Rule-based tax settlement

Set up rule-based tax settlement

- Go to Tax > Declarations > Sales tax > Settle and post sales tax.

- Enter the appropriate values, and then select OK.

Validate tax settlement voucher entries

- Go to Tax > Indirect taxes > Sales tax > Sales tax settlement periods.

- Select the settlement period, and then select Sales tax payments.

- Verify that the settlement for the selected registration for the period is successfully posted.

- Select Print report.

GST authority payment

- Go to Accounts payable > Payments > Payment journal.

- Create a journal.

- Select Lines.

- Create a journal voucher for the authority account.

- Select Settle transactions.

- Select the appropriate transaction, and then select Post > Post.

- Select Inquiries > Voucher.

Update challan information

To update challan information, select Functions > Challan information.

Manually adjust a tax settlement

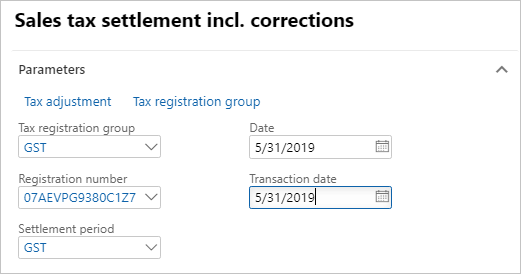

- Go to Tax > Declarations > Sales tax > Settle and post sales tax.

- Enter the appropriate values.

- Select Tax adjustment.

Exclude transactions from the settlement

- Expand the GST node.

- Select the CGST node, and then select Transaction.

- Cancel the selection of the transaction that should be excluded from the settlement.

- Select Update.

Note

When the tax set-off rule is recalculated, the components are adjusted accordingly.

Partial settlement of the transactions

Select the SGST node, and then select Transaction.

Select the transaction, and then update the Recoverable amount to settle field.

Select Update.

Note

- When the tax set-off rule is recalculated, the components are adjusted accordingly.

- Excess recoverable, unsettled transactions, and partially settled transactions should be part of the next settlement period.

Select Close.

Select the Update check box.

Select OK, and close the report.

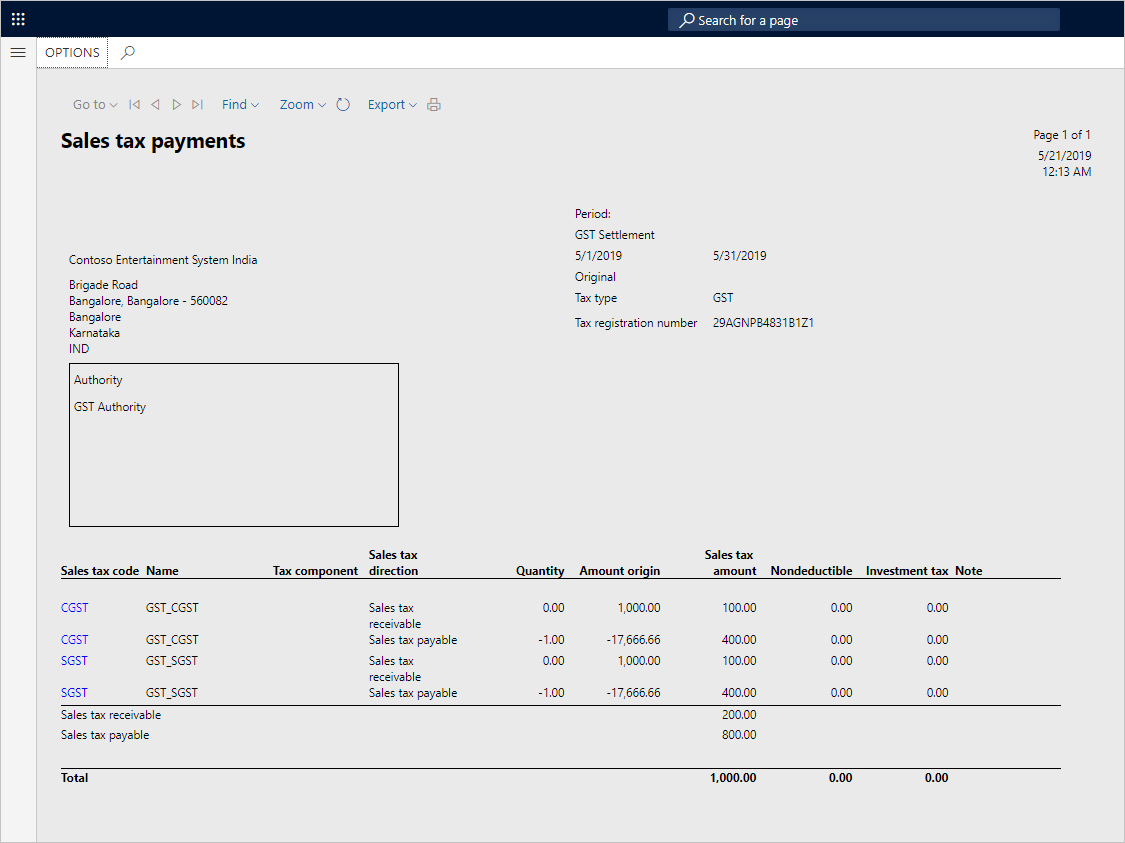

Validate the tax settlement voucher entries

- Go to Tax > Indirect taxes > Sales tax > Sales tax settlement periods.

- Select the settlement period, and then select Sales tax payments.

- Verify that the settlement for the selected registration for the period is successfully posted.