Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Important

This content is archived and is not being updated. For the latest documentation, go to What's new and planned for Dynamics 365 Business Central. For the latest release plans, go to Dynamics 365 and Microsoft Power Platform release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users, automatically |  Oct 1, 2022

Oct 1, 2022 |

Oct 1, 2022

Oct 1, 2022 |

Business value

Users can report VAT statements and returns based on the new VAT Date instead of the Posting Date to meet requirements by certain countries.

Feature details

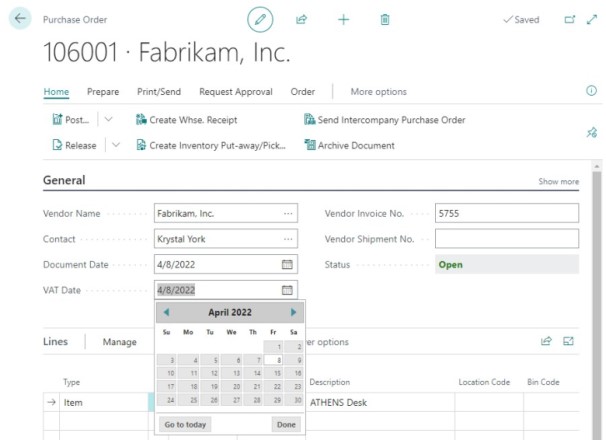

Some countries require reporting for VAT statements and VAT returns by using a date that's different than the Posting Date. Sometimes, the date can be Document Date, but even this date can differ from the requirement. For this reason, the new VAT Date exists on all purchase and sales documents, as well as on journals. Before starting, users can set up the default value for VAT Date (Posting Date or Document Date) in the General Ledger Setup, but the date can be changed on individual documents and journals. When a document is posted, the new VAT Date will be visible in VAT entries and in G/L entries. If necessary, it's possible to change the VAT Date after posting.

Tell us what you think

Help us improve Dynamics 365 Business Central by discussing ideas, providing suggestions, and giving feedback. Use the forum at https://aka.ms/bcideas.

Thank you for your idea

Thank you for submitting this idea. We listened to your idea, along with comments and votes, to help us decide what to add to our product roadmap.

See also

Working with VAT Date (docs)