Create a credit note against a sales invoice

Create a sales order

Go to Accounts receivable > Sales orders > All sales orders.

Create a sales credit note for a taxable item.

In the Original invoice number field, select a value.

Verify that the Original invoice date field is automatically set based on the original invoice number that you selected, and then save the record.

Select Tax information.

Select the GST tab.

Select the Customer tax information tab.

Select OK.

On the Action Pane, on the Sell tab, in the Tax group, select Tax document.

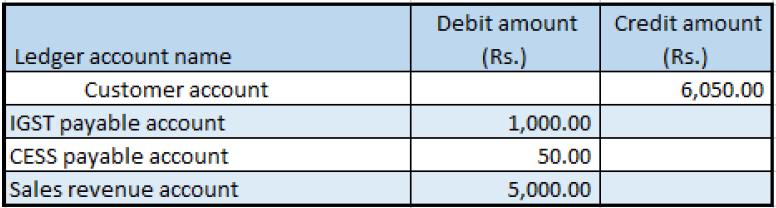

You should see something that resembles the following example:

- Taxable amount: -5,000

- IGST: 20 percent

- CESS: 1 percent

Select Close.

Post the invoice

On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

In the Quantity field, select All.

On the Others tab, verify that the Invoice type field is set to Original.

Note

You can post a revised credit note by selecting Revised in the Invoice type field and then adding a reference to the original credit note.

Select OK, and then select Yes to acknowledge the warning message that you receive.

Validate the voucher

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

- Select Voucher.

Note

You can create a sales credit note through the general ledger and a free text invoice.