Spanish Intrastat

The Intrastat page is used to generate and report information about trade among European Union (EU) countries/region. The Spanish Intrastat declaration contains information about the trade of goods that you can use for reporting.

The following fields are included on the Spanish Intrastat declaration.

| Field on the Intrastat declaration | Corresponding field on the Intrastat journal page | Description |

|---|---|---|

| Dispatch/destination country | Country/region (in the Dispatch/destination section) | The member state that is the origin or destination of the goods. |

| County | County of origin/destination (in the Dispatch/destination section) | The Spanish province where goods were obtained (in the case dispatches) or arrive (in the case of arrivals). |

| Delivery terms | Delivery terms (in the Codes section) | How the commodities are transported to or from Spain. |

| Transaction code | Transaction code (in the Codes section) | The nature of the agreement that forms the basis for the delivery of commodities. |

| Transport | Transport (in the Codes section) | How the commodities are transported. |

| Port | Port (in the Codes section) | The unique port code. |

| Commodity code | Commodity (in the Codes section) | The eight-digit commodity code according to the Combined Nomenclature. |

| Origin country | Country/region of origin (in the Country/region of origin section) | The country or region where the commodities were produced or manufactured. |

| Statistics procedure | Statistics procedure (in the Codes section) | The detailed version of the commodity flow. |

| Net mass | Weight (in the Data section) | The mass of the goods of all positions of the Combined Nomenclature. The value includes goods that require the declaration of additional units but excludes the weight of the packaging. The net mass is specified in kilograms. |

| Additional units | Quantity of additional units (in the Unit section) | For some commodities, you must report the supplementary unit, such as the number of items, and the number of m2, m3, pairs, and dozens. |

| Invoice amount | Invoice amount (in the Invoice value section) | The taxable amount. This amount constitutes the value that must be determined for tax purposes. |

| Statistical value | Statistical value (in the Statistical value section) | The value that the company would have at the time of entry into (in the case of arrivals) or departure from (in the case of dispatches) the Spanish statistical territory, after taxes on consumption (but no other taxes) are deducted. The value includes a proportional part of the transport and insurance costs of the journey up to the point where the goods enter or leave Spanish territory. For more information, see the description of the prerequisite for miscellaneous charges in Intrastat overview. |

Set up Intrastat

From the Global repository, import the latest version of the following Electronic reporting (ER) configurations:

- Intrastat model

- Intrastat report

- Intrastat (ES)

For more information, see Download ER configurations from the Global repository of Configuration service.

Set up the delivery address

For the Intrastat declaration on arrivals, it's important that you set the delivery address. The report will show the county from the delivery address as the destination county where the goods arrive.

When you create a vendor invoice, you can select the delivery address in the Delivery address field in the Address section on the Vendor FastTab of the Create purchase order dialog box. Select either your company's address or the site address.

Set up an address format

To set up an address format that includes county information, follow these steps.

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the Address format tab, select New to create a new address format. To update an existing address format, select it in the grid.

- In the Configure address component section, select Add.

- In the Address application object field, select County. Then select the corresponding box in the New line column.

- Add the address objects as required by the authorities.

- On the Country/region tab, select ESP in the grid.

- In the Address format field, select the address format that you just created.

Set up region codes

The Intrastat declaration requires that a county code be reported. To set up the county code, follow these steps.

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the State/province tab, select New.

- In the Country/region field, select ESP.

- In the State field, enter the name.

- On the County tab, select New.

- In the Country/region field, select ESP.

- In the State field, select the corresponding state.

- In the County field, enter the name of the county.

- In the ES county code field, enter the code according to the authority requirements.

Set up an address for a legal entity

- Go to Organization administration > Organizations > Legal entities, and select your organization in the grid.

- On the Addresses FastTab, select Edit.

- In the Edit address dialog box, in the State field, select your company's state.

- In the County field, select your company's county.

Set up an address for a site

- Go to Warehouse management > Setup > Warehouse > Site, and select the site in the grid.

- On the Addresses FastTab, select Edit.

- In the Edit address dialog box, in the State field, select your site's state.

