Microsoft Dynamics GP Analytical Accounting

Analytical Accounting is a tool that helps you to analyze, interpret, and create reports based on your company’s chart of accounts.

Using Analytical Accounting, you can better assess your company’s accounts. You can also store information which cannot be computed in monetary terms such as labour hours. You can enter detailed analysis information without resorting to segmental accounting. You can create budgets using analysis dimensions and compare your actual figures with budgeted figures.

With Analytical Accounting, you can:

Set up unlimited analysis dimensions.

Enter analysis information for a group of analysis dimensions.

Create budgets using the analysis dimensions you’ve set up.

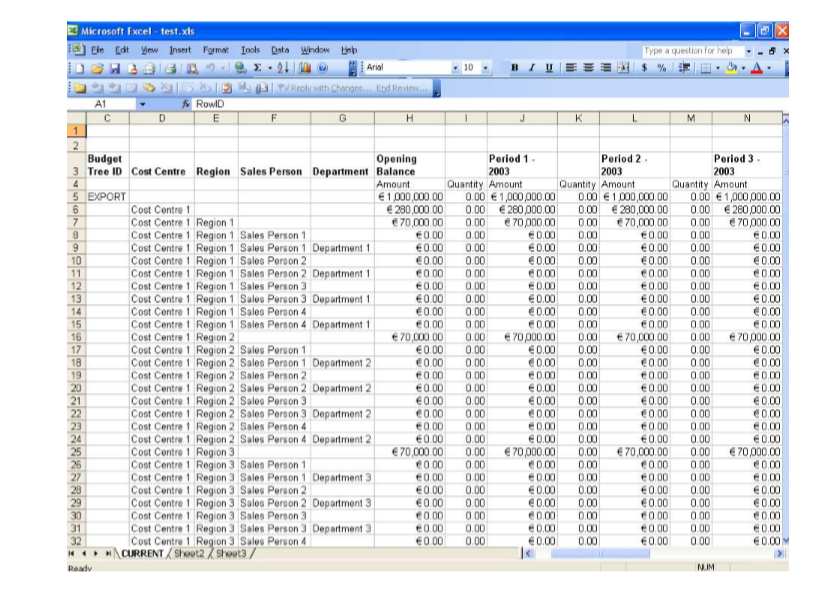

Perform comprehensive reporting by exporting analysis queries to Microsoft Excel.

Important

You must be using Excel 2000 or higher to export Analytical Accounting queries to Excel.

This manual is designed to give you an understanding of how to use the features of Analytical Accounting, and how it integrates with the Microsoft Dynamics GP system.

To make best use of Analytical Accounting, you should be familiar with system-wide features described in the System User’s Guide, the System Setup Guide, and the System Administrator’s Guide.

Some features described in the documentation are optional and can be purchased through your Microsoft Dynamics GP partner.

To view information about the release of Microsoft Dynamics GP that you’re using and which modules or features you are registered to use, choose Help >> About Microsoft Dynamics GP.

The manual is divided into the following parts:

Part 1, Setup, describes the set up tasks you need to complete to start using Analytical Accounting. It explains how to set up analysis codes and account classes in order to enter analysis information. It also describes how you can set up budgets for a group of analysis dimensions.

Part 2, Transactions, provides detailed information about entering and viewing analysis information for your transactions. For more information, see Microsoft Dynamics GP Analytical Accounting Part 2: Transactions.

Part 3, Routines, Inquiries and Reports, describes how to perform queries for the analysis information you have entered and generate reports. For more information, see Microsoft Dynamics GP Analytical Accounting Part 3: Routines, Inquiries and Reports.

Part 1: Setup

Use this part of the documentation to understand how you can start using Analytical Accounting. The following information is discussed:

Chapter 1, “Setup” introduces you to Analytical Accounting and explains how to set it up for your company.

Chapter 2, “Cards” provides information about setting up analysis codes for Analytical Accounting.

Chapter 3, “Budgets” explains how to set up budget trees and assign budgets to nodes and account combinations. It also explains how you can export and import budgeted information to Excel.

Chapter 1: Setup

The Analytical Accounting Setup wizard helps you complete the tasks required to begin using Analytical Accounting. You can use the information here to then specify Analytical Accounting options. You can set up posting options, modify column headers, define fiscal years and set up the SmartList for Analytical Accounting. You can also set default labels for the user-defined fields to be used in analysis dimensions. You can specify whether transactions can be posted with partial analysis information.

When you set up Analytical Accounting, you can open each setup window and enter information, or you can use the Setup Checklist window (Administration >> Setup >> Setup Checklist) to guide you through the setup process. See your System Setup Guide (Help >> Contents >> select Setting up the System) for more information about the Setup Checklist window.

Note

Analytical Accounting is not compatible with SQL Server 7.0.

This information is divided into the following sections:

Analytical Accounting overview

Creating default records

Setting up posting options for Analytical Accounting

Activating Analytical Accounting

Assigning security roles and tasks to users

Setting up Analytical Accounting options

Modifying column headings for inquiries and reports

Defining fiscal years

Setting up SmartList integration

Setting up default user-defined fields for transaction dimensions

Setting up assignment options

Setting up user access to codes

Analytical Accounting overview

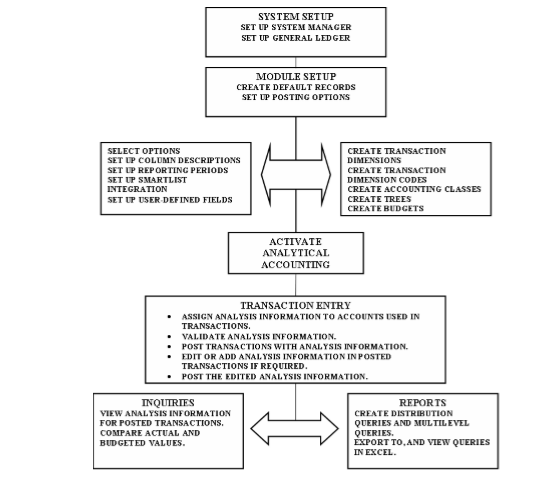

The following flowchart shows you the sequence in which you will set up Analytical Accounting, enter analysis information, and generate queries and reports.

Creating default records

After installing Analytical Accounting, you must run the Create Default Record routine using the Analytical Accounting Setup wizard. You must run this routine once, for each company registered in your Microsoft Dynamics GP system.

Important

You must be logged in as SA or DYNSA to set up Analytical Accounting.

To create default records:

Open the Analytical Accounting Setup wizard window. (Administration >> Setup >> Company >> Analytical Accounting >> Setup)

The option Create Default Record is marked by default. This option is only available if it has not already been completed.

Choose Next to go to the Selected Option window, or choose Cancel to exit the setup process.

The tasks that will be performed are displayed in the Selected Option window.

Choose Finish to perform the tasks displayed. An arrow next to a task in the scrolling window indicates the progress of the tasks that are running. As each task is completed, a check mark appears next to it. If any error occurs, an error sign is displayed.

Choose OK to close the window when all the tasks are completed.

Setting up posting options for Analytical Accounting

Once you’ve installed Analytical Accounting for your company, you must set up the appropriate posting options for Analytical Accounting in the Microsoft Dynamics GP Posting Setup window. Be sure that you’ve completed this task before you activate Analytical Accounting,

In order to collect analytical information for an account, the account must be linked to an account class. Analytical Accounting does not support posting in summary. Therefore, you must ensure that each account in the Account Maintenance window that you want to link to an account class has its level of posting set to detail. Refer to Linking accounts to an account class for information about linking accounts to an account class.

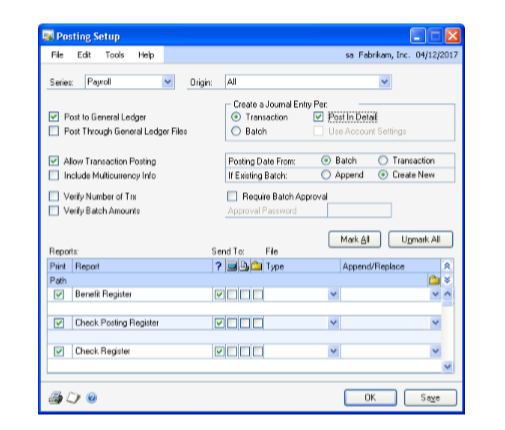

To set up posting options for Analytical Accounting:

Open the Posting Setup window. (Administration >> Setup >> Posting >> Posting)

Refer to the Microsoft Dynamics GP posting setup procedures (Help >> Contents >> Setting up the System) and (Help >> Contents >> Using the System) for information about setting up posting in Microsoft Dynamics GP.

In the Posting Setup window, select the option Create a Journal Entry per Transaction or Batch. If you select Batch, mark the Use Account Settings option.

Select Payroll in the Series field and All in the Origin field, and mark the Post in Detail option to post U.S. Payroll transactions in detail for all origins, except Period End Reports.

Important

You must mark this option to enter and view analysis information for U.S. payroll transactions.

Once Analytical Accounting is activated, you cannot select Create a Journal Entry Per Batch without marking Use Account Settings. You also cannot unmark the Use Account Settings option after Analytical Accounting has been activated. However, you can change the posting option to Create a Journal Entry per Transaction, or per Batch with Use Account Settings marked after Analytical Accounting has been activated.

