Appreciate fixed assets

Appreciation is an increase in the value of a fixed asset (typically land and buildings). It can also be used for a fixed asset that increases in value because of increased demand for the item.

You can use an appreciation entry as a correction to increase an asset's depreciable base when the depreciation of the asset was too high in the past. This value is posted as a gain in the financial statements.

Similar to a write-down transaction, you can post an appreciation entry from the following journals:

Fixed asset G/L journal for depreciation books with G/L integration enabled

Fixed asset journal for depreciation books without G/L integration enabled

Before you can post an appreciation entry to the general ledger, make sure that you set up the appreciation G/L accounts for the posting groups to which you want to post the appreciation.

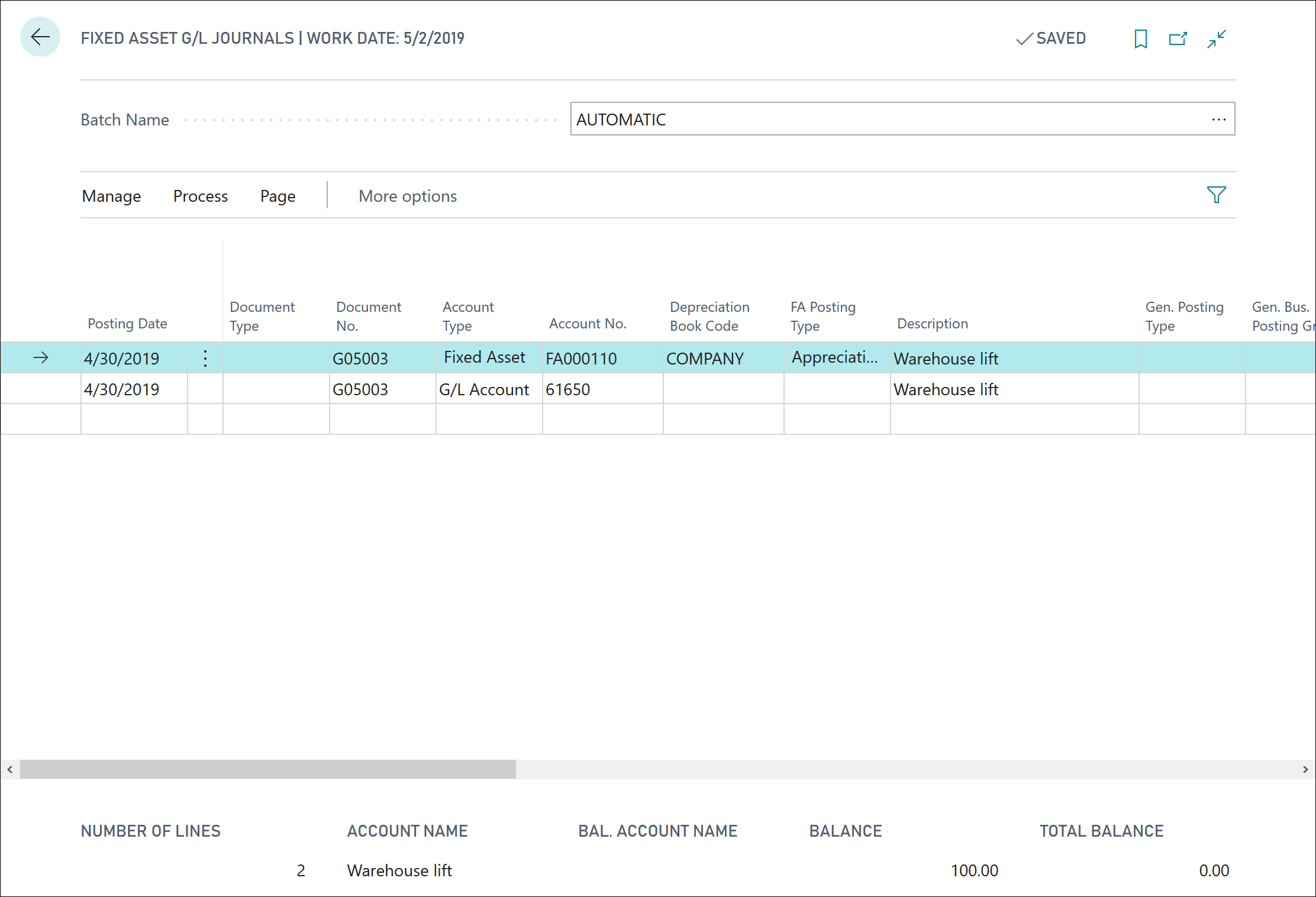

To post an appreciation entry through the fixed asset G/L journal, follow these steps:

Select the Search for page icon in the upper-right corner of the page, enter fixed asset g/l journals, and then select the related link.

On the first journal line, enter the following fields:

Posting Date: example posting date

Document Type: <blank>

Account Type: Fixed Asset

Account No.: example fixed asset number

FA Posting Type: Appreciation

Amount: example amount

Select Process > Insert FA. Bal. Account. Business Central creates a second line with a balancing entry.

Select Process > Post and then post the journal lines.

If the entries don't have to be integrated with the general ledger, you can also post appreciation from the fixed asset journal.