Set up and report value-added tax (VAT)

Value-added tax (VAT) was introduced in the United Arab Emirates (UAE) on January 1, 2018. Businesses in the UAE are responsible for carefully documenting their business income, costs, and associated VAT charges.

Registered businesses and traders charge VAT to all their customers at the current rate, and they incur VAT on goods and services that they buy from suppliers. The difference between these sums is reclaimed or paid to the government. Federal Decree Law No. (8) of 2017 on Value Added Tax outlines the tax scope, rate, responsibility for tax, and supply of goods and services in all cases. These cases include supply in special cases, supply of more than one component, supply via agent, supply by government entities, and cases of deemed supply. For more detailed information about VAT regulations, see the Federal Tax Authorities of United Arab Emirates website.

Configure a legal entity for VAT

According to the Requirements Document for Tax Accounting Software that the Federal Tax Authority (FTA) issued, additional information must be set up when you configure a legal entity.

In Microsoft Dynamics 365 Finance, go to Organization administration > Organizations > Legal entities.

On the Value added tax FastTab, set the following fields:

- Taxable person name – Electronic VAT reports require the name of the taxable person. Names in English and Arabic will be filled in on reports. If the user interface (UI) language of the legal entity is set to English, the Known as field on the Global address book page can be used to store names in another language, such as Arabic.

- Tax agency name and Tax agent name – The name and Tax Agency Number (TAN) of the tax agency, and the name and Tax Agent Approval Number (TAAN) of the tax agent, are required when electronic VAT reports are prepared by a contracted tax agent or vendor.

- Declarant name – The electronic VAT report will include information about the person who is preparing a VAT declaration.

- VAT refund required (if any) – Set this option to Yes if a VAT refund is due and the company has requested to receive it.

- Profit margin scheme – Set this option to Yes if the company operates in a special business scheme by using the Profit Margin scheme.

- VAT on behalf of customer – Set this option to Yes if the company operates as an agent that pays import VAT on behalf of another taxable person.

[ ]

]

To prepare your legal entity in Finance for VAT accounting and reporting, use the Sales tax functionality. For more detailed information, see the following articles:

- Setting up sales tax authorities

- Set up a sales tax settlement period

- Ledger posting groups

- Sales tax exempt codes

- Sales tax reporting codes

- Setting up sales tax codes

- Setting up sales tax groups and item sales tax groups

- Set up conditional sales taxes (used for cash accounting)

- Set up tax registration IDs

- Set up reverse charge mechanism

Configure the tax authority

The FTA must be set up as a sales tax authority. After the vendor account is associated with the tax authority, the system creates automatic payments to vendor payables during the settlement process.

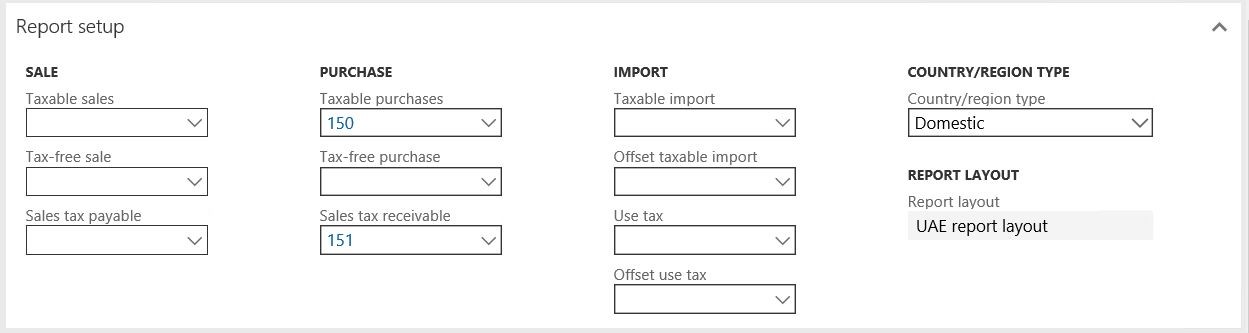

Go to Tax > Sales tax > Sales tax authorities, and set up the address information of your FTA office. Be sure to select UAE report layout in the Report layout field.

[ ]

]

When you've finished, you can associate sales tax settlement periods with the tax authority that you just configured and with sales tax codes.

Configure sales tax codes and sales tax reporting codes

The electronic VAT declaration report is based on the configuration of a specific UAE report layout for sales tax. This layout should be selected as the default layout in the setup of the tax authority.

Set up sales tax codes by following the appropriate procedure for the profile of your company's business in Sales Tax section of the Help documentation.

To run the UAE report layout that includes the electronic VAT declaration, you must first set up the appropriate number of reporting codes that are associated with the amount that is reporting in each VAT declaration.

