Polish Intrastat

The Intrastat page is used to generate and report information about trade among European Union (EU) countries/regions. The Polish Intrastat declaration contains information about the trade of goods for reporting.

The following fields are included in the Polish Intrastat declaration. All of the fields are included on arrivals and dispatches except for RodzajTransportu (the transport mode) and KrajPochodzenia (the country or region of origin) which aren't included on dispatches, and IdKontrahenta (the customer's foreign VAT number) which isn't included on arrivals.

| Field name | Description |

|---|---|

| Deklaracja Data | The date when the document is created. |

| Miesiac | The reference month of the declaration. |

| Rok | The reference year of the declaration. |

| Numer | The declaration number in the reference period. |

| Wersja | The version number of the declaration. |

| NrWlasny | The declaration identifier. The value is automatically generated. |

| Typ | The report direction. |

| Rodzaj | The type of declaration. The value indicates whether the report is the original declaration or a correction declaration. |

| UC | The unit code that the Intrastat declaration is addressed to. The value is specified in the Tax exempt number field in the Sales tax section on the Agent tab of the Foreign trade parameters page. |

| Nazwa | The name of the company. |

| Miejscowosc, UlicaNumer, KodPocztowy | The full address of the legal entity. |

| Nip | The Polish tax identification number (value-added tax [VAT] ID). |

| Regon | The Polish statistical identification number (enterprise number). |

| LacznaWartoscFaktur | The sum of invoice values. |

| LacznaWartoscStatystyczna | The sum of statistical values. |

| LacznaLiczbaPozycji | The total number of goods items. |

| PozId | The consecutive number of a given goods item. |

| OpisTowaru | The trade name of the commodity. |

| KrajPochodzeniaWysylki | The International Organization for Standardization (ISO) code for the country or region of the counterparty. |

| WarunkiDostawy | The Intrastat code for the delivery terms. |

| RodzajTransakcji | The code that indicates the nature of the transaction. Polish companies use two-digit transaction codes. |

| KodTowarowy | The eight-digit commodity code according to the Combined Nomenclature. |

| RodzajTransportu | The Intrastat code for the transport mode. |

| KrajPochodzenia | The ISO code for the country or region where the commodities were produced or manufactured. |

| MasaNetto | The net mass in full kilograms. |

| IloscUzupelniajacaJm | The quantity in the supplementary unit of measure, in whole numbers. |

| WartoscFaktury | The invoice value of all transactions that are covered by one item. |

| WartoscStatystyczna | The statistical value. |

| Wypelniajacy: NazwiskoImie, Telefon, Faks, Email | The first and last names, telephone number, fax number, and email address of the person who submits the declaration. |

| IdKontrahenta | The customer's foreign VAT number in an EU member state. |

Set up Intrastat

From the Global repository, import the latest version of the following Electronic reporting (ER) configurations:

- Intrastat model

- Intrastat report

- Intrastat (PL)

For more information, see Download ER configurations from the Global repository of Configuration service.

Set up a VAT ID and an enterprise number for your company

Create registration types for company codes

You must create two registration types for company codes: one for the VAT ID (NIP code) and one for the enterprise number (Regon code).

- Go to Organization administration > Global address book > Registration types > Registration types.

- On the Action Pane, select New to create a registration type for the VAT ID.

- In the Enter registration type details dialog box, in the Name field, enter a name for the new registration type. For example, enter NIP.

- In the Country/region field, select POL.

- Select Create.

- On the Action Pane, select New to create a registration type for the enterprise number.

- In the Enter registration type details dialog box, in the Name field, enter a name for the new registration type. For example, enter Regon.

- In the Country/region field, select POL.

- Select Create.

Match the registration types with registration categories

Go to Organization administration > Global address book > Registration types > Registration categories.

On the Action Pane, select New to create a link between each registration type that you created and a registration category.

- For the registration type for the VAT ID (NIP code), select the VAT ID registration category.

- For the registration type for the enterprise number (Regon code), select the Enterprise ID (COID) registration category.

Set up a VAT ID and an enterprise number for your company

- Go to Organization administration > Organizations > Legal entities.

- In the grid, select your company.

- On the Action Pane, select Registration IDs.

