Configure item groups and item model groups

Item groups

In every legal entity, you must set up at least one item group because it is a prerequisite that will be used in inventory processing.

Item groups are used to manage inventory by dividing inventory items into groups based on item characteristics. You can select main account numbers for the automatic ledger transactions that are generated for item group receipt and issue transactions in inventory. You can also set up demand and supply forecasts for item groups.

Item groups serve three main purposes:

- Defining sets of ledger accounts for accounting entries of a collection of products that are classified in the item group.

- Using item groups to report detailed financial information and queries.

- Creating other reports that are related to products.

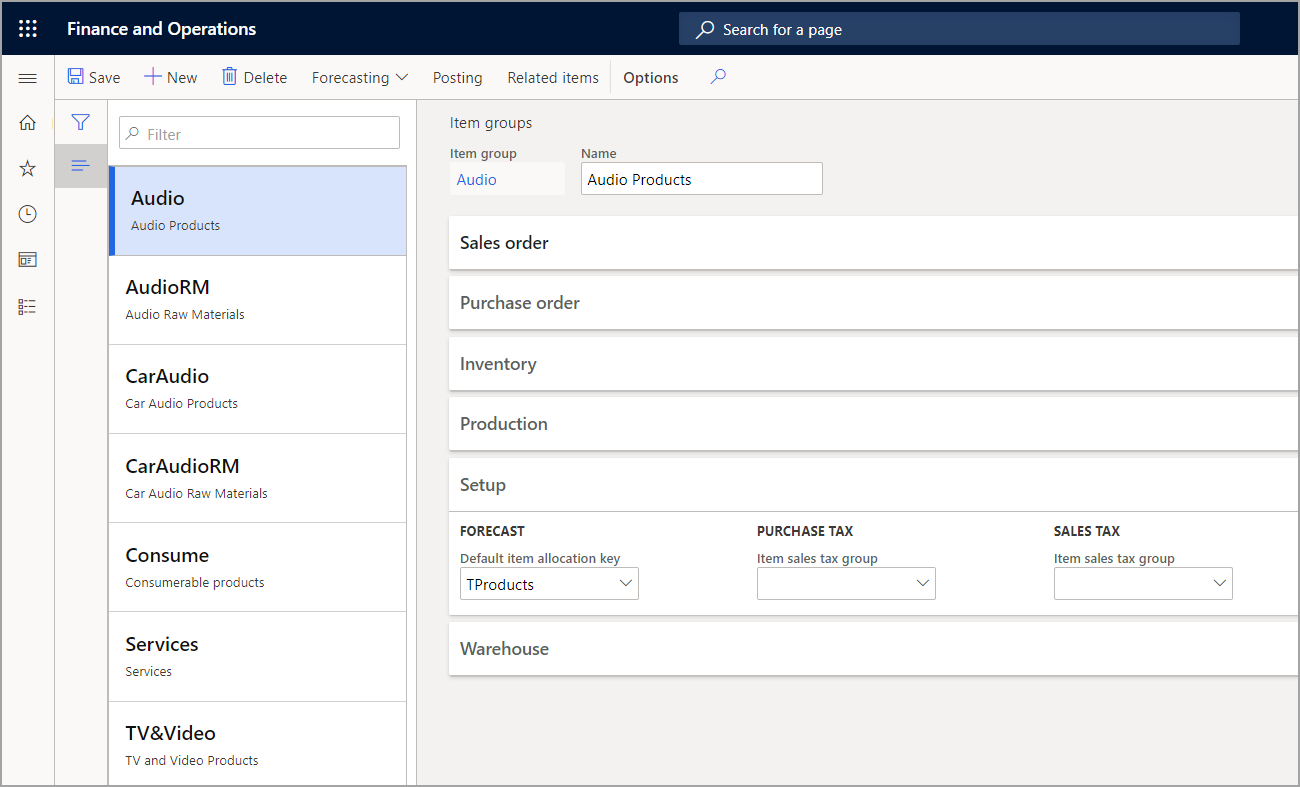

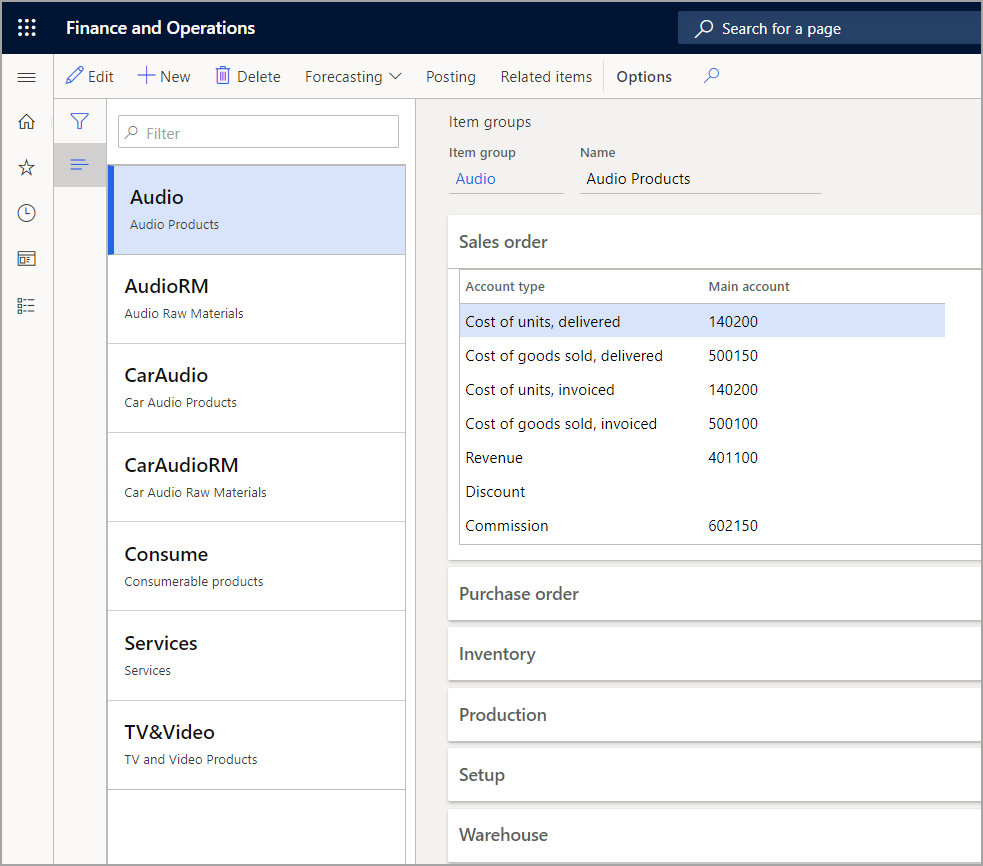

To create an item group, go to Inventory management > Setup > Inventory > Item groups. Specify which accounts from the chart of accounts to use for the various account types in each area.

The Sales order FastTab shows the main accounts that are configured for the item group, in addition to the accounting that is related to the sales order document in the revenue cycle.

For products that are configured as stocked products, an inventory transaction is recorded with the sales order line for the ordered quantity.

For example, when a stocked product is delivered for a sales order, accounting entries are generated in the Order, packing slip main account (issue) and Sales, packing-slip offset main account (consumption) fields, if the Post physical inventory check box on Item model groups page and the Post packing slip in ledger option in the Accounts receivable parameters are selected.

The Purchase order FastTab shows the main accounts that are configured for the item group, in addition to the accounting that is related to a purchase order document in the procurement cycle.

For a product that is configured as a stocked product, inventory transactions are generated with the purchase order line for the ordered quantity.

The Inventory FastTab shows the accounts that are used for inventory-related posting for the item group.

For example, the system uses Inventory, fixed receipt price profit and Inventory, fixed receipt price loss account types to post gain or loss for variance to the Fixed receipt price of products that are configured with a Fixed receipt price inventory model in the inventory model group. It also uses Receipt and Issue to post receipts and issue inventory movements for stocked product.

