Introduction - Set up an additional reporting currency

With Business Central, companies can record general ledger transactions in the local currency (LCY) and an additional reporting currency (ACY). The main purpose for using an additional reporting currency is to generate reports that are more meaningful to users of financial statements and other reports.

The following is the required setup for using an additional reporting currency:

Select general ledger accounts for posting exchange rate adjustments.

Specify the exchange rate adjustment method for general ledger accounts.

Specify the exchange rate adjustment method for VAT entries.

Enable the additional reporting currency.

After an additional reporting currency is set up, the system completes the following actions:

Records amounts in both LCY and the additional reporting currency on each general ledger entry and on other entries, such as VAT entries.

Uses information from the Currency Exchange Rates page to find the exchange rate for recording transactions in the additional reporting currency.

Set up the currency card

Set up the general ledger accounts for posting exchange rate adjustments on the Currency Card page of the currency that you want to set up as the additional reporting currency.

Make sure that you set up the following fields:

Unrealized Gains Acc. and Unrealized Losses Acc.

Realized Gains Acc. and Realized Losses Acc.

Realized G/L Gains Account and Realized G/L Losses Account

Residual Gains Account and Residual Losses Account

If a currency is used as an additional reporting currency, the entries for that currency on the Currency Exchange Rates page must not be overwritten.

Set up the chart of accounts

When you use an additional reporting currency, make a selection for every G/L posting account in the Exchange Rate Adjustment field. This selection determines how amounts for an account will be adjusted for exchange rate fluctuations between LCY and the additional reporting currency when the Adjust Exchange Rate batch job is run to adjust G/L accounts.

In the Exchange Rate Adjustment field, choose between the following options:

No adjustment - No exchange rate adjustment is made to the general ledger account. This option is the default.

Select this option if the exchange rate between the LCY and additional reporting currency is always fixed.

Adjust Amount - The LCY amount is adjusted for any exchange rate gains or losses. Exchange rate gains or losses are posted to the general ledger account in the Amount field and to the accounts that you specified for gains or losses in the Realized G/L Gains Account and Realized G/L Losses Account fields on the Currencies page.

Adjust Additional-Currency Amount - The additional reporting currency is adjusted for any exchange rate gains or losses. Exchange rate gains or losses are posted to the general ledger account in the Additional-Currency Amount field and to the accounts that you specified for gains or losses in the Realized G/L Gains Account and Realized G/L Losses Account fields on the Currencies page.

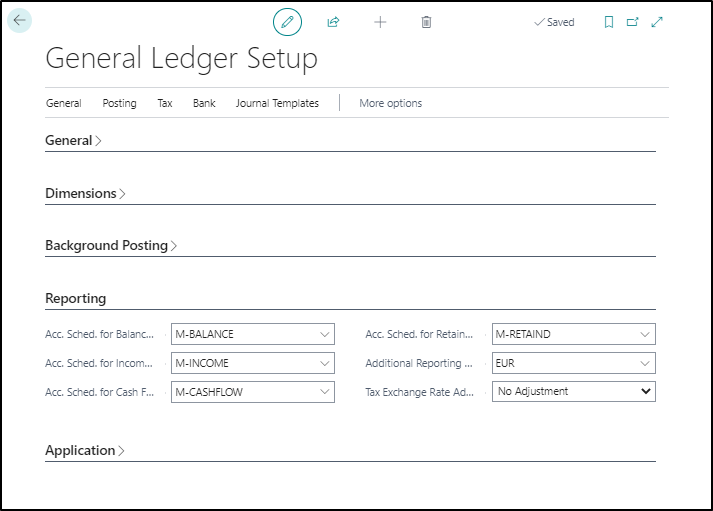

Complete the setup of the General Ledger Setup page

On the General Ledger Setup page, set up the following fields:

Tax Exchange Rate Adjustment - This field will be VAT Exchange Rate Adjustment in some countries or regions.

Additional Reporting Currency - This field designates the extra currency you want to report in other than your local currency (LCY).

Specify the exchange rate adjustment method for VAT entries

When you use an additional reporting currency, you can use the VAT Exchange Rate Adjustment field on the General Ledger Setup page to determine how the accounts that are set up for VAT posting on the VAT Posting Setup page are adjusted for exchange rate fluctuations. Adjustments between LCY and the additional reporting currency are calculated when the Adjust Exchange Rates batch job to adjust G/L accounts is run.

Choose between the same options as you would with the general ledger entries, but in this case, the entries that are adjusted will be the VAT entries:

No adjustment - No exchange rate adjustment is made to the general ledger account. This option is the default.

Adjust Amount - The LCY amount is adjusted for any exchange rate gains or losses. Exchange rate gains or losses are posted to the general ledger account in the Amount field and to the accounts that you specified for gains or losses in the Realized G/L Gains Account and Realized G/L Losses Account fields on the Currencies page.

Adjust Additional-Currency Amount - The additional reporting currency is adjusted for any exchange rate gains or losses. Exchange rate gains or losses are posted to the general ledger account in the Additional-Currency Amount field and to the accounts that you specified for gains or losses in the Realized G/L Gains Account and Realized G/L Losses Account fields on the Currencies page.

Activate the additional reporting currency

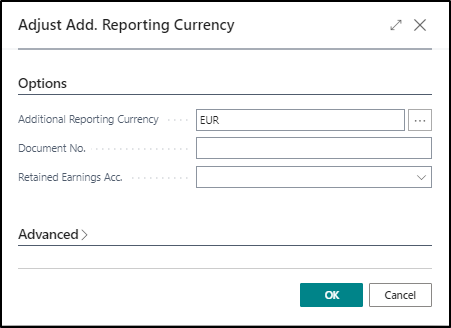

On the General Ledger Setup page, you can select the additional currency that you want to report in the Additional Reporting Currency field. You'll receive a confirmation message that describes the effects of activating the additional reporting currency, and then the Adjust Add. Reporting Currency batch job will open.

The Adjust Add. Reporting Currency batch job converts LCY amounts on existing entries to the additional reporting currency. The batch job uses a default exchange rate that is copied from the exchange rate that is valid on the work date on the Currency Exchange Rates page. Residual amounts that occur on conversion of LCY to the additional reporting currency are posted to the residual gains and losses accounts that are specified on the Currencies page. The posting date and document number for these entries are the same as for the original general ledger entry.

After all residual entries are posted, the batch job posts a rounding entry on the closing date of each closed year to the retained earnings account. This approach ensures the ending balance of the income accounts for each closed year is zero in both LCY and the additional reporting currency.

Fill in the following fields on the Currencies page:

Document No. - Identifies the document number to use for the entry that was created by the batch job that is posted to the retained earnings account. For the residual amount entries, the original transaction document number applies.

Retained Earnings Acc. - Specifies the retained earnings account for the batch job to use in posting. This account must be the same as the account that was used by the Close Income Statement batch job.

After you have run the batch job, amounts on the following existing entries will be in both LCY and in the additional reporting currency:

General ledger

Item application

VAT or Tax

Job ledger

Value

Production order lines

Production order ledger

In addition, all future entries of the same type will have amounts recorded in both LCY and the additional reporting currency.