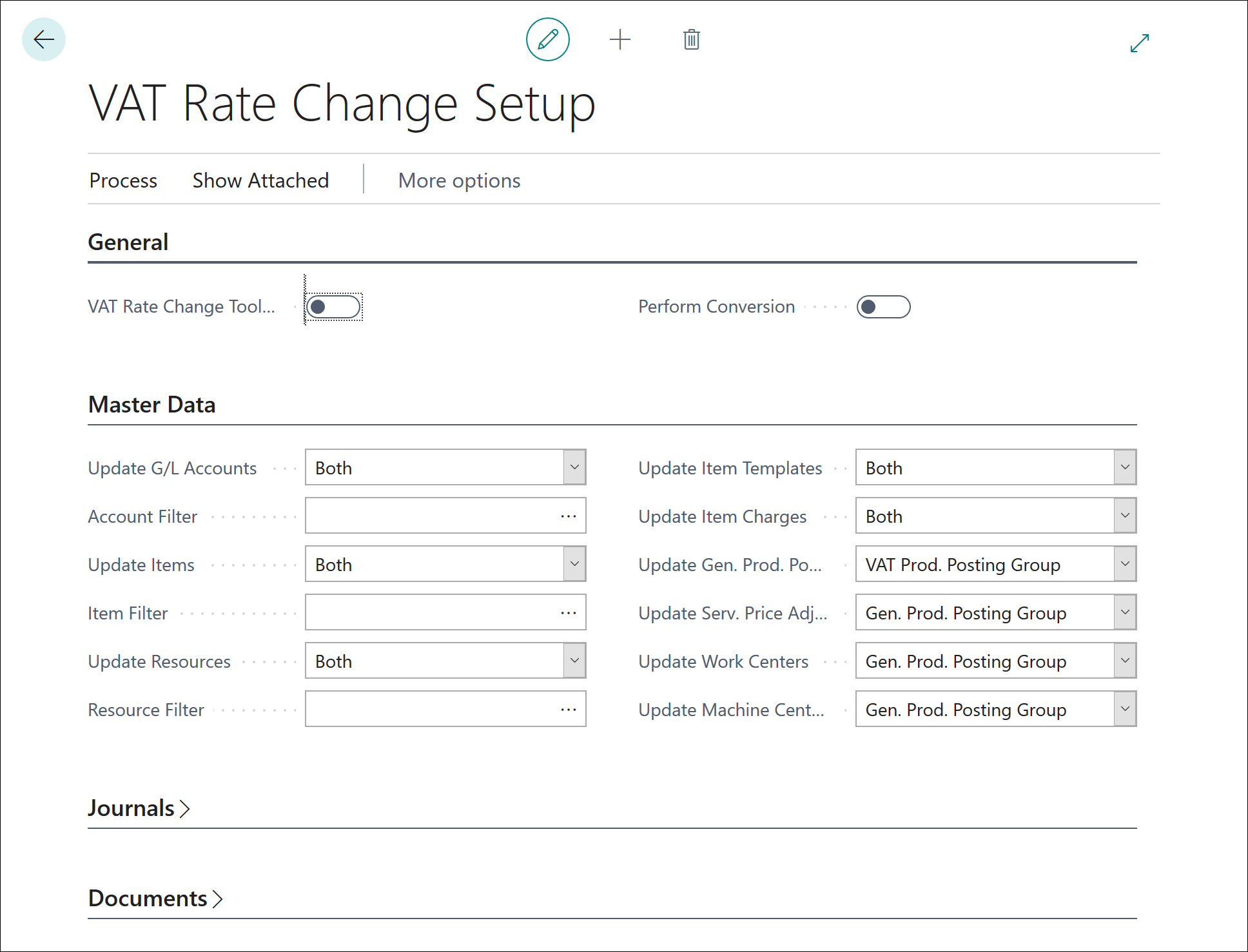

Configure the VAT Rate Change Tool

In the VAT Rate Change Setup window, you can specify the master data, journals, and documents to be converted to the new VAT rate.

