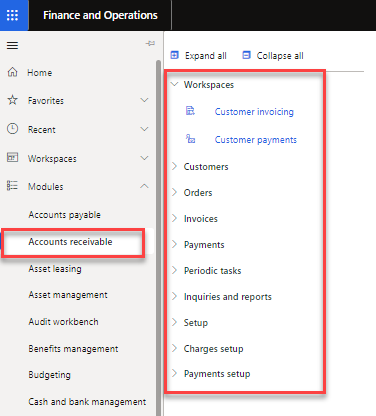

Accounts receivable

Use the Accounts receivable module in Finance to track customer invoices and incoming payments.

The following are examples of tasks that you can perform in the Accounts receivable module:

- Create customer invoices that are based on sales orders or packing slips.

- Create free text invoices that are not related to sales orders.

- Receive payments by using several different payment types, including bills of exchange, cash, checks, credit cards, and electronic payments.

- Use centralized payments to record payments in a single legal entity on behalf of the other legal entities, if your organization includes multiple legal entities.

- Distribute transaction amounts and use subledger journal entries for free text invoices.

- Maintain customer posting profiles.

- Configure credit cards, for authorization, and capture payments.

- Create a customer invoice.

- Set up and process recurring invoices.

- Correct a free text invoice.

- Set up bills of exchange.

- Set up interest rates for an interest code.

- Waive, reinstate, or reverse interest fees.

- Set up Single Euro Payments Area (SEPA) direct debit mandate.

- Close accounts receivable.

- Use a customer payment to settle multiple invoices that span multiple discount periods.

- Reimburse customers.

- Handle customer payments for a partial amount.

- Prioritize payments that are received from a customer and settle them by configured rule.