Go to Tax > Indirect tax > Sales tax > Sales tax reporting codes, and create or update sales tax reporting codes according to the information in the following table.

| Sales tax code | VAT reporting code | Report setup | Description | VAT rate |

|---|---|---|---|---|

| SRSAD | 10 | Sale > Taxable sales | Standard rated supplies in Abu Dhabi | 5 |

| - | 11 | Sale > Tax Payable | Standard rated supplies in Abu Dhabi | 5 |

| SRSAD-A | 15 | Sale > Tax Payable | Standard rated supplies in Abu Dhabi – Adjustment | 5 |

| SRSD | 20 | Sale > Taxable sales | Standard rated supplies in Dubai | 5 |

| - | 21 | Sale > Tax Payable | Standard rated supplies in Dubai | 5 |

| SRSD-A | 25 | Sale > Tax Payable | Standard rated supplies in Dubai – Adjustment | 5 |

| SRSS | 30 | Sale > Taxable sales | Standard rated supplies in Sharjah | 5 |

| - | 31 | Sale > Tax Payable | Standard rated supplies in Sharjah | 5 |

| SRSS-A | 35 | Sale > Tax Payable | Standard rated supplies in Sharjah – Adjustment | 5 |

| SRSA | 40 | Sale > Taxable sales | Standard rated supplies in Ajman | 5 |

| - | 41 | Sale > Tax Payable | Standard rated supplies in Ajman | 5 |

| SRSA-A | 45 | Sale > Tax Payable | Standard rated supplies in Ajman – Adjustment | 5 |

| SRSRQ | 50 | Sale > Taxable sales | Standard rated supplies in Umm Al Quwain | 5 |

| - | 51 | Sale > Tax payable | Standard rated supplies in Umm Al Quwain | 5 |

| SRSRQ-A | 55 | Sale > Tax payable | Standard rated supplies in Umm Al Quwain – Adjustment | - |

| SRSRK | 60 | Sale > Taxable sales | Standard rated supplies in Ras Al Khaimah | 5 |

| - | 61 | Sale > Tax payable | Standard rated supplies in Ras Al Khaimah | 5 |

| SRSRK-A | 65 | Sale > Tax payable | Standard rated supplies in Ras Al Khaimah – Adjustment | 5 |

| SRSF | 70 | Sale > Taxable sales | Standard rated supplies in Fujairah | 5 |

| - | 71 | Sale > Tax Payable | Standard rated supplies in Fujairah | 5 |

| SRSF-A | 75 | Sale > Tax payable | Standard rated supplies in Fujairah – Adjustment | 5 |

| TRPTS | 80 | Sale > Taxable sales | Tax Refunds provided to Tourists | 5 |

| - | 81 | Sale > Tax Payable | Tax Refunds provided to Tourists | 5 |

| TRPTS-A | 85 | Sale > Tax payable | Tax Refunds provided to Tourists – Adjustment | 5 |

| SSRCP-R | 90 | Purchases > Taxable Purchases | Supplies subject to the reverse charge provisions-Sales | 5 |

| - | 91 | Purchases > Taxable Receivable | Supplies subject to the reverse charge provisions-Sales | 5 |

| SSRCP-R-A | 95 | Purchases > Taxable Receivable | Supplies subject to the reverse charge provisions-Sales – Adjustment | 5 |

| ZRS | 100 | Sale > Taxable sales | Zero rated supplies | 0 |

| SOGSRC | 110 | Sale > Taxable sales | Supplies of goods and services to registered customers in other GCC implementing states | 5 |

| ES | 120 | Sale > Taxable sales | Exempt supplies | 0 |

| GITUAE | 170 | Purchases > Taxable Purchases | Goods imported into the UAE | 5 |

| - | 171 | Purchases > Sales tax payable | Goods imported into the UAE | 5 |

| GITUAE-R | 130 | Sale > Taxable sales | Goods imported into the UAE reverse charge | -5 |

| - | 131 | Sale > Tax Payable | Goods imported into the UAE reverse charge | -5 |

| SSRCP-R | 90 | Sale > Taxable sales | Supplies subject to the reverse charge provisions | -5 |

| - | 91 | Sale > Tax Payable | Supplies subject to the reverse charge provisions | -5 |

| SSRCP | 170 | Sale > Taxable sales | Supplies subject to the reverse charge provisions | 5 |

| - | 171 | Sale > Tax Payable | Supplies subject to the reverse charge provisions | 5 |

| SRE-A | 160 | Purchases > Taxable Receivable | Standard rated expenses – Adjustment | 5 |

| SSRCP | 170 | Sale > Taxable sales | Supplies subject to the reverse charge provisions | - |

| - | 171 | Sale > Tax Payable | Supplies subject to the reverse charge provisions | -5 |

| SSRCP-A | 175 | Sale > Tax Payable | Supplies subject to the reverse charge provisions – Adjustment | - |

| GTTKOB | 180 | Sale > Taxable sales | Goods transferred to the Kingdom of Bahrain | - |

| - | 181 | Sale > Tax Payable | Goods transferred to the Kingdom of Bahrain | 5 |

| GTTKOB-A | 185 | Sale > Tax Payable | Goods transferred to the Kingdom of Bahrain – Adjustment | - |

| GTTSOK | 190 | Sale > Taxable sales | Goods transferred to the State of Kuwait | - |