After Analytical Accounting has been activated, any account that has a level of posting set to summary in the Account Maintenance window cannot be linked to an account class. After you have linked an account to an account class, you cannot change the level of posting from detail to summary in the Account Maintenance window.

Complete the setup procedures and choose OK or Save to save the posting setup.

Activating Analytical Accounting

You must activate Analytical Accounting in all the companies where it will be used. The Activate Analytical Accounting routine can be accessed through the Analytical Accounting Setup wizard.

You cannot enter or view analysis information for your transactions before you activate Analytical Accounting. Also, the Smartlist folders that are created for Analytical Accounting will not display any data until you have activated Analytical Accounting.

You can, however, access Analytical Accounting Setup and Cards windows and create necessary setup information such as transaction dimensions, relations, and codes before activating Analytical Accounting.

Before activating Analytical Accounting, you must have marked the appropriate options in the Posting Setup window. Refer to Setting up posting options for Analytical Accounting for more information.

The process of activation will also ensure that the last updated balances in your Microsoft Dynamics GP accounts are transferred to the Analytical Accounting system tables.

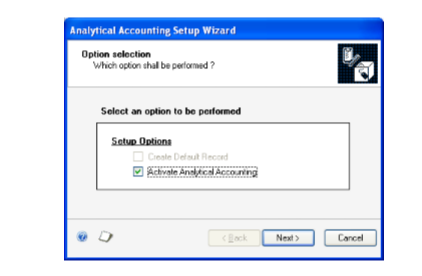

To activate Analytical Accounting:

Open the Analytical Accounting Setup Wizard window. (Administration >> Setup >> Company >> Analytical Accounting >> Setup)

Mark the Activate Analytical Accounting option to activate the product for the company you are logged into. If you have not registered Analytical Accounting, a message appears when you mark the option Activate Analytical Accounting prompting you to do so. Contact your Microsoft Dynamics GP representative for more information about registration.

The Activate Analytical Accounting option is available only if you’ve created the default records for the company you are logged into. Refer to Creating default records for more information.

Choose Next to go to the next setup window which displays the tasks that are performed.

Choose Finish to perform the tasks. An arrow next to a task in the scrolling window indicates the progress of the tasks that are running. As each task is completed, a check mark appears next to it. If any error occurs, an error sign is displayed.

When all the tasks are completed, choose OK to close the window.

Assigning security roles and tasks to users

Individual security is role-based in Microsoft Dynamics GP. Each user must be assigned to a security role before they can access any forms, reports, or other data within Microsoft Dynamics GP. After installing Analytical Accounting, the user must add the AA roles to each user, and add the AA security tasks to the appropriate roles. If this is not done, the user will not have access to any Analytical Accounting information.

To begin assigning user security, identify the daily tasks that a user completes within Microsoft Dynamics GP. Then either select from the default security roles or create new security roles that only grant access to the tasks that the user needs.

For example, user ABC is an analysis manager for Fabrikam, Inc., and needs access to set up and administer Analytical Accounting, enter or edit transaction dimensions or perform other analysis tasks. Review the default security roles in Microsoft Dynamics GP to find one that grants access to the appropriate analysis functionality for user ABC. For our example, the AA MANAGER* security role is appropriate for user ABC. Use the User Security Setup Window to assign the AA MANAGER* security role to user ABC in the Fabrikam, Inc. company.

The default security roles for Analytical Accounting are AA MANAGER and AA CLERK. You can assign the following default security tasks to these roles. You can also create new roles and tasks based on your requirement.

ADMIN_AA_001*

CARD_AA_001*

TRX_AA_001*

INQ_AA_001*

INQ_AA_002*

RPT_AA_001*

AADEFAULTUSER*

ADMIN_AA_002*

To specify security settings for specific tasks in Analytical Accounting, use the

Security Task Setup window. (Administration >> Setup >> System >> Security Tasks) To assign security tasks to the security roles, use the Security Role Setup window (Administration >> Setup >> System >> Security Roles) and grant access to the required windows, reports or files. Refer to the System Setup documentation for more information on security in Microsoft Dynamics GP.

Setting up Analytical Accounting options

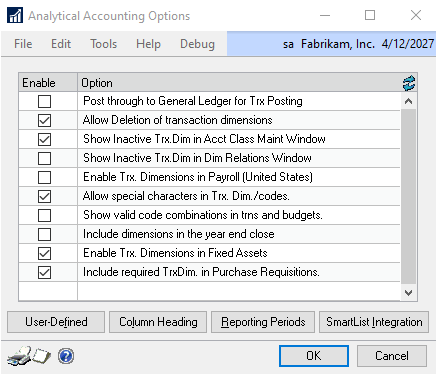

You can set up posting, viewing, and deletion options in the Analytical Accounting Options window.

To set up Analytical Accounting options:

Open the Analytical Accounting Options window. (Administration >> Setup >> Company >> Analytical Accounting >> Options)

Mark the Post Cash Receipt deposits automatically in Bank Reconciliation option so that cash receipts entered in Receivables Management directly update the checkbook balance when posted. You will not be required to post the cash receipt again from the Bank Deposit Entry window (Transactions >> Financial >> Bank Deposits) in Bank Reconciliation if you mark this option.

Mark the Post through to General Ledger for Transaction Posting option to directly update posting accounts when individually entered transactions are posted from the subsidiary modules. Batches are created during transaction posting in the subsidiary modules and automatically update the posting accounts after the individual transactions have been posted from these modules.

Mark the Allow Deletion of Transaction Dimensions option to delete transaction dimensions that exist in posted transactions from the Transaction Dimension Maintenance window. Refer to Defining transaction dimensions for more information about deleting a transaction dimension.

Tip

You can restrict users’ ability to delete a transaction dimension. To do this, open the Security Setup window (Administration >>Setup >> System >> Security) and deny access as necessary, to the Transaction Dimension Maintenance window.

Mark the Show Inactive Trx Dim in Acct Class Maint window option to view the transaction dimensions that have been set to inactive in the Accounting Class Maintenance window. Refer to Defining transaction dimensions for more information about making a transaction dimension inactive.

Mark the Show Inactive Trx Dim in Dim Relations window option to view the transaction dimensions which have been set to inactive in the Transaction Dimension Relations window. Refer to Defining transaction dimensions for more information about viewing inactive transaction dimensions.

Mark the Enable Transaction Dimensions in Payroll (United States) option to enable transaction dimensions for transactions entered through the Payroll (United States) series. This option is available only if you have registered the Payroll module in the Registration window (Administration >> Setup >> System >> Registration). Refer to the Microsoft Dynamics GP documentation for more information.

Note

You must mark the Post in Detail option for the Payroll series in the Posting Setup window before you can enable transaction dimensions in U.S. Payroll.

Unmark the Allow special characters in Trx Dim./Codes option if you are using FRx® with Analytical Accounting. FRx does not support transaction dimension IDs or code IDs that contain special characters.

Mark the Show valid code combinations in trns and budgets option if required. Selecting this option will display in the Code lookup window only those codes that have a valid combination with the codes that you have already selected for an analytical transaction or for a budget tree.

Mark the Include dimensions in the year end close option to move analysis information to history in the year end close process. Refer to Including Analytical Accounting in the year-end close process.

Mark the Enable Trx. Dimensions in Fixed Assets option to enable transaction dimensions for transactions entered through the Fixed Asset GL posting. This option is available only if you have registered for Fixed asset module in the Registration window (Administration >> Setup >> System >> Registration). Refer to the Microsoft Dynamics GP documentation for more information.

Choose User-Defined to open the Analytical Default User-Defined Fields Setup window. Refer to Setting up default user-defined fields for transaction dimensions for more information.

Choose Column Heading to open the Column Maintenance window. Refer to Modifying column headings for inquiries and reports for more information.

Choose Reporting Periods to open the Reporting Periods window. Refer to Defining fiscal years for more information.

Choose Smart List Integration to open the Smart List Integration window. Refer to Setting up SmartList integration for more information.

Click the printer icon button to print the Company Options report.

Choose Redisplay to revert to the last saved information in the scrolling window.

Choose OK to save the changes made to the window and close the window.

Choose Cancel to close the window without saving the changes.

Modifying column headings for inquiries and reports

Analytical Accounting uses pre-defined columns to classify information in the Multilevel Query wizard. You can modify the column header and column description information for each column. Columns are created for actual figures, budgeted figures and variances. Refer to Creating and running a multilevel query for more information about multilevel queries.

You cannot create or delete any column in this window.

To modify column headings for inquiries and reports:

Open the Column Maintenance window. (Administration >> Setup >> Company >> Analytical Accounting >> Options >> Column Heading button)

The Column Description field displays the description of the column. Select the description and enter a unique column description, if needed.

The Column Header field displays the standard header as a brief description for the column. Enter a unique column header, if needed.

The column type and column data type will be displayed when you click the show button. You cannot modify this information. The columns types are Standard-Debit, Standard-Credit, Standard-Budget, and Standard-Variance

Choose Load Defaults to insert the default column description and header information.