- On the Registration ID FastTab, select Add.

- In the Registration type field, select one of the registration types that you created earlier.

- Enter your company's VAT ID (NIP code) or enterprise number (Regon code), depending on the registration type that you selected in the previous step.

- Repeat steps 4 through 6 for the other registration type that you created earlier.

Set up a company address

- Go to Organization administration > Organizations > Legal entities.

- In the grid, select your company.

- On the Addresses tab, select Edit.

- In the Edit address dialog box, in the ZIP/postal code field, select your company's ZIP/postal code.

- In the Street field, enter your address.

- In the City field, select your city.

Set up foreign trade parameters

- Go to Tax > Setup > Foreign trade parameters.

- On the Intrastat tab, on the Electronic reporting FastTab, in the File format mapping field, select Intrastat (PL).

- In the Report format mapping field, select Intrastat report.

- On the Commodity code hierarchy FastTab, in the Category hierarchy field, select Intrastat. The Category hierarchy type of the Category hierarchy you select in the Category hierarchy field must be set to the Commodity code hierarchy on the Category hierarchy role associations page. (Modules > Product information management > Setup > Categories and attributes > Category hierarchy)

- In the Transaction code field, select the transaction code for property transfers. You use this code for transactions that produce actual or planned transfers of property against compensation (financial or otherwise). You also use it for corrections. Companies in Poland use two-digit transaction codes.

- In the Credit note field, select the transaction code for the return of goods.

- On the Country/region properties tab, in the Country/region field, list all the countries or regions that your company does business with. For each country that is part of the EU, select EU in the Country/region type field, so that the country appears on your Intrastat report. For Poland, select Domestic in the Country/region type field.

- On the Agent tab, on the Agent FastTab, in the Sales tax section, in the Tax exempt number field, enter 420000 to indicate the unit code that the Intrastat declaration is addressed to.

- On the Contact tab, enter the name, telephone number, fax number, and email address of the person who is submitting the declaration.

- On the Number sequences tab, in the Number sequence code field for the XML file number reference, specify a non-continuous number sequence that has a maximum of nine characters. This field is used to automatically generate a value for the Declaration identifier field on the Intrastat report.

Set up product parameters for the Intrastat declaration

- Go to Product information management > Products > Released products.

- In the grid, select a product.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select the commodity code. The name of the commodity will be printed in the Description of commodities field on the Intrastat report.

- In the Origin section, in the Country/region field, select the product's country or region of origin.

- On the Manage inventory FastTab, in the Net weight field, enter the product's weight in kilograms.

Set up compression of Intrastat

Go to Tax > Setup > Foreign trade > Compression of Intrastat, and select the fields that should be compared when Intrastat information is summarized. For Polish Intrastat, select the following fields:

- Commodity

- Transaction code

- Country/region of origin

- Transport

- Delivery terms

- Country/region of sender

- Country/region

- Correction

- Tax exempt number

- Direction

- Invoice

Set up the transport method and delivery terms

Set up transport codes.

- Go to Tax > Setup > Foreign trade > Transport method.

- On the Action Pane, select New.

- In the Transport field, enter a unique code. Polish companies use one-digit transport codes.

Set up mode of delivery Intrastat codes.

- Go to Procurement and sourcing > Setup > Distribution > Terms of delivery.

- In the grid, select a set of delivery terms.

- On the General FastTab, in the Intrastat code field, enter the unique code.

Intrastat transfer

On the Intrastat page, on the Action Pane, you can select Transfer to automatically transfer the information about intracommunity trade from your sales orders, free text invoices, purchase orders, vendor invoices, vendor product receipts, project invoices, and transfer orders. Only documents that have an EU country as the country or region of destination or consignment will be transferred.

You can also manually enter transactions by selecting New on the Action Pane.

Generate an Intrastat report

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, set the following fields.

Field Description From date Select the start date for the report. Generate file Set this option to Yes to generate a .xml file for your Intrastat report. File name Enter the name of the .xml file. Generate report Set this option to Yes to generate an .xlsx file for your Intrastat report. Report file name Enter the name of the .xlsx file. Direction Select Arrivals for a report about intracommunity arrivals.

