysis information exists for the selected journal entry.

The Unassigned field displays the distribution amount that is not assigned in value and percentage.

In the assignment list view, enter the transaction distribution amount for an assignment in functional or originating currency, by value or on a percentage basis. Each assignment created for the distribution is displayed separately.

The Number field displays the number of the assignment. When you enter a new assignment for an account that already has one assignment, the analytical information from the first assignment automatically defaults on to the new assignment. You can edit this information.

An arrow before the Number field indicates that the analysis information displayed is for the selected assignment.

The Originating or Functional Amount field displays the assignments originally posted for the selected account. Enter or edit the amount assigned in the Originating/Functional Amount field. You can enter assignments in the functional or originating currency based on the option you selected in the Currency View.

The Assign% field displays the assignments originally posted for the selected account. You can overwrite these assignments.

You can enter the assignment either in value or percentage terms.

Alias field Displays the alias. The Alphanumeric field in the scrolling window displays the transaction dimension codes that are associated with the alias for the transaction dimensions displayed. You can change these codes if required. Refer to Creating an alias for more information.

The Reference field displays the information entered for the existing assignments. You can change this information for existing assignments, and add new reference information for any new assignments that you create.

The assignment option you’ve saved for General Ledger determines whether the distribution amount must be assigned fully, or can be assigned partially. Refer to Setting up assignment options for more information.

Choose Delete Row to delete a selected row in the assignment list view. You cannot choose this option if only a single assignment has been entered.

Choose Remaining to add one assignment for the remaining unassigned amount. The new assignment will ensure that the total assigned amount equals the distribution amount. For example, the distribution amount is $100 and you’ve entered four assignments that total $75. When you choose Remaining, a fifth assignment for the remaining value, $25 is created. This button is not available if the distribution field is blank or has a zero value.

Choose Default to load the current setup information specified for the account class in the Accounting Class Maintenance window and create a single assignment. The following processes will occur:

Fixed, Required, and Optional Transaction Dimensions (including hidden transaction dimensions) will be installed.

All the assignments that you have created for the current distribution will be removed and a single assignment that is equal to the distribution amount will be created.

If the analysis type is changed to or from Not Allowed, transaction dimensions will be added or removed.

Transaction dimensions that have been deleted will be removed.

Enter or select an existing transaction dimension in the Trx. Dimension field to add it to the analytical account if required. You can only select transaction dimensions whose analysis type is set as Required, Fixed, or Optional for the account class that the distribution account is linked to.

You can also remove a transaction dimension from the scrolling window if it is no longer needed.

The Transaction Dimension Description field displays the description of each Transaction Dimension that is listed.

Enter or edit the transaction dimension code for each transaction dimension listed in the Trx Dimension field if required. Entering a code is optional, except for those transaction dimensions that have the analysis type set to Required.

You can add new alphanumeric codes on the fly if you’ve selected that option in the Transaction Dimension Maintenance window. You can only edit an alphanumeric code that the user ID you’re logged in as and the selected distribution account, both have access to. Refer to Setting up user access to codes , and Setting up account access to codes for more information.

Choose Validate to validate the analysis information of the analytical account displayed in the window. The Analytical Accounting Validation Log Report is displayed if errors are found in the analysis information entered. Refer to Validating adjustments and correcting errors for more information.

Choose the printer icon to print the Analytical Adjustment Entry edit list for the current distribution displayed or for all distributions of the journal entry that can be adjusted. The Analytical Accounting Validation Log report which describes the Analytical Accounting errors also is printed if errors exist.

Choose Clear to clear all the values entered that you’ve not saved. If you’ve saved any changes to a selected journal entry, you cannot clear this window until you’ve posted or deleted such saved changes.

Choose Save to save the changes you’ve made to the analysis information of all the analytical accounts of the journal entry. You can only save changes for one journal entry at a time. You must post or delete these changes before you can make changes to another journal entry.

The analysis information that you have entered is validated when you choose Save. You can save with errors, but you cannot post until all the errors have been corrected.

Choose Post to post your changes and close the window. The analysis information that you have entered is validated when you choose Post. You can post a partial assignment if you have allowed partial assignments in General Ledger on the Assignment Setup window.

Note

Until you post an adjustment, the analysis information last posted with the journal entry will be available for inquiry and reporting.

Choose Delete to delete any adjusted analytical information for the journal entry. Any analytical information entered for the journal entry when it was last posted will be retained.

Validating adjustments and correcting errors

You can validate an adjustment by choosing the Additional >> Run Validation or by pressing CTRL+R. You can also validate an adjustment by choosing the OK, Save or Validate buttons.

