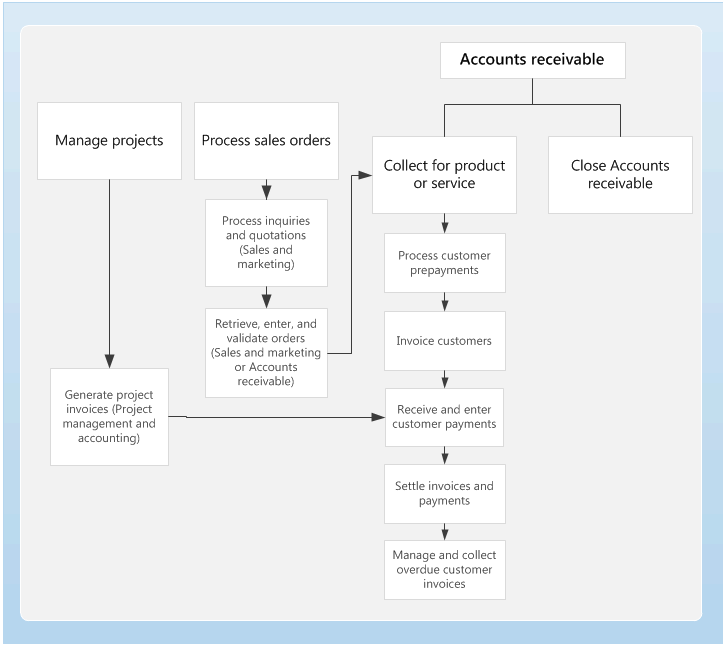

Accounts receivable home page

Use Accounts receivable to track customer invoices and incoming payments.

You can create customer invoices that are based on sales orders or packing slips. You can also enter free text invoices that aren't related to sales orders. You can receive payments by using several different payment types. These include bills of exchange, cash, checks, credit cards, and electronic payments. If your organization includes multiple legal entities, you can use centralized payments to record payments in a single legal entity on behalf of the other legal entities.

Business processes

Set up Accounts receivable

Use Accounts receivable to track customer invoices and payments that you receive from customers. You can set up customer groups, customers, posting profiles, interest notes, collection letters, commissions, and parameters regarding customers, charges, deliveries and destinations, bills of exchange, and other types of Accounts receivable information.

- Accounting distributions and subledger journal entries for free text invoices

- Customer posting profiles

- Credit card setup, authorization, and capture

- Create a customer invoice

- Set up and process recurring invoices

- Correct a free text invoice

- Set up bills of exchange

- Set up interest rates for an interest code

- Waive, reinstate, or reverse interest fees

- SEPA direct debit overview

- Set up SEPA direct debit mandate

- Close Accounts receivable

Subscription billing

Subscription billing enables organizations to manage subscription revenue opportunities and recurring billing through billing schedules.

Set up credit and collections

Accounts receivable collections information is managed in one central view, the Collections page. Credit and collections managers can use this central view to manage collections. Collections agents can begin the collections process from customer lists that are generated by using predefined collection criteria, or from the Customers page.

- Credit and collections in Accounts receivable

- Configure Accounts receivables and Credit and collections

- Set up Credit and collections

Set up payments and settlements

Accept different types of payments from customers, such as bills of exchange, cash, checks, credit cards, and electronic payments.

- Use a customer payment to settle multiple invoices that span multiple discount periods

- Centralized payments for Accounts receivable

- Settle a partial customer payment and the final payment in full before the discount date

- Settle a partial customer payment before the discount date with a final payment after the discount date

- Settle a partial customer payment that has discounts on credit notes

- Settle a partial customer payment that has multiple discount periods

- Reimburse customers

- Customer payments for a partial amount

Additional resources

What's new and in development

Go to the Microsoft Dynamics 365 Roadmap to see what new features are planned.

Blogs

You can find opinions, news, and other information about Accounts receivable and other solutions on the Microsoft Dynamics 365 blog and the Microsoft Dynamics 365 finance and operations - Financials blog.

The Microsoft Dynamics Operations Partner Community Blog gives Microsoft Dynamics Partners a single resource where they can learn what is new and trending in Dynamics 365.

Task guides

Additional help is available as task guides inside the application. To access task guides, click the Help button on any page.

Videos

Check out the how-to videos that are now available on the Microsoft Dynamics 365 YouTube Channel.