Create a GSTIN master

To make the India localization solution for Goods and Services Tax (GST) in Microsoft Dynamics 365 Finance available, you must complete the following master data setup:

- Define a business vertical.

- Update the state code and union territory.

- Create a Goods and Services Tax Identification Number (GSTIN) master.

- Define GSTINs for the legal entity, warehouse, vendor, or customer masters.

- Define Harmonized System of Nomenclature (HSN) codes and Service Accounting Codes (SACs).

- Create main accounts for the GST posting type.

- Create a tax settlement period.

- Attach the GSTIN to a tax registration group.

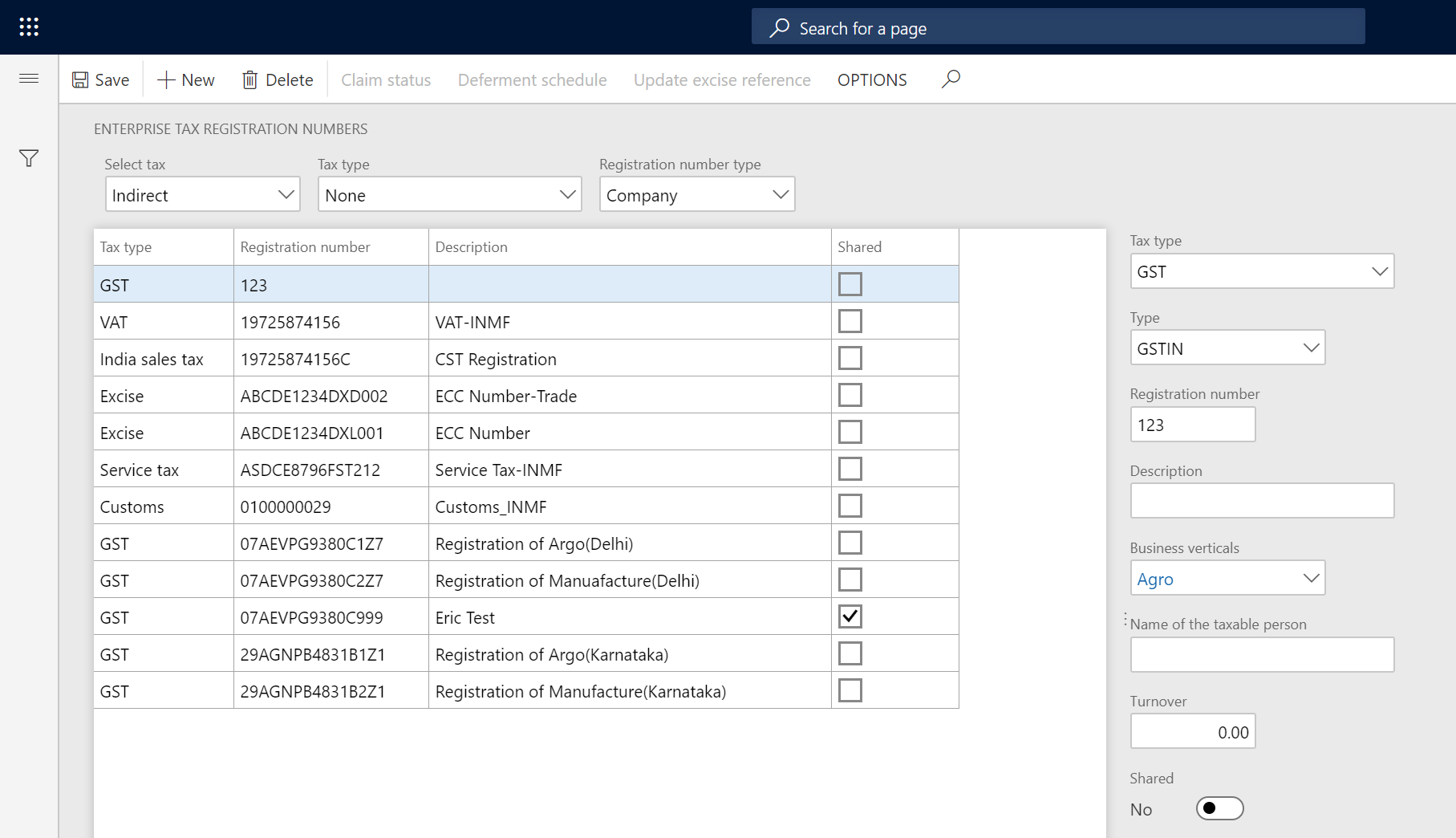

Define company registration numbers for the GST tax type

Go to Tax > Setup > Sales Tax > Enterprise tax registration numbers.