- In the County field, select your site's county.

Set up foreign trade parameters

Go to Tax > Setup > Foreign trade parameters.

On the Intrastat tab, on the Electronic reporting FastTab, in the File format mapping field, select Intrastat (ES).

In the Report format mapping field, select Intrastat report.

On the Commodity code hierarchy FastTab, in the Category hierarchy field, select Intrastat.

On the General FastTab, in the Transaction code field, select the transaction code for property transfers. You use this code for transactions that produce actual or planned transfers of property against compensation (financial or otherwise).

In the Credit note field, select the transaction code for the return of goods.

In the County of origin/destination field, select the county in Spain where your company is located. This value is used for the Intrastat declaration on dispatches.

On the Spanish Intrastat tab, on the General FastTab, follow these steps to set default values for purchase orders and sales orders. You can overwrite the default values when you create an order.

- In the Transport field, select the code for the default transport type.

- In the Port field, select the code for the default port.

- In the Statistics procedure field, select the code for the default statistics procedure.

- In the Delivery terms field, select the code for the default delivery terms.

On the Country/region properties tab, in the Country/region field, list all the countries or regions that your company does business with. For each country that is part of the EU, in the Country/region type field, select EU, so that the country appears on your Intrastat report.

Set up product parameters for the Intrastat declaration

- Go to Product information management > Products > Released products, and select a product in the grid.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select the commodity code.

- In the Origin section, in the Country/region field, select the product's country or region of origin.

- On the Manage inventory FastTab, in the Net weight field, enter the product's weight in kilograms.

Compression of Intrastat

Go to Tax > Setup > Foreign trade > Compression of Intrastat, and select the fields that should be compared when Intrastat information is summarized. For Spanish Intrastat, select the following fields:

- County of origin/destination

- Country/region of origin

- Direction

- Country/region of sender

- Country/region

- Delivery terms

- Port

- Statistics procedure

- Transport

- Transaction code

- Commodity

- Invoice

Set up a transport method for the Intrastat declaration

- Go to Tax > Setup > Foreign trade > Transport method.

- On the Action Pane, select New.

- In the Transport field, enter a unique code.

Note

Spanish companies use one-digit transport codes.

Intrastat transfer

On the Intrastat page, on the Action Pane, you can select Transfer to automatically transfer the information about intracommunity trade from your sales orders, free text invoices, purchase orders, vendor invoices, vendor product receipts, project invoices, and transfer orders. Only documents that have an EU country as the country or region of destination (for dispatches) or consignment (for arrivals) will be transferred.

You can also manually enter transactions by selecting New on the Action Pane.

Generate an Intrastat report

- Go to Tax > Declarations > Foreign trade > Intrastat.

- On the Action Pane, select Output > Report.

- In the Intrastat Report dialog box, enter the start and end dates for the report.

- Set the Generate file option to Yes to generate a .txt file, and then enter the name of the .txt file for the Intrastat report.

- Set the Generate report option to Yes to generate an .xlsx file, and then enter a name for the file.

- Select Arrivals if the report is about intracommunity arrivals or Dispatches if it's about intracommunity dispatches.

- Select OK, and review the generated reports.

Example

This example shows how to post arrivals and dispatches for Intrastat. It uses the DEMF legal entity.

Preliminary setup

Go to Organization administration > Organization > Legal entities, and select the DEMF legal entity.

On the Addresses FastTab, select Edit, and then, in the Country/region field, select ESP (Spain).

Import the latest version of the following ER configurations:

- Intrastat model

- Intrastat report

- Intrastat (ES)

Set up region codes

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the State/province tab, select New.

- In the Country/region field, select ESP.

- In the State field, enter MC.

- In the Description field, enter Region of Murcia.

- On the County tab, select New.

- In the Country/region field, select ESP.

- In the State field, select MC.

- In the County field, enter Murcia.

- In the ES county code field, enter 47.

- On the Action Pane, select Save.

Set up an address format

To set up an address format that includes county information, follow these steps.

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the Address format tab, select 0005 in the grid.

