Accounts payable home page

This article provides an overview of Accounts payable.

You can enter vendor invoices manually or receive them electronically through a data entity. After the invoices are entered or received, you can review and approve the invoices by using an invoice approval journal or the Vendor invoice page. You can use invoice matching, vendor invoice policies, and workflow to automate the review process so that invoices that meet certain criteria are automatically approved, and the remaining invoices are flagged for review by an authorized user.

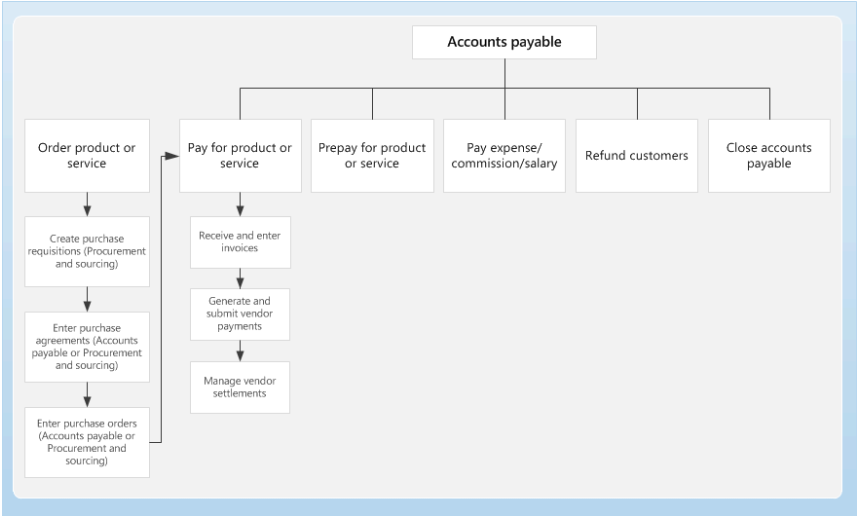

Business processes

Set up Accounts payable

In Accounts payable, you can set up the following:

- vendor groups

- vendors

- posting profiles

- various payment options

- parameters regarding vendors, charges, deliveries and destinations, and promissory notes.

Configure Accounts payable overview.

Accounting distributions and subledger journal entries for vendor invoices.

Foreign currency revaluation for Accounts payable and Accounts receivable.

Configure vendor invoices

Use Accounts payable to track invoices and outgoing expenditures to vendors.

Accounts payable invoice matching overview.

Set up Accounts payable invoice matching validation.

Invoice matching and intercompany purchase orders.

Resolve discrepancies during invoice totals matching overview.

Default offset accounts for vendor invoice journals and invoice approval journals.

Vendor collaboration invoicing workspace.

Configure vendor payments

Assign a system-defined payment type, such as check, electronic payment, or promissory note, to any user-defined method of payment. Payment types are optional, but they're useful when you validate electronic payments and want to be able to quickly determine which payment type a payment uses.

Set up and generate positive pay files.

Create vendor payments by using a payment proposal.

Vendor payments for a partial amount.

Take a discount that is more than the calculated discount for a vendor payment.

Take a cash discount outside the cash discount period.

Electronic reporting sample vendor checks.

Prepayment invoices vs. prepayments.

Centralized payments for Accounts payable.

Settlements

The following topics provide information about settlements. Settlement is the process of settling payments with invoices.

Settle a partial vendor payment that has discounts on vendor credit notes

Settle a partial vendor payment that has multiple discount periods

Settle a partial vendor payment and the final payment in full before the discount date

Single voucher with multiple customer or vendor records

Additional resources

What's new and in development

Go to the Microsoft Dynamics 365 release plans to see what new features are planned.

Blogs

You can find opinions, news, and other information about Accounts payable and other solutions on the Microsoft Dynamics 365 blogand the Microsoft Dynamics 365 Finance - Financials blog.

The Microsoft Dynamics Operations Partner Community Blog gives Microsoft Dynamics Partners a single resource where they can learn what is new and trending in Dynamics 365.

Community blogs

How to manage payables in Dynamics 365 Finance

Task guides

Additional help is available as task guides inside the application. To access task guides, click the Help button on any page.

Videos

Check out the how-to videos that are now available on the Microsoft Dynamics 365 YouTube Channel.