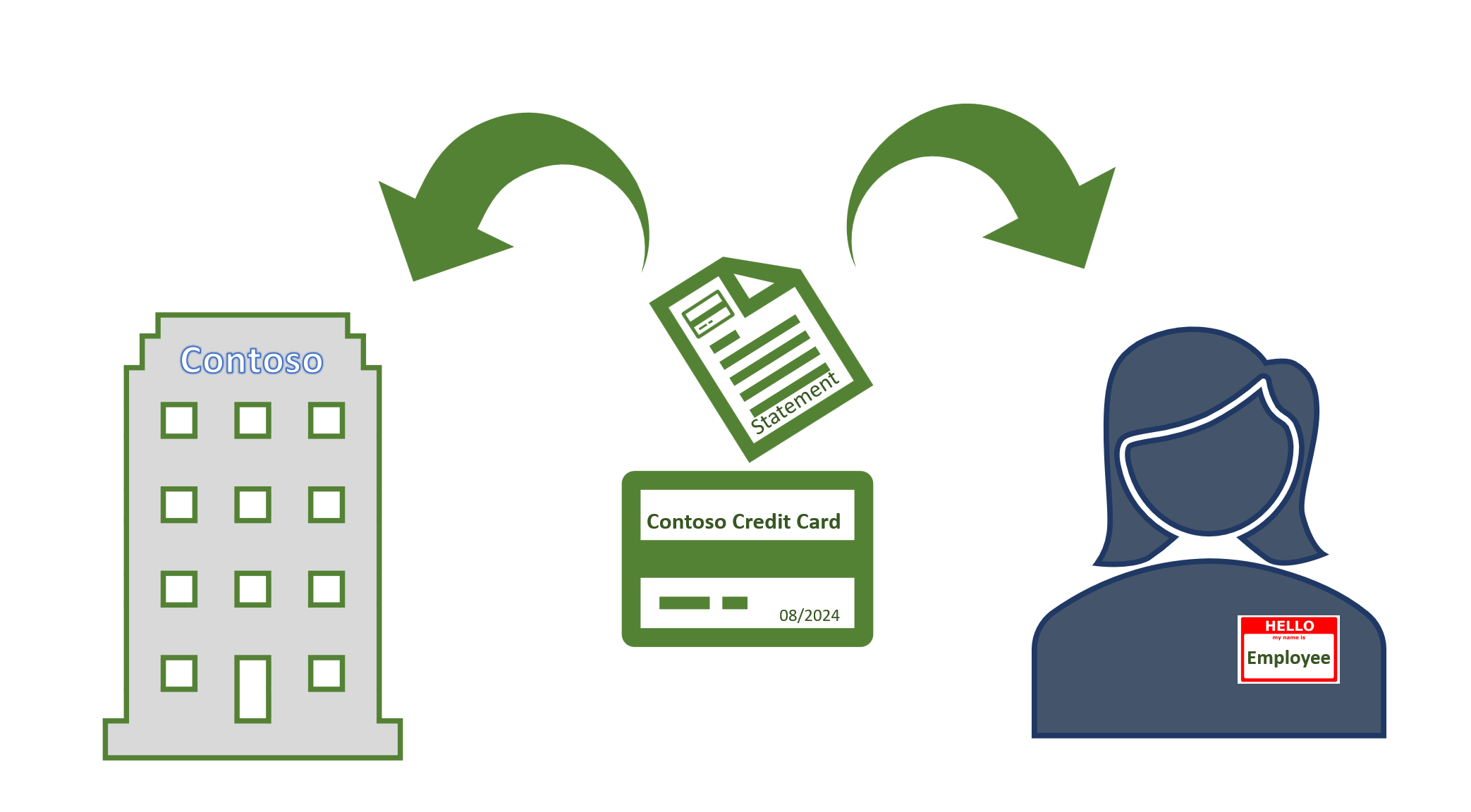

Personal expenses on an expense report

Occasionally, workers might charge their corporate credit cards for personal expenses during business travel. If you do not define a process for handling personal expenses when employees submit their itemized expense reports, the approval process for expense reports could be disrupted.

Your organization has two ways to handle situations when an employee makes personal charges on the corporate account:

Paid by the employee - Your company does not bear personal costs that appear on the corporate credit card bill. Instead, the organization produces a report that shows personal expenses and the corporate expenses that are charged to the corporate credit card. The employee directly pays the credit card vendor for the incurred personal expenses on the company credit card.

Paid by the organization- The organization pays the entire corporate credit card bill. Then, in a separate motion, the organization debits or deducts the employee's paycheck for the incurred personal expenses.

After your organization has chosen how to enforce these policies, you can implement your method of choice on the Expense management parameters page.