Choose the printer icon button to print all the column definitions.

Choose Redisplay to update the window by displaying any new information since you last modified the column headings.

Choose OK to close the window.

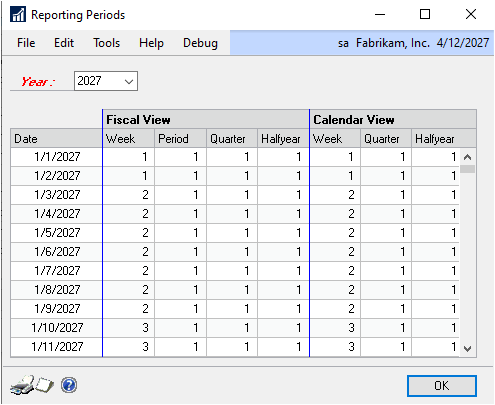

Defining fiscal years

The Reporting Periods window displays the calendar and fiscal definition for the fiscal years that are set up in Microsoft Dynamics GP. While doing an analysis or preparing a report, you can switch between the Calendar and Fiscal view. The fiscal year can be viewed by date, week, period, quarter, or half year.

To define fiscal years:

- Open the Reporting Periods window. (Administration >> Setup >> Company >> Analytical Accounting >> Options >> Reporting Periods button)

The Year field displays the current open year. Select a year from the fiscal years set up in Microsoft Dynamics GP. The Fiscal View and the Calendar view columns display information for the selected year.

Choose the printer icon button to print the settings for the selected year.

Choose OK to close the window.

Setting up SmartList integration

You can add Analytical Accounting records to the SmartList using the SmartList Integration window. All the records that you add to the SmartList will also become available in the Report List (Reports >> Report List). In the Report List window, choose Actions >> Add to My Reports, to open the Add to My Reports window, where you can add a report to the My Reports list. Refer to the Microsoft Dynamics GP documentation for more information on My Reports.

Folders will be created at the root level in the SmartList for the following type of records:

AA Accounting Classes

AA Distribution Queries

AA Multilevel Queries

AA Trees

AA Trx Dimension Codes

AA Trx Dimensions

AA Dimension Balances

Analytical Accounting Transactions

Asset ID

Book ID

If you choose to process a folder that already exists in the SmartList Integration window, the Analytical Accounting records related to that folder will be added to the relevant folder in the SmartList.

To set up SmartList integration:

- Open the SmartList Integration window.

(Administration >> Setup >> Company >> Analytical Accounting >> Options >> SmartList Integration)

Mark the options you want to create in the Install field. The Smart List Folder lists all the folders that you can install into a SmartList.

If you mark a checkbox and choose Process, a folder will be created. For example, if you mark AA Trx Dimension and choose Process, a folder is created for transaction dimension in the SmartList that will display all the existing transaction dimensions.

If you unmark a checkbox that had been marked earlier, the folder will be removed from the SmartList after you click Process.

Choose Mark All to select all the folders in the scrolling window.

Choose Unmark All to unmark all the folders in the scrolling window.

Choose Process to add or remove the SmartList folders that you’ve selected. Choose OK when a message appears after the SmartList folders have been created.

Choose Cancel to close the window without saving the changes made to the scrolling window.

Setting up default user-defined fields for transaction dimensions

Analytical Accounting allows you to enter labels for up to twenty user-defined fields for each alphanumeric transaction dimension. User-defined fields are of four types: Text, Numeric, Date and Checkbox. You can define up to five fields of each type. You can use these fields to enter additional information for each transaction dimension code that you’ve set up. This information can be printed on the multilevel query report that you generate for the transaction dimension code.

To set up default user-defined fields for transaction dimensions:

Open the Analytical Default User-Defined Fields Setup window. (Administration >> Setup >> Company >> Analytical Accounting >> Options >> User-Defined button)

Modify the label for each user-defined field if required. The system generated label for each user-defined field is the same as the field name. For example, the system generated label for Text Field 1 is Text Field 1. You cannot enter the same label in two fields. The label entered for each field is saved as soon as you move to another field in the window.

The labels you enter in this window will be the default labels for all alphanumeric transaction dimensions that you’ve set up. You can change these labels for each alphanumeric transaction dimension. Refer to Setting up userdefined fields per transaction dimension for more information.

Choose Load Defaults to clear all the values you’ve entered and revert to the system generated values.

Choose the printer icon to print the Analytical Default User-Defined Fields Setup Report.

Choose OK to close the window.

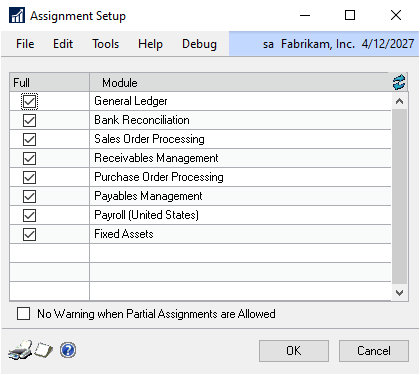

Setting up assignment options

You can specify if the distribution amount of an analytical account is to be assigned fully or partially. You can post partially assigned transactions in those modules where you allow partial assignments. By default Fixed Assets will be unmarked during the upgrade. When Analytical accounting is activated Fixed Asset will be marked by default on a new install or a new company.

To set up assignment options:

Open the Assignment Setup window. (Administration >> Setup >> Company >> Analytical Accounting >> Assignment)

All the Microsoft Dynamics GP modules that integrate with Analytical Accounting are listed in the scrolling window. The Full option is marked for all by default. This indicates that the distributions must be fully assigned before you can post the transactions.

Note

In the case of Bank Management transactions, you can post a transaction with partial assignments, if you’ve allowed partial assignments for the module that you’re posting the Bank Management transaction to. The Inventory module is not included since assignments are not allowed in this module.

Unmark the Full option for the modules where you want to allow partial assignments. If you allow partial assignments for a module, you can post a transaction even if the sum of assignments entered for an analytical account is not equal to the distribution amount of the analytical account.

You can mark and unmark this option at any time for each module. The options that you have saved will apply to all un-posted and future transactions.

Mark the option “No Warning When Partial Assignments Are Allowed” if you do not want to be warned while saving or posting partially assigned transactions. When this option is unmarked, you will be warned each time you save or post a partially assigned transaction. You can choose Yes on the message to continue saving or posting with partial assignments.

You can mark this option even when the Full option has been marked for all modules. You can mark or unmark this option at any time.

Choose the Redisplay button to revert to the last saved changes on the window.

Choose OK to save your changes and close the window.

Choose Cancel to close the window without saving any changes.

Choose Print to print the Assignment Options report for the assignment options that you’ve saved for each module.

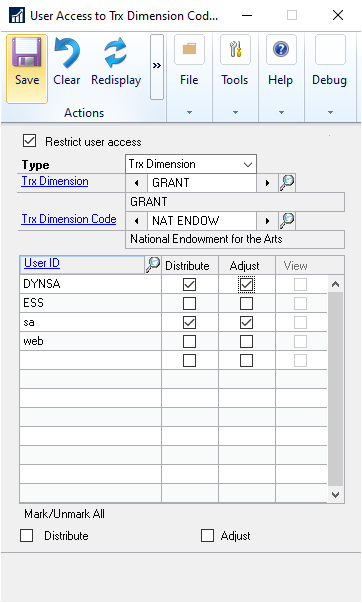

Setting up user access to codes

Use the User Access to Trx Dimension Codes window to specify which users have permission to use transaction dimension codes in distributions and adjustments. This will ensure that the analysis information at the time of posting transactions or adjustments is entered only by users with the access to use the required codes.

If you’re already using Analytical Accounting, then all existing users in the company will have access to distribute and adjust all the existing transaction dimension codes by default. However, when you create a new code, you must specify the users who have permission to use that code in transactions. Also, any new users that you create in the company must be given access to the existing transaction dimension codes that they are required to use.

Security access to use a transaction dimension code is granted automatically to the user who created the code during transaction entry.

The user access that you set up is valid only for the company that you’re logged into. To give users access to codes for another company, you must login to that company and grant the required access.

You can specify user access only for codes belonging to alphanumeric transaction dimensions. You can give access to users per transaction dimension code, per user or per employee. If you are using Analytical Accounting with Payroll (United States), the user provided with access to employees can view, sort and filter analysis information in multilevel query and distribution query reports.

Users can still view the transaction dimension codes though they may not have permission to distribute or adjust those codes.

To set up user access per transaction dimension code:

Open the User Access to Trx Dimension Codes window. (Administration >> Setup >> Company >> Analytical Accounting >> User Access)

The Type field displays Transaction Dimension as the default selection.

Select an alphanumeric transaction dimension in the Transaction Dimension field. You can select an active or an inactive transaction dimension.

Select the Transaction Dimension Code for which you want to set user access.

The scrolling window displays all the user IDs you’ve set up for the company. You can add or remove users from the scrolling window.

Mark the Distribute and Adjust options for the users to whom you want to give access to the selected code. Unmark these options for the users to whom you do not want to give access.

If you are already using Analytical Accounting, the Distribute and Adjust options are marked by default for all existing users.

