Credit management

Credit management is a feature that has great value to finance users of Microsoft Dynamics 365 Finance. Credit management can:

- Suggest credit control activities, thereby improving cash flow.

- Reduce bad debts.

- Provide insights and controls that help you manage credit risks.

Set up and generate credit limit adjustments

A credit limit adjustment is a process that uses journals, approvals, and postings to track changes to customer credit limits. The system creates a historical record of changes to a customer’s credit limit, which allows you to review proposed changes to customer credit limits before approving changes.

Finance includes many options for you to create credit limit adjustments, including the ability to make them temporary. You can generate adjustments for one customer or a list of customers. Additionally, you can have credit limit adjustments be created automatically based on rules that are set up in the system.

Credit limit adjustment setup

You'll need to complete a few steps to use credit limit adjustments:

- Specify the number sequence.

- Set up customer credit groups.

- Create risk scoring groups.

- Determine risk classifications.

- Set automatic credit limits.

- Set up customer credit adjustment workflows.

Number sequences

Because credit limit adjustments use journals, a number sequence is needed. You can specify the number sequence on the Number sequences tab of the Credit and collections parameters page. To perform this step, go to the Credit and collections module, select Setup, and then select the Credit and collections parameters menu item.

You should also consider whether to enable the Allow manual editing of credit limit option or not. Use this setting to determine whether users can manually override a customer credit limit. You can access this option on the Credit tab.

Customer credit groups

You can set up customer credit groups for managing credit limits. This step is optional, and it will allow you to create groups of customers who share a credit limit. To set the credit limit adjustment for the entire group, use the Credit limit adjustments form.

To set up credit limit groups, go to the Credit and collections module, select the Customers section, and then select the Customer credit groups menu item. The page has a list view and a details view.

On this page, you'll add each customer to the group. Then, you'll enter a credit limit and a credit limit expiration date. This limit and expiration will apply to all customers in the group. The expiration date isn't required.

Note

Not including an expiration date can affect the settings that you need to use when creating a credit adjustment journal. Direct adjustments that are made to a customer might override an adjustment that's made to the customer credit group. The journal that's posted later will apply to the specific customer.

Risk scoring groups

Risk scoring groups will set up rules to determine whether a particular customer is a low or high risk. To create risk scoring groups, go to the Credit and collections module and select Setup > Credit management setup > Risk > Scoring groups. You can specify the allowed criteria in the Group type.

For each Group type, you'll select a Score type. The scoring type can be a range of values (specify min and max for each range) or a user-defined value. The following screenshot shows the scoring for the Average Balance score type. Higher average balances will result in higher risk.

Each customer is evaluated against all scoring types that you've set up for a group. These scores for each type will be added to create an overall customer score.

You can also specify user-defined values for scores.

Risk classification/Risk group

When you add together all risk scores for a customer, you can determine the risk group to which the customer should be added. To set up risk classifications, go to the Credit and collections module and select Setup > Credit management setup > Risk > Risk classification. Enter each risk group with a description and then specify a range of scores for the risk group.

Risk group indicators are visible on the Credit management hold list pages, which you can access from the Credit management hold list group of the Credit and collections module.

Automatic credit limits

Automatic credit limit rules will define conditions and credit limits that should be applied when specific conditions are met. The conditions are based on risk scores, not risk classifications.

Customer credit adjustment workflow

Two credit adjustment workflows are available: one workflow to approve or reject an entire journal and another that approves or rejects line-level entries. To set up the workflows, go to the Credit and collections module, select the Setup group, and then select the Credit management workflows menu item.

Both workflows support an Approval task and a Post journal task. You can choose to automatically post a journal when it's approved. You can also exclude the Post journal task in your workflow. A person with Post permissions can perform post operations manually.

You can set up the line-level workflow to group the credit limits so that different people can approve based on the new credit limit amount. The following graphics show the grouping setup for a line level workflow.

The following screenshot shows the line level definition.

The following image shows a line level workflow diagram.