- In the Configure address component section, verify that the Address application object field is set to County and that the corresponding box in the New line column is selected.

- On the Country/region tab, select ESP in the grid.

- In the Address format field, select 0005.

Set up an address for a legal entity

- Go to Organization administration > Organizations > Legal entities, and select DEMF in the grid.

- On the Addresses FastTab, select Edit.

- In the Edit address dialog box, in the State field, select MU.

- In the County field, select Murcia.

Change the site address

- Go to Warehouse management > Setup > Warehouse > Sites, and select 1 in the grid.

- On the Addresses FastTab, select Edit.

- In the Edit address dialog box, in the Country/region field, select ESP.

- In the State field, select MU.

- In the County field, select Murcia.

- Select OK.

Set up transport parameters

- Go to Tax > Setup > Foreign trade > Transport method.

- On the Action Pane, select New.

- In the Transport field, enter 2.

- In the Description field, enter Air transport.

- Go to Procurement and sourcing > Setup > Distribution > Terms of delivery, and select CIF in the grid.

- On the General FastTab, in the Intrastat code field, enter 3.

Set up a statistics procedure

- Go to Tax > Setup > Foreign trade > Statistics procedure.

- On the Action Pane, select New.

- In the Statistics procedure field, enter 1.

- In the Text 1 field, enter Sending to finals.

Set up foreign trade parameters

- Go to Tax > Setup > Foreign trade > Foreign trade parameters.

- On the Intrastat tab, on the General FastTab, in the Transaction code field, select 11.

- In the County of origin/destination field, select Murcia.

- On the Electronic reporting FastTab, in the File format mapping field, select Intrastat (ES).

- In the Report format mapping field, select Intrastat Report.

- On the Commodity code hierarchy FastTab, verify that the Category hierarchy field is set to Intrastat.

- On the Spanish Intrastat tab, on the General FastTab, in the Transport field, select 2.

- In the Port field, select 23.

- In the Statistics procedure field, select 1.

- In the Delivery terms field, select CIF.

- On the Country/region properties tab, select New.

- In the Party country/region field, select ESP.

- In the Intrastat code field, enter ES.

- In the Country/region type field, select Domestic.

- In the Party country/region field, select DEU. Then, in the Country/region type field, select EU.

- Verify that a line for ITA (Italy) is created and that the Country/region type field is set to EU.

Set up product information

- Go to Product information management > Products > Released products, and select D0001 in the grid.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select 100 200 30.

- In the Origin section, in the Country/region field, select ESP.

- In the State/province field, select MC.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 2.

- On the Action Pane, select Save.

- Select D0003 in the grid.

- On the Foreign trade FastTab, in the Intrastat section, in the Commodity field, select 100 200 30.

- In the Origin section, in the Country/region field, select DEU.

- On the Manage inventory FastTab, in the Weight measurements section, in the Net weight field, enter 5.

- On the Action Pane, select Save.

Create a sales order with an EU customer

- Go to Accounts receivable > Orders > All sales orders.

- On the Action Pane, select New.

- In the Create sales order dialog box, on the Customer FastTab, in the Customer section, in the Customer account field, select DE-015.

- On the Address FastTab, verify that the address is in ITA (Italy).

- On the General FastTab, in the Storage dimensions section, in the Site field, select 1.

- In the Warehouse field, select 11.

- Select OK.

- On the Lines tab, on the Sales order lines FastTab, in the Item number field, select D0001. Then, in the Quantity field, enter 10.

- On the Line details FastTab, on the Foreign trade tab, verify that the Statistics procedure, Transaction code, Transport, Port, Commodity, County of origin/destination, Country/region of origin, and State of origin fields are automatically set.

- On the Header tab, on the Delivery FastTab, in the Misc. delivery info section, in the Delivery terms field, select CIF.

- On the Action Pane, select Save.

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Posting invoice dialog box, on the Parameters FastTab, in the Parameter section, in the Quantity field, select All.

- Select OK to post the invoice.

Transfer the transaction to the Intrastat journal and review the result

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, in the Parameters section, set the Customer invoice option to Yes.

