Set up deferrals (Russia)

Deferrals are expense types that are stored differently in general accounting principles and tax accounting principles. To use the deferral functionality, you must complete the following setup:

- Write-off methods

- Value models

- Posting profiles

- Sequence of calculation

- Deferrals groups

- General ledger parameters

- Deferrals

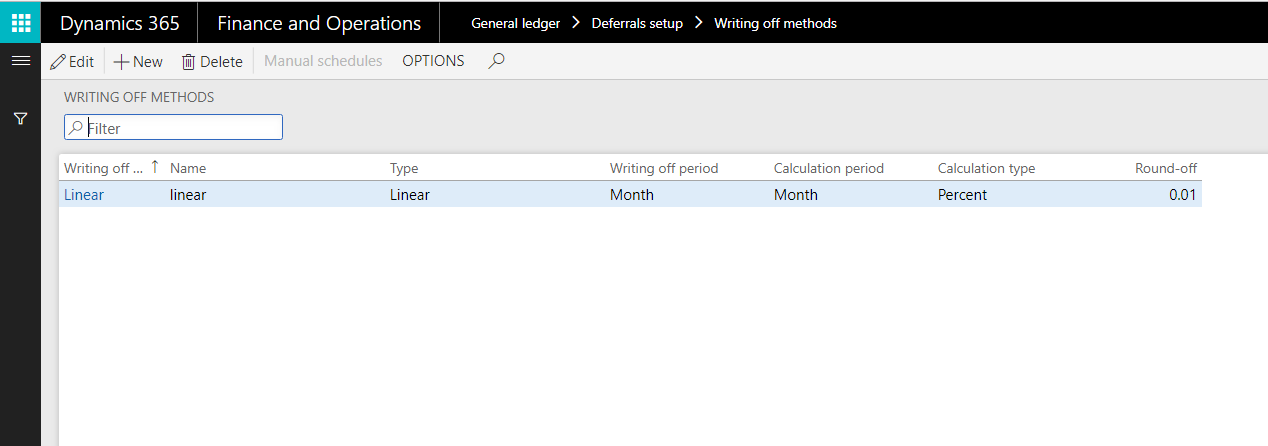

Write-off methods

Follow these steps to create write-off methods for deferred expenses.

Go to General ledger > Deferrals setup > Writing off methods.

On the Action Pane, select New to create a write-off method for deferred expenses.

The following table describes the fields on the Writing off methods page.

Field Description Writing off method Enter the code for the write-off method. Name Enter a description of the write-off method. Type Select the type of write-off: - Linear – Evenly divide the write-off amount across all intervals in the defined period.

- Manual – Manually enter either a percentage of the total or the amount to write off in each period, depending on the calculation type that you select in the Calculation type field. On the Manual schedules page, you can set up a different percentage for each write-off period. On the Writing off sum page, you can set up a different amount for each write-off period.

- Linear with factor – Multiply the calculated result by a calculated factor.

Writing off period Select the write-off period for the deferred expense: - Month

- Quarter

- Half-Yearly

- Years

Calculation period Select the calculation period for the deferred expense: - Month – The deferrals write-off calculation is done proportionately over the number of months in the given period.

- Day – The deferrals write-off calculation is done proportionately over the number of days in the given period. This option lets you calculate the deferred expense write-off amount for an incomplete reporting period, based on the number of calendar days in the period.

- Period – The calculation is done proportionately for the number of periods that are defined in the Writing off period field.

Calculation type If you selected Manual in the Type field, select the calculation type for the manual write-off: - Percent – A percentage of the total is written off in each period. You manually enter this percentage on the Manual schedules page.

- Amount – An amount is written off. On the Writing off sum page, you can set up a separate amount for each write-off period.

Round-off Enter the round-off value for the deferred expense write-off amount. If you selected Manual in the Type field and Amount in the Calculation type field, on the Action Pane, select Manual schedules to create write-off schedules.