If errors are found while posting, the adjustment will not be posted. The Analytical Accounting Validation Log window will open, listing all the errors found.

To correct an Analytical Accounting error, double-click on the relevant error to open the Analytical Adjustment Entry window. The specific distribution where the error exists is displayed. You can post the adjustment only after all the errors have been resolved.

The validation process verifies the following information for each analytical account that has been adjusted:

The transaction dimensions of the analytical account are active or have not been deleted.

Transaction dimension codes have been entered for all those transaction dimensions where Code Required During Adjustment has been marked on the Transaction Dimension Maintenance window.

The transaction dimension codes used are active.

The analytical account has access to the transaction dimension codes that have been entered.

The user making the adjustments has access to the transaction dimension codes that have been entered.

The combination between the transaction dimension codes of the alphanumeric transaction dimensions is valid.

If Full Assignment is opted for in General Ledger, then the total of all assignments entered for the analytical account equals the distribution amount of the account.

Viewing detail journal entries with analysis information

Use the Analytical Accounting Detail Journal Entry Inquiry window to view analysis information of an account for the current year or for a closed year from the Transaction Entry Zoom window. Refer to Transferring analysis information for closed years to history for more information on year end closing process.

This window only will display those distribution accounts of a Journal Entry that comprise analysis information.

To view detail journal entries with analysis information:

Open the Analytical Accounting – Detail Journal Entry Inquiry window. (Inquiry >> Financial >> Detail >> Select an account and Year >> Click the Journal Entry link >> Select account >> CTRL+T)

(Inquiry >> Financial >> History Detail >> Select an account and Year >> Click the Journal Entry link >> Select account >> CTRL+T)The Analytical Detail Inquiry window displays all analysis information that has been entered for the distribution account. The Journal Entry field displays the Journal Number.

The Reporting Ledger field displays the reporting ledger assigned to the General Ledger transaction in the General Ledger transaction entry window (Transactions >> Financial >> General). Refer to the General Ledger documentation for more information.

This field is available only if you have marked the Allow check box for the Reporting Ledger option in the General Ledger Setup window (Administration >> Setup >> Financial >> General Ledger).

Enter or select a distribution for the Journal Entry.

The Account field displays the account related to the distribution. Choose the expansion button to open the Microsoft Dynamics GP Account Entry window.

The Audit Trail Code field displays the Analytical Accounting Audit Trail Code.

Note

An Audit Trail Code is created for each Journal Entry made in Analytical Accounting. This Audit Trail is separate from the one created by Dynamics GP.

The Transaction Date field displays the transaction date of the selected Journal Entry

The Company ID field displays the ID for the current company.

The Originating or Functional Amount field displays the distribution amount in the originating or functional currency based on the option selected in the Currency View. Choose the expansion button to view multicurrency information if the originating currency differs from the functional currency. When the Analytical Accounting-Journal Entry Inquiry window is opened for Unit Accounts, the currency information will not be available.

Choose Expand to display all analysis information entered for the distribution account in the list window which includes assignments, reference information entered per assignment, transaction dimensions and their codes.

Choose Collapse to display analysis information entered per assignment.

You also can view all information entered for each assignment or just reference information that may exist. Choose the plus button (+) available next to each assignment to view all analysis information entered for an assignment or choose the minus button (-) to view only reference information.

Viewing journal entries with analysis information

You can view analysis information for posted transactions in the Analytical Accounting Journal Entry Inquiry window.

To view journal entries with analysis information:

Open the Analytical Accounting-Journal Entry Inquiry window. (Inquiry >> Financial >> Journal Entry Inquiry >> CTRL+T)

(Inquiry >> Financial >> Analytical Accounting >> Journal Entry)The Journal Entry field displays the Journal Number selected. Enter or select a Journal Entry Number of an open Year.

The Reporting Ledger field displays the reporting ledger assigned to the General Ledger transaction in the General Ledger transaction entry window (Transactions >> Financial >> General). Refer to the General Ledger documentation for more information.

This field is available only if you have marked the Allow check box for the Reporting Ledger option in the General Ledger Setup window (Administration >> Setup >> Financial >> General Ledger).

You can browse and sort by the following options:

Journal Entry You can browse analysis information entered for each Journal Entry.

Audit Trail Code You can browse analysis information based on the Audit Trail Code of a Journal Entry.

Posting Date You can browse analysis information by Posting Date.

Choose OK to close the window.

Analytical Accounting check links

Checking links examines tables, checking corresponding information in related tables in Analytical Accounting and Microsoft Dynamics GP and, if possible, changing the data to match the corresponding data in a table.

To check links:

Ensure that all users are logged out of Microsoft Dynamics GP. To view which users are in the Microsoft Dynamics GP system and where, choose Administration >> Setup >> System >> User Activity.

