Tax reporting by reporting codes

This article describes the general approach for setting up and generating the tax statement by reporting codes for some countries/regions. This approach is common for users in legal entities in the following countries/regions:

- Australia

- Japan

Tax statement overview

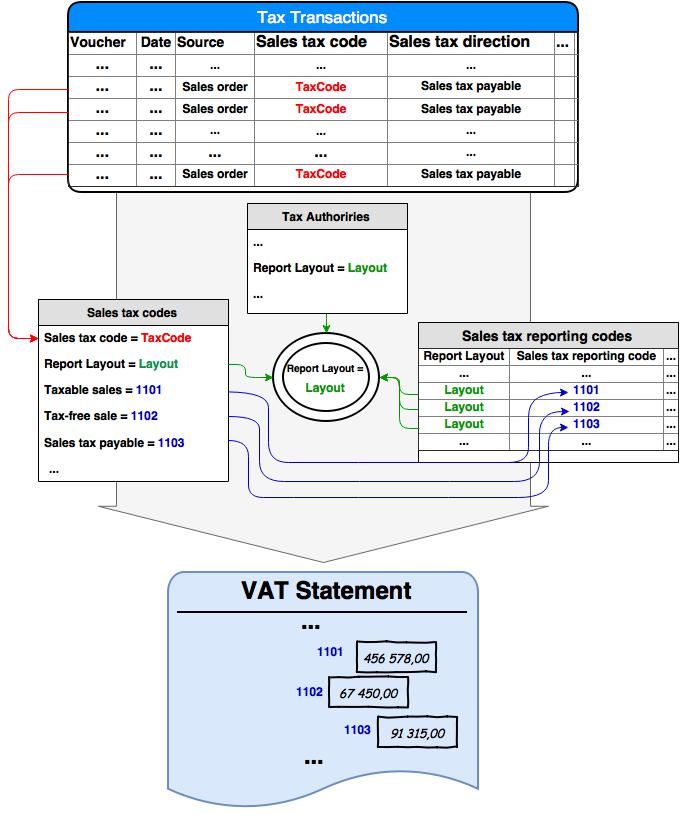

The tax statement is based on tax transaction amounts. The process of generating a tax statement is part of the Sales tax payment process, which is implemented through the Settle and post sales tax function. This function calculates the sales tax that's due for a given period. The settlement calculation includes the posted sales tax for the selected settlement period for the tax transactions. For more information, see Create a sales tax payment. The process for calculating data for a tax statement is based on the relationship between sales tax codes and sales tax reporting codes, where sales tax reporting codes match the tax statements boxes (or tags in XML). For each sales tax code, sales tax reporting codes should be set up for each type of transaction, such as taxable sales, taxable purchases, taxable import. These type of transactions are described in the Sales tax codes for tax reporting section later in this article.

For each sales tax reporting code, a specific report layout should be determined. At the same time, sales tax codes are linked to a specific sales tax authority through sales tax settlement periods. For every sales tax authority, a report layout should be determined. Thus, only sales tax reporting codes with the same report layout that's set up for a sales tax authority in sales tax settlement periods for the sales tax code can be selected in the report setup of the sales tax code. A sales tax transaction generated upon posting an order or a journal, contains a sales tax code, sales tax source, sales tax direction, and transaction amounts (tax base amount and tax amount in accounting currency, sales-tax currency, and transaction currency). Based on the combination of tax transaction attributes, transaction amounts compose total amounts for sales tax reporting codes specified for sales tax codes. The following illustration shows the data relationship.

Tax statement setup

To generate a tax statement you must set up the following items.

Sales tax authorities for tax reporting

Before you can set up sales tax reporting codes, you must select the correct report layout for the sales tax authority. On the Sales tax authorities page, in the General section, select a report layout. This layout will be used when you set up sales tax reporting codes.

Sales tax reporting codes

Sales tax reporting codes are box codes in the tax statement or tag names in XML format. These codes are used to aggregate and prepare amounts for the report. When you configure the electronic reporting format of the tax statement, the names of the result amounts will be used. You can create and maintain sales tax reporting codes on the Sales tax reporting codes page. You must assign each code a report layout. After you create the sales tax reporting codes, you can choose the codes in the Report setup section on the Sales tax codes page.

Sales tax codes for tax reporting

Base amounts and tax amounts of sales tax transactions can be aggregated on reporting codes in the tax statement (XML tags or declaration boxes). You can set up this behavior by associating sales tax reporting codes for different transaction types for sales tax codes on the Sales tax codes page. The following table describes the transaction types in the report setup for sales tax codes. The calculation includes transactions for all types of sources except sales tax.

| Transaction type | Description of transactions and amounts to be counted on the transaction type |

|---|---|

| Taxable Sales | Sum of Tax base amounts of tax transactions which satisfy the following conditions:

|

| Tax-free sales | Sum of Tax base amounts of tax transactions which satisfy the following conditions:

|

| Sales tax payable | Sum of Tax amounts of the tax transactions which satisfy the following conditions:

|

| Taxable sales credit note | Sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Fax exempt sales credit note | Sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Sales tax on sales credit note | Sum of Tax amounts of the tax transactions which satisfy the following conditions:

|

| Taxable purchases | Sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Tax-free purchase | Sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Sales tax receivable | Sum of Tax amounts of the tax transactions which satisfy the following conditions:

|

| Taxable purchase credit note | Sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Tax exempt purchase credit note | Sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Sales tax on purchase credit note | Sum of Tax amounts of the tax transactions which satisfy the following conditions:

|

| Taxable import | Sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Offset taxable import | Reversed sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Taxable import credit note | Sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Offset taxable import credit note | Reversed sum of Tax base amounts of the tax transactions which satisfy the following conditions:

|

| Use tax | Sum of Tax amounts of the tax transactions which satisfy the following conditions:

|

| Offset use tax | Reversed sum of Tax amounts of the tax transactions which satisfy the following conditions:

|

Note

For the preceding table, it's assumed that the following criteria are met:

- The tax base amount is a transaction amount from the Origin in Accounting currency field.

- The tax amount is a transition amount from the Actual sales tax amount in Accounting currency field.

Country/region-specific resources for tax statements

The tax statement for each country/region must meet the requirements of that country/region's legislation. There are predefined general models and formats of tax statements for the countries/regions that are listed in the following table.

| Country/region | Additional information |

|---|---|

| Australia | Business activity statement (BAS) |

| Japan | Japan consumption tax report |