The Production FastTab shows the accounts that are used for manufacturing-related posting for the item group.

The Setup FastTab lets you set up default forecast and tax groups. The Forecast tab contains the Default item allocation key. Select the user-defined allocation key to serve as the proposed standard key when you create forecasts for the item group. Item allocation keys are created in the Item allocation keys setup of the Master planning module.

The Purchase tax and Sales tax groups contain the Item sales tax group field. This is where you specify a default item sales tax group for items in the selected item groups.

Item model groups

Item model groups contain settings that determine how items are controlled and handled upon item receipts and issues. These settings also determine how item consumption is calculated. This feature facilitates maintenance because many items are frequently controlled with the same setup.

You can attach several products to an item model group. Instead of providing detailed information for each item, one item model group collects all the information. This links it to the products in question, and helps make updating easier because you can typically manage several items according to the same setup that only has to be updated in one place. Therefore, you should create item model groups only as needed.

Item model groups are an important part of configuring product for stock, inventory management, and accounting. Item model groups contain settings that determine how items are controlled and handled upon item receipt and issue.

To create an item model group, go to Inventory management > Setup > Inventory > Item model groups.

Item model groups determine the following stock and inventory policies:

- Whether the product is stocked or not stocked

- The cost flow assumption and cost measurement method for valuing inventory of stocked products

- If physical and financial negative inventory is permitted

- If inventory transactions should be posted to the general ledger

- The workflow that is used when you send or receive items

- The reservation rules

An item model group setup is important when you determine how the item will integrate with other areas of Supply Chain Management. Not all fields are covered in this module because they apply to other areas of the system that will be covered in other modules.

Costing method & cost recognition

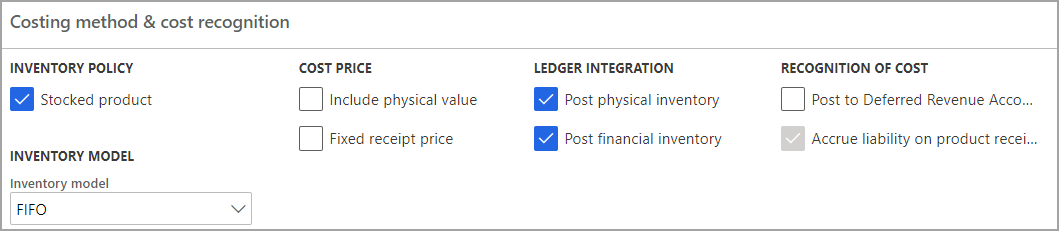

The Costing method & cost recognition field group determines whether products are tracked in stock.

It contains the Stocked product parameter. If the Stocked product check box is cleared, no inventory-transactions are maintained for the product. Therefore, the product cannot be used for production or inventory-related features. This includes inventory journals that rely on inventory transactions.

The product that is not stocked can be used on sales and purchase orders.

Select the Stocked product check box to indicate that the product should be handled in inventory. Products that are handled in inventory generate inventory transactions. These products can be included in cost calculations. On-hand quantities can also be maintained for these products. Stocked products include items and services.

A service cannot be added to stock. However, the system requires that proforma stock transactions be generated for services that contribute to the inventory value of tangible goods. For example, proforma stock transactions must be generated if a service is used to subcontract production steps.

The following are transactions that are only used for stocked products:

- Production orders

- Transfer orders

- Inventory journals

- Quarantine orders

- Quality orders

- Inventory blocking

- Inventory forecasting

If an item model group is set up for a product that is not stocked, many of the parameters are irrelevant.

Ledger integration

The Ledger integration field group determines whether inventory transactions are to be posted to the general ledger, physically or financially, and when they must be posted. The fields in this group are as follows:

- Post physical inventory

- Post financial inventory

- Post to deferred revenue account on sales delivery

- Accrue liability on product receipt

Post physical inventory

The following list explains the effect of the Post physical inventory parameter when it is selected or cleared:

- If this field is selected, physical movements of stocked products are posted in the ledger if:

- On sales delivery, when the Post packing slip in ledger parameter is selected on the Accounts receivable parameters page.

