Set up a VAT statement

Most companies are required to periodically submit a VAT declaration. The VAT statement is used to specify the basis for calculating the VAT that is payable to tax authorities. The VAT statement is defined based on the following parameters:

Accounts in the Chart of Accounts window

Entries in the VAT Entries window

The advantage of using VAT entries is that you can close these entries by posting the VAT settlement. When you work with VAT entries, you can locate VAT correction entries in previous accounting periods, where the VAT statement is created.

In Business Central, the VAT statement is typically only defined during the initial company setup, and it is set up with a format that is required by tax authorities. Additionally, the VAT statement can be previewed and printed after it is defined.

Before creating a VAT statement, you must create a VAT statement template.

To create a VAT statement template, follow these steps:

Select the search for page icon in the top-right corner of the page, enter VAT Statement Templates, and then select the related link.

Select New.

In the Name field, enter a unique name for the template.

In the Description field, enter a short description for the template.

To assign statements to a template, follow these steps:

On the VAT Statement Templates window, select the relevant template.

On the Navigate tab of the ribbon, select Statement Names.

In the Name field, enter a unique name for the statement.

In the Description field, enter a short description for the statement.

The VAT statement is now defined in the VAT Statements window.

Occasionally, you might have different VAT reporting requirements, such as when you are reporting to different government authorities or to different governments. When different VAT reporting is required, you must create different VAT statements.

If different VAT Statements are created based on the same template, different names are created in the VAT Statement Names window.

When the VAT business posting group and the VAT product posting group transaction posts, the system processes the VAT amounts on the G/L accounts according to how they are defined in the VAT Posting setup. Then, the VAT entries are created.