Create credit limit adjustments

You can create credit limit adjustments by using the Credit limit adjustments or Customer credit groups page in the Credit and collections module.

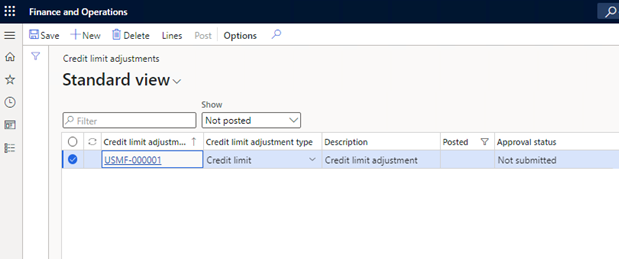

To go to the Credit limit adjustments page, go to Credit and collections > Credit limit adjustments > Credit limit adjustments.

To go to the Customer credit groups, go to Credit and collections > Customers > Customer credit groups.

You can create an adjustment for an individual customer by using the All customers list page or the Customer details page.

You can make two types of adjustments. The system automatically selects the type for you if you go to the Credit limit adjustments form from a customer credit group and then select one of the buttons on this form:

- Credit limit – This option will make a permanent change to a customer’s credit limit. The change starts immediately and can have an expiration date.

- Temporary credit limit – This option will create a temporary change that might begin and expire in the future. You can enter a value for the New from date and the Expiration date fields for lines in a Temporary credit limit journal.

To go to the journal lines, and then select the journal number in the Credit limit adjustment field or select the Lines button in the Action Pane.

Select accounts to adjust

You can manually enter new credit limits and expiration dates for individual customer accounts or customer credit groups by using the Generate button in the Action Pane. Then, choose one of the following options:

- From existing customers

- From existing customer credit groups

- Automatic credit limits

Add customers or customer credit groups manually

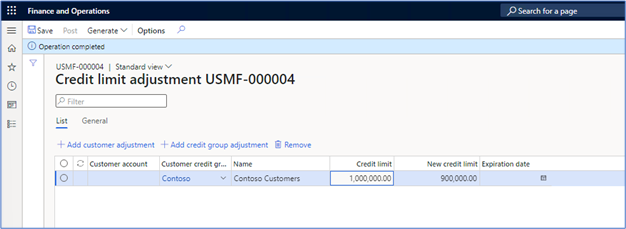

To manually add a customer or customer credit group, select +New, + Add customer adjustment, or + Add credit group adjustment. All options will add a new line. The only difference is the field where the cursor will be placed within the new line: the Customer account or the Customer credit group.

Generate a customer list

If you select the Generate button on the Action Pane, you'll need to specify criteria to select customers for inclusion. The following screenshot shows the options after selecting the Generate from existing customers option.

The following table describes the options that are available on both pages.

| Option | Description |

|---|---|

| Adjustment value | The amount to adjust the current credit limit by. This value might be a dollar amount to add to the current limit or a percentage of the current limit based on the options that are selected in the Value type field. This value can be a negative number. |

| Value type | Fixed indicates that this value is a dollar amount to add to the credit limit (not an adjustment). Percent indicates an amount to adjust by. |

| Round-off | The decimal place to round to. The value 01 indicates that the number should be rounded to the nearest hundredth. |

| Rounding form | Options include Normal, Downward, and Rounding-up. Normal will round down if the fractional amount is < 50, up if > 50, or up or down to the even number if equal to 50. Downward will always round down to the nearest number. Rounding-up will always round up to the nearest number. |

| Absolute Expiration date | The date when the new credit limit expires. Use this date or the relative date, but not both. An expiration date isn't required. |

| Relative to date offset | The number of calendar days until the current credit limit expiration date. |

| Delete existing lines | This option will remove all lines in the journal before adding the ones that will be generated from this dialog. |

The following options are only available for temporary credit limit adjustments.

| Option | Description |

|---|---|

| Absolute new from date | The date when the credit limit should become effective. This date is only used for temporary adjustments. This date isn't required. |

| Relative from date offset | Add this number of calendar days to the current credit limit to show the temporary adjustment to the new date. This date is only used for temporary adjustments. |

Automatic credit limits require an expiration date.