Take a backup of all your databases.

Always take a backup before checking links.

Open the Analytical Accounting Check Links window

(Administration >> Maintenance >> Analytical Accounting Check Links).Select the table groups to check links for, whether AA Open and History Transactions, AA Work Transactions, or both.

Choose Insert to insert the highlighted logical tables in the Selected Tables list.

Choose All to Insert all files from the Logical Tables list into the Selected Tables list so you can check links for all files.

Choose Remove to remove any table from the Selected Tables list, highlight the table name and choose Remove.

Choose Preview to print the AA File Maintenance Error Log Report - Preview.

Choose Cancel to Close the window. If you inserted table group names into the Selected Tables list.

Total Number of records field displays the total number of records within the tables in the Selected Tables list.

Choose Process to check links for the selected tables and print the Check Links Report.

The Report Destination window will appear, and you can specify where the Check Links Report should be printed. If you mark File, select the appropriate table format and enter the report file name.

The Check Links Report will display any information that was re-created. We recommend that you send the Check Links Report to the screen, and then print it if necessary, because it may be very large. Each report can only be printed once each time you check links, so its a good idea to send the report to a file as well.

To determine what information to re-enter, use the Table Descriptions window (Administration >> Resource Descriptions >> Tables) to view information for the table you checked links for, then use a window that accesses the table to reenter information.

Tip

You may want to create a report using Report Writer that lists all fields included in the table that you checked links for. This report can serve as a valuable reference tool. For more information, refer to the Report Writer manual.

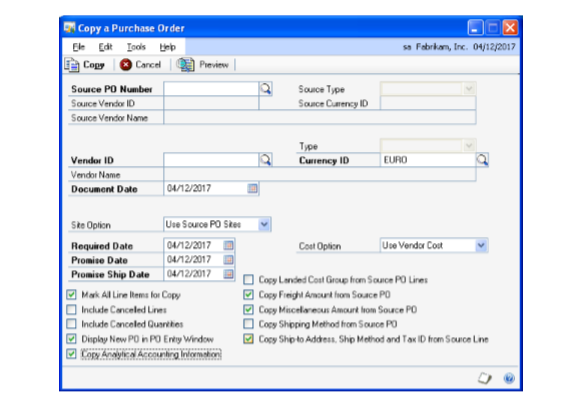

Copying Analytical Accounting Information for General Journal

Use the Copy Journal Entry window to copy analytical accounting information for posted transaction.

To copy analytical accounting information for general journal:

- Open copy the Transaction Entry window.

(Transactions >>Financial >> General)

Choose Copy. The Copy Journal Entry window will open.

In the Copy Journal Entry window, select the year that the transaction you’re copying was posted.

Select the journal entry number for the transaction that you’re copying.

Mark the Copy Analytical Accounting information option.

Choose OK. The Copy Journal Entry window will close. The new transaction will appear in the Transaction entry window along with the analytical accounting information. Modify the analytical accounting information as necessary.

Chapter 5: Payables Management Transactions

You can enter and view analysis information for transactions in Payables Management. You can create assignments, enter transaction dimension codes, and also view analysis information created for a document. You also can save transactions with analysis information to a single or recurring batch before posting the batch. Analysis information created for transactions can be validated at any time before they are posted.

You can open the Analytical Transaction Entry window only if Analytical

Accounting has been activated. Refer to Activating Analytical Accounting for more information about activating Analytical Accounting.

This information is divided into the following sections:

Entering analysis information for payables transactions

Entering analysis information for manual payments

Processing batches of computer checks with analysis information

Entering analysis information while applying documents

Unapplying a document

Applying unposted credit memos, returns and payments

Unapplying unposted credit memos, returns and payments

Voiding documents with analysis information

Viewing analysis information for payables transactions

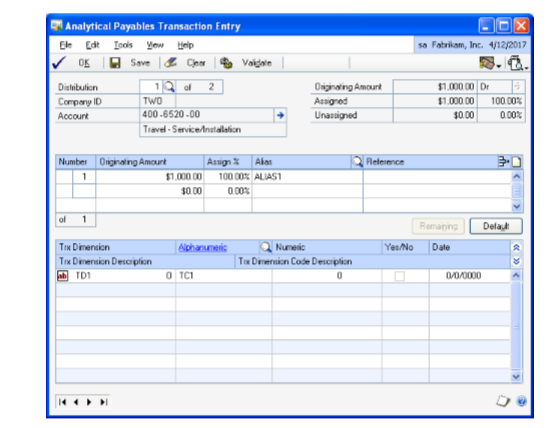

Entering analysis information for payables transactions

You can create assignments and enter transaction dimension codes for accounts that are linked to an account class from the Payables Transaction Entry window. This information can be entered in the Analytical Payables Transaction Entry window.