In the Default Values for User ID field, mark the Distribute and Adjust options to give access to all the users displayed in the scrolling window. Unmark these options to remove access for all users displayed in the scrolling window.

Choose Save to save your access settings and clear the window.

Choose Clear to clear the window without saving changes.

Choose Redisplay to revert to the last saved changes. The scrolling window will also display any new users that have been set up in the company since you opened this window.

To set up user access per user:

Open the User Access to Trx Dimension Codes window. (Administration >> Setup >> Company >> Analytical Accounting >> User Access)

Select User ID in the Type field.

Select the user ID in the User ID field.

Select an alphanumeric transaction dimension. You can select an active or inactive transaction dimension. The scrolling window displays all the transaction dimension codes belonging to the selected transaction dimension. You can add or remove codes from the scrolling window.

Mark the Distribute and Adjust options for the codes to which you want to give access to the selected user. Unmark these options for the codes to which you do not want to give access.

If you are already using Analytical Accounting, the Distribute and Adjust options are marked by default for all existing transaction dimension codes.

In the Default Values for Trx Dimension Codes field, mark the Distribute and Adjust options to give access to all the codes displayed in the scrolling window. Unmark these options to remove access for all codes displayed in the scrolling window for the selected user.

Choose Save to save your access settings and clear the window.

Choose Clear to clear the window without saving changes.

Choose Redisplay to revert to the last saved changes. The scrolling window will also display any new transaction dimension codes that have been set up in the company since you opened this window.

To set up user access per employee:

Open the User Access to Trx Dimension Codes window. (Administration >> Setup >> Company >> Analytical Accounting >> User Access)

Select Employee in the Type field.

In the scrolling window, mark the View column for each corresponding User ID to which you want to grant permission to view, sort, and filter by employee ID on distribution and multilevel query reports.

Choose Save to save your access settings and clear the window.

Choose Clear to clear the window without saving changes.

Choose Redisplay to revert to the last saved changes.

Chapter 2: Cards

You can set up various transaction dimensions, relationships between alphanumeric transaction dimensions, transaction dimension codes, and valid code combinations in order to enter analysis information. The process of creating account classes and linking accounts to an account class in Analytical Accounting also is explained. Information about trees and tree structures, which are used in reporting, is also explained.

This information is divided into the following sections:

Defining transaction dimensions

Setting up user-defined fields per transaction dimension

Setting transaction dimension relationships

Changing the order of transaction dimensions

Defining transaction dimension codes

Entering details for user-defined fields per code

Defining combinations between transaction dimension codes

Copying a transaction dimension code combination

Creating an alias

Copying an alias

Importing an alias

Format to import aliases

Setting up an account class

Linking accounts to an account class

Linking accounts to classes and nodes

Setting up account access to codes

Entering analysis information for fixed assets transactions

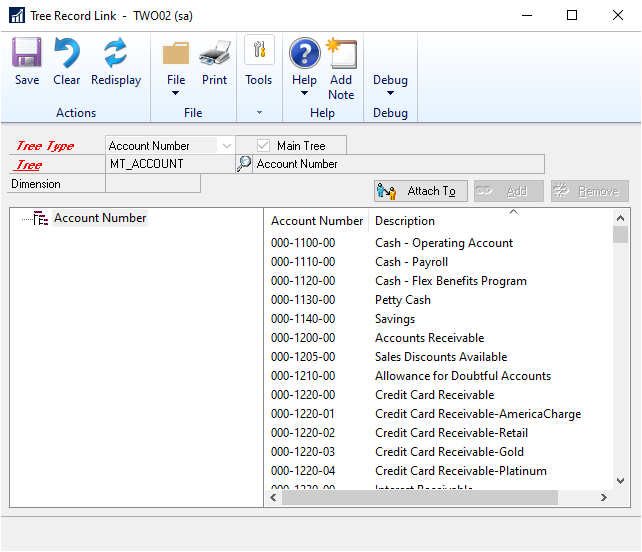

Setting up trees

Defining a tree structure

Copying a tree structure

Linking master records to an existing tree structure

Adding master records to an existing tree

Defining transaction dimensions

Use the following information to set up various types of transaction dimensions. A transaction dimension is any transaction criterion that you can classify, report and analyze for a period. A transaction dimension can be Alphanumeric, Numeric, Yes/ No (Boolean) or Date Type. For example, you can set up Cost Centre, Profit Centre, Country/Region, Billable or Hours as transaction dimensions. You can define any number of transaction dimensions according to your analysis or reporting requirements.

Note

If you are integrating Analytical Accounting with FRx, be sure that transaction dimensions do not contain any special characters in them. Refer to Setting up Analytical Accounting options for information on avoiding use of special characters.

To define transaction dimensions:

Open the Transaction Dimension Maintenance window. (Cards >> Financial >> Analytical Accounting >> Transaction Dimension)

Enter the name of a transaction dimension.

Note

Use a different name for the transation dimension other than the six AA dimensions that already exist.

Mark Inactive if you do not want to enter analysis information for the transaction dimension during transaction entry. An inactivated transaction dimension cannot be used to create analysis information. Unmark the Inactive check box to activate a transaction dimension.

Select the analysis type of the transaction dimension from the Data Type list. For example, an alphanumeric data type could be a profit centre of the company, numeric could be the quantity of units sold, boolean could be a billable or saleable item, and date type could be the date on which goods are dispatched.

The data type you select is used to determine the additional setup information that you can or cannot create for a transaction dimension. It also determines the type of analysis information that you can enter for the transaction dimension. For example, if you select a data type of Numeric, you can enter only numbers as analysis information.

Enter the description for the transaction dimension in the Description 1 field.

Enter any additional descriptions for the transaction dimension in the Description 2 field.

Keep the Create New Codes on the Fly option marked to create alphanumeric transaction dimension codes during transaction entry. This will allow you to open the Transaction Dimension Code Maintenance window (Cards >> Financial >> Analytical Accounting >> Transaction Dimension Code) to add a new alphanumeric transaction dimension code during transaction entry. Unmark the option if it is not required.

Mark the Create New Codes in Background option to create new alphanumeric transaction dimension codes in the background during transaction entry. Selecting this option will automatically add the new code during transaction entry to the existing codes of the alphanumeric transaction dimension. This option is available only if you selected the Create New Codes on the Fly option.

Note

In the case of non-alphanumeric transaction dimensions, transaction dimension codes are always created in the background.

Select the number of decimal places from the Decimal Places list to determine the number of decimal places that can be used for a numeric transaction dimension code. This field is available only if the data type of the transaction dimension is Numeric.

Select the U of M Schedule ID to link a Unit of Measure ID to a Numeric transaction dimension. The base unit is displayed beside the numeric transaction dimension code during transaction entry. This field is available only if the data type of the transaction dimension is Numeric.

Mark the Allow Adjustments option to allow the selected transaction dimension to be adjusted in the Analytical Adjustment Entry window. You can make adjustments only for transaction dimensions that have this option marked. You can mark or unmark this option at any time. Refer to Adjusting analysis information in posted transactions for more information on adjustments.

Mark the Code Required During Adjustment option to make entering a code a required criteria during adjustment entry. You cannot post an adjustment until you enter a Transaction Dimension Code against the Transaction Dimension. This option is unmarked and not available if you’ve not marked Allow Adjustments.

Mark the Include In Year End Close option to include the analysis information for alphanumeric transaction dimensions during the year end closing process. You must have also marked the Include In Year End Close option for the transaction dimension in the Analytical Accounting Options window.

Choose User-Defined to open the Transaction Dimension User-Defined Fields Setup window. You can enter unique labels for each transaction dimension that you have set up.

Choose Relations to open the Transaction Dimension Relations window. The Relations button is only available for alphanumeric transaction dimensions. Refer to Setting transaction dimension relationships for more information.

Choose Order to open the Transaction Dimension Order window to change the order of the transaction dimensions that you’ve created. Refer to Changing the order of transaction dimensions for more information.

Choose Codes to open the Transaction Dimension Code Maintenance window if the transaction dimension is alphanumeric. Refer to Defining transaction dimension codes for more information.

Choose the Print drop-down list to print setup details of the transaction dimension currently displayed or all the transaction dimensions that you have created.

Choose Save to save the details that you have entered for the transaction dimension.

Choose Clear to clear the window.

Choose Delete to delete a transaction dimension with all its codes and relations, if applicable. You cannot carry out any inquiries for transaction dimensions that have been deleted.

If you have created a query or queries using the Distribution Query wizard or Multilevel Query wizard, you cannot delete a transaction dimension that has been saved in such query or queries. Refer to *Chapter 17, “Inquiries”*for more information about queries. You also cannot delete a transaction dimension that is used in a budget tree ID.

You can delete a transaction dimension that exists in posted transactions only if you have selected the Allow Deletion of Transaction Dimensions option in the Analytical Accounting Setup window (Administration >> Setup >> Company >> Analytical Accounting >> Setup).

Setting up user-defined fields per transaction dimension

You can change the default labels you’ve set up in the Analytical User-Defined Setup window, and assign unique labels for each alphanumeric transaction dimension.