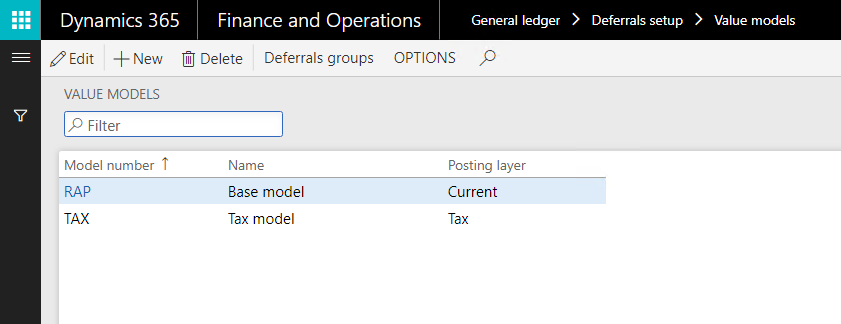

Value models

Go to General ledger > Deferrals setup > Value models.

On the Action Pane, select New to create value models for deferrals accounting.

The following table describes the fields on the Value models page.

Field Description Model number Enter the deferrals model to associate with the deferral. Name Enter a name for value model. Posting layer Select a posting layer for the value model. On the Action Pane, select Deferrals groups to set up deferrals groups that are related to the selected value model.