Create a record.

In the Tax type field, select GST.

In the Registration number type field, select Company to create state-wide company registration numbers.

In the Type field, verify that GSTIN, GDI, and UID appear in the list, and then select a value.

In the Registration number field, enter a value.

In the Description field, enter a value.

In the Business vertical field, select a value.

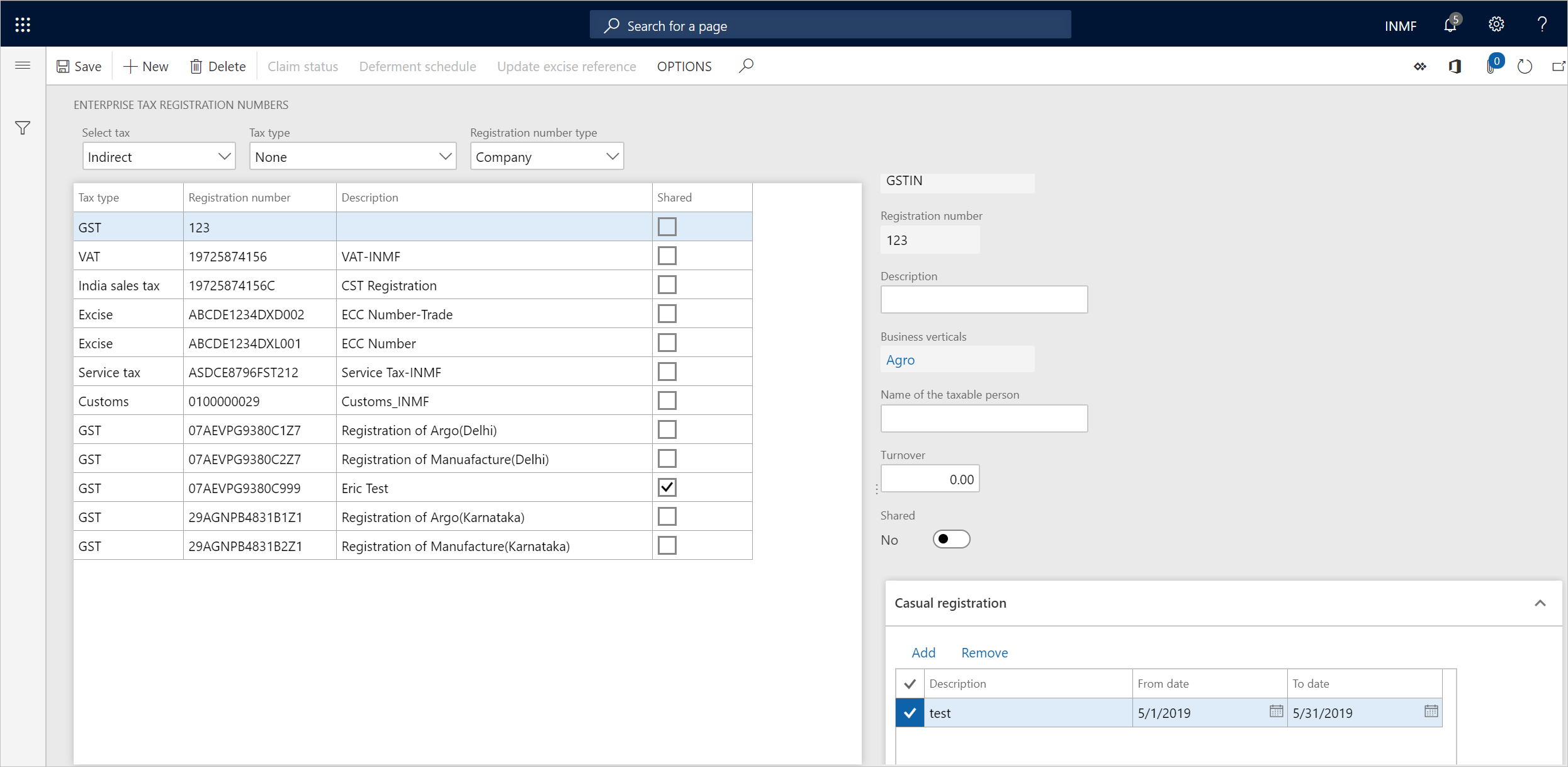

On the Casual registration FastTab, select Add.

