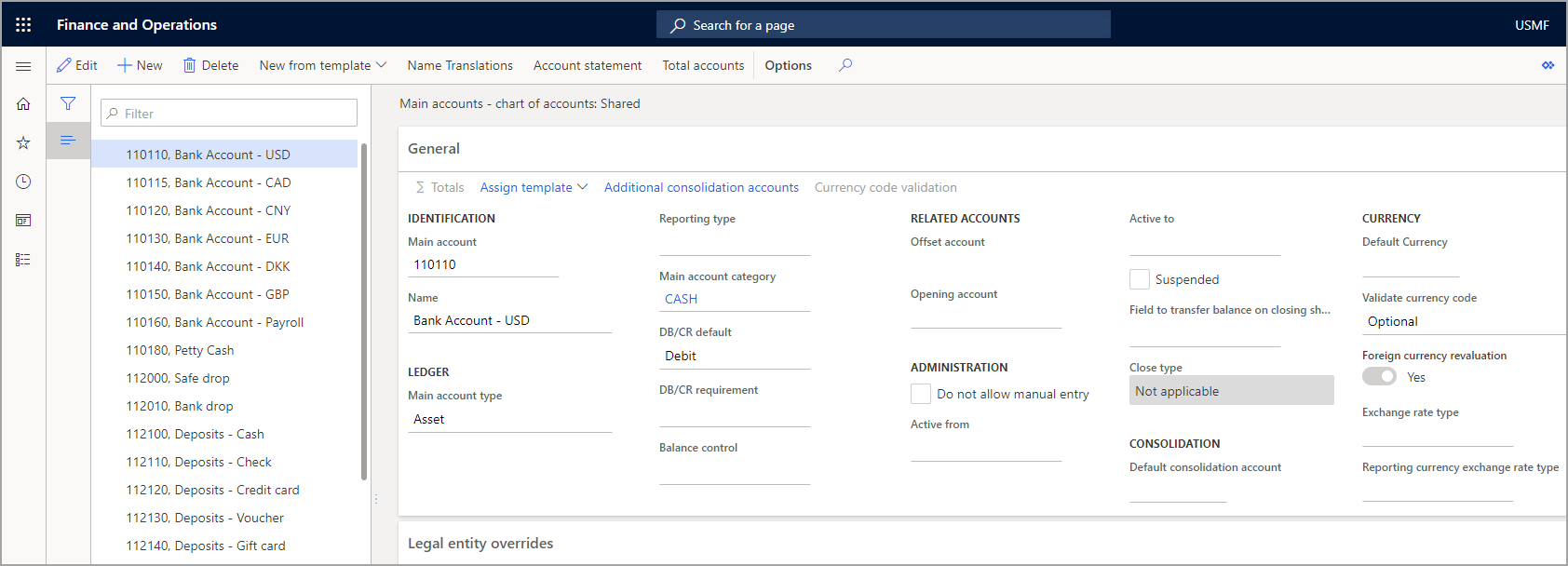

Main account information

A main account is an account in the general ledger that you can use to record financial transactions, balances, or totals that pertain to assets, liabilities, revenues, expenses, and owner's equity. Select information is specific to the main account, such as the main account category, debit and credit controls, and related accounts.

General ledger > Chart of accounts > Accounts > Main accounts

If you use an account only for debit or for credit transactions, then select a Debit or Credit value in the DB/CR requirement dropdown menu. The system verifies your selection when it validates and posts the journal lines. If you leave the field blank, the system automatically proposes a debit.

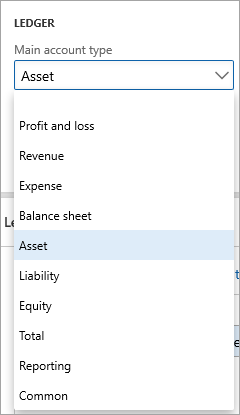

You need to select a main account type when creating the main account on the Main accounts page.

The following main account types determine how the system uses the account in the chart of accounts.

Profit and loss, Revenue, and Expense -- Use these account types as posting accounts. The Profit and loss account is for recording revenue and expenses. The sum of all operating accounts determines the year-end results. The Revenue and the Expense accounts have the same function as the Profit and loss account. The system rolls the balances for these main accounts into the year-end result account during the Opening transactions process. Budgetary control uses the expense accounts.

Balance sheet, Asset, Liability, and Equity -- Use these account types as transaction accounts that record the amounts that a company owns or owes. If you use assets, liability, and equity accounts, the accounts can have a higher degree of specification, and you can more precisely structure reports about the company balance. The balances for these main accounts roll forward to the new year during the Opening transactions process.

Total -- Use this account type to add account intervals. For example, consider a scenario where you're running a financial statement. In this situation, it's frequently useful to total a range of revenue accounts so that you can obtain a quick overview of the total sales for the current period.

Reporting -- Use this account type for financial statement reporting. If you select Reporting in the Type field, select how to use the account for reporting. You can select Header, Empty header, or Page header.

Legal entity overrides

Not all main accounts are valid for all legal entities, and a main account might be relevant only for a specific period. In this scenario, you can use the Legal entity overrides section to identify the companies that the system should suspend the main account for, the owner, and the period when the dimension is active. The overrides at the shared level can't be more restrictive than the overrides at the legal entity level.

Balance control accounts

Use the Balance control accounts page to monitor the current and expected balance on an account as you enter transactions in a journal. You aren't required to set up balance control accounts to work with Finance. The balance control accounts help you track the current and expected balance of liquidity accounts, including bank accounts and petty cash accounts. You can select the balance control criterion for the transactions on the current account in the Balance control list.

For example, when you enter transactions in a journal for the account, if Debit control is selected, the system ensures that the total amount of journal transactions don't cause the balance for the account to go into a credit.

You should only select asset or liability accounts in this field because profit and loss, revenue, and cost accounts are set to zero when you create opening transactions.

By selecting the Do not allow entry checkbox, you prevent a user from manually entering this account in a journal entry. If you select the Suspended checkbox, you prevent all postings to the selected main account. You can't suspend an account that's assigned as a budget group account on another account.