Introduction to depreciation methods

In Dynamics 365 Business Central, you can assign the following depreciation methods to an asset:

Straight-line

Declining-balance 1

Declining-balance 2

DB1/SL (declining-balance 1/straight-line)

DB2/SL (declining-balance 2/straight-line)

User-defined

Manual

Additionally, you can use a Half-Year Convention depreciation method, which you will set up differently from other depreciation methods.

Straight-line method

In the Straight-line depreciation method, a fixed asset depreciates by the same amount each year. You can enter a straight-line depreciation method by specifying the following fields on the Depreciation Books FastTab:

Depreciation Method - Straight-line

Depreciation Starting Date - When depreciation should begin for the asset.

No. of Depreciation Years or Depreciation Ending Date - Specify the number of years that you expect to depreciate the asset or enter when depreciation should end for the asset.

The program uses the following formula to calculate the depreciation amount:

Depreciation Amount = (Book value - Salvage Value) * Number of Depreciation Days) / Remaining Depreciation Days

The program calculates the remaining depreciation days as the number of depreciation days minus the number of days between the depreciation starting date and the last FA entry date. The book value might be reduced by posted Write-Down, Appreciation, Custom 1, or Custom 2 amounts, depending on whether the Part of Book Value option is selected in the FA Posting Type Setup window. If you use this calculation, the fixed asset is fully depreciated by the depreciation ending date.

Other than configuring the straight-line depreciation method with the starting date and number of periods, you can also specify the following parameters:

Fixed yearly percentage -

Depreciation Amount = (Straight line % * Depreciable Basis * Number of Depreciation Days) / (100 * 360)Fixed yearly amount -

Depreciation Amount = (Fixed Depreciation Amount * Number of Depreciation Days) / 360

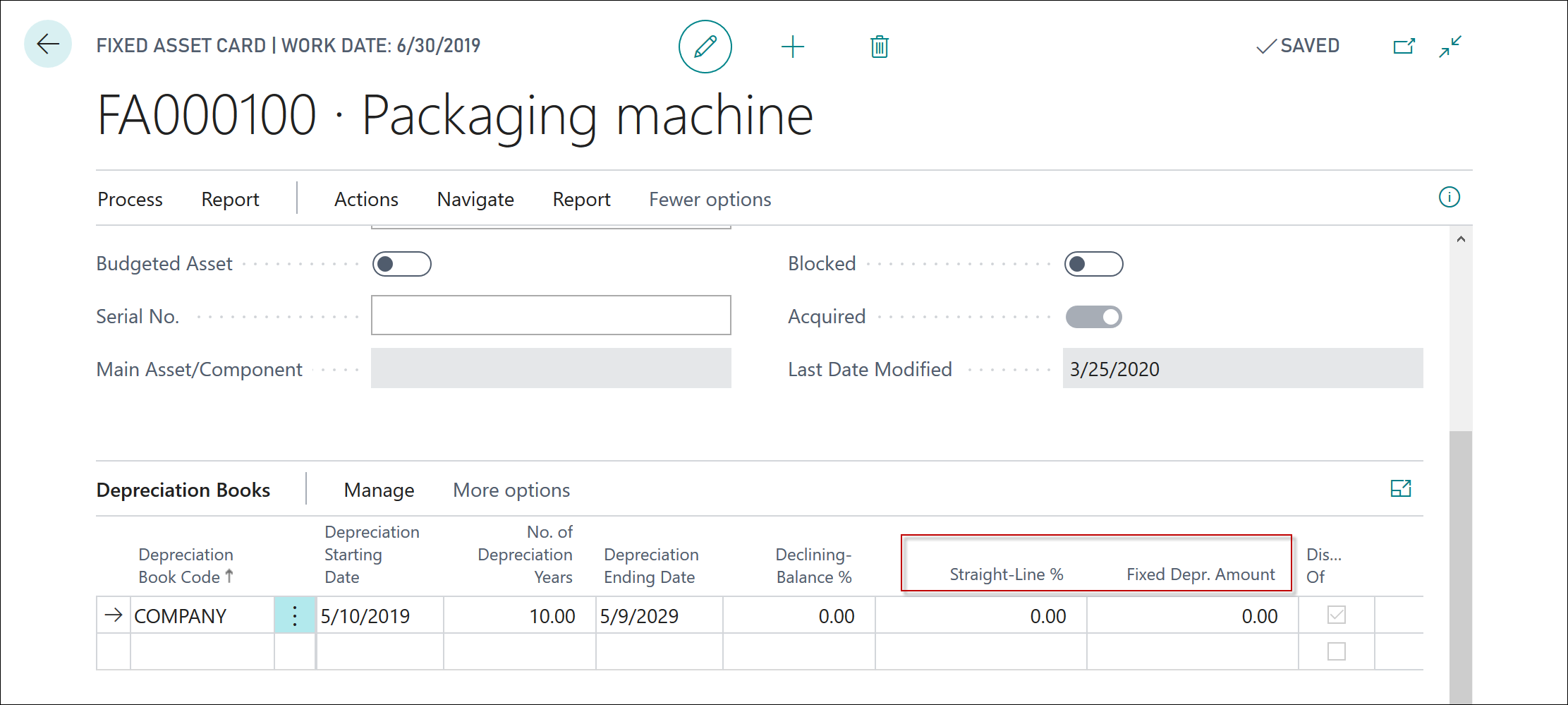

By default, these fields are not visible on the Depreciation Books FastTab of the fixed asset card. To use these fields, complete the following tasks:

On the Depreciation Books FastTab, select Add More Depreciation Books.

Use Personalize to add the Straight-Line % field or the Fixed Depr. Amount field.

Declining-balance 1 method

The Declining-balance 1 method of depreciation is an accelerated method that allocates the largest part of the cost of an asset to the early years of its useful lifetime. To use this method, specify a fixed yearly percentage.

The program uses the following formula for calculating depreciation amounts:

Depreciation Amount = (Declining-Bal. % * Number of Depreciation Days * Depr. Basis) / (100 * 360)

The depreciable basis is calculated as the book value less the posted depreciation since the starting date of the current fiscal year.

When you use this method, the posted depreciation amount can contain entries with various posting types (Write-Down, Custom 1, and Custom 2) that have been posted since the starting date of the current fiscal year. These posting types are included in the posted depreciation amount if the Depreciation Type and Part of Book Value check boxes are selected in the FA Posting Type Setup window.

Declining-balance 2 method

The Declining-balance 2 method of depreciation calculates the same total depreciation amount for each year as Declining-balance 1. However, if the Calculate Depreciation batch job is run one or more times a year, the Declining-balance 1 method results in equal depreciation amounts for each period. Alternatively, the Declining-balance 2 method results in amounts that decline for each period.

DB1/SL method

The DB1/SL method of depreciation is a combination of the Declining-balance 1 and Straight-line methods of depreciation. When you run the Calculate Depreciation batch job, the program calculates both a declining balance and a straight-line amount and then uses the larger of the two amounts. When you select this method, enter data into both the Number of Depreciation Years and the Declining Balance % fields. The depreciation starts with the Declining-balance 1 method and ends with the Straight-line method.

DB2/SL method

The DB2/SL depreciation method is a combination of the Declining-balance 2 and Straight-line methods. This method is the same as the DB1/SL method, except that it calculates depreciation according to the rules of the Declining-balance 2 method instead of the Declining-balance 1 method.

User-defined method