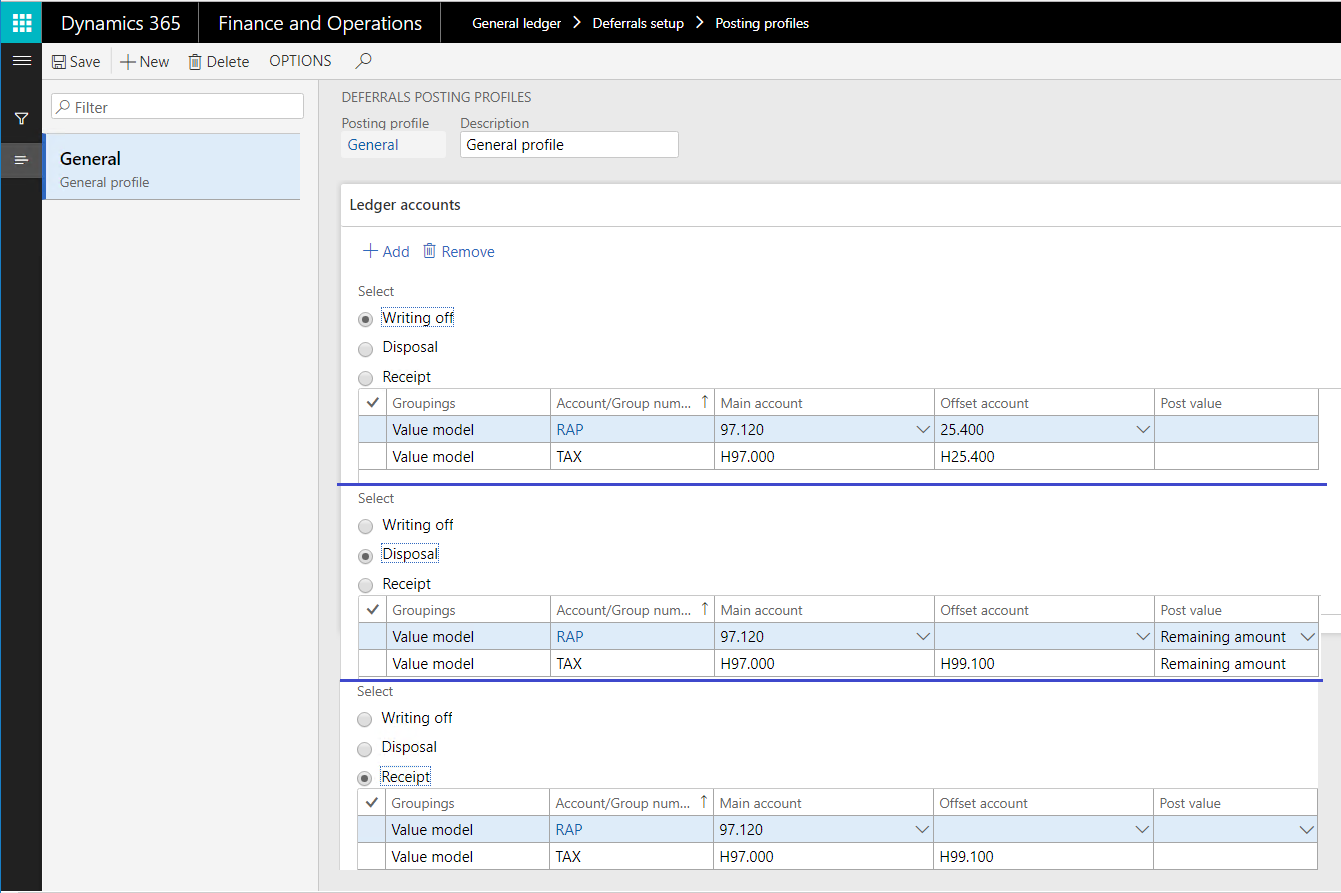

Posting profiles

Go to General ledger > Deferrals setup > Posting profiles.

On the Action Pane, select New to create posting profiles for deferred expenses.

The following table describes the fields on the Deferrals posting profiles page.

Field Description Posting profile Enter a name for the posting profile. Description Enter a description of the posting profile. Writing off Select this option to set up ledger accounts that are used to write off the value of the asset. Disposal Select this option to set up ledger accounts that are used to dispose of the asset. Receipt Select this option to set up ledger accounts that are used to post receipt transactions for deferrals. Groupings Select the grouping method for the deferred expense profile: - All – The Main account and Offset account fields are applicable to all deferrals.

- Value model – The Main account and Offset account fields are applicable to the value model that is selected in the Account/Group number field.

- Group – The Main account and Offset account fields are applicable to the deferrals group that is selected in the Account/Group number field.

- Table – The Main account and Offset account fields are applicable to the deferral that is selected in the Account/Group number field.

Account/Group number Select a value model, deferrals group, or deferral, depending on the value that you selected in the Groupings field. Main account Select the main account for write-off posting or deferred expense disposal. Offset account Select the offset account for write-off posting or deferred expense disposal. Post value Select the value to post: - Remaining amount

- Initial amount

- Amount written off

Note: This field is available only if you select the Disposal option.

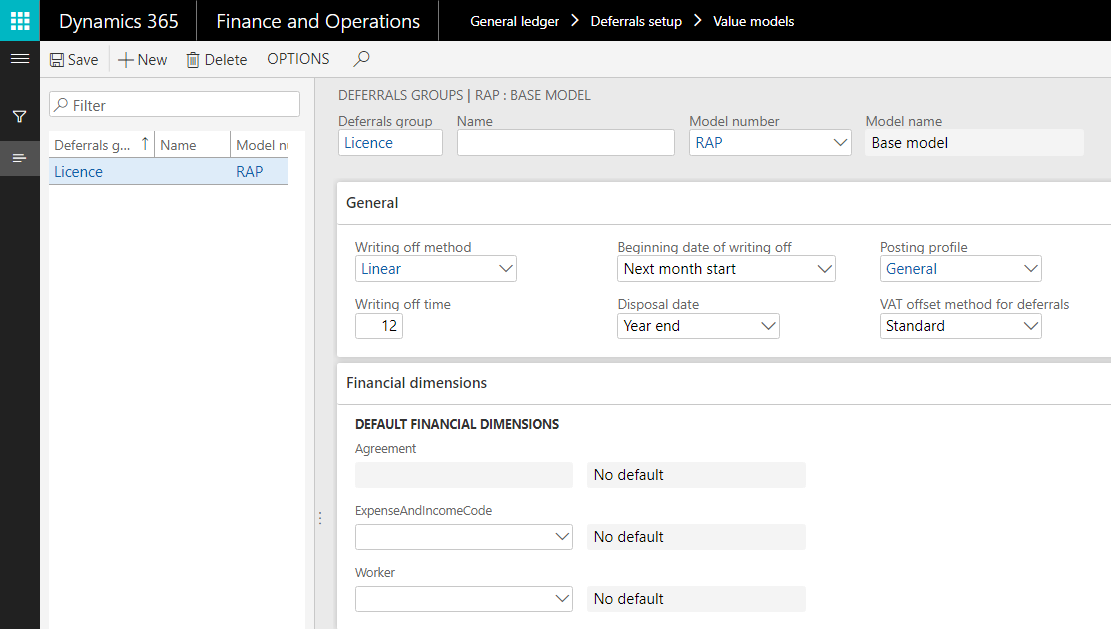

Deferrals groups

Go to General ledger > Deferrals > Deferrals groups.

