Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Important

This content is archived and is not being updated. For the latest documentation, go to What's new or changed in Dynamics 365 Finance. For the latest release plans, go to Dynamics 365, Power Platform, and Cloud for Industry release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users by admins, makers, or analysts | - |  Jul 14, 2023

Jul 14, 2023 |

Business value

Though in many countries/regions, withholding tax is only due on payment, there are companies in other countries/regions such as Italy, Netherlands, Mexico, Egypt, Indonesia, and the Philippines with firm practices to calculate, display, and post withholding tax at invoice time. In the Philippines, withholding tax posting at invoice time is legally required.

Feature details

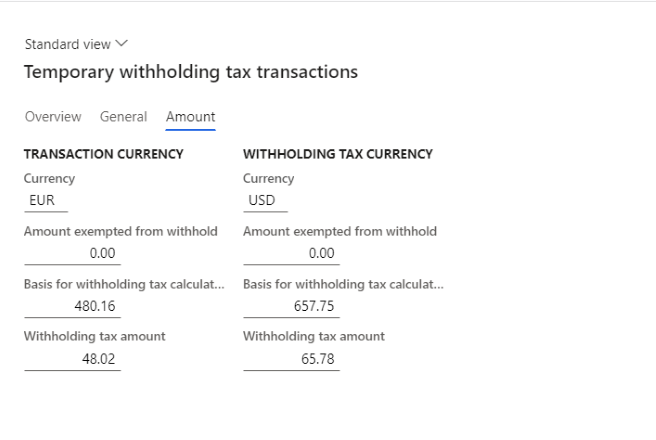

With this feature, the withholding tax amount is estimated on the purchase order and the vendor invoice so that the user can validate the withholding tax setup prior to payment.

The following functionalities are available with this feature:

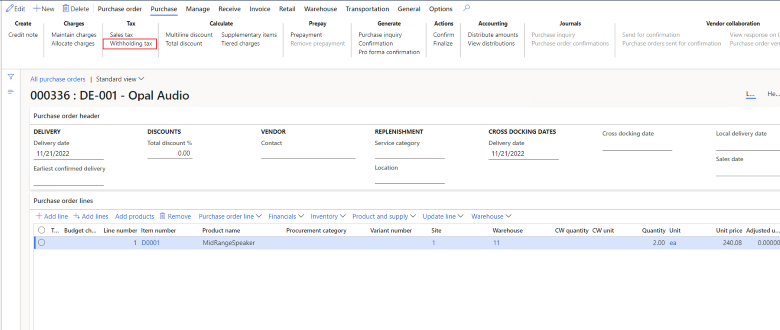

- A Withholding tax button for temporary withholding tax transactions that contain the withholding tax amount information at document header level.

- Withholding tax amount is calculated and recalculated after field and transaction updates.

- Withholding tax limit, threshold, and cash discount are considered in the calculation.

- Withholding tax group assignment, code determination validation, and error handling.

- Withholding tax currency exchange rate date adaptation.

At this time, withholding tax posting during invoicing is not available.

Thank you for your idea

Thank you for submitting this idea. We listened to your idea, along with comments and votes, to help us decide what to add to our product roadmap.