To set up user-defined fields per transaction dimension:

- Open the Transaction Dimension User-Defined Fields Setup window. (Cards >> Financial >> Analytical Accounting >> Transaction Dimension >>User-Defined button)

The transaction dimension and description are displayed in the Transaction Dimension and Description fields.

- Modify the label for each user-defined field if required. You cannot enter the same label in two fields. The label entered for each field is saved as soon as you move to another field in the window.

The values you enter in this window will be the user-defined field names for all transaction dimensions codes belonging to the selected transaction dimension. You can enter details for each field code in the Transaction Dimension Code User-Defined Fields Maintenance window. Refer to Entering details for userdefined fields per code for more information.

Choose Load Defaults to clear all the values you’ve entered and revert to the values entered in the Analytical Default User-Defined Fields Setup window.

Choose the printer icon to print the Transaction Dimension User-Defined Fields Setup Report.

Choose OK to close the window.

Setting transaction dimension relationships

The following information explains the various kinds of relationships that you can set up between alphanumeric transaction dimensions. You can create a relationship of ownership between alphanumeric transaction dimensions where a transaction dimension is owned or owns another transaction dimension. For example, you can set the relationship between profit centre P1 and cost centre C1 as: P1 owns C1. You can create other combinations as well in the Transaction Dimension Relations window. Setting up relationships will also ease data entry.

To set transaction dimension relationships:

Open the Transaction Dimension Relations window.

(Cards >> Financial >> Analytical Accounting >> Transaction Dimension Relation)

(Cards >> Financial >> Analytical Accounting >> Transaction Dimension >> Relations button)

Enter or select an alphanumeric transaction dimension. The scrolling window displays all the other alphanumeric transaction dimensions that you have created except the transaction dimension that you have selected.

Inactive alphanumeric transaction dimensions will be displayed in the

Transaction Dimension Relations window if you have marked the Show Inactive Trx Dim in Dim Relations window option in the Analytical Accounting Setup window.

Select the type of relationship to establish between the selected transaction dimension and the other transaction dimensions displayed from the Relation List. You can set the relationship between transaction dimensions to one of the following options in the Relation list:

All combinations allowed All code combinations between two transaction dimensions are permitted. For example, if the transaction dimensions profit centre and cost centre are set to a relationship of All Combinations Allowed then any profit centre code can be used with any cost centre code.

Combination not allowed Code combinations between two transaction dimensions are not permitted. For example, transaction dimension profit centre and cost centre set to a Combination relationship is not allowed; then code combination between these transaction dimensions is not allowed.

If you set the relationship between two alphanumeric transaction dimensions to Combination not allowed, you cannot use both the transaction dimensions at the same time for analysis during transaction entry.

Is owned by Where the selected alphanumeric transaction dimension is owned by another alphanumeric transaction dimension. For example, cost centre C1 is owned by profit centre P1.

Owns Trx Dimension where the selected alphanumeric transaction dimension owns another alphanumeric transaction dimension.

Example

Suppose that factory X (which is a cost centre) manufactures only Product Y (which is a profit centre). You can create a relationship where the cost centre owns the profit centre. This will ensure that all analysis information entered for the expenses incurred by the cost centre automatically will be picked up for the profit centre.

An alphanumeric transaction dimension can own only one alphanumeric transaction dimension. Additionally, an alphanumeric transaction dimension cannot be owned by more than one alphanumeric transaction dimension at a time.

The relationships Is owned by and Owns Trx Dimension require combinations to be set between the codes of the owning and owned alphanumeric transaction dimensions. For example, factory X (cost centre) manufactures only Product Y (profit centre). You would have to create a combination where a code of the cost centre, factory X, owns a code of the profit centre, Product Y.

While creating analysis information, the code of the owned transaction dimension will derive the relevant code of the owning transaction dimension. For example, if you enter Product Y while entering analysis information, it will derive the code Factory X, as you have created a combination between the codes Factory X and Product Y.

The code of an owning transaction dimension can own any number of codes of the owned transaction dimension. However, a code of the owned transaction dimension can be assigned to only one code of the owning transaction dimension at a time.

You can set the code combination while creating codes in the Trx Dimension Code Maintenance window or in the Transaction Dimension Code Validation window.

If you delete a transaction dimension that owns another transaction dimension, the codes of the owning transaction dimension also will be deleted. The relevant codes of the owned transaction dimension will now not be owned by any code.

An alphanumeric transaction dimension that has been set to Inactive, cannot own any other alphanumeric transaction dimension. However, the owned alphanumeric transaction dimension can be inactive.

The code or codes of an owning transaction dimension must be active before you create a combination with code or codes of the owned transaction dimension.

Valid subset Certain code combinations between two transaction dimensions are permitted. This relation allows you to restrict the code combinations.

Example

Sales Zone A is a Revenue Centre. There are products X, Y and Z. Revenue Centre A sells only Products X and Y, which are set as a Profit Centre. You can specify that Revenue Centre is a valid subset of Profit Centre and create a valid code combination of A with X and Y. This will ensure that where Revenue Centre and Profit Centre are used together while entering analysis information, A can be used only with X and Y or vice versa.

You can set the code combinations between the transaction dimensions in the Transaction Dimension Code Validation window.

Choose the Show as Tree button to open the Transaction Dimension Dependency (Relation) Inquiry window where the transaction dimensions are displayed in the form of a tree. Refer to *Chapter 17, “Inquiries”*for more information.

Choose Save to save the changes you’ve made.

Choose Clear to clear the window.

Choose Redisplay to revert to the information last displayed in the window. The window also will display any other alphanumeric transaction dimensions that have been created by other users while you were setting up relationships.

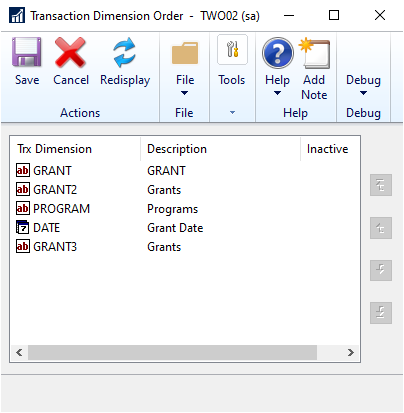

Changing the order of transaction dimensions

You can change the order in which the transaction dimensions will appear during transaction entry and inquiry windows using the Transaction Dimension Order window. The relevant transaction entry or inquiry window displays the transaction dimensions in the order that is specified in the Transaction Dimension Order window.

To change the order of transaction dimensions:

- Open the Transaction Dimension Order window.

(Cards >> Financial >> Analytical Accounting >> Transaction Dimension Order)

(Cards >> Financial >> Analytical Accounting >> Transaction Dimension >> Order Button

The transaction dimensions and their descriptions are displayed in the scrolling window in the order they were created.

Choose the Move to Top button to shift a selected item to the top of the list.

Choose the Move Up button to shift a selected item one line up in the list window.

Choose the Move Down button to shift a selected item one line down in the list window.

Choose the Move to Bottom button to shift a selected item to the bottom of the list window.

Choose Save to save changes you’ve made.

Choose Cancel to close the window without saving the changes.

Defining transaction dimension codes

Use the following information to define alphanumeric transaction dimension codes. Transaction dimension codes are the defined values of transaction dimensions that you enter during transaction entry and for which analysis information is collected.

If you are integrating Analytical Accounting with FRx, be sure that transaction dimension codes do not contain any special characters in them. Refer to Setting up Analytical

Accounting options for information on avoiding use of special characters.

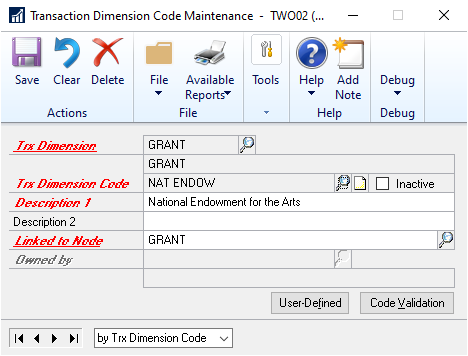

To define transaction dimension codes:

- Open the Transaction Dimension Code Maintenance window.

(Cards >> Financial >> Analytical Accounting >> Transaction Dimension Code)

(Cards >> Financial >> Analytical Accounting >> Transaction Dimension >> Codes button)

Enter or select an alphanumeric transaction dimension in the Trx Dimension field.

Enter a code in the Trx Dimension Code field. For example, if your manufacturing units are Cost Centres, you can enter the location of a manufacturing unit, say Fargo, as a Cost Centre code.

If a transaction dimension owns another transaction dimension, you first need to create the codes for the owning transaction dimension. For example, if a Profit Centre owns a Cost Centre, then you have to first create codes for the Profit Centre.

At least one active code must exist for an owning transaction dimension before you begin to create combinations with the codes of the owned transaction dimension. You cannot delete the last remaining code of the owning transaction dimension if codes exist for the owned transaction dimension.

Note

You must grant access to users to use this code in the User Access to Trx Dimension Codes window. However, security access to use a transaction dimension code is granted automatically to the user who created the code during transaction entry.

Enter the description for the transaction dimension code in the Description 1 field.

Note

Two transaction dimension codes cannot have the same description.

Enter any additional description for the transaction dimension code in the Description 2 field.