You can create automatic credit limits to define and update customer credit limits. The automatic credit limits are created for a risk group, and they're based on specific values that are used in the scoring groups. You can use these automatic credit limits to generate credit limit entries. If a customer has been assigned to a specific risk group, and the customer's credit information matches the criteria for an automatic credit limit, then a credit limit adjustment entry will be created.

Journal lines

Whether you choose to manually add lines to the journal or use an automated option, your lines will be in one of two formats:

Credit limit journal lines - Include the current credit limit, the new credit limit, and the expiration date. When you use the Credit group option, you won't be able to view individual lines for each customer, only the one line that represents the group. The following example uses a fixed amount of negative 100,000 as the adjustment value.

Temporary credit limit lines - Show the current From and To dates and allow you to enter a New from date and Expiration date. The system will add these values for you if you choose one of the Generate menu items.

Approval process

When you enable the approval workflow, the Workflow button will display on the Action Pane of the Credit limit adjustment journal page. You can submit the journal for approval from that menu item.

Approval work items will be generated, and the journal will wait for as many approvers as specified in the workflow. The journal can be posted by the workflow automatically, or you can leave the journal for a user to post.

Posting

When a workflow is approved, the Post button will be enabled on the Credit limit adjustment journal page. You might need to select Save to enable Post, even if you haven't made a change to the page.

Review credit limit adjustment history

You can review the already-posted credit limit adjustment journals from credit limit adjustment lists. To do so, go to the Credit and collections module, select the Credit limit adjustments group, and then select the Credit limit adjustment menu item. Change the Show option to All or Posted to view the posted journals and the journals that are still drafts.

Additionally, you can view the temporary credit limit history for a specific customer by going to the All customers list page, selecting a customer, and then selecting the Temporary credit limits menu item from the Credit management menu.

The current credit limit is visible in the Credit and collections tab on the Customer details page.

You can view the credit limit and temporary credit limit for the customer simultaneously. The Total credit limit shows the amount of credit that the customer has currently. The preceding screenshot shows that the temporary credit limit hasn't expired and that a 275,000 credit limit has been applied to the customer.

