What's new or changed for India GST in 10.0.10 (May 2020)

This article includes a summary of the new features and critical bug fixes released in Dynamics 365 Finance version 10.0.10 for India GST localization.

New features

Import order over delivery

Previously, you could not adjust import order quantities on the Invoice registration page. This meant that customers couldn't accept a delivery of more items than what was originally ordered. With this new feature, you can update the invoice registration quantity to match the over delivery quantity. Complete the following steps to set up accepting over delivery.

- Go to Procurement and sourcing > Setup > Procurement and sourcing parameters.

- On the Deliver tab, set Accept delivery to Yes, and then select Save.

Complete the following steps to update the over delivery quantity.

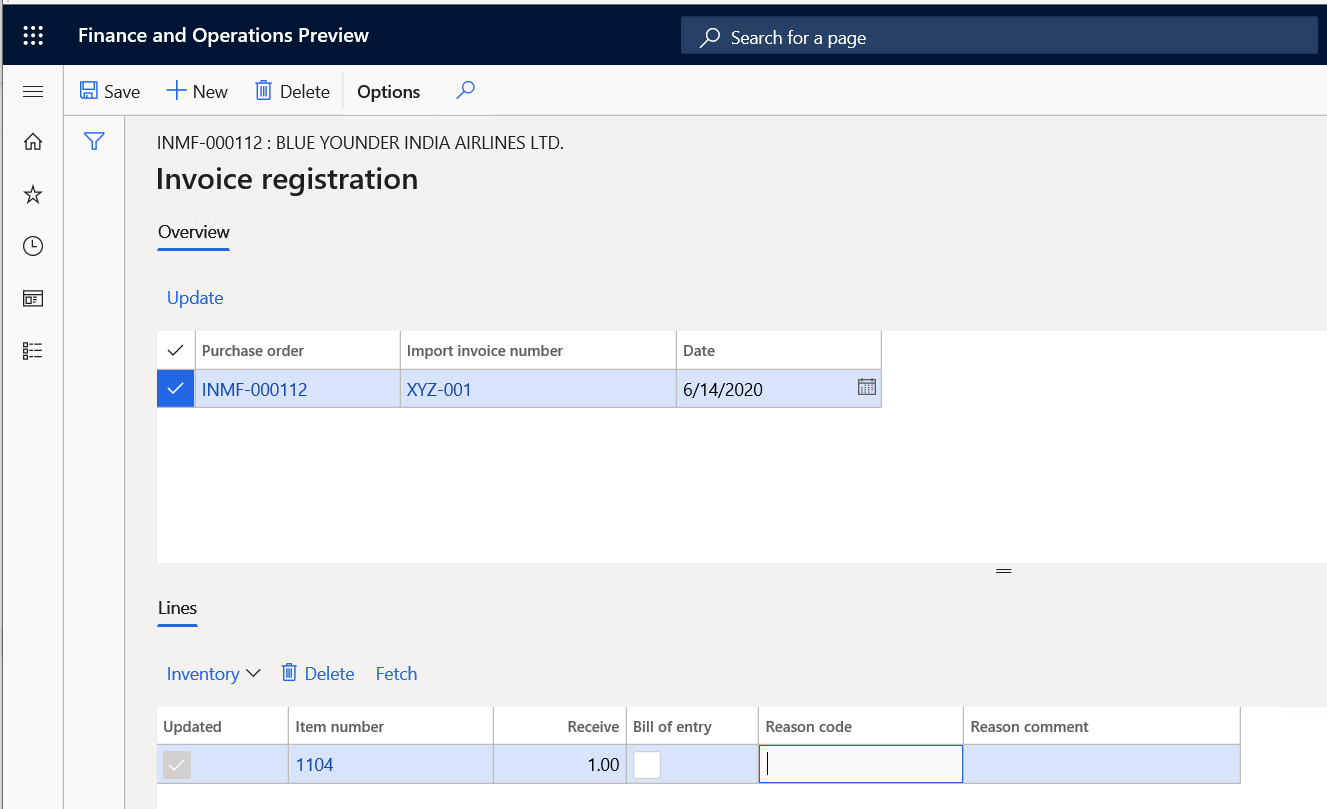

- On the Invoice registration page, in the Overview pane, in the Import invoice number field, select the invoice you want to update.

- In the Lines pane, in the Receive field, update the quantity.

TDS on foreign vendor transactions

TDS on a foreign vendor invoice results in a voucher imbalance error because the transactions on voucher do not balance. As per rule 26 of Income tax act, TDS on a foreign currency transaction is converted on the TTR buying rate instead of normal GAP rate.