The Analytical Payables Transaction Entry window opens automatically from the Payables Transaction Entry Distribution window in the following instances:

If the account is linked to an account class and the Analytical Payables Transaction Entry window has not been opened even once for the account.

If changes are made to a distribution line that affects analysis information such as account or amount or type of amount created previously for such line.

If you delete a document from the Payables Transaction Entry window, the analysis information that exists for the document will also be deleted.

In case of multicurrency transactions, a change in the transaction date re-creates distributions due to a change in the exchange rate. Analysis information entered previously is deleted when the distributions are re-created.

If you select Default in the Payables Transaction Entry Distribution window, all analysis information created for the document will be deleted.

To enter analysis information for payables transactions:

Open the Analytical Payables Transaction Entry window. (Transactions >> Purchasing >> Transaction Entry >> Choose the Analytical Accounting button)

(Transactions >> Purchasing >> Transaction Entry >> CTRL+T or Additional >>Analytical Transaction)

(Transactions >> Purchasing >> Transaction Entry >> Tax expansion button >>CTRL+T or Additional >> Analytical Transaction)

(Transactions >> Purchasing >> Transaction Entry >> Distributions button >> CTRL+T or Additional >> Analytical Transaction)

Refer to Entering analysis information for General Ledger transactions for more information about entering the analysis information.

Entering analysis information for manual payments

You can also enter analysis information for manual payments using the Analytical Payables Manual Payment Entry window.

If you delete a document from the Payables Manual Payment Entry window, the analysis information that exists for the document also will be deleted.

In case of multicurrency transactions, a change in the transaction date re-creates distributions due to a change in the exchange rate. Analysis information entered earlier is deleted when the distributions are re-created.

If you select Default on Payables Transaction Entry Distribution window, all analysis information created for the document will be deleted.

The Analytical Payables Manual Payment Entry window will open automatically from the Payables Transaction Entry Distribution window, when you press TAB from a row in the following instances:

• If the account is linked to an account class and the Analytical Payables Manual Payment Entry window has never been opened for the account.

• If changes are made to a distribution line that affects analysis information entered previously for the line. These include changing the account, amount or debit to credit or vice versa, as this will delete the previously entered analysis information and create a single assignment of 100 percent.

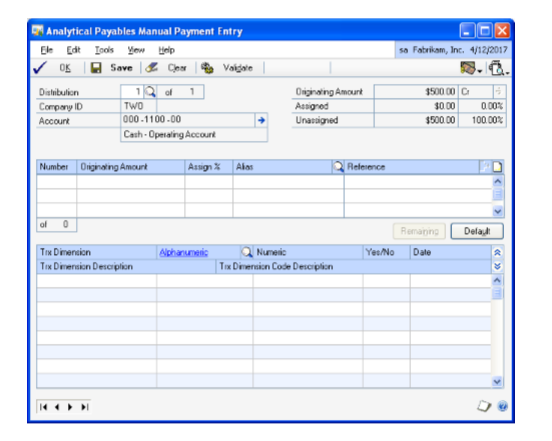

To enter analysis information for manual payments:

- Open the Analytical Payables Manual Payment Entry window.

(Transactions >> Purchasing >> Manual Payments >> Choose the

Analytical Accounting button)

(Transactions >> Purchasing >> Manual Payments >> CTRL+T or Additional>>Analytical Transaction)

(Transactions >> Purchasing >> Manual Payments >> Distributions >> CTRL+T or Additional >> Analytical Transaction)

