Define HSN codes and Service Accounting Codes

To make the India localization solution for Goods and Services Tax (GST) in Microsoft Dynamics 365 Finance available, you must complete the following master data setup:

- Define a business vertical.

- Update the state code and union territory.

- Create a Goods and Services Tax Identification Number (GSTIN) master.

- Define GSTINs for the legal entity, warehouse, vendor, or customer masters.

- Define Harmonized System of Nomenclature (HSN) codes and Service Accounting Codes (SACs).

- Create main accounts for the GST posting type.

- Create a tax settlement period.

- Attach the GSTIN to a tax registration group.

Define HSN codes

- Go to Tax > Setup > Sales tax > India > HSN code.

- Create a record.

- In the Chapter field, enter a value.

- In the Heading field, enter a value.

- In the Subheading field, enter a value.

- In the Country/region extension field, enter a value.

- In the Statistical suffix field, enter a value.

- Save the record, and verify that the HSN code field is updated.

- In the Description field, enter a value.

- Select Close.

Define SACs

- Go to Tax > Setup > Sales tax > India > Service accounting codes.

- Create a record.

- In the SAC field, enter a value.

- In the Description field, enter a value.

- Save the record, and then select Close.

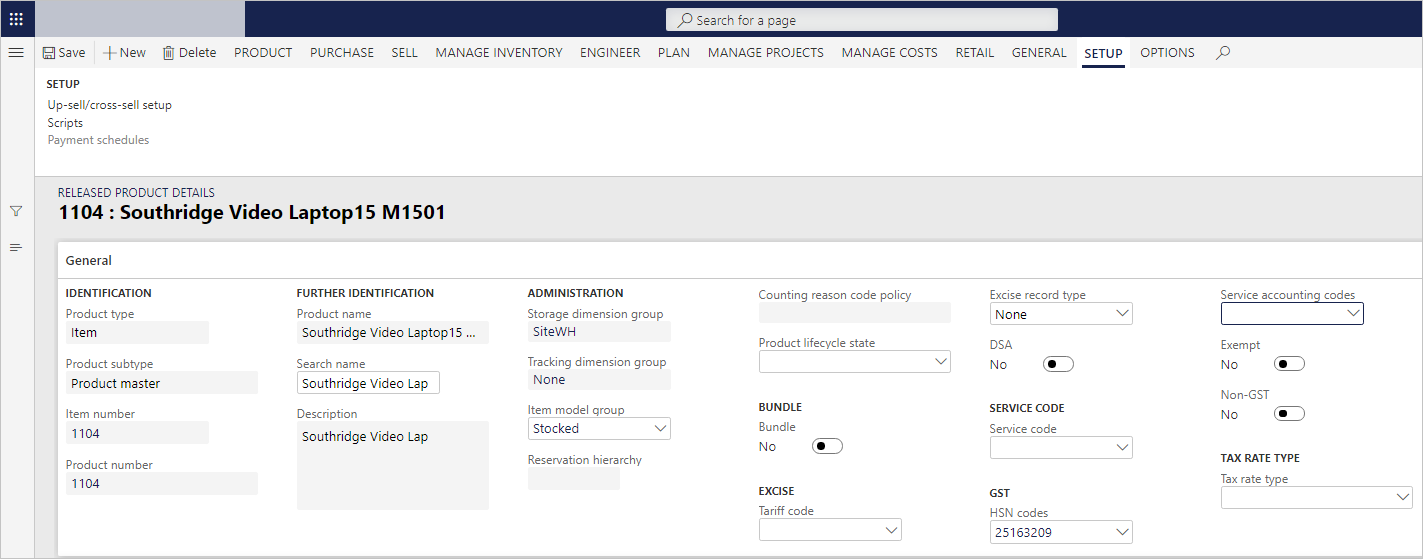

Assign HSN codes and SACs to products

- Go to Product information management > Products > Released products.

- Select a product, and then select Edit.

- On the General FastTab, if the product type is Item, select a value in the HSN codes field. If the product type is Service, select a value in the Service accounting codes field.

- Save the record, and then select Close.

The following setup is required for the calculation of GST:

- An HSN code should be defined for the Item product type, or an SAC should be defined for the Service product type.

- The item sales tax group should be removed.

Assign SACs to miscellaneous charges

Go to Accounts payable > Charges setup > Charges code.

Select a charges code.

On the Tax information FastTab, in the Service accounting codes or HSN codes field, enter a value.

In the Service category or ITC Category field, enter a value.

Set the Exempt option to Yes to exempt these charges from the calculation of GST.

Save the record.

When this charge code is selected for a transaction, the defined tax information is automatically entered, and GST is calculated accordingly.

Go to Accounts receivable > Charges setup > Charges code.

Select a charges code.

On the Tax information FastTab, in the Service accounting codes or HSN codes field, enter a value.

Set the Exempt option to Yes to exempt these charges from the calculation of GST.

Save the record.

When this charge code is selected for a transaction, the defined tax information is automatically entered, and GST is calculated accordingly.