| - | 191 | Sale > Tax Payable | Goods transferred to the State of Kuwait | 5 |

| GTTSOK-A | 195 | Sale > Tax Payable | Goods transferred to the State of Kuwait – Adjustment | - |

| GTTSOO | 200 | Sale > Taxable sales | Goods transferred to the Sultanate of Oman | - |

| - | 201 | Sale > Tax Payable | Goods transferred to the Sultanate of Oman | 5 |

| GTTSOO-A | 205 | Sale > Tax Payable | Goods transferred to the Sultanate of Oman – Adjustment | - |

| GTTSOQ | 210 | Sale > Taxable sales | Goods transferred to the State of Qatar | 5 |

| - | 211 | Sale > Tax Payable | Goods transferred to the State of Qatar | 5 |

| GTTSOQ-A | 215 | Sale > Tax Payable | Goods transferred to the State of Qatar – Adjustment | 5 |

| GTTKOSA | 220 | Sale > Taxable sales | Goods transferred to the Kingdom of Saudi Arabia | - |

| - | 221 | Sale > Tax Payable | Goods transferred to the Kingdom of Saudi Arabia | - |

| GTTKOSA-A | 225 | Sale > Tax Payable | Goods transferred to the Kingdom of Saudi Arabia – Adjustment | 5 |

| RVPKOB | 230 | Purchases > Taxable Purchases | Recoverable VAT paid in the Kingdom of Bahrain | - |

| - | 231 | Purchases > Taxable Receivable | Recoverable VAT paid in the Kingdom of Bahrain | - |

| RVPKOB-A | 235 | Purchases > Taxable Receivable | Recoverable VAT paid in the Kingdom of Bahrain – Adjustment | 5 |

| RVPSOK | 240 | Purchases > Taxable Purchases | Recoverable VAT paid in the State of Kuwait | - |

| - | 241 | Purchases > Taxable Receivable | Recoverable VAT paid in the State of Kuwait | - |

| RVPSOK-A | 245 | Purchases > Taxable Receivable | Recoverable VAT paid in the State of Kuwait – Adjustment | 5 |

| RVPSOO | 250 | Purchases > Taxable Purchases | Recoverable VAT paid in the Sultanate of Oman | - |

| - | 251 | Purchases > Taxable Receivable | Recoverable VAT paid in the Sultanate of Oman | - |

| RVPSOO-A | 255 | Purchases > Taxable Receivable | Recoverable VAT paid in the Sultanate of Oman – Adjustment | 5 |

| RVPSOQ | 260 | Purchases > Taxable Purchases | Recoverable VAT paid in the State of Qatar | - |

| - | 261 | Purchases > Taxable Receivable | Recoverable VAT paid in the State of Qatar | - |

| RVPSOQ-A | 265 | Purchases > Taxable Receivable | Recoverable VAT paid in the State of Qatar – Adjustment | 5 |

| RVPKOSA | 270 | Purchases > Taxable Purchases | Recoverable VAT paid in the Kingdom of Saudi Arabia | - |

| - | 271 | Purchases > Taxable Receivable | Recoverable VAT paid in the Kingdom of Saudi Arabia | - |

| RVPKOSA-A | 275 | Purchases > Taxable Purchases | Recoverable VAT paid in the Kingdom of Saudi Arabia – Adjustment | 5 |

Use the information in the "Report setup" column of the preceding table to configure sales tax codes and associate them with sales tax reporting codes on the Report setup FastTab of each sales tax code that is relevant to your company's business.

[ ]

]

Set up the VAT declaration for UAE

The implementation of VAT reporting for the UAE is based on Electronic reporting (ER) configurations. For more information about the capabilities and concepts of configurable reporting, see Electronic reporting.

To use the VAT declaration in a legal entity that has its primary address in UAE, import the latest version of the following ER configurations:

- VAT declaration model

- VAT declaration model mapping

- VAT declaration Excel (AE)

For more information, see Download ER configurations from the Global repository of Configuration service.

After all the configurations are uploaded, the configuration tree should be present in Electronic reporting > Reporting configurations.

Important

After all the ER configurations from the previous table are imported, set the Default for model mapping option to Yes for the VAT declaration model mapping configuration.

Generate a VAT declaration in Excel

To generate the VAT declaration report for UAE in Excel, use the standard Report sales tax for settlement reporting period procedure (Tax > Declarations > Sales tax > Report sales tax for settlement reporting period), and print the VAT declaration report.

To generate the VAT declaration after a VAT settlement is completed, go to Tax > Sales tax inquiries > Sales tax payments, and select the required sales tax payment. Then, on the Action Pane, select Export VAT file. (For more information, see Create a sales tax payment.)

[ ]

]

In the Export VAT file dialog box, specify the required information.

[ ]

]

You're prompted to save the downloaded Excel file for the VAT declaration to your local computer. Save the file, and verify the content of the reported data.

According to the requirements of the FTA accounting systems, an electronic reporting file can't be edited after it's generated from the system. Any corrections that are required must be made in the system. After you've finished making corrections, generate a new reporting file.

After the reporting file is validated, upload it to the FTA e-Tax portal by using procedures that are specific to your company registration with FTA.