Select Dispatches for a report about intracommunity dispatches.Declaration identifier The document ID is automatically generated and can be updated. Declaration type Select Declaration for an original declaration.

Select Declaration correction – replacement for a correction declaration that is intended to fully replace an existing, previously submitted original or correction declaration.City of document creation Enter the value that should be printed in the Miejscowosc field in the Intrastat declaration. Date of document creation Enter the value that should be printed in the Deklaracja Data field in the Intrastat declaration. Document No Enter the value that should be printed in the Numer field in the Intrastat declaration. Document version Enter the value that should be printed in the Wersja field in the Intrastat declaration. Select OK, and review the generated reports.

Example

This example shows how to post arrivals and dispatches for Intrastat by using the DEMF legal entity.

Preliminary setup

Import the latest version of the following ER configurations:

- Intrastat model

- Intrastat report

- Intrastat (PL)

Set up a company address

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the City tab, select New.

- In the Country/region field, select POL.

- In the City field, enter Warsaw.

- On the ZIP/postal code tab, select New.

- In the Country/region field, select POL.

- In the City field, select Warsaw.

- In the ZIP/postal code field, enter 00-844.

- Go to Organization administration > Organization > Legal entities, and select the DEMF legal entity.

- On the Addresses FastTab, select Edit.

- In the Country/region field, select POL.

- In the ZIP/postal code field, select 31-111.

- In the Street field, enter Statystyczna 22/1.

- In the City field, select Warsaw.

- Select OK.

Set up a VAT ID and an enterprise number code for your company

Create registration types for company codes

- Go to Organization administration > Global address book > Registration types > Registration types.

- On the Action Pane, select New to create a registration type for the VAT ID (NIP code).

- In the Enter registration type details dialog box, in the Name field, enter NIP.

- In the Country/region field, select POL.

- Select Create.

- On the Action Pane, select New to create a registration type for the enterprise number (Regon code).

- In the Enter registration type details dialog box, in the Name field, enter Regon.

- In the Country/region field, select POL.

- Select Create.

Match the registration types with registration categories

Go to Organization administration > Global address book > Registration types > Registration categories.

On the Action Pane, select New to create a link between each registration type that you created and a registration category.

- For the NIP registration type, select the VAT ID registration category.

- For the Regon registration type, select the Enterprise ID (COID) registration category.

Set up a VAT ID and an enterprise number for your company

- Go to Organization administration > Organizations > Legal entities.

- In the grid, select DEMF.

- On the Action Pane, select Registration IDs.

- On the Registration ID FastTab, select Add.

- In the Registration type field, select NIP.

- In the Registration number field, enter 1234567890.

- Select Add.

- In the Registration type field, select Regon.

- In the Registration number field, enter 12345678901234.

Set up a number sequence code

- Go to Organization administration > Number sequences > Number sequences.

- On the Action Pane, on the Number sequence tab, in the New group, select Number sequence.

- On the Identification FastTab, in the Number sequence code field, enter XML_file.

- On the Scope parameters FastTab, in the Scope field, select Company.

- In the Company field, select DEMF.

- On the Segments FastTab, in the Length field for the Alphanumeric segment, enter 4.

- On the General FastTab, in the Setup section, set the Continuous option to No.

- In the Number allocation section, in the Largest field, enter 9999.

Set up foreign trade parameters

- Go to Tax > Setup > Foreign trade > Foreign trade parameters.

- On the Intrastat tab, on the General FastTab, in the Transaction code field, select 11.

- On the Electronic reporting FastTab, in the File format mapping field, select Intrastat (PL).

- In the Report format mapping field, select Intrastat Report.

- On the Commodity code hierarchy FastTab, verify that the Category hierarchy field is set to Intrastat.

- On the Country/region properties tab, select New.

- In the Party country/region field, select POL. Then, in the Country/region type field, select Domestic.

- In the Party country/region field, select DEU. Then, in the Country/region type field, select EU.

- On the Agent tab, on the Agent FastTab, in the Sales tax section, in the Tax exempt number field, enter 420000.

- On the Contact tab, in the Name field, enter Manish Chopra.

- In the Telephone field, enter 425-555-5068.

- In the Fax number field, enter 425-555-5049.