TDS on transaction in foreign currency

- Main transaction in GAP rate or manually updated exchange rate

- TDS on transaction as per TDS exchange rate

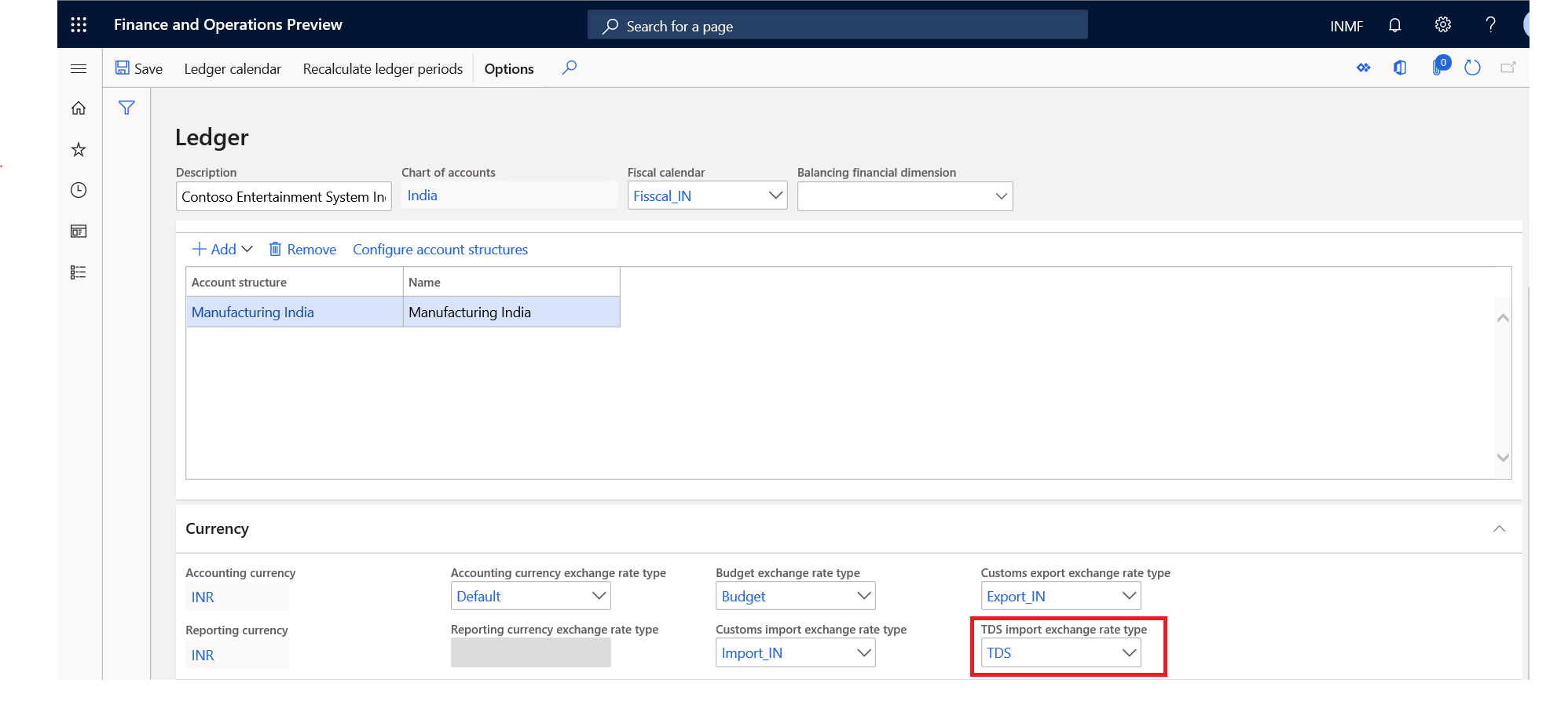

You can set up the TDS exchange rate as TDS and the Accounting currency exchange rate type as Default on the Ledger page.

Accounting entries

| Description | Dr. (US$) | Dr. (INR) | Cr. (US$) | Cr. (INR) |

|---|---|---|---|---|

| Service/lease exp. | 100 | GAP rate | ||

| CGST | 9 | GAP rate | ||

| SGST | 9 | GAP rate | ||

| Vendor | 108 (118-10) | (118@GAP rate - 10@TDS exchange rate) | ||

| TDS payable | 10 | TDS exchange rate | ||

| Total | 118 | 118 |

Critical fixes

Enable date time tracking for the Tax run time lookup condition table.

Transaction type is not showing when the Tax journal is posted.

Unable to generate a recurring free text invoice using the Free text invoice template.

There is a difference between the sales tax payment and the actual transaction posted to tax authorities. This fix ensures that the sales tax settlement amount and the actual amount posted to the tax authority is matched. -Adjusted amount origin field shows an incorrect value. The system is picking the adjusted base amount posted in the initial transaction and that same amount is used for subsequent transactions.

Tax calculation appears incorrect when a discount is applied through the General Journal in multi-line transactions. This happens with the discount ledger account for debit or credit. Two scenarios include:

- Creating a credit note for a customer (GST is calculating negative value for discount).

- Creating an invoice/debit note for a customer (GST is calculating positive value for discount).

Upcoming fixes in 10.0.11

- When a vendor record is created with multiple sub-vendors, the main supplier name and address are displayed in GSTR-2, which is not the information selected on the Tax information tab during posting.

- The Withholding tax journal is created to adjust the withholding tax (TDS) amount and select the voucher transaction for adjustment. An error occurs when the journal is posted and the transaction has been selected and transferred to the General journal.

- Warning message is displayed when you define a charge code with the posting type of Ledger and an item combination on the transaction.

- A system error occurs while running withholding (TDS) tax payment.

- Incorrect tax information is created from sales agreement and pushed to the sales order. Specifically, the Address field displays the address of the legal entity instead of the warehouse address.

- When you post a free text invoice with GST tax and you selected to round off when setting up currencies, the system is not rounding the invoice amount for the customer sub-ledger account, but is rounding off correctly in the customer main ledger for the voucher.

- The TDS section code and invoice number are not appearing in TDS inquiries.

Palaute

Tulossa pian: Vuoden 2024 aikana poistamme asteittain GitHub Issuesin käytöstä sisällön palautemekanismina ja korvaamme sen uudella palautejärjestelmällä. Lisätietoja on täällä: https://aka.ms/ContentUserFeedback.

Lähetä ja näytä palaute kohteelle