Huomautus

Tämän sivun käyttö edellyttää valtuutusta. Voit yrittää kirjautua sisään tai vaihtaa hakemistoa.

Tämän sivun käyttö edellyttää valtuutusta. Voit yrittää vaihtaa hakemistoa.

Go to Accounts payable > Invoice > Invoice journals.

Create a journal, and then select Lines.

Create a purchase transaction for a composite vendor, and save the record.

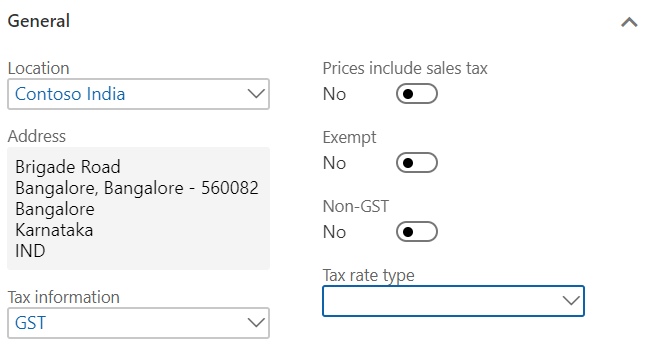

Select Tax information.

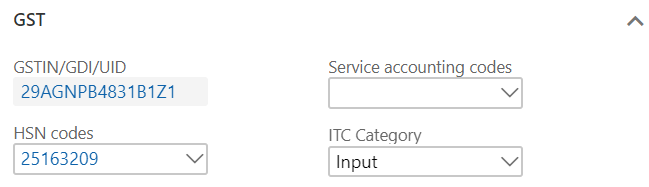

On the GST FastTab, in the HSN codes field, select a value.

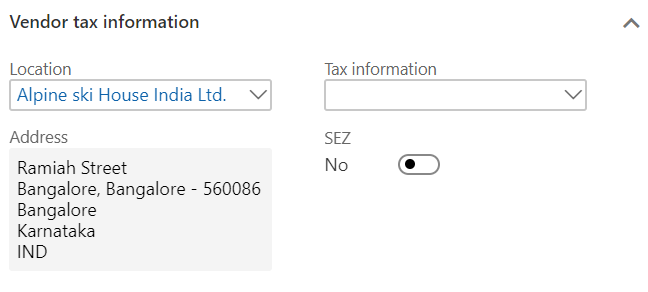

On the Vendor tax information FastTab, verify the information.

Select OK.

Validate the tax details

- Select Tax document.

- Select Close.

- Select Post > Post to post the journal.

- Close the message that you receive.

Validate a voucher

To validate a voucher, select Inquiries > Voucher.