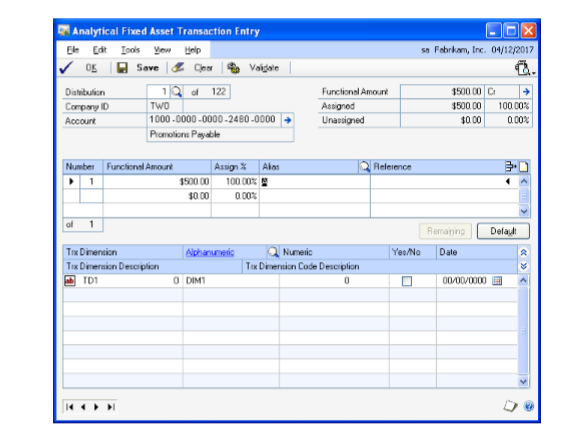

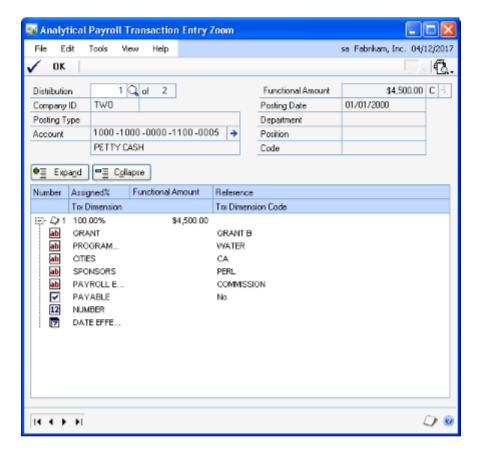

IMAGE – AAPMT.jpg

The Analytical Payables Transaction Entry window displays the distribution account selected. To view other distributions, enter or select a distribution number.

- Refer to Entering analysis information for General Ledger transactions for more information about the entering analysis information.

Processing batches of computer checks with analysis information

You can enter analysis information for distributions that are created after a computer check run only in the General Ledger. The Analytical Transaction Entry window cannot be opened from any of the Microsoft Dynamics GP windows where computer checks are posted.

For computer checks, the option Post Through General Ledger files under Posting Setup will not be available. This is to ensure that analysis information for distribution accounts linked to an account class is created before updating General Ledger History.

A verification takes place to check if any of the distribution accounts are linked to an account class in the following instances:

- When you print checks from the Print Payables Checks window

(Transactions >> Purchasing >> Print Checks)

- When you post a batch from the Post Payables Checks window

(Transactions >> Purchasing >> Post Checks)

- When you post a batch from the Process Payables Checks window

(Transactions >> Purchasing >> Process Remittance)

If the distribution accounts are linked to an account class, then the default codes that are set for the account class will be assigned to these distribution accounts. A single assignment will be created for each distribution account that is linked to an account class.

There will be no Analytical Accounting validation during a computer check run or while printing a cheque.

If you void checks in the Post Payables Check window, all the distributions for the payment will be deleted in Microsoft Dynamics GP and the payment will move to history. Any analysis information that exists for the payment will also be deleted.

Entering analysis information while applying documents

You can enter analysis information for distributions, if any, created after posted payments, credit memos and returns documents are applied in the Apply Payables Documents window (Transactions >> Purchasing >> Apply To). You can enter analysis information in the Analytical Apply Payables Documents window.

Analysis information can be entered for distributions created for terms taken, writeoffs, realized gain or realized loss when posted credit documents, returns and payments are applied against invoices, if the distribution accounts are linked to an account class in the Analytical Apply Payables Documents window. The Analytical Apply Payables Documents window will open when you choose OK in the Apply Payables Documents window. This would be applicable even if distributions are created after transactions are auto applied.

The Analytical Apply Payables Document window will also open if you change the Customer ID or Document No. in the Apply Payables Documents window.

If the Analytical Apply Payables Documents window has been opened at least once, you can open it any time thereafter by pressing CTRL+T or choosing Additional >> Analytical Transaction before the distributions are posted.

The Analytical Apply Payables Documents window will open displaying the first of the distribution accounts created during the process of apply that have been linked to an account class.

If you’ve marked the Show valid code combinations in trns and budgets option in the Analytical Accounting Options window, then the lookup window will display only those codes that have a valid combination with the codes you have already selected for the transaction.

Refer to Entering analysis information for payables transactions for more information about entering analysis information.

Unapplying a document

When you unapply posted credit memos, returns or payments, the entries relating to terms taken, write offs, realized gain or loss are reversed. Analysis information must be entered for these distribution accounts if they are linked to an account class. You can enter analysis information in the Analytical Apply Payables Documents window. The window opens when you choose OK in the Apply Payables Documents window.

The analysis information entered for distribution accounts relating to terms taken, write offs, realized gain or loss will be validated before these entries are posted. Errors detected will be displayed in the Analytical Accounting Validation Log.

You will not be able to close the Apply Payables Document window without entering all required analysis information for the distribution accounts linked to an account class.

Applying unposted credit memos, returns and payments

You can enter analysis information for credit memos, returns and payments applied in the Payables Transaction Entry and Payables Manual Payment Entry windows using the Analytical Payables Transaction Entry or Analytical Payables Manual Payment Entry windows. The Analytical Payables Transaction Entry or Analytical Payables Manual Payment Entry windows will open when you select OK in the Apply Payables Documents window.

Analysis information entered for the Accounts Payable account in the Payables Transaction Entry or Manual Payments Entry windows before the credit memo, return or payment is applied, will be deleted if distributions are created for terms taken, write offs, and realized gain or loss.