For the data to which the new VAT rate applies, you can update the VAT product posting group, the general product posting group, or both.

For master data, you can apply filters when not all data needs a VAT rate update.

The four FastTabs on the VAT Rate Change Setup window are:

General

Master Data

Journals

Documents

In the General FastTab, you can set up following fields:

VAT Rate Change Tool Completed - Use this field to specify if the VAT rate change conversion is completed. If this field is selected and you want to perform multiple conversions, an error message appears. Clear this field to perform multiple conversions.

Perform Conversion - Select this field if you want to perform the VAT rate conversion. Clear this field to run a test conversion.

On the Master Data FastTab, you can specify how you want to perform VAT and general posting group conversions for master data.

For master data, the VAT Rate Change Tool can affect the VAT product posting group and the general product posting group. Depending on the type of master data, you can update one or both posting groups.

For the following master data, you can update both the VAT product posting group and the general posting group:

G/L accounts

Items

Resources

Item categories

Item charges

You can select one of the following options on the Master Data FastTab:

VAT Product Posting Group - The selected field is updated by the VAT product posting group conversion.

Gen. Prod. Posting Group - The selected field is updated by the general product posting group conversion.

Both - The selected field is updated by both the VAT and the general product posting group conversions.

No - The selected field is not updated.

For the following master data, you can update the general product posting group:

Service price adjustment detail

Work centers

Machine centers

Select one of the following options on the Master Data FastTab when you are updating the general product posting group:

Gen. Prod. Posting Group - The selected field is updated by the general product posting group conversion.

No - The selected field is not updated.

You can update the VAT product posting group for the general product posting group by basing your update on the old VAT product posting group. Business Central updates the general product posting groups that have the old VAT product posting group by default.

On the Journals FastTab, you can specify how you want to perform VAT and general posting group conversions for journals.

For journals, the VAT rate change tool can affect the VAT product posting group and the general product posting group. Depending on the type of journal, you can update one or both posting groups.

For the following journals, you can update both the VAT product posting group and the general posting group:

General journals

General journal allocations

Standard general journal lines

You can select one of the following options on the Journals FastTab:

VAT Product Posting Group - The selected field is updated by the VAT product posting group conversion.

Gen. Prod. Posting Group - The selected field is updated by the general product posting group conversion.

Both - The selected field is updated by both the VAT and the general product posting group conversions.

No - The selected field is not updated.

For the following journals, you can update the general product posting group:

Resource journals

Job journals

Requisition lines

Standard item journal lines

On the Journals FastTab, select one of the following options to update the general product posting group:

Gen. Prod. Posting Group - The selected field is updated by the general product posting group conversion.

No - The selected field is not updated.

On the Documents FastTab, you specify how you want to perform VAT and general posting group conversions for documents.

For documents, the VAT Rate Change Tool can affect the VAT product posting group and the general product posting group. Depending on the type of document, you can update one or both posting groups.

For the following documents, you can update both the VAT posting group and the general posting group:

Sales documents

Purchase documents

Service documents

You can select one of the following options on the Documents FastTab:

VAT Product Posting Group - The selected field is updated by the VAT product posting group conversion.

Gen. Prod. Posting Group - The selected field is updated by the general product posting group conversion.

Both - The selected field is updated by both the VAT and the general product posting group conversions.

No - The selected field is not updated.

If you select the Ignore Status on Sales Docs or Ignore Status on Purchase Docs options, all the existing documents are updated regardless of the status. This update will include documents that have a status of released.

You can update the VAT product posting group for the following documents:

Reminders

Finance charge memos

You can select one of the following options on the Documents FastTab:

VAT Prod. Posting Group - The selected field is updated by the VAT product posting group conversion.

No - The selected field is not updated

Finally, for production orders, you can select to update the general product posting group on the VAT Rate Change Setup window.