In the From date and To date fields, define the valid period for the casual registration number.

In the Description field, enter a value.

On the Number sequences FastTab, define number sequences for the GST invoice and Bill of supply references.

- The GST invoice number sequence will be used when customer sales that have GST transactions are posted.

- The Bill of supply number sequence will be used when customer sales that have non-GST transactions are posted.

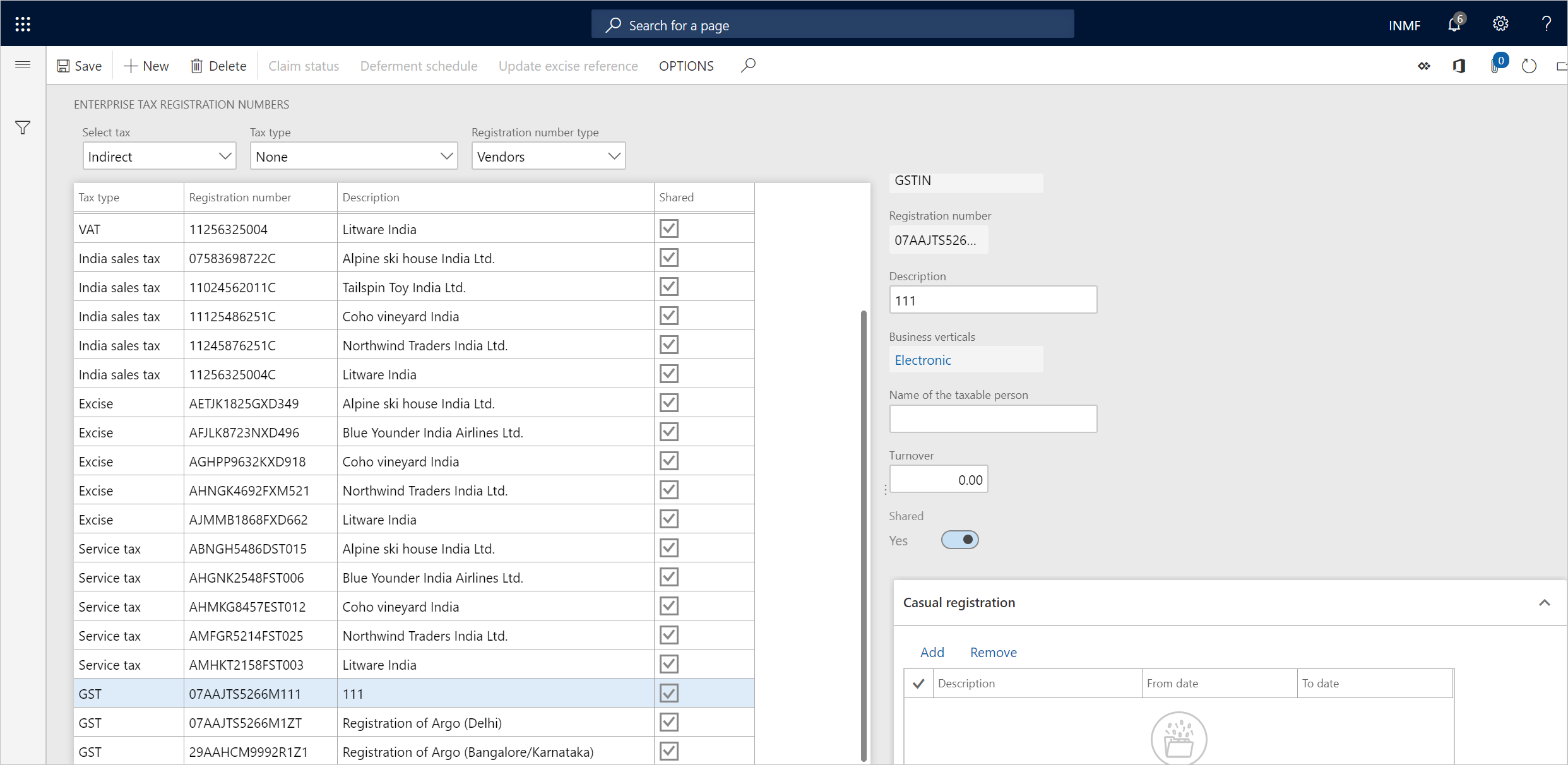

Define vendor registration numbers for the GST tax type

- In the Registration number type field, select Vendors to create state-wide vendor registration numbers.