Mark Inactive if you do not want to use the transaction dimension code to create analysis information. To use the transaction dimension code during transaction entry, you must unmark the Inactive check box.

You cannot inactivate the following codes:

An alphanumeric transaction dimension code that owns another alphanumeric transaction dimension code. This will be applicable even if the owned alphanumeric transaction dimension code is inactive.

A transaction dimension code that has been set as a default for a Fixed or Hidden Alphanumeric transaction dimension. The code must be removed as a default before it is inactivated. Refer to Setting up an account class for more information about default codes and Fixed and Hidden transaction dimensions.

You can inactivate the following codes:

- The default codes of the Required or Optional Alphanumeric transaction dimensions. When you inactivate transaction dimension codes, they will be removed from the relevant account class in the Accounting Class Maintenance window. Refer to Setting up an account class for more information about account classes.

You can create codes for inactive alphanumeric transaction dimensions, but you can use these codes only if the transaction dimension is activated.

In the Linked to Node field, select a node for the specific transaction dimension code as each code has to be linked to a valid node of the Main Tree.

A Main Tree is created by default for each Alphanumeric Transaction Dimension that you create. You can create an unlimited number of additional trees. You can also create a new node from the Linked to Node field. Refer to Setting up trees for more information.

In the Owned By field, select a code of the transaction dimension that will own the transaction dimension code you are creating. This field is available only if a transaction dimension is owned by another transaction dimension.

Choose Code Validation to open the Trx Dimension Code Validation window where you can set valid combinations between transaction dimension codes of the selected alphanumeric transaction dimension and the other existing alphanumeric transaction dimensions. Refer to Defining combinations between transaction dimension codes for more information.

Where transaction dimensions are valid subsets, you can create valid code combinations between inactive transaction dimension codes. However, these codes cannot be used till they have been activated. Refer Setting transaction dimension relationships for more information about valid subsets.

Choose User-Defined to open the Transaction Dimension Code User-Defined Fields Maintenance window, where you can enter values for the user-defined fields you have set up.

Choose the printer icon button to print a report for the details you have set up for the codes of the transaction dimension currently displayed or for all alphanumeric transaction dimensions.

Choose Save to save the changes you’ve made.

Choose Clear to clear the entries you’ve made.

Choose Delete to remove the transaction dimension code displayed. You cannot delete a transaction dimension code if you have used it in any posted transaction. To delete such a transaction dimension code, you will have to delete the transaction dimension that the code belongs to.

You cannot delete a transaction dimension code if it is used as a default code of a fixed alphanumeric transaction dimension in the Accounting Class Maintenance window. You also cannot delete a transaction dimension code that is used in a budget tree ID.

If you delete a code that owns another code, the code that is owned will be automatically assigned to the next available code of the owning alphanumeric transaction dimension.

Entering details for user-defined fields per code

Once you’ve entered labels for the user-defined fields that you want to use, you can enter details for each field in the Transaction Dimension Code User-Defined Fields Maintenance window. You can enter different details for each code that you have set up.

To enter details for user-defined fields per code:

- Open the Transaction Dimension Code User-Defined Fields Maintenance window. (Cards >> Financial >> Analytical Accounting >> Transaction Dimension Code >> User-Defined button)

The Transaction Dimension, and Transaction Dimension Code fields display the selected code for which you’re entering user-defined information.

Enter the necessary values in the user-defined text, numeric, and date fields.

Mark the required checkbox fields.

Choose OK to close the window. You must choose Save on the Transaction Dimension Code Maintenance window in order to save the values you’ve entered.

Choose the print icon on the Transaction Dimension Code Maintenance window to print the Transaction Dimension Code Maintenance report along with the details for user-defined fields.

Defining combinations between transaction dimension codes

You can set combinations between the transaction dimension codes of

alphanumeric transaction dimensions that you have created, using the Transaction Dimension Code Validation window. These combinations are verified during transaction entry while entering analysis information and therefore, you can’t enter code combinations that aren’t valid. In addition, if the combination between two transaction dimension codes isn’t valid, it will not pass the validation routine in Analytical Accounting.

The combination between the transaction dimension codes only can be set if transaction dimensions are alphanumeric. You cannot define a code combination if the relationship between the two transaction dimensions is set to Combination not Allowed or All combinations allowed.

You can change the ownership between the transaction dimension codes in this window.

To define combinations between transaction dimension codes:

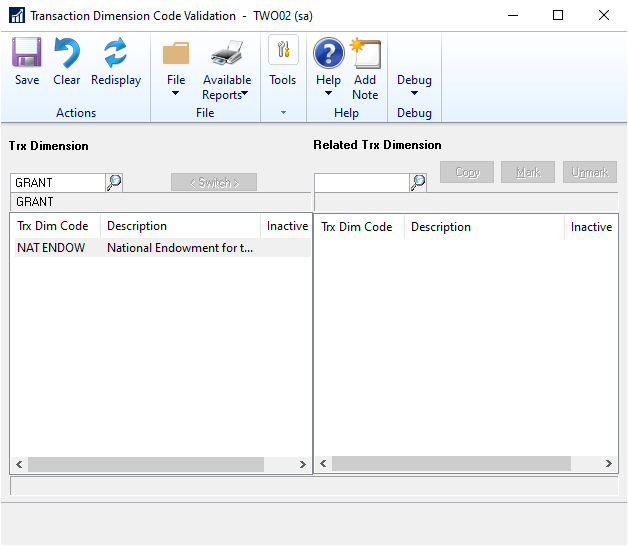

Open the Transaction Dimension Code Validation window. (Cards >> Financial >> Analytical Accounting >> Transaction Dimension Code Validation)

In the Trx Dimension field, select a transaction dimension. All the transaction dimension codes that you’ve created for the selected transaction dimension are displayed in the left scrolling window. The Trx Dimension Code column displays the name that you have assigned to the transaction dimension code in the Transaction Dimension Code Maintenance window. The Description column displays the description of the transaction dimension code created in the Transaction Dimension Code Maintenance window.

In the Related Trx Dimension field, select the transaction dimension that you will use to create a code combination. A related transaction dimension is one that is owned by or is a valid subset of the transaction dimension selected in the Trx Dimension field.

All the codes of the related transaction dimension will be displayed in the right scrolling window. If the relationship between the transaction dimensions is that of ownership, the combination between the codes of the owned and owning transaction dimensions that you have entered in the Transaction Dimension Code Maintenance window will be displayed.

- To create a valid code combination between transaction dimensions that are valid subsets or in the case of ownership, select and mark a code for both the transaction dimensions and the related transaction dimension. You can select only one code at a time from the transaction dimension and related transaction dimension. The codes you have marked will constitute a valid combination.

For example, if you have selected Cost Centre in the Transaction Dimension field and Profit Centre in the Related Transaction Dimension field (which are valid subsets), you can create a valid code combination between the code C1 of Cost Centre and P1 of Profit Centre. Mark C1 and P1 in the scrolling window to create the combination. You also can mark C1 and P2 or C2 and P1, thereby creating unlimited valid code combinations.

In the Related Transaction Dimension field, you also can select a transaction dimension where the relationship that exists is Combination Not Allowed or All Combination Allowed. However, you can’t select any codes of these transaction dimensions.

The Inactive field displays the alphanumeric transaction dimensions that have been inactivated.You can create combinations between the codes of inactive alphanumeric transaction dimensions that are valid subsets.

Choose Save to save a code combination.

Choose the printer icon button to print a report displaying the code combinations of the transaction dimension code that is highlighted in the left scrolling window with the codes of the related transaction dimension. You can also print a report displaying the code combinations between all codes of the transaction dimension with the codes of the related transaction dimension.

To interchange the transaction dimensions between the left and right scrolling windows, choose Switch.

Choose Clear to clear the information from the window.

Choose Redisplay to revert to the information last displayed and to display any other transaction dimension codes that have been created while you were setting code relationships.

Choose Copy to open the Copy Transaction Dimension Code Validation Copy window. Refer Copying a transaction dimension code combination 40 for more information.

Choose Mark to mark the code that has been selected from the right scrolling window.

Choose Unmark to unmark the code selected from the right list window.

Copying a transaction dimension code combination

You can copy one, all, or a subset of the related transaction dimension code combinations in the Transaction Dimension Code Validation window to the transaction dimension codes of another transaction dimension using the Copy Transaction Dimension Code Combinations window. Copying is only possible if the relation between the two transaction dimensions is set to Valid Subset in the Transaction Dimension Relations window. Refer Setting transaction dimension relationships for more information.

Example

Sales Zone A is a Revenue Centre. Sales Zone A sells only two products, X and Y.

You’ve defined Products as Profit Centres. In the Transaction Dimension Code

Validation window, you have created a combination between Sales Zone A and Products X and Y. Using the Copy button, you can create the same combination with any other sales zone, say Sales Zone B.

You must select a code of the related transaction dimension in the Transaction Dimension Code Validation window before opening the Copy Transaction Dimension Code Combination window. A transaction dimension code will be selected automatically when you select a code for the related transaction dimension.

