Risk management in startup teams

This unit will cover how to manage risk in startup teams. We'll start with managing conflict between cofounders. Then, we'll discuss how to use vesting of founder shares to help protect the company if one founder leaves.

Cofounder conflict

Disagreement among cofounders can lead to a breakdown in working relationships. If this breakdown isn't addressed, it can cause startups to fail.

If you haven't already, download and complete a Founder Alignment Exercise. It can be a useful way to unpack the expectations of each founder and identify any mismatches before they lead to breakdowns in team cohesion.

Another simple strategy that can reduce the risk of serious cofounder conflict is to discuss how the cofounders will work together at the outset and reflect what's agreed in a cofounder agreement.

A cofounder agreement is a simple legal agreement. It sets out how the company will be run, how the cofounders will make decisions, how they'll resolve disagreements, and what happens if an agreement can't be reached.

The key elements of a cofounder agreement typically include:

- A brief description of the company and what it's setting out to achieve.

- The names of the cofounders. (It's surprisingly common for some individuals to assume they'll be a cofounder, only to later realize that their teammates held a different view.)

- The contribution expected from each cofounder, including time and capital.

- The equity stake that each cofounder will have.

- The process that will be used for reviewing and adjusting equity stakes over time.

- Salaries or other financial compensation. (This element is relevant after the company starts generating revenues or raises external capital.)

- The functional roles and responsibilities of each cofounder, and what decisions they're responsible for making. (Keep in mind that in the early days, it's generally best not to be overly prescriptive about roles, because everyone has to do a bit of everything.)

- The process to be used for making different types of decisions, and who will be involved.

- The process to be used for conflict resolution if a decision can't be reached.

- What happens if a cofounder leaves the company (including some consideration of whether they leave on good terms or bad terms).

- Non-compete clauses to prevent a departing cofounder from starting a competing business.

- The circumstances under which a cofounder can be removed from the company, and the process for doing this.

- The events that can trigger a winding up of the company, and the process for doing this.

It's important to draft a cofounder agreement before anyone has created any substantive intellectual property (such as writing code) or there's any money involved (either customer revenues or investor funds). Last, make sure that each cofounder signs the agreement!

Vesting of founder shares

Despite your best efforts, it's possible that you or one of your cofounders will decide to leave the company. Departure of a cofounder in the first few years of a startup is surprisingly common. It can happen for many reasons, including financial pressures or disagreements between founders.

If a founder leaves but remains a large shareholder, this can be a major demotivating factor for the remaining founders who are working hard for no additional benefit. It can also make the company much less attractive to investors, because a sizable chunk of equity is now owned by someone who is (at best) passive and not contributing, or (at worst) disgruntled and actively seeking to disrupt the company by blocking decisions or refusing to sign critical documents.

To address this problem, startups frequently adopt founder vesting. That is, each founder earns equity over time, contingent on their ongoing involvement and performance.

The mechanics of founder vesting vary somewhat by region. In essence, they enable issuing of shares to cofounders on company formation. The company holds the right to buy back some or all of those shares at nominal cost if the individual leaves.

The longer the person remains in the company, the more of their shares vest (ownership transfers permanently to the individual).

The main benefits of founder vesting are:

- It incentivizes founders to stay for the long term, because they'll earn a substantial shareholding only by remaining involved.

- It protects the company if a founder leaves by minimizing the chances of them walking away with a large unearned shareholding.

Founder vesting has two components:

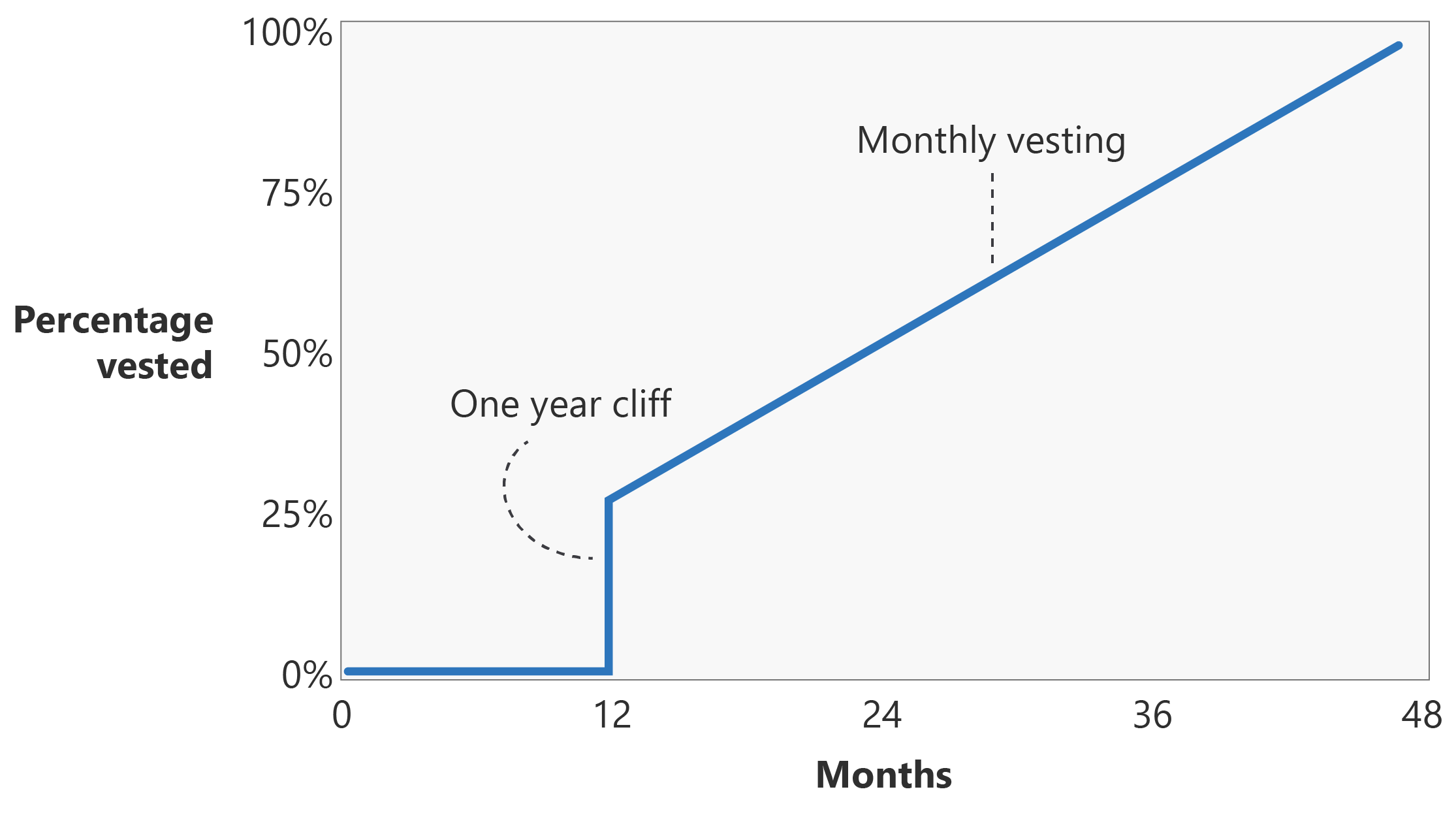

Cliff. A cliff is typically a one-year period from the date of incorporation in which none of the founders have any vested shares. At the end of the year, assuming that each founder has remained involved, 25 percent of their shares will vest.

If a founder departs within the first year, they forfeit all of their shareholding. This makes sense on the basis that in most startups, not much value is created in the first year.

Monthly vesting. The remaining 75 percent of each founder's shareholding is vested in equal installments over the following three years.

What happens when the company raises money from investors?

It's common for early-stage investors to insist on a reset of founder vesting so that each of the founders has to re-earn their shares, including any that had already vested.

This can be a contentious point, but investors often request it because they want to have confidence that all members of the founding team are committed to the business going forward.

What happens in an exit?

If the company is acquired before all of the founders' shares have fully vested, it's common for vesting agreements to allow for immediate vesting of unvested shares. This process is known as accelerated vesting. It ensures that founders are properly compensated alongside investors, employees, and any other shareholders.