- Select New to create a record.

- In the Tax type field, select GST.

- In the Registration number field, enter a value.

- In the Description field, enter a value.

- In the Business vertical field, select a value.

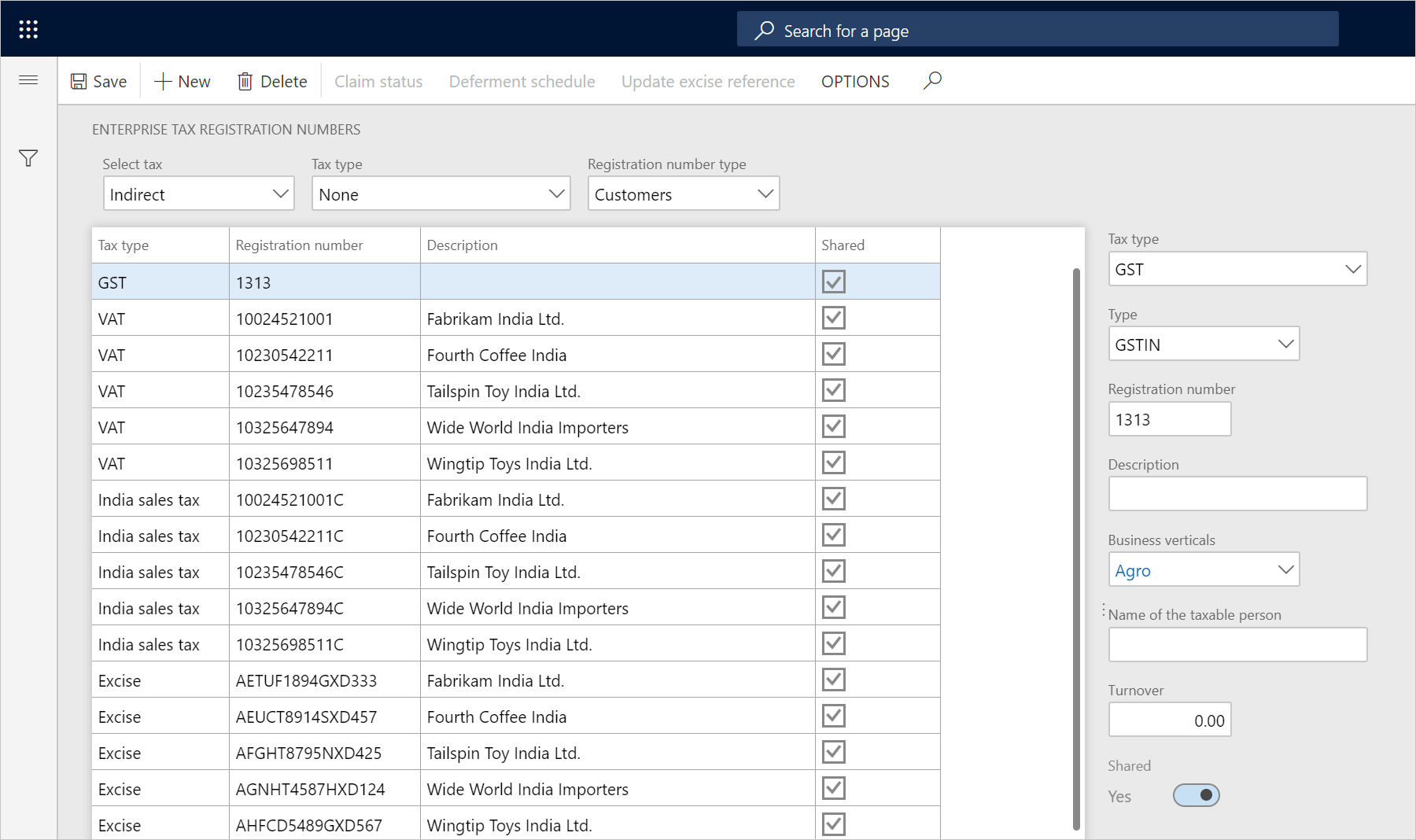

Define customer registration numbers for the GST tax type

- In the Registration number type field, select Customers to create state-wide customer registration numbers.

- Select New to create a record.

- In the Tax type field, select GST.

- In the Registration number field, enter a value.

- In the Description field, enter a value.

- In the Business vertical field, select a value.