Unapplying unposted credit memos, returns and payments

If you unapply unposted credit memos, returns and payments that were applied, prior to posting, analysis information entered for the distribution accounts relating to terms taken, write offs and realized gain or loss accounts will be deleted.

Voiding documents with analysis information

When you void documents in the Void Historical Payables Transaction window

(Transactions >> Purchasing >> Void Historical Transaction) or the Void Open Payables Transaction window (Transactions >> Purchasing >> Void Open Transaction), all analysis information entered for the document during transaction entry will be copied with the exception of the balance type of each distribution account linked to an account class. The balance type of each distribution account will be reversed.

The Analytical Transaction Entry window cannot be opened prior to voiding a document in the Void Historical Payables Transaction or Void Open Payables Transaction windows.

The Analytical Accounting Posting Journal will print after the Microsoft Dynamics GP reports, if you’ve selected the option under Posting Setup. This report will display all analysis information for the voided transaction.

Viewing analysis information for payables transactions

You can view analysis information for payables transactions in the Analytical Payables Transaction Entry zoom window. The Analytical inquiry window will only display distribution accounts of a document that are linked to an account class.

To view analysis information for payables transactions:

Open the Analytical Payables Transaction Entry zoom window. (Inquiry >> Purchasing >> Transaction by Vendor/Document >> Select a document and zoom on the Document Number >> Additional >> Analytical Transaction)

(Inquiry >> Purchasing >> Transaction by Vendor/Document >> Select document and zoom to Document Number >> Distributions button >> Additional >> Analytical Transaction)The Analytical Payables Transaction Entry zoom window displays all analysis information created for a distribution account.

Refer to Viewing analysis information for Purchase Order Processing documents for more information about viewing analysis information for transactions.

Chapter 6: Purchase Order Processing Transactions

You can enter analysis information for transactions in Purchase Order Processing and save analysis information for a batch.

This information is divided into the following sections:

Entering analysis information for purchase orders and receipts

Entering analysis information for purchase orders

Analysis information for adjusting entries

Posting transactions with analysis information

Posting a batch with analysis information

Posting through to General Ledger for transaction posting

Viewing analysis information for Purchase Order Processing documents

Viewing analysis information for purchase orders

Copying Analytical Accounting Information for Purchase Order or Purchase Order Line Items

Entering analysis information for purchase orders and receipts

The Analytical Receivings Transaction Entry and the Analytical Purchasing Invoice Entry windows will open automatically when you press TAB from a row in the Payables Transaction Distribution Entry window in the following instances:

If the account is linked to an account class and the Analytical Transaction Entry window has not been opened even once for the account.

If changes are made to a distribution line that affects analysis information entered previously for such line. These include changing the account or amount or debit to credit or credit to debit, as this will delete the previously entered analysis information and create a single assignment of 100 percent.

If you delete a document in the Receivings Transaction Entry window or the Purchasing Invoice Entry window, the analysis information entered for the document also will be deleted.

If you void an unposted document in the Receivings Transaction Entry or Purchasing Invoice Entry windows, analysis information created for the document will be deleted.

In case of multicurrency transactions, a change in the transaction date re-creates distributions due to a change in the exchange rate. If the transaction date is altered, analysis information created previously is deleted when the distributions are recreated.

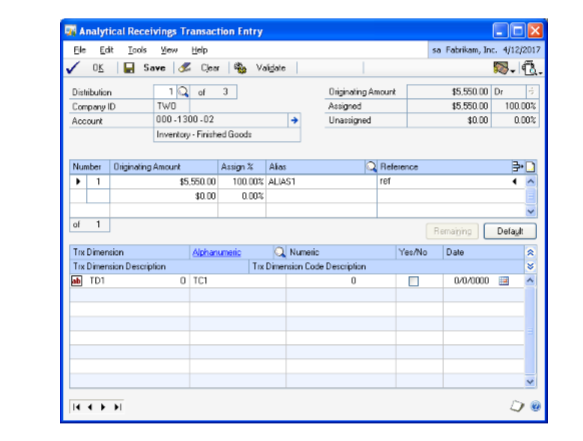

To enter analysis information for purchase orders and receipts:

Open the Analytical Receivings Transaction Entry or Analytical Purchasing Invoice Entry windows. (Transactions >> Purchasing >> Receivings Transaction Entry >> Choose the Analytical Accounting button)

(Transactions >> Purchasing >> Receivings Transaction Entry >> Enter vendor item >> CTRL+T or Additional >> Analytical Transaction)

(Transactions >> Purchasing >> Enter/Match Invoice >> Choose the Analytical Accounting button)

(Transactions >> Purchasing >> Enter/Match Invoice >> Enter quantity invoiced >> CTRL+T or Additional >> Analytical Transaction)

Refer to Entering analysis information for General Ledger transactions for more information on entering analysis information for transactions.

