Payment schedule

Before getting started, know that the following payment setups in a legal entity is shared between accounts payable and accounts receivable:

- Payment days

- Payment schedules

- Terms of payment

- Cash discounts

You can use payment schedules to accept customer payments in installments. Define the following to set up a payment schedule:

- Number of installments

- Amount of each installment

- Due date of each installment

A payment schedule consists of consecutive payments in set time intervals. The payments can be the following:

- Set amount

- Specified number of payments in which the amount owed is divided to create equal payments

For example, an invoice of USD 6,000.00 is sent to a customer. It is expected to be paid at USD 2,000.00 each month until the balance is paid. During this period, the customer invoice is not considered past due if the scheduled payments are made on time. This is also known as a finance plan, or contract payments.

The following list shows methods of allocation in a payment schedule:

- Total - Total amount outstanding on the invoice due.

- Fixed amount - A specific, fixed amount is due for each payment on the specified payment dates.

- Fixed quantity - Payment of the total amount is divided into a fixed quantity of payments.

- Specified - A specified amount is due on each specified payment date. If Specified is selected, the payment schedules and amounts must be defined on the Payment lines FastTab.

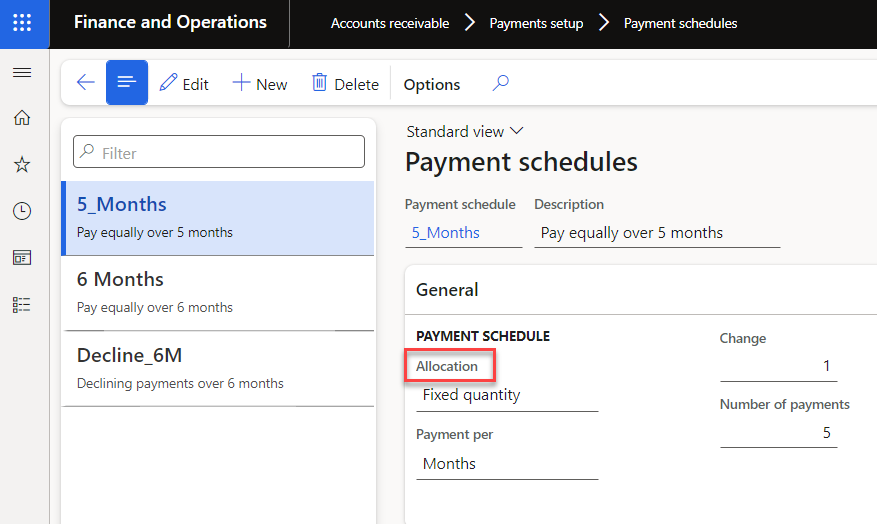

Accounts receivable > Payment setup > Payment schedules

Depending on the value selected in the Allocation list, different fields are enabled on the General and Payment lines FastTabs. For example, If Total is selected in the Allocation list, no other fields are enabled on the General FastTab.

If Specified is selected in the Allocation list, perform the following to complete the payment schedule setup:

- From the Accounts receivable > Payment setup > Payment schedules page, select the General FastTab, and in the Payment per list, select the date interval in Days, Months, or Years. Finance uses this information when it calculates the due date of each installment.

- Use the Sales tax allocation list to distribute the sales tax amount to the payment schedule installments.

- Select the Payment lines FastTab to define the line information for the payment schedule, to designate how many different payments there should be, and to divide how much of the total should be paid in each payment.

- Enter the time interval for each installment in the Quantity field.

- Enter the value of the installment in the Amount in transaction currency field. Enter the value of the installment either as a percentage of the amount invoiced or as an absolute amount, depending on the value in the Percentage/Amount field.

- Select whether the value entered is a percent or an absolute amount in the Percentage/Amount list.

If Fixed amount or Fixed quantity is selected in the Allocation list, perform the following to complete the payment schedule setup.

- From the Payment schedules page, on the General FastTab, in the Payment per list, select the date interval in Days, Months, or Years. Finance uses this information when it calculates the due date of each installment.

- In the Change field, enter the number of units related to the payment per value between the due dates of each installment.

- If the Allocation field is set to fixed quantity, enter the fixed number of installments in the Number of payments field.

- If the Allocation field is set to fixed amount, enter the fixed amount in the Amount in transaction currency field.

- In the Minimum field, enter the minimum installment amount. Minimum amounts override calculated payment amounts.

Accounts receivable > Payment setup > Payment schedules