To copy a transaction dimension code combination:

- Open the Copy Transaction Dimension Code Combinations window. (Cards >> Financial >> Analytical Accounting >> Transaction Dimension Code Validation >> Copy button)

The Copy from Trx Dimension field displays the source that the code combination will be copied from. The source always will be the related transaction dimension that is displayed in the Transaction Dimension Code Validation window.

The Copy to Trx Dimension field displays the destination to which the code combination must be copied. The destination always will be the transaction dimension displayed in the Transaction Dimension Code Validation window.

- All the transaction dimension codes of the Copy to Trx Dimension, except for the code selected in the Transaction Dimension Code Validation window, will be displayed. All codes displayed in the scrolling window will be automatically selected.

You can select one, all or a subset of transaction dimension codes to copy to the code combination. Press SHIFT+CTRL to select more than one transaction dimension code from the list window.

Choose Copy to start the process of copying the transaction dimension code combinations to the codes you have selected. The window will close as soon as the copying process is complete.

After the process has been completed, a combination is created between Sales Zone B and Products X and Y.

Choose Cancel to close the window. The code combination will not be copied to the codes you have selected in the window.

Creating an alias

You can create aliases to group the transaction dimension code combinations that you use while entering analysis information for transactions. Aliases allow you to enter large amounts of analysis information quickly and accurately during transaction entry. When you use an alias, the codes associated with the alias default for the account. You can also change the default transaction dimension codes for the alias during transaction entry. You can create multiple aliases with different combinations of transaction dimension codes. Refer to Entering analysis information for General Ledger transactions for more information.

To create an alias:

Open the Alias Maintenance window. (Cards >> Financial >> Analytical Accounting >> Alias)

Enter a name, description, and a short description for the alias that you are setting up.

The scrolling window displays all the alphanumeric transaction dimension codes that you have set up.

Mark the Inactive checkbox to inactivate the alias displayed in the window. You cannot use an inactive alias during transaction entry.

Select a transaction dimension code for each transaction dimension to include in the alias.

Choose Save to save the alias you have set up.

Choose Clear to clear the values, or Delete to delete the alias displayed in the window.

Choose Copy to copy the transaction dimension codes from an existing alias to set up another alias. Refer to Copying an alias for more information.

Choose Import to import the transaction dimension codes from an Excel application to the alias. Refer to Importing an alias for more information.

Copying an alias

You can copy an existing alias to set up another alias and modify it as required. The transaction dimension codes from the existing alias are copied to the new alias. You can add or delete transaction dimension codes in the new alias.

To copy an alias:

- Open the Copy Alias window. (Cards >> Financial >> Analytical Accounting >> Alias >> Select an alias >> Copy button)

The Copy from Alias field displays the alias you selected in the Alias Maintenance window.

Enter an alias name to copy to in the Copy to Alias field.

Enter a description and a short description for the new alias.

Choose Copy to copy the transaction dimension codes to the new alias.

Choose Cancel to cancel the process and close the window.

Importing an alias

You can import alias information from an Excel spreadsheet that has been set up in the required format. Refer to Format to import aliases for more information.

To import an alias:

Open the Import Alias window. (Cards >> Financial >> Analytical Accounting >> Alias >> Import button)

Select the path for the Excel file to import the alias information from.

The Select the Worksheet field displays all the worksheets in the selected Excel file. Highlight the worksheet that you want to import.

Select a destination for the log file.

Choose OK to import the alias information from the selected worksheet.

Format to import aliases

You can import aliases only if they are in the required format. The first line in the

Excel sheet from which you are importing the alias information must be blank. The Excel sheet must have the columns Alias, Description, SDescription, Trx Dim, and Trx Dim Code.

Refer to Importing an alias for more information on importing aliases.

Setting up an account class

An account class is a category of accounts. During transaction entry, it determines the Microsoft Dynamics GP accounts that you can enter analysis information for. The Analytical Transaction Entry window, where you will enter analysis information, can be opened in relation to a specific Microsoft Dynamics GP account only if such account is linked to an account class.

In the Accounting Class Maintenance window, you can define transaction dimensions for each account that can be used during transaction entry, if linked to an account class, to enter analysis information. You can select default transaction dimension codes for each of the transaction dimensions, determine if default codes can be overwritten during transaction entry, and allow or restrict the ability to report on customers, vendors, item numbers, and site IDs.

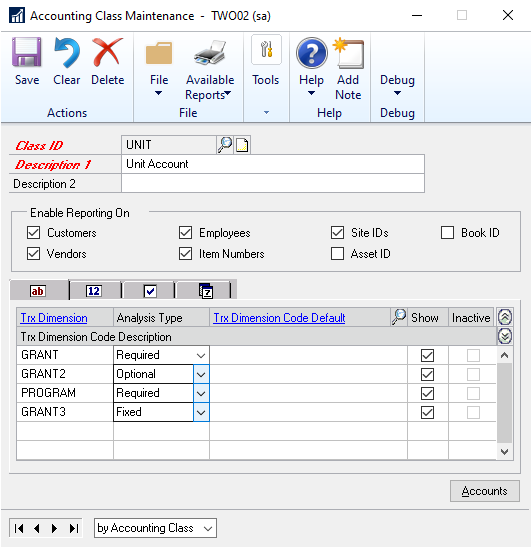

To set up an account class:

Open the Accounting Class Maintenance window. (Cards >> Financial >> Analytical Accounting >> Accounting Class)

Enter or select an account class in the Class ID field. The existing alphanumeric transaction dimensions will be displayed in the scrolling window.

Enter a description for the account class in the Description 1 field. Enter an additional description, if required, in the Description 2 field.

In the Enable Reporting On field, mark the following options to view analysis information about:

Customers This will allow customer numbers to be stored during transaction entry for reporting purposes. You can view analysis information entered in relation to a customer against the transaction dimensions set up in the account class or the accounts linked to the class. If you unmark this option, you cannot view analysis information for customers.

Vendors This will allow vendor numbers to be stored during transaction entry for reporting purposes. You can view analysis information entered in relation to a vendor against the transaction dimensions set up in the account class or the accounts linked to the class. If you unmark this option, you cannot view analysis information for vendors.

Employees This will allow employee IDs to be stored during transaction entry for reporting purposes. You can view analysis information entered in relation to an employee against the transaction dimensions set up in the account class or the accounts linked to the class. If you unmark this option, you cannot view analysis information for employees.

Item Numbers This will allow item numbers to be stored during transaction entry for reporting purposes. You can view analysis information entered in relation to an item number against the transaction dimensions set up in the account class or the accounts linked to the class. If you unmark this option, you cannot view analysis information for item numbers.

Site IDs This will allow site IDs to be stored during transaction entry for reporting purposes. You can view analysis information entered in relation to a site ID against the transaction dimensions set up in the account class or the accounts linked to the class. If you unmark this option, you cannot view analysis information for site IDs.

Asset IDs This will allow asset IDs to be stored during transaction entry for reporting purposes. You can view analysis information entered in relation to a assets ID against the transaction dimensions set up in the account class or the accounts linked to the class. If you unmark this option, you cannot view analysis information for assets IDs.

Book IDs This will allow book IDs to be stored during transaction entry for reporting purposes. You can view analysis information entered in relation to a book ID against the transaction dimensions set up in the account class or the accounts linked to the class. If you unmark this option, you cannot view analysis information for book IDs.

- In the scrolling window, you can select the analysis type for each transaction dimension. The following analysis types are available in the Data Type field:

Not allowed Transaction dimension will not be available to create analysis information for accounts linked to the account class. Transaction dimension codes cannot be entered for this transaction dimension during transaction entry. The transaction dimensions with an analysis type of Not allowed will not be displayed in the Analytical Transaction Entry windows.

By default, any new transaction dimension that is added will have an analysis type of Not Allowed.

Required Transaction dimension codes must be entered for the transaction dimension for each account that is linked to the account class.

Optional The entry of a transaction dimension code for such transaction dimensions optional. For each account linked to the account class, analysis information may or may not be entered.

Fixed A default transaction dimension code must be entered against this transaction dimension and it cannot be overwritten during transaction entry. The code will be used for all accounts linked to the account class. The default transaction dimension code must be entered and can be overwritten only in the Accounting Class Maintenance window.

If the relationship between alphanumeric transaction dimensions is Combination Not Allowed, the analysis type of one of the transaction dimensions must always be Not Allowed. You cannot change the analysis type from Combinations Not allowed to Required or Optional or Fixed.

- You can enter a default transaction dimension code for the transaction dimension if the analysis type of the transaction dimension is Required, Fixed or Optional. This default dimension code will be displayed during transaction entry and only can be overwritten if the analysis type of the transaction dimension is not Fixed.

If you’ve marked the Show valid code combinations in trns and budgets option in the Analytical Accounting Options window, then the lookup window will display only those codes that have a valid combination with the codes you have already selected for the transaction.

Note

You are required to enter a default transaction dimension code if the analysis type of the transaction dimension is Fixed.

- If the distribution accounts of a fixed or variable allocation account are linked to an account class, you must ensure that during transaction entry default transaction dimension codes are entered for all transaction dimensions set to Required in the class. These codes will be considered when you post transactions comprising fixed or variable allocation accounts.

For an alphanumeric transaction dimension, you can select a default transaction dimension code from the transaction dimension code Lookup window. You also can view information for a code or create a new code by opening the Transaction Dimension Code Maintenance window from the Trx Dimension Code Default Link.

