Revise advance payments that include tax

- Go to Accounts receivable > Payments > Payment journal.

- Create a record.

- In the Name field, select a value.

- On the Setup tab, select the Amounts include sales tax check box.

- Select Lines.

- Create a customer advance payment journal, and save the record.

- Select Tax information.

- On the GST tab, in the HSN code field, select a value.

- Select the Customer tax information tab.

- Select OK.

- On the General tab, in the Invoice type field, select Revised.

- In the Original transaction ID field, select a value.

- Verify that the Original transaction date field is automatically set, based on the original transaction ID that you selected.

Validate the tax details

Select Tax document.

Example

IGST: 20 percent

Select Close.

Select Post > Post.

Close the message that you receive.

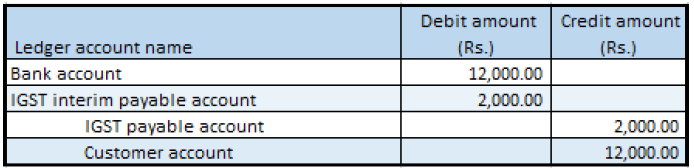

Validate the financial entries

To validate the financial entries, select Inquiries > Voucher. Here is an example.