Cash flow forecasting

To track and create cash flow forecasts, the Accounts receivable person uses a combination of enterprise resource planning software and offline Excel spreadsheets. Because data is spread out into many different areas, the process of tracking the actual metrics of the business and presenting it accurately is difficult. Additionally, the information is manually entered and updated.

The Accounts receivable person can use Intelligent cash flow forecasting to save, edit cash flow forecasts, and compare them, in real time, to the actual numbers. At Contoso Entertainment, the owners must have the ability to view different possibilities regarding their forecasts. By using this forecasting feature, they can provide the owners with an optimistic, pessimistic, and realistic view of what the cash flows could be and the differences between them.

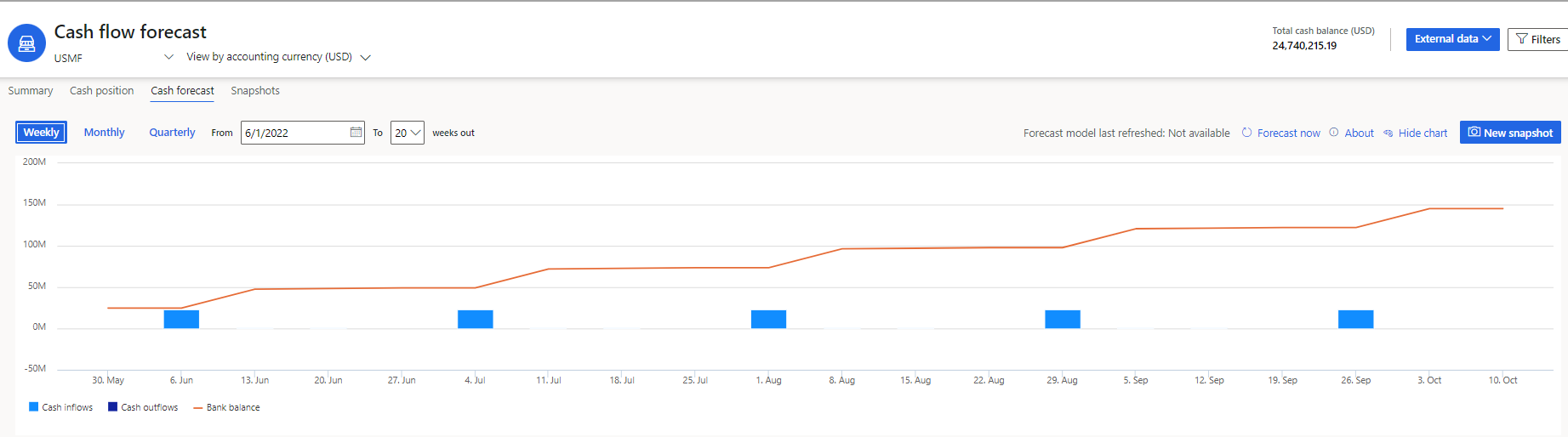

The screenshot above shows one of these forecast models and how we can view the different potential outcomes of cash flows.

From this point, the Accounts receivable person can analyze the insights and use them for relevant planning based on expected future cash flows.