- In the Email field, enter manishc@contoso.com.

- On the Number sequences tab, in the Number sequence code field for the XML file number reference, select XML_file.

Set up product information

- Go to Product information management > Products > Released products.

- In the grid, select D0001.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select 100 200 30.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 2.

- On the Action Pane, select Save.

- In the grid, select D0003.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select 100 200 30.

- In the Origin section, in the Country/region field, select DEU.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 5.

- On the Action Pane, select Save.

Change the site address

- Go to Warehouse management > Setup > Warehouse > Sites.

- In the grid, select 1.

- On the Addresses FastTab, select Edit.

- In the Edit address dialog box, in the Country/region field, select POL.

- Select OK.

Set up a transport method

Create a transport method.

- Go to Tax > Setup > Foreign trade > Transport method.

- On the Action Pane, select New.

- In the Transport field, enter 3.

- In the Description field, enter Road transport.

Assign the new transport method to a mode of delivery. In this way, you set up the default values that are used for the transport method when the corresponding mode of delivery is selected.

- Go to Procurement and sourcing > Setup > Distribution > Modes of delivery.

- In the grid, select 10.

- On the Foreign trade FastTab, in the Transport field, select 3.

Select the default mode of delivery for a customer.

- Go to Accounts receivable > Customers > All customers.

- In the grid, select DE-016.

- On the Invoice and delivery FastTab, in the Mode of delivery field, select 10.

Select the default mode of delivery for a vendor.

- Go to Accounts payable > Vendors > All vendors.

- In the grid, select DE-001.

- On the Invoice and delivery FastTab, in the Mode of delivery field, select 10.

Set up codes for terms of delivery

Set up an Intrastat code for the terms of delivery.

- Go to Procurement and sourcing > Setup > Distribution > Terms of delivery.

- In the grid, select CIF.

- On the General FastTab, in the Intrastat code field, enter CIF.

Select the default delivery terms for a customer.

- Go to Accounts receivable > Customers > All customers.

- In the grid, select DE-016.

- On the Invoice and delivery FastTab, in the Delivery terms field, select CIF.

Select the default delivery terms for a vendor.

- Go to Accounts payable > Vendors > All vendors.

- In the grid, select DE-001.

- On the Invoice and delivery FastTab, in the Delivery terms field, select CIF.

Verify an EU customer's tax-exempt number code

- Go to Accounts receivable > Customers > All customers.

- In the grid, select DE-016.

- On the Invoice and delivery FastTab, in the Sales tax section, verify that the Tax exempt number field is set to DE9012.

Create a sales order with an EU customer

- Go to Accounts receivable > Orders > All sales orders.

- On the Action Pane, select New.

- In the Create sales order dialog box, on the Customer FastTab, in the Customer section, in the Customer account field, select DE-016.

- On the General FastTab, in the Storage dimensions section, in the Site field, select 1.

- In the Warehouse field, select 11.

- On the Address tab, verify that the Address field is set to Teichgasse 12, Kiel, 24103, DEU, because the customer is from Germany.

- Select OK.

- On the Header tab, on the Delivery FastTab, verify that the Delivery terms field is set to CIF, and the Mode of delivery field is set to 10.

- On the Lines tab, on the Sales order lines FastTab, in the Item number field, select D0001. Then, in the Quantity field, enter 8.

- On the Line details FastTab, on the Foreign trade tab, verify that the Transaction code field is set to 11, the Commodity field is set to 100 200 30, and the Country/region of origin field is set to POL.

- On the Action Pane, select Save.

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Posting invoice dialog box, on the Parameters FastTab, in the Parameter section, in the Quantity field, select All.

- On the Setup FastTab, in the Sales date field, select 10/18/2021 (October 18, 2021).

- Select OK to post the invoice.

Transfer the transaction to the Intrastat journal and review the result

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, in the Parameters section, set the Customer invoice option to Yes.

Select Filter.

In the Intrastat Filter dialog box, on the Range tab, select the first line, and verify that the Field field is set to Date.

In the Criteria field, select the current date.

Select OK to close the Intrastat Filter dialog box.

Select OK to close the Intrastat (Transfer) dialog box, and review the result. The line represents the sales order that you created earlier.