On the Action Pane, select New to create groups for deferred expenses.

The following table describes the fields on the Deferrals groups page.

Field Description Deferrals group Enter the identification code for the deferrals group. Name Enter the name of the deferrals group. Model number Select the deferral model number. Model name The name of the value model. Writing off method Select the write-off method for the deferrals. Writing off time Enter the write-off period for the deferrals. Beginning date of writing off Select the start date for the write-off. Disposal date Select the date of disposal. Posting profile Select the posting profile for the transactions. VAT offset method for deferrals Select the value-added tax (VAT) deduction method for deferrals: - Standard – Use the standard VAT deduction method to process incoming VAT for factures that are related to deferrals.

- Proportionate – Use the proportional VAT deduction method to process incoming VAT for factures that are related to deferrals.

The deferrals group that is set up has a one-to-one (1:1) relation to value model that is related to the posting profiles setup.

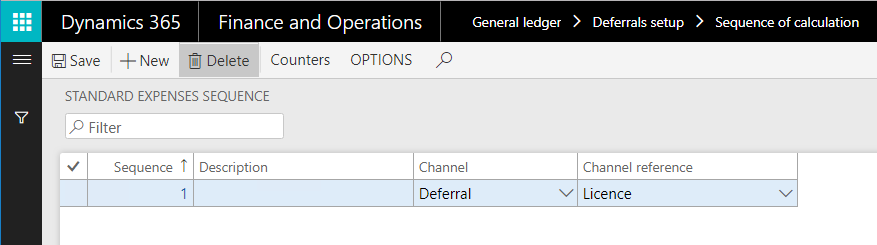

Sequence of calculation

You use the Standard expenses sequence and Counter setup pages to create calculation sequences that are used to create deferrals for vendor invoices.

Note

Before you can set up the calculation sequence and counters, you must set up expense codes on the Expense and income codes page.

Go to General ledger > Deferrals setup > Sequence of calculation.

On the Action Pane, select New to set up revenue or expense calculation sequences.

The following table describes the fields on the Standard expenses sequence page.

Field Description Sequence Enter the sequence number. Description Enter a description of the calculation sequence. Channel Select the deferral output format for the calculation results. Channel reference Select the deferred expense group to record the calculation results to. If necessary, you can create deferrals for the bookkeeping accounting and tax accounting models at the same time by separating them with commas.

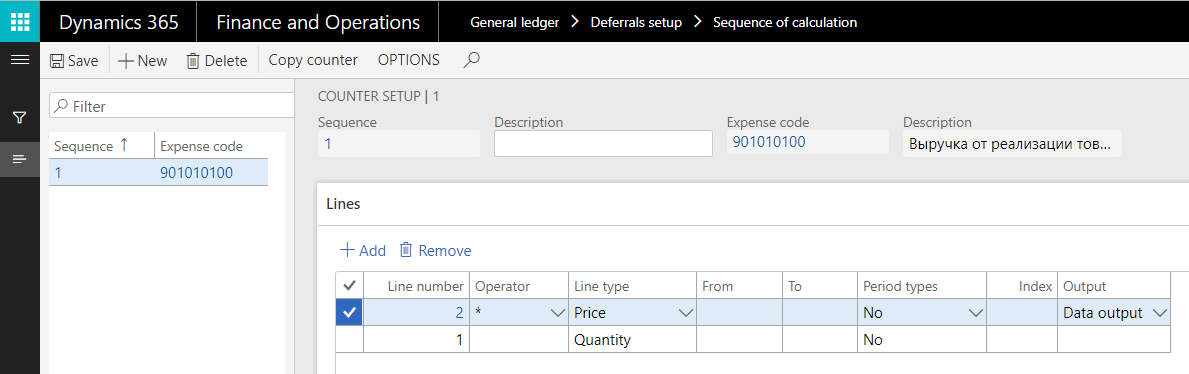

On the Action Pane, select Counters to open the Counter setup page.

On the Action Pane, select New to create counters for the calculation sequence.

The following table describes the fields on the Counter setup page.

