Cash discounts

Depending on the situation, you can do the following with cash discounts:

- Accrue if a customer meets your company payment terms on time, or are given to customers when they pay their invoices in a specified period.

- Link to the Customer tables and Vendor tables.

- Post to the ledger account that is specified for the cash discount automatically if an invoice is settled on time.

Consider the following scenario:

Adventure Works Cycles offers a cash discount if a customer pays invoices within certain dates.

Adventure Works Cycles has set up the following codes:

- 5D10% - Cash discount of 10 percent when the amount is paid within five days.

- 10D5% - Cash discount of five percent when the amount is paid within ten days.

- 14D2% - Cash discount of two percent when the amount is paid within 14 days.

The three cash discounts occur sequentially as the cash discount date nears. However, only one cash discount is granted.

To specify the cash discounts after the 5D10% code, the 10D5% code is selected in the Next discount code list. On the 10D5% code, the 14D2% code is selected in the Next discount code list. Finally, on the 14D2% code, the Next discount code list is left blank. You can assign cash discounts to customers, journals, or sales orders.

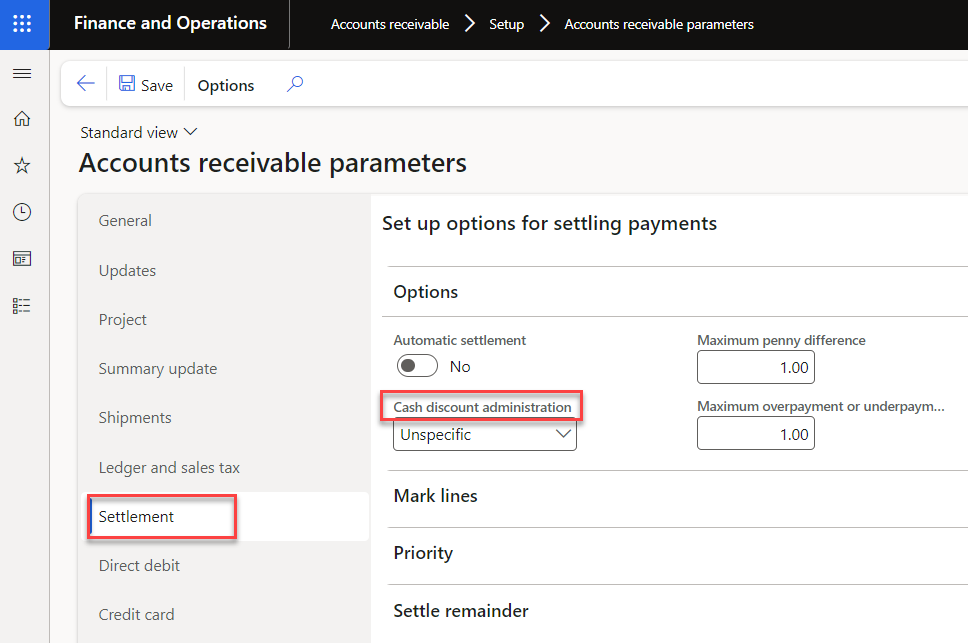

In the Cash-discount administration field in the Accounts receivable > Setup > Accounts receivable parameters page and Settlement tab, select what to do with an overpayment or underpayment when a cash discount is not deducted when the invoice is settled.

If you select Unspecific, the underpayment amount is posted to the customer cash discount account. If the applicable cash discount was posted in the same company as the overpayment, Finance will adjust the cash discount.

If the applicable cash discount was not posted in the same company as the overpayment, it is posted to the system cash discount account. If there are multiple cash discounts so that an overpayment was settled against multiple invoices, the adjustment to the discount is from the last invoice to the first discount.

Accounts receivable > Setup > Accounts receivable parameters > Settlement tab

If you select Specific, the overpayment or underpayment amount is posted to the Customer cash discount account.

To better understand these two options, consider the following example:

A customer's invoice total is USD 105.00, and the obtainable cash discount is USD 10.50. Considering the cash discount, the customer will pay USD 94.50 (105-10.50).

However, the amount they receive from the customer is USD 95.00.

If the Cash-discount administration parameter is set to Unspecific, the invoice is settled, and the difference of USD 0.50 is posted to the ledger account that is specified for cash discount differences.

If the Cash-discount administration parameter is set to Specific, the invoice is settled, and the difference of USD 0.50 is posted to the customer's cash discount account.

To specify that the cash discount is calculated based on the amount plus sales tax, go to the General ledger parameters page, select the Sales tax tab, and then expand the Tax options FastTab. In this section, you need to enable Cash discount is calculated on amount including sales tax in the Customer cash discount area.

General ledger > Ledger setup > General ledger parameters > Sales tax