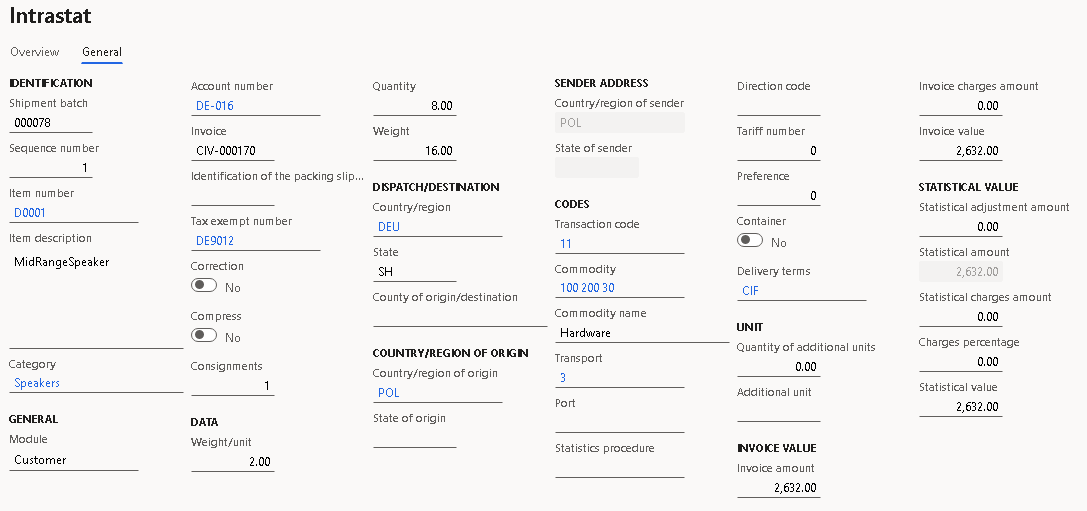

Select the transaction line, and then select the General tab to view more details.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, on the Parameters FastTab, in the Date section, in the From date field, select the first day of the current month.

In the Export options section, set the Generate file option to Yes. Then, in the File name field, enter the required name.

Set the Generate report option to Yes. Then, in the Report file name field, enter the required name.

In the Direction field, select Dispatches.

In the File format mapping section, verify that the Declaration type field is set to Declaration.

In the City of document creation field, enter Krakow.

In the Date of document creation field, select 10/19/2021 (October 19, 2021).

In the Document No field, enter 11.

In the Document version field, enter 22.

Select OK, and review the report in XML format that is generated. The following table shows the values in the example report.

Field name

Field description

Value

Information about the document

Deklaracja Data

The date when the document was created.

2021-10-19

Miejscowosc

The city where the document was created.

Krakow

LacznaLiczbaPozycji

The total number of items.

1

LacznaWartoscStatystyczna

The total statistical value.

2632

LacznaWartoscFaktur

The total invoice value.

2632

UC

The unit code.

420000

Rodzaj

The type of declaration.

D

Wersja

The document version.

22

Numer

The document number.

11

Miesiac

The reference month.

10

Rok

The reference year.

2021

Typ

The report direction.

W

NrWlasny

The declaration identifier.

21ISTDEMF-0001

Information about the company

Miejscowosc

The city where the company is located.

Warsaw

Regon

The company's Regon code.

12345678901234

Nip

The company's NIP code.

1234567890

KodPocztowy

The company's ZIP/postal code.

31-111

UlicaNumer

The street where the company is located.

Statystyczna 22/1

Nazwa

The name of the company.

Contoso Entertainment System Germany

Information about the good

WartoscStatystyczna

The statistical value.

2632

WartoscFaktury

The invoice value.

2632

MasaNetto

The net mass.

16

IdKontrahenta

The customer's VAT number.

DE9012

KodTowarowy

The commodity code.

10020030

RodzajTransakcji

The transaction code.

11

WarunkiDostawy

The terms of delivery mode.

CIF

KrajPochodzeniaWysylki

The code for the country or region of dispatch/destination.

DE

OpisTowaru

A description of the commodities.

Hardware

PozId

The item number.

1

Contact information

Email

The submitter's email address.

manishc@contoso.com

Faks

The submitter's fax number.