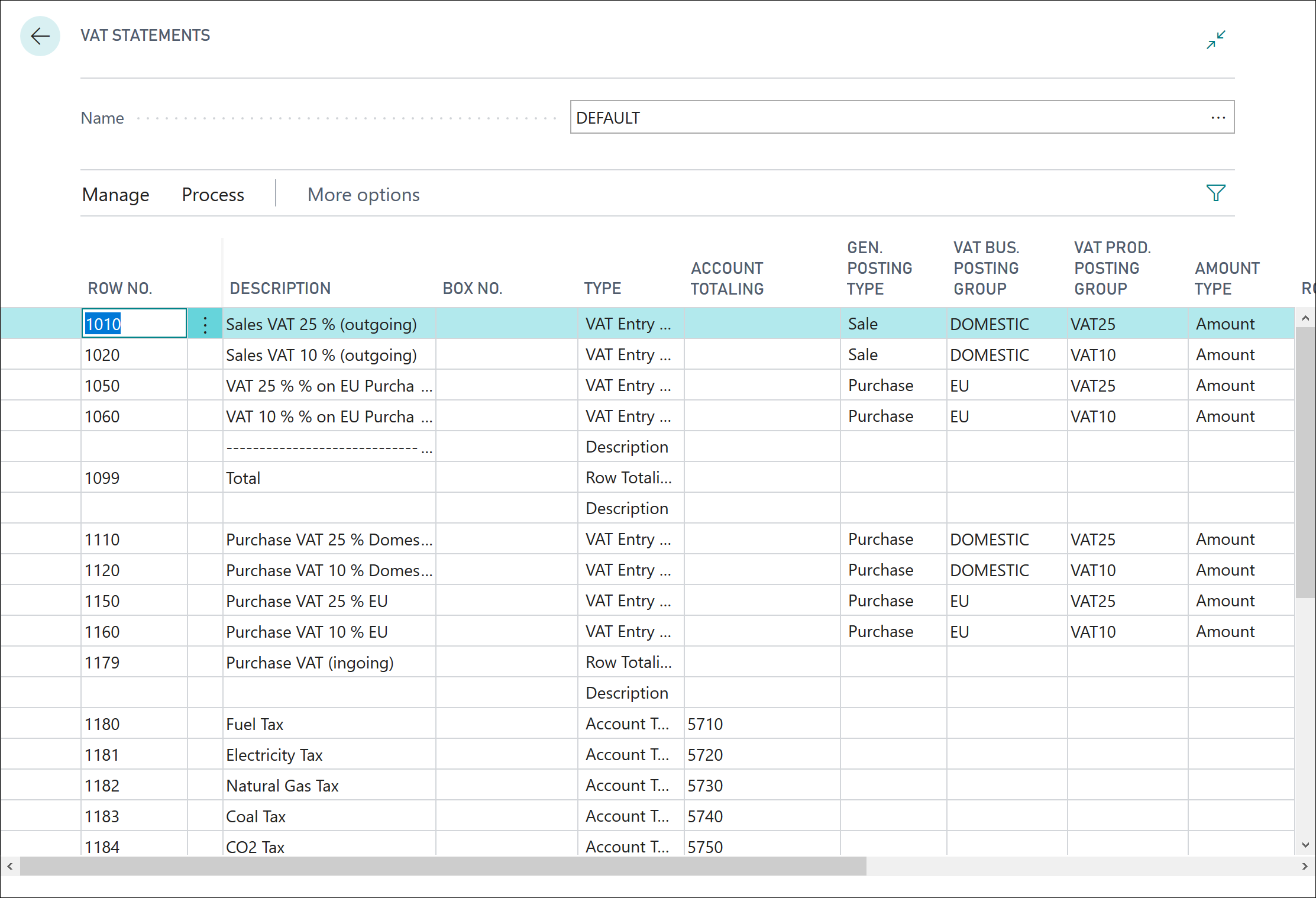

You can use the VAT Statements window to calculate the VAT settlement amount for a specific period. By defining the VAT Statements window, you determine how the statement is calculated and how it appears when it is printed.

Each line in the VAT statement represents a filter on the G/L Entry table or the VAT Entry table.

The following list describes the fields that appear on the VAT Statement:

Name - Accesses the VAT Statement Names window. New statement names can be set up or existing statements can be selected.

Description - Description of the VAT statement line. We recommend that you use the description from the Customs and Tax authorities' VAT statement form.

Type - Determines what the VAT statement line includes. The following options are available:

Account Totaling - Used when VAT is totaled by using G/L Account entries. If this option is selected, the Account Totaling field must be filled in with the G/L account range to total.

VAT Entry Totaling - Used when VAT is totaled by using VAT entries. If this option is selected, you must fill in the following fields:

Gen. Posting Type

VAT Bus. Posting Group

VAT Prod. Posting Group

Amount Type

Row Totaling - Used to define the totaling of other rows in the VAT statement. If this is selected, the Row Totaling field must be filled in with the row range to total.

Description - Used when the row is to contain only text or symbols, for example, a dotted line.

Account Totaling - If Account Totaling is selected in the Type field, specify the G/L account interval or a series of G/L account numbers to be included in the row total.

General Posting Type, VAT Bus. Posting Group, and VAT Prod. Posting Group - If VAT Entry Totaling is selected in the Type field, the appropriate value for the row must be specified in each field. These fields determine the VAT entries that are totaled from the VAT Entry table.

Amount Type - If VAT Entry Totaling is selected in the Type field, specify whether the totaling of VAT entries will consist of VAT amounts or the amounts on which the VAT is based. The options in this field are as follows:

Blank - No amount is totaled.

Amount - The VAT amount in the selected VAT entries is totaled in the row.

Base - The base amount that is used to calculate VAT in the selected VAT entries is totaled in the row.

Unrealized Amount - The unrealized VAT amount in the selected VAT entries is totaled in the row.

Unrealized Base - The unrealized base amount that is used to calculate the unrealized VAT in the selected VAT entries is totaled in the row.

Row Totaling - If this option is selected in the Type field, the row number interval or the series of row numbers that should be included in the row total must be specified.

Calculate With - Determines whether Business Central reverses the sign of VAT entries when it performs calculations. The options in this field are as follows:

Sign - Uses the sign of the VAT entry.

Opposite Sign - Uses the opposite sign of the VAT entry.

Print - If this option is selected, the row is printed on the VAT Statement.

Print With - Determines whether amounts on the VAT statement are printed with their original sign or with the sign reversed. The options are the same as in the Calculate With field.

New Page - If this option is selected, a new page begins immediately after this row when the VAT statement is printed.