Set up funds in the public sector

A fund is a self-balancing set of financial books that is used to control and monitor the planned use of resources, often in compliance with legal and administrative requirements. Public sector organizations use funds to demonstrate their fiscal accountability.

Fund numbers are used as dimension values in financial account numbers where a dimension has been mapped to a fund. Public sector organizations usually require balanced entries for financial dimensions that are related to funds.

You can use a fund to control and monitor the planned use of resources, often in compliance with legal and administrative requirements. Funds are established to conduct specific activities or attain certain objectives of a government entity according to special legislation, regulations, or other restrictions.

Fund details

Each fund must have a unique fund number (even though the field allows nonnumeric values). Some organizations refer to fund number as fund, fund code, fund account number, or fund account.

In Finance, fund numbers are used as dimension values in financial account numbers where a dimension has been mapped to a fund. When an account number is linked to a fund, it belongs to the set of financial books that are contained by that fund.

Public sector organizations usually require balanced entries for financial dimensions that are related to funds. When a financial dimension or a combination of dimensions is marked to require balanced entries, the system will not post a transaction where debits do not equal credits for the financial dimension.

Fund classes and fund types for public sector

The Governmental Accounting Standards Board (GASB) recommends a set of Generally Accepted Accounting Principles (GAAP) for state and local governmental accounting. The GAAP identifies eight fund types that are categorized under the three fund classes:

- Governmental - Governmental funds are funds accounting for government activities that are not considered proprietary (business type) or fiduciary. The general fund is an example of a governmental fund. This is the main operating fund of a government. Special revenue funds, capital project funds, and debt service funds are other examples of governmental funds.

- Proprietary - Proprietary funds are business-type funds that use the accrual method of accounting to record revenues and expenses in accounting periods that are different from the periods that are used in governmental funds. Examples of proprietary funds include enterprise funds and internal service funds.

- Fiduciary - Fiduciary funds represent "other people's money." Because the government does not own the assets and liabilities in this fund, it keeps a separate set of books to track and report on the fund's activities. Examples of fiduciary funds include trust funds and agency funds.

Fund types are categories that you can use to group funds for detailed fiscal tracking and reporting. Many funds can be included in a single high-level report, but each fund remains a separate fiscal and accounting entity with its own general ledger, income statements, and balance sheet reports.

The Generally Accepted Accounting Principles (GAAP) for state and local governmental accounting provides standards that you can follow when you set up your system of funds and fund types.

Public sector organizations can set up fund types according to their operational requirements.

Examples of possible fund types include the following:

- General fund

- Special revenue

- Debt service

- Capital projects

- Enterprise

- Internal service

- General long-term debt (GASB 34)

- Agency

- Component unit

- Expendable trust

- Capital assets (GASB 34)

- Investment trust

- Permanent

- Non-expendable trust

- Pension trust

- Private purpose trust

The following lists funds that might be used by a town government:

- General fund

- School of technology

- Information technology

- Farmers market

- Utilities commission

- Courier service

- Worker's compensation fund

- Comprehensive major medical plan

- Deferred compensation

- Local sales tax collections

- Clerk of courts

The following table shows these funds grouped by fund class and fund type.

| Fund class | Fund type | Fund number | Fund name |

|---|---|---|---|

| Governmental | General Fund | 1103 | General Fund |

| Special Revenue Funds | 1343 | School of Technology | |

| 1372 | Information Technology | ||

| Proprietary | Enterprise Funds | 2501 | Farmers Market |

| 2541 | Utilities Commission | ||

| Internal Service Funds | 2723 | Courier Service | |

| 2738 | Worker's Compensation Fund | ||

| Fiduciary | Pension Trust Funds | 3320 | Comprehensive Major Medical Plan |

| 3324 | Deferred Compensation | ||

| Agency Funds | 3912 | Local Sales Tax Collections | |

| 3914 | Clerk of Courts |

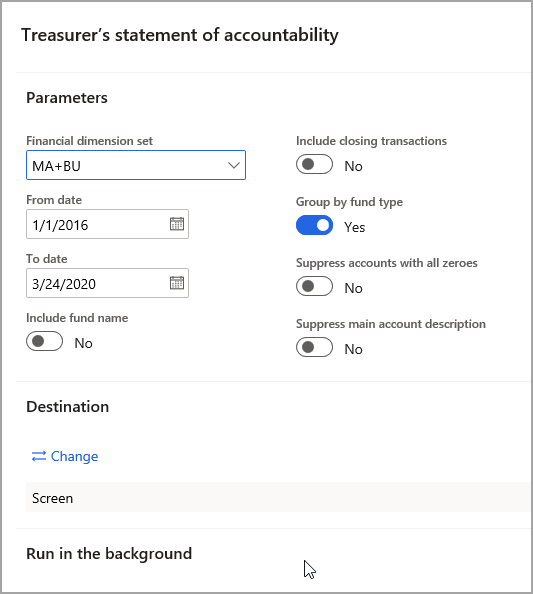

You can view a report that will be a trial balance specifically on treasurer's funds by going to General ledger > Inquiries and reports > Ledger reports > Treasurer's statement of accountability. This can be run daily to review the activity in fund accounts for the treasurer's fund and compare it to other funds. You can look for discrepancies, unexpected balances, and any adjustments that may be needed.