425-555-5049

Telefon

The submitter's telephone number.

425-555-5068

NazwiskoImie

The submitter's name.

Manish Chopra

Review the report in Excel format that is generated.

Create a purchase order

- Go to Accounts payable > Purchase orders > All purchase orders.

- On the Action Pane, select New.

- In the Create purchase order dialog box, in the Vendor account field, select DE-001.

- In the Site field select 1.

- In the Warehouse field select 11.

- Select OK.

- On the Header tab, on the Delivery FastTab, verify that the Mode of delivery field is set to 10, and the Delivery terms field is set to CIF.

- On the Lines tab, on the Purchase order lines FastTab, in the Item number field, select D0003. Then, in the Quantity field, enter 6.

- On the Line details FastTab, on the Foreign trade tab, verify that the Transaction code is set to 11, the Transport field is set to 3, the Commodity field is set to 100 200 30, and the Country/region of origin field is set to DEU.

- On the Action Pane, on the Purchase tab, in the Actions group, select Confirm.

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- On the Action Pane, select Default from, and then, in the Default quantity for lines field, select Ordered quantity. Then select OK.

- On the Vendor Invoice header FastTab, in the Invoice identification section, in the Number field, enter 00010.

- In the Invoice dates section, in the Invoice date field, select the current date. This date will be used for Intrastat transfer.

- In the Receive document date field, select 10/18/2021 (October 18, 2021).

- On the Action Pane, select Post to post the invoice.

Create an Intrastat declaration for arrivals

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, set the Vendor invoice option to Yes.

Select OK to transfer the transactions, and then review the Intrastat journal.

Review the information on the General tab for the purchase order.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, on the Parameters FastTab, in the Date section, in the From date field, select the first day of the current month.

In the Export options section, set the Generate file option to Yes. Then, in the File name field, enter the required name.

Set the Generate report option to Yes. Then, in the Report file name field, enter the required name.

In the Direction field, select Arrivals.

In the File format mapping section, verify that the Declaration type field is set to Declaration.

In the City of document creation field, enter Krakow.

In the Date of document creation field, select 10/19/2021 (October 19, 2021).

In the Document No field, enter 11.

In the Document version field, enter 22.

Select OK, and review the report in XML format that is generated. The following table shows the values in the example report.

Field name

Field description

Value

Information about the document

Deklaracja Data

The date when the document was created.

2021-10-19

Miejscowosc

The city where the document was created.

Krakow

LacznaLiczbaPozycji

The total number of items.

1

LacznaWartoscStatystyczna

The total statistical value.

965

LacznaWartoscFaktur

The total invoice value.

965

UC

The unit code.

420000

Rodzaj

The type of declaration.

D

Wersja

The document version.

22

Numer

The document number.

11

Miesiac

The reference month.

10

Rok

The reference year.

2021

Typ

The report direction.

P

NrWlasny

The declaration identifier.

21ISTDEMF-0002

Information about the company

Miejscowosc

The city where the company is located.

Warsaw

Regon

The company's Regon code.

12345678901234

Nip

The company's NIP code.

1234567890

KodPocztowy

The company's ZIP/postal code.

31-111

UlicaNumer

The street where the company is located.

Statystyczna 22/1

Nazwa

The name of the company.

Contoso Entertainment System Germany

Information about the good

WartoscStatystyczna

The statistical value.

965

WartoscFaktury

The invoice value.

965

MasaNetto

The net mass.

30

KrajPochodzenia

The code for the country or region of origin.

DE

RodzajTransportu

The mode of transport code.

3

KodTowarowy

The commodity code.

10020030

RodzajTransakcji

The transaction code.

11

WarunkiDostawy

The terms of delivery mode.

CIF

KrajPochodzeniaWysylki

The code for the country or region of dispatch/destination.

DE

OpisTowaru

A description of the commodities.

Hardware

PozId

The item number.

1

Contact information

Email

The submitter's email address.

manishc@contoso.com

Faks

The submitter's fax number.

425-555-5049

Telefon

The submitter's telephone number.

425-555-5068

NazwiskoImie

The submitter's name.

Manish Chopra

Review the report in Excel format that is generated.