You can validate a transaction by pressing CTRL+T or by choosing Additional>> Run Validation in the following windows:

Payables Transaction Entry

Payables Manual Payments Entry

Apply Payables Documents

Receivings Transaction Entry

Purchasing Invoice Entry

Refer to Validating transactions and correcting errors for more information about validation.

If errors are detected in the transaction, the Analytical Accounting Validation Log window will open displaying all errors detected by the validation routine.

Tip

You can select View >> Incomplete or Erroneous Distributions, to browse through the distribution accounts in the Analytical Transaction Entry window which are incomplete or have erroneous information.

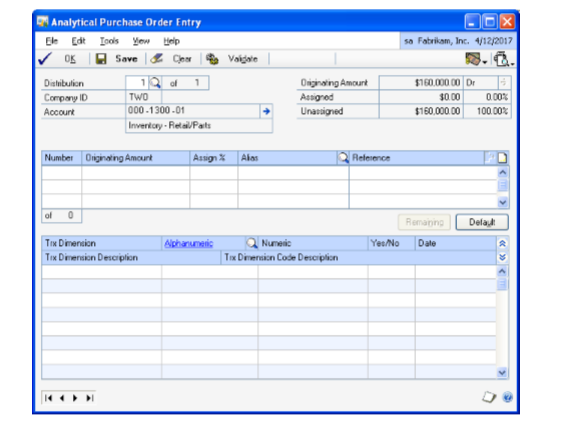

Entering analysis information for purchase orders

You can enter analysis information for inventory, purchases or drop ship accounts linked to a line item while entering a purchase order. The information will default when you receive these line items in the Receivings Transaction Entry window.

You can open the Analytical Purchase Order Entry window from the Purchasing Item Detail Entry window in the following instance if the account is linked to an account class:

• If changes are made to a distribution line that affects analysis information such as account or amount entered previously for such line. This will delete and refresh the previously entered analysis information and create a single assignment of 100 percent.

If you delete a document or a distribution line in the Purchase Order Entry or the Purchasing Item Detail Entry window, the analysis information entered for the same will also be deleted.

You cannot edit the Purchase Order Entry or the Purchasing Item Detail Entry window while the Analytical Purchase Order Entry window is open.

In the case of multicurrency transactions, a change in the transaction date re-creates distributions due to a change in the exchange rate. If the transaction date is altered, analysis information created previously is deleted when the distributions are recreated.

Note

Analysis information is not copied when you choose to copy PO lines from another PO to the current PO. You must enter fresh analytical information for the new purchase order.

To enter analysis information for purchase orders:

Open the Analytical Purchase Order Entry window. (Transactions >> Purchasing >> Purchase Order Entry >> Enter or select a purchase order >> Choose the Analytical Accounting button)

(Transactions >> Purchasing >> Purchase Order Entry >> Enter or select a purchase order >> CTRL+T or Additional >> Analytical Transaction) (Transactions >> Purchasing >> Purchase Order Entry >> Enter or select a purchase order >> Item or Vendor Item expansion button >> Choose the Analytical Accounting button)

(Transactions >> Purchasing >> Purchase Order Entry >> Enter or select a purchase order >> Item or Vendor Item expansion button >> CTRL+T or Additional >> Analytical Transaction)

When you open the Analytical Purchase Order Entry window from the Purchasing Item Detail Entry window, it displays only the account for the selected item.

Refer to Entering analysis information for General Ledger transactions for more information on entering analysis information for transactions.

You can validate the analysis information by pressing CTRL+R or by choosing Additional >> Run Validation in the Purchase Order Entry or the Purchasing Item Detail Entry windows. Refer to Validating transactions and correcting errors for more information about validation.

Analysis information for adjusting entries

Adjusting entries are posted to General Ledger for each item that has its current cost changed and uses the Average Perpetual valuation method. Adjusting entries are also posted for quantity sold transactions relating to the purchase receipt of items that use the Average Perpetual, LIFO Perpetual, or FIFO Perpetual valuation method. Such entries are created in the following instances:

The user selects to revalue inventory when posting a purchasing invoice where the invoice cost differs from the shipment cost.

The Adjust Costs utility is used to edit a purchase receipt record’s cost.

A Purchase Order line item is changed to a status of Closed when its Quantity Shipped is greater than the Quantity Invoiced, when Quantity Invoiced is not zero.

A purchase receipt is inserted into an existing purchase receipt stack.

When such adjusting entries are generated in General Ledger, default transaction dimension codes are loaded and a single assignment is created for distribution accounts that are linked to an account class. You can modify the default analysis information, before posting through General Ledger. Refer to Entering analysis information for General Ledger transactions for more information.