Select Filter.

In the Intrastat Filter dialog box, on the Range tab, select the first line, and verify that the Field field is set to Date.

In the Criteria field, select the current date.

Select OK to close the Intrastat Filter dialog box.

Select OK to close the Intrastat (Transfer) dialog box, and review the result. The line represents the sales order that you created earlier.

Select the transaction line, and then select the General tab to view more details.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, on the Parameters FastTab, in the Date section, select the month of the sales order that you created.

In the Export options section, set the Generate file option to Yes. Then, in the File name field, enter the required name.

Set the Generate report option to Yes. Then, in the Report file name field, enter the required name.

In the Direction field, select Dispatches.

Select OK, and review the report in .txt format that is generated. The following table shows the values in the example report.

Field Value Dispatch/destination country IT County 47 Delivery terms 3 Transaction code 11 Transport 2 Port 23 Commodity code 10020030 Origin country ES Statistics procedure 1 Net mass 20 Additional units (Blank) Invoice amount 3290 Statistical value 3290 Review the report in Excel format that is generated.

Create a purchase order

- Go to Accounts payable > Purchase orders > All purchase orders.

- On the Action Pane, select New.

- In the Create purchase order dialog box, in the Vendor account field, select DE-001.

- On the General FastTab, in the Storage dimensions section, in the Site field, select 1.

- In the Warehouse field, select 11.

- On the Vendor FastTab, in the Address section, in the Delivery address field, select Site 1.

- Select OK.

- On the Header tab, on the Delivery FastTab, verify that the Delivery terms field is set to CIF.

- On the Lines tab, on the Purchase order lines FastTab, in the Item number field, select D0003. Then, in the Quantity field, enter 100.

- On the Line details FastTab, on the Foreign trade tab, in the Foreign trade section, verify that the Transaction code, Transport, Port, Statistics procedure, County of origin/destination, Commodity, and Country/region of origin fields are automatically set.

- On the Action Pane, on the Purchase tab, in the Actions group, select Confirm.

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- On the Action Pane, select Default from. In the Default quantity for lines field, select Ordered quantity. Then select OK.

- On the Vendor invoice header FastTab, in the Invoice identification section, in the Number field, enter 0001.

- In the Invoice dates section, in the Invoice date field, select 9/13/2021 (September 13, 2021).

- On the Action Pane, select Post to post the invoice.

Create an Intrastat declaration for arrivals

Go to Tax > Declarations > Foreign trade > Intrastat.

On the Action Pane, select Transfer.

In the Intrastat (Transfer) dialog box, set the Vendor invoice option to Yes.

Select OK to transfer the transactions, and review the Intrastat journal.

Review the General tab for the purchase order.

On the Action Pane, select Output > Report.

In the Intrastat Report dialog box, on the Parameters FastTab, in the Date section, select the month of the purchase order that you created.

In the Export options section, set the Generate file option to Yes. Then, in the File name field, enter the required name.

Set the Generate report option to Yes. Then, in the Report file name field, enter the required name.

In the Direction field, select Arrivals.

Select OK, and review the report in .txt format that is generated. The following table shows the values in the example report.

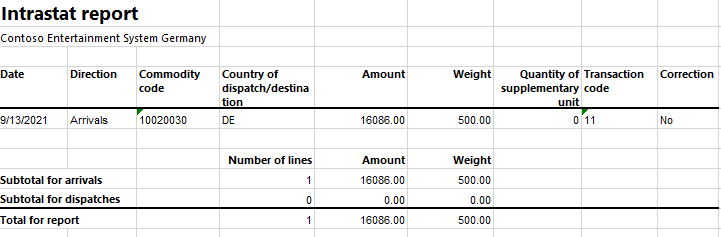

Field Value Dispatch/destination country DE County 47 Delivery terms 3 Transaction code 11 Transport 2 Port 23 Commodity code 10020030 Origin country DE Statistics procedure 1 Net mass 500 Additional units (Blank) Invoice amount 16086 Statistical value 16086 Review the report in Excel format that is generated.