Note

You must select an expense code. When you use the periodic process to generate deferrals, the expense code that is specified for a counter is used to generate deferrals for vendor invoices that have the same expense code.

Field Description Sequence Select the calculation sequence code. Description Enter a name for the counter. Expense code Select an expense code. Description The description of the expense code. Line number Enter a unique line number. Operator Select the mathematical or logical operator for the calculation sequence: - + (plus sign) – Add the values in the range that is defined by the From and To fields for the line type that is selected in the Line type field. The resulting value is used for the calculation sequence.

- – (minus sign) – Subtract the values in the range that is defined by the From and To fields for the line type that is selected in the Line type field. The resulting value is used for the calculation sequence.

- * (asterisk) – Multiply the values in the range that is defined by the From and To fields for the line type that is selected in the Line type field. The resulting value is used for the calculation sequence.

- / (slash) – Divide the values in the range that is defined by the From and To fields for the line type that is selected in the Line type field. The resulting value is used for the calculation sequence.

- Min – Use the minimum value in the range that is defined by the From and To fields for the line type that is selected in the Line type field for the calculation sequence.

- Max – Use the maximum value in the range that is defined by the From and To fields for the line type that is selected in the Line type field for the calculation sequence.

Line type Select a line type. From Select the first value in the range of values that is used for the calculation sequence. To Select the last value in the range of values that is used for the calculation sequence. Register field Select the register field to use for the calculation sequence. Note: This field is available only if you selected Register in the Channel field on the Standard expenses sequence page.

Table field Select a table field. Note: This field is available only if you selected Ratio in the Channel field on the Standard expenses sequence page.

Field ID The identification number of the register field. Note Enter an optional comment about the counter setup.

If you want to create a sequence of calculations to generate a deferrals master record, on the last line, in the Output field, specify Data output. The value of this line is the amount of the generated deferral.

The following table provides detailed instructions about how to fill in the From, To, Period types, and Index fields depending on the value in the Line type field.

| Line type | Description |

|---|---|

| Register | Select a register in the From field or a range of registers in the From and To fields. |

| Line type | Select a line number in the From field. |

| Rates | Select a rate code in the From field. |

| Constant | Enter a constant in the From field. |

| Price | The price from the source document that is generated in the transaction will be selected. The From and To fields are not editable. |

| Quantity | The transaction will be selected from the quantity in the generated source document. |

| Expense | Select a range of expense or income codes in the From and To fields to calculate the amount of expenses and income. The range can consist of a single code. |

| Debit activity | Select a range of accounts in the From and To fields on which the amount of debit activity will be calculated. The amount will be calculated for the period defined in the Period types and Index fields. The range can consist of a single account. |

| Credit activity | Select a range of accounts in the From and To fields on which the amount of credit activity will be calculated. The amount will be calculated for the period defined in the Period types and Index fields. The range can consist of a single account. |

| Debit balance | Select a range of accounts in the From and To fields on which the amount of debit balance will be calculated. The amount will be calculated for the period defined in the Period types and Index fields. The range can consist of a single account. |

| Credit balance | Select a range of accounts in the From and To fields on which the amount of credit balance will be calculated. The amount will be calculated for the period defined in the Period types and Index fields. The range can consist of a single account. |

| Deferral write-off | Select a deferrals group in the From field to calculate the planned write-off of deferrals in the current period. |

To copy the counter settings from one calculation sequence to another, on the Action Pane, select Copy counter to open the Copy aisle dialog box.

The following table describes the fields in the Copy aisle dialog box.

Field Description Sequence (in the Copy from section) Select the sequence to copy the counter settings from. Expense code (in the Copy from section) Select the expense code to copy the counter settings from. Sequence (in the Copy to section) Select the sequence to copy the counter settings to. Expense code (in the Copy to section) Select the expense code to copy the counter settings to.