If you have marked the option Post Through General ledger Files in the Posting Setup window (Administration >> Setup >> Posting >> Posting), or you have marked the option Post through to General Ledger for Trx Posting in the Analytical Accounting Options window (Administration >> Setup >> Company >> Analytical

Accounting >> Options), the transaction or batch is posted directly through General Ledger with default analysis information for the additional distributions. You can modify this information in the Analytical Adjustment Entry window if required. Refer to Adjusting analysis information in posted transactions for more information.

Posting transactions with analysis information

When you post a transaction with analysis information from the following windows, a validation will take place:

Payables Transaction Entry

Payables Manual Payments Entry

Receivings Transaction Entry

Purchasing Invoice Entry

When you close the Apply Payables Documents window, analysis information created for the document in the window will be validated.

Refer to Validating transactions and correcting errors for more information. In addition to Analytical Accounting information, Microsoft Dynamics GP information will also be validated before the transaction is posted.

The Analytical Posting Journal will be printed after a transaction is posted or after closing the Apply Payables Documents window if specified under Posting Setup.

Posting a batch with analysis information

You can enter analysis information for transactions within a Payables or Purchasing Batch. Refer to Entering analysis information for purchase orders and receipts for more information about entering analysis information.

You can print the Analytical Accounting Edit List and Analytical Accounting

Validation Log to check if errors exist in the analysis information along with the Microsoft Dynamics GP Edit List for a selected batch by choosing the printer icon button.

When you post a batch from the Payables Management window or the Purchase Order Processing window, a validation takes place for all the transactions saved in the batch. Refer to Validating transactions and correcting errors for more information about the validation process. Microsoft Dynamics GP and Analytical Accounting transactions without errors are posted. The Analytical Posting Journal is printed, if specified under Posting Setup, along with the Microsoft Dynamics GP reports. If errors are found during the validation process, the Analytical Accounting Validation Log report is printed listing the analysis errors for the transactions in the batch being posted. You can correct the errors by editing the transactions in the window where the transaction originated from.

If you delete a single or recurring use batch or a transaction within such batches, the analysis information entered for the transactions in the batch or for the transaction will also be deleted.

You can save a transaction in a batch with Analytical Accounting errors but you cannot post the transaction.

For a recurring batch, the analysis information of the batch last posted will be retained and will update each subsequent batch that is posted, unless changes are made to the analysis information in the batch.

When you print the Analytical Posting Journal, detailed analysis information of all accounts will be printed. This would also include accounts with errors. The Analytical Validation Log report detailing all Analytical Accounting errors will also be printed. You can correct Analytical Accounting errors by opening the batch and then correcting the transactions that have errors.

Posting through to General Ledger for transaction posting

Individual transactions and batches posted from Payables Management will automatically update the appropriate posting accounts in General Ledger if you have marked the following options, and if there are no Analytical Accounting and Microsoft Dynamics GP errors:

Post through General Ledger files under Posting Setup (Administration >> Setup >> Posting >> Posting); and

Post through to General Ledger for Trx Posting (Administration >> Setup >> Company >> Analytical Accounting >> Setup)

Refer to Setting up posting options for Analytical Accounting for more information about Analytical Accounting posting setup.

While posting individual and batch transactions, Analytical Accounting or Microsoft Dynamics GP errors may exist which would prevent the transaction or batch from updating the appropriate posting accounts in General Ledger. For example, default codes may not be assigned for Required transaction dimensions in the account class that the distribution accounts of Fixed or Variable accounts are linked to. The transaction or batch will update the General Ledger. You must correct the errors in the transaction or batch in the General Ledger from the Transaction Entry window (Transactions >> Financial >> General) before the posting accounts can be updated.

The Analytical Accounting and Microsoft Dynamics GP errors will be displayed in the Analytical Accounting Validation Log Report which will print after the transaction or batch updates Payables Management.

The transaction and batch will update the Payables Management. You will be able to view analysis information that originated for the transaction or batch in Payables Management from the relevant Inquiry windows.

Viewing analysis information for Purchase Order Processing documents

You can view analysis information created for transactions in Purchase Order Processing in the Analytical Purchasing Invoice Inquiry Zoom window.

You can view the assignments, transaction dimension codes and reference notes that have been created for individual transaction distributions in this window.

To view analysis information for Purchase Order Processing documents:

Open the Analytical Purchasing Invoice Inquiry Zoom window. (Inquiry >> Purchasing >> Purchase Order Docs >> Purchasing Invoice Inquiry Zoom >> CTRL+ T or Additional >> Analytical Transaction)