For Numeric transaction dimensions, the field to the right of the Trx Dimension Code Default field will display the Base U of M and the decimal places, if it has been set in the Transaction Dimension Maintenance window.

Choose the Show button to display the description of the Trx Dimension Codes of alphanumeric transaction dimensions.

Mark the Show check box to view transaction dimensions while entering analysis information for transactions. This check box will be marked by default if the transaction dimension is Required, Fixed or Optional. Unmark the check box if you don’t want to view the transaction dimension during transaction entry.

You cannot hide a transaction dimension unless a default transaction dimension code has been entered. If the default code of a Required or Optional transaction dimension that is hidden is removed from the Accounting Class Maintenance window, the transaction dimension automatically will be set to Show. However, transaction dimensions will be displayed in Inquiry windows, regardless of the status marked here.

- Inactive transaction dimensions will be displayed in the Accounting Class Maintenance window if you have selected the Show Inactive Trx Dim in Acct. Class Maint window option in the Analytical Accounting Setup window. The check box under the Inactive column will be marked automatically if the transaction dimension is inactive. This column is non-editable.

The analysis type of an inactive transaction dimension always will be Not Allowed. It cannot be changed to any other analysis type unless the transaction dimension is activated.

Choose Accounts to open the Account Class Link window. Refer Linking accounts to an account class for more information.

Choose Save to save the changes you’ve made. When you choose Save, the following checks take place:

If transaction dimensions have been deleted or inactivated, a message is displayed indicating that the relevant transaction dimension is deleted or inactivated. The Accounting Class Maintenance window will be cleared after you close the message.

If a transaction dimension code is deleted or inactivated a message is displayed indicating that the relevant code is deleted or inactivated. You can save the account class only if you replace or remove the relevant code.

If the relationship between the default codes you’ve set up in the Account Class Maintenance window is still valid.

If the relation between the default codes of such dimensions is no longer valid, a message appears. You cannot save changes to the account class if the combination between codes is not valid.

Choose Clear to clear the window.

Choose Delete to delete an account class. When you delete a class, all information related to such class will be removed from all unposted transactions, where accounts linked to such class have been used.

The Accounting Class Maintenance window will be updated when opened after the following changes are made:

If you change the relationship between transaction dimensions in the Transaction Relations window, the analysis type of the transaction dimensions will be set to Not Allowed in the Accounting Class Maintenance window. The default codes you’ve entered for the dimensions also will be removed.

If you change the ownership between codes and the codes have been used as default codes in the Accounting Class Maintenance window, the codes will be removed from the account class.

Example

Profit Centre owns Cost Centre. Code P1 owns C1. Both codes are default codes in the Accounting Class Maintenance window. This relationship is changed so that C1 is now owned by P2. In the Accounting Class Maintenance window, P1 and C1 will be deleted. However, you cannot change this relationship if C1 is used as a default code for a fixed transaction dimension. The analysis type of the transaction dimension has to be changed prior to changing the ownership.

If transaction dimensions are valid subsets and you change the combination between codes used as default codes in the Transaction Dimension Code Validation window, the codes will be removed from the Accounting Class Maintenance window.

Example

Profit Centre and Cost Centre are valid subsets. Code P1 and C1 are set as a valid combination and are used as defaults in the Accounting Class Maintenance window. Subsequently, P1 is set as a valid combination only with C2. In the Accounting Class Maintenance window, C1 and P1 will be removed.

However, you cannot change the combination between C1 and P1 if Profit

Centre and Cost Centre are Fixed types and have been used as default codes. To

do this, you must change the analysis type of Profit Centre and Cost Centre from Fixed to any of the other available analysis types.

Transaction Dimensions or Transaction Dimension codes that have been deleted or inactivated will be removed from the Accounting Class Maintenance window. To delete or inactivate default transaction dimension codes for a fixed or hidden transaction dimension, you must change the analysis type set for the transaction dimension to show.

Linking accounts to an account class

Use the Account Class Link window to link accounts to an account class.

You can link any Microsoft Dynamics GP account to an account class, except for the fixed and variable allocation accounts. However, distribution accounts for fixed and variable accounts can be linked to an account class.

Note

An account can be linked only to one account class.

To link accounts to an account class:

Open the Account Class Link window. (Cards >> Financial >> Analytical Accounting >> Accounting Class Maintenance >> Accounts button)

(Cards >> Financial >> Analytical Accounting >>Accounting Class Link)

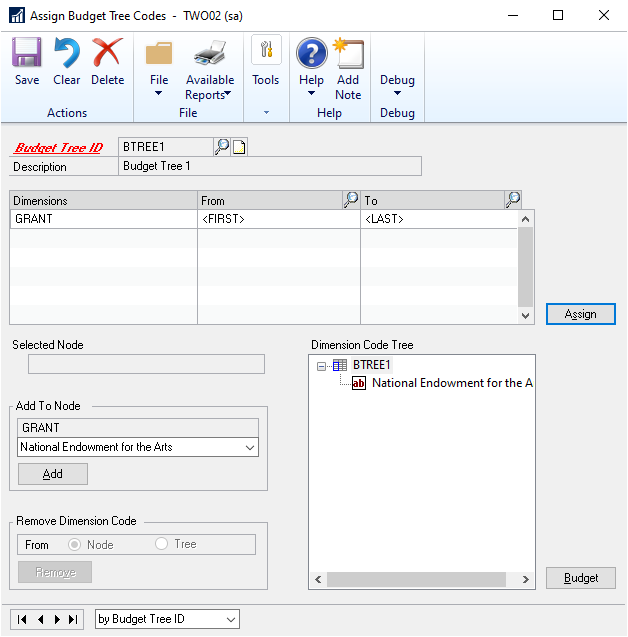

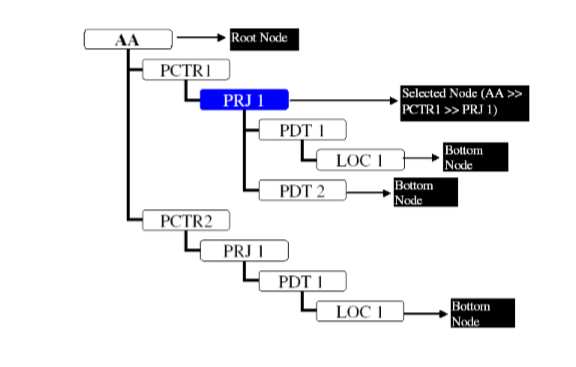

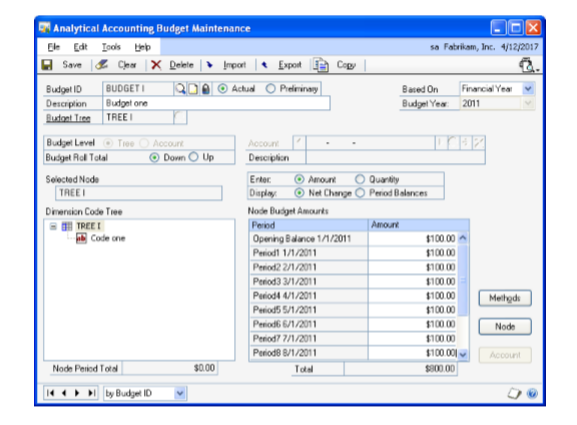

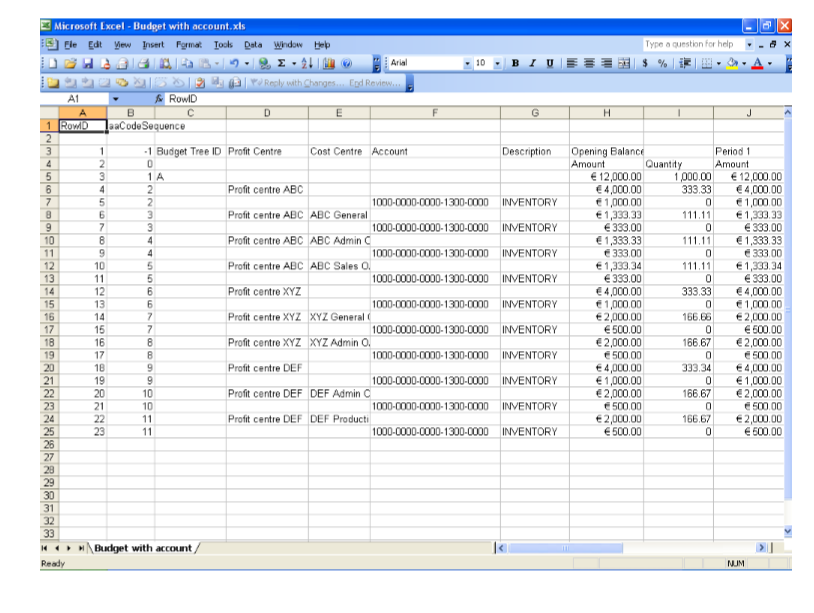

Enter or select an account class to that the accounts will be linked to. The scrolling window will display all the accounts in the Microsoft Dynamics GP Chart of Accounts except fixed and variable allocation accounts.