Review a customer’s risk score

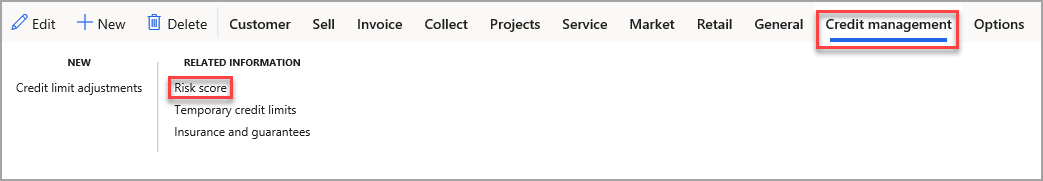

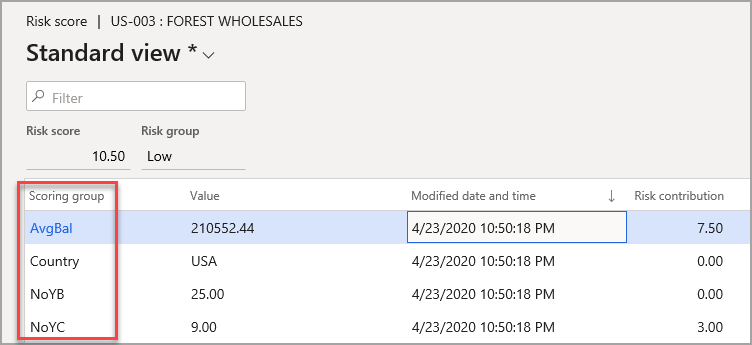

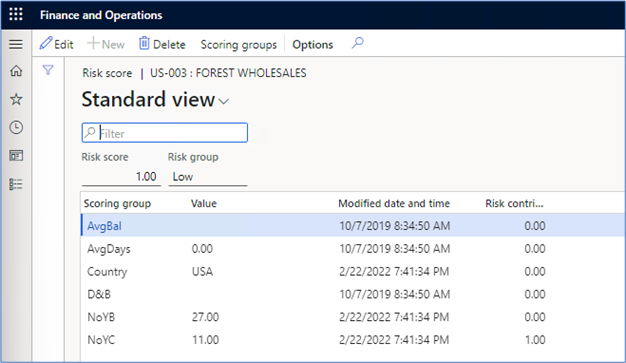

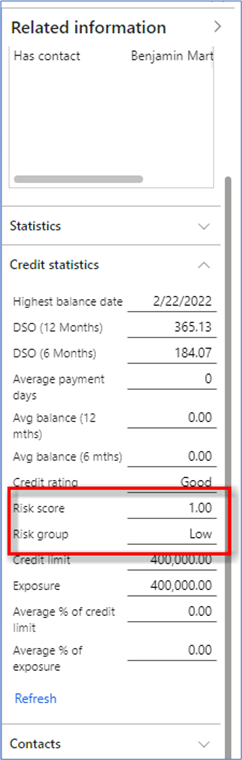

To review a customer’s risk score, go to the Credit and collections module, select All customers, and then select the Customer list page or the Customer details page. Select a customer, select the Credit management menu in the Action Pane, and then select Related information > Risk score.

You'll need to run a periodic job to update risk. To schedule the job, go to the Credit and collections module and select Periodic tasks. Select Credit management group and then select the Update risk scores menu item.

The system will calculate a numeric score for each scoring group and will calculate total scores for each customer. The customer that's referenced in the following screenshot has a risk score of 1.

The risk score is also visible in the Credit statistics fact box.

Configurable blocking rules

The Configurable blocking rules page allows a company to set up a variety of rules that will block sales from occurring. For example, if a company has used 100 percent of their credit limit, a sales order will be blocked. The best example of the available options is shown in the following screenshot in the Days overdue rules. The standard table-group-all selection is available, so if a rule needs to be set for one customer, a group of customers, or all customers, it can be done. One variable in this rule is the Risk group, where a specific group could be selected to be a factor. The standard operators are available for you to use when, in this case, you're defining how many days that the group can be overdue.

Credit and collections > Setup > Credit management setup > Blocking rules

Dynamic release of credit holds

In Credit and collections, you can find a Credit management hold list at Credit and collections > Credit management hold list > Credit holds due for review. This list provides detail for many items, including all customers, their sales orders that are on hold and their amounts, the credit hold reason, and the risk indicator. However, central to this page is the ability to release the hold, reject the hold, or evaluate for release.

Credit limit management

Three tasks that you can complete regarding credit limits are:

Force credit hold - Occasionally, a sales order needs to be blocked, even if it doesn't meet criteria on the blocking rules, such as when a credit manager has learned of a possible issue. This feature allows for multiple orders to be placed on hold for a particular customer or a customer group. To complete this process, go to Credit management > Periodic tasks > Credit management > Force credit hold .

Calculate balance statistics - This option generates a list of all Customer balance statistics. With this option, you can view customers and their balances on specific dates along with their Credit limit and Exposure. You can find the inquiry by going to Credit and collections > Inquiries and reports > Credit management > Customer balance statistics.

Update risk scores - This periodic job recalculates the risk score for customers. You can find the job by going to Credit and collections > Inquiries and reports > Credit management > Update risk scores. When the job is run, you can view the results in the Credit and collections > Customers > All customers page by going to the Credit management tab and selecting Risk score. The following screenshot shows the risk score for Forest Wholesales and, based on the factors that were previously discussed regarding Scoring groups, their score has been updated with the latest data to compute their score of 10.50.