- On product receipt, when the Post product receipt in ledger parameter is selected on the Accounts payable parameters page.

- On production report as finished, when the Post report as finished in ledger is selected on the Production control parameters page.

- If you select the Post physical inventory parameter, packing lists from purchases or sales are posted at cost in the ledger. This means that the value of physically received, delivered, or floating items is not only reflected in the inventory, but also in the ledger. When the same purchase or sales invoice is updated, the transactions are reversed from the packing slip update.

- If you clear the Post physical inventory parameter, physical movements of stocked products are not posted in the ledger, regardless of whether the Post packing slip in ledger, Post product receipt in ledger, and Post report as finished in ledger setup options are selected in the accounts receivable, accounts payable, and production control parameters.

Post financial inventory

The following list explains the effect of the Post financial inventory parameter when it is selected or cleared:

- If this field is selected, the updated financial value of items is posted in the ledger when:

- A purchase order is invoice-updated. The product expenditure is posted to the inventory receipt account.

- A sales order is invoice-updated. The cost of the product is posted to the inventory issue and consumption accounts.

- If you clear this parameter, purchases are posted to the item purchase expenditure for the expense account when the purchase is matched to a vendor invoice.

The inventory value that is posted can then be reconciled with the related status accounts in the general ledger.

If this option is cleared, when a purchase order is invoice-updated, the value of the items is posted to the item consumption account, but not to the inventory receipt account. When a sales order is invoice-updated, no posting occurs in the item consumption account or the issue account. Clear this option for service items if the item consumption should not be posted when sales orders are invoiced. When this option is cleared, journal lines for the items do not generate ledger postings.

Post to deferred revenue account on sales delivery

Select the Post to deferred revenue account on sales delivery parameter to post the expected revenue on sales delivery. This is typically used when a company recognizes revenue at the time of shipment instead of at the time of billing the customer. When the order is invoiced, the accounting entries for deferred revenue are relieved.

Select this option to accrue the estimated revenue for the delivered quantity of packing slip updates. The accrued revenue that is accounted on the sales delivery is offset when the customer is invoiced for the delivery.

Accrue liability on product receipt

Select the Accrue liability on product receipt parameter to post the expected expenditure and liability for purchase for packing slip updates to the general ledger. When the product receipt is matched to vendor invoice, the accounting entries for accrued liability are relieved.

Include physical value

Select the Include physical value option to indicate that transactions that are physically updated should be included in the calculation of the average cost. At inventory close, this parameter can be used, depending on the method that is used for inventory valuation. The following inventory valuation methods use this parameter during inventory close:

- FIFO

- LIFO

- LIFO date

The following inventory valuation methods do not use this parameter during inventory close:

- Weighted avg.

- Weighted avg. date

Fixed receipt price

Select the Fixed receipt price option to adjust issues and receipts to a fixed receipt price. The fixed receipt price is a principle for inventory valuation that sets the price of receipts to the active planned cost or basic cost of a product.

The fixed receipt price is defined in the Price field on the Manage costs tab on the Released product details page.

When this option is selected, receipts and issues are posted as follows:

- For purchase receipts, posting occurs at the actual cost.

- For purchase invoices, the price difference between the actual cost and the fixed receipt price is posted to the general ledger as a variance.

- The amount is posted to the loss or profit account for the fixed receipt price.

- Inventory is updated based on the fixed receipt price.

- For sales order packing slips and sales invoices, posting occurs at the estimated cost.

When you run an inventory close or a recalculation, if the Fixed receipt price option is selected, the value of issue transactions is adjusted according to the price that is specified in the Price field. If the Fixed receipt price option is cleared, the value of issue transactions is not adjusted according to this price.

If the fixed receipt price is changed, and you want all new issue transactions to use the new cost, follow these steps:

- Run an inventory close.

- Adjust the balance for the on-hand inventory so that the balance matches the new cost.

- Activate a new planned cost.

Inventory model

Select the inventory model that is used to close and perform adjustments on the Closing and adjustment page.