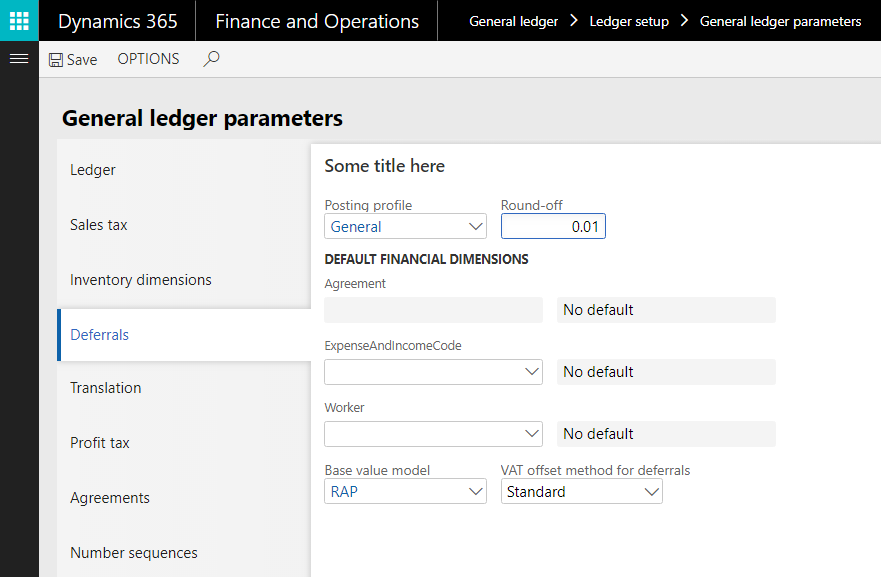

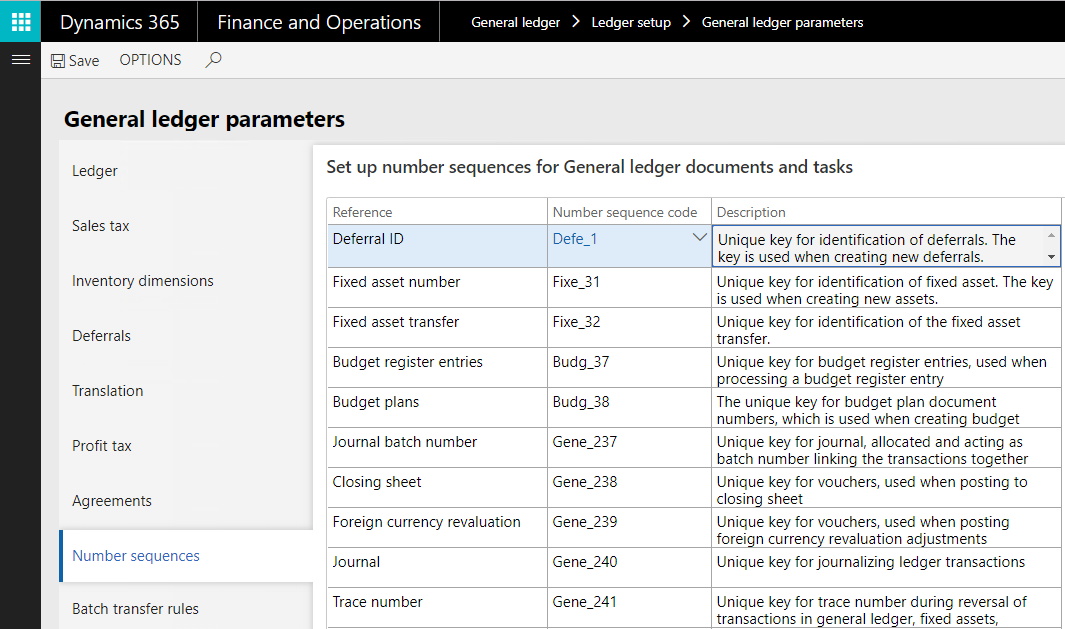

General ledger parameters

Go to General ledger > Ledger setup > General ledger parameters.

On the Deferrals tab, set the fields by using the information in the following table.

Field Description Posting profile Select the posting profile that is used by default. The posting profile is automatically shown on the deferral voucher when it's registered. Round-off Define the default round-off amount for the deferral write-off methods. For example, if you enter 0.01, values are rounded to two decimal places. Expense and income code Select default expense and income codes. Worker Select a default worker. Base value model Select a default value model. VAT offset method for deferrals Select a default VAT offset method for deferrals.

On the Number sequences tab, in the Number sequence code field, select the number sequence code for the Deferral ID reference.

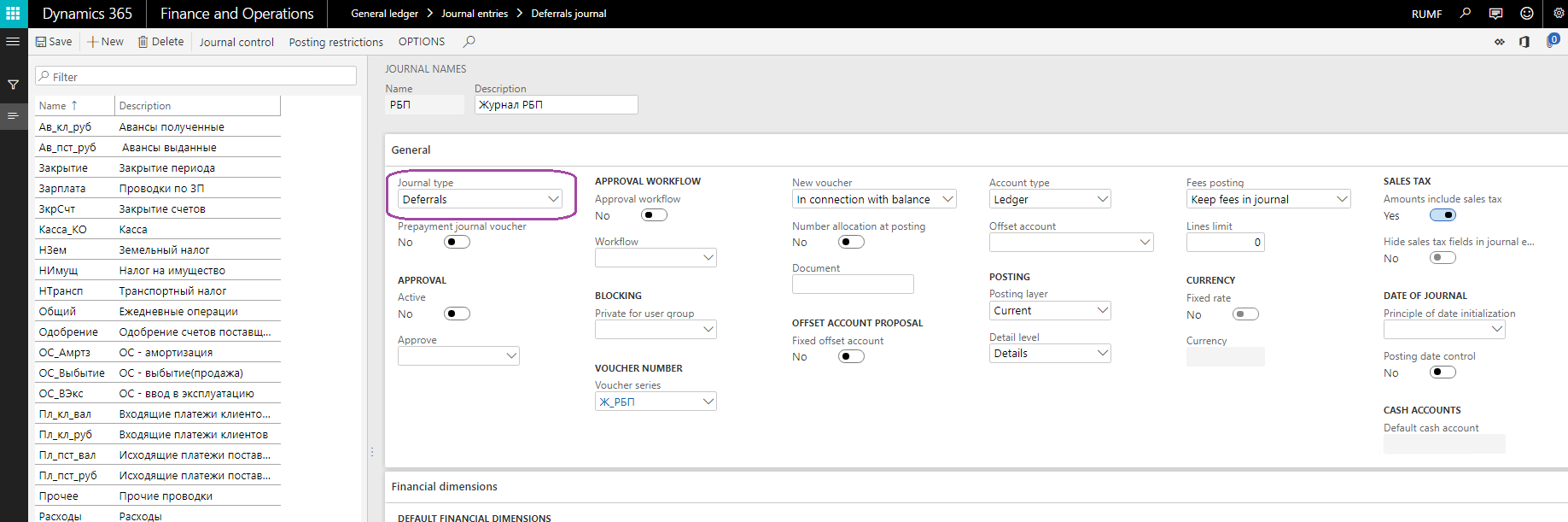

Go to General ledger > Journal setup > Journal names.

On the Action Pane, select New to create a journal of the Deferrals type to work with deferrals.

In the Name field, enter the name of the journal.

In the Description field, enter a short description of the journal.

In the Journal type field, select Deferrals.

In the Voucher series field, select the number sequence that is used for voucher numbering.

Deferrals

Deferrals can be created manually, or they can be automatically generated by using a periodic operation. For more information about how to create a deferral, see Create or generate deferrals (Russia).

Go to General ledger > Deferrals > Deferrals.

You can use the Deferrals page to manually create deferrals, or to review and work with deferrals.

The following table describes the fields on the Deferrals page.

Field Description Deferral ID The identification code for the deferral. This code is updated according to the configured number sequence. Name Enter a name for the deferral. Comment Enter a detailed description of the deferral. Date attached Select the creation date of the deferral. Table name The name of the table that provides the source data that is used to generate the deferral. Reference The identifier of the data table that provides the source data that is used to generate the deferral. Expense code Select the expense code for the deferral. VAT offset method for deferrals Select the VAT deduction method for deferrals: - Standard – Process the incoming VAT for factures that are related to deferrals by using the standard VAT deduction method.

- Proportionate – Process the incoming VAT for factures that are related to deferrals by using the proportional VAT deduction method.

The following table describes the buttons on the Action Pane of the Deferrals page.

Button Description Copy deferral Create a deferral that is identical to the selected deferral. Deferrals models Define deferrals models for the selected deferral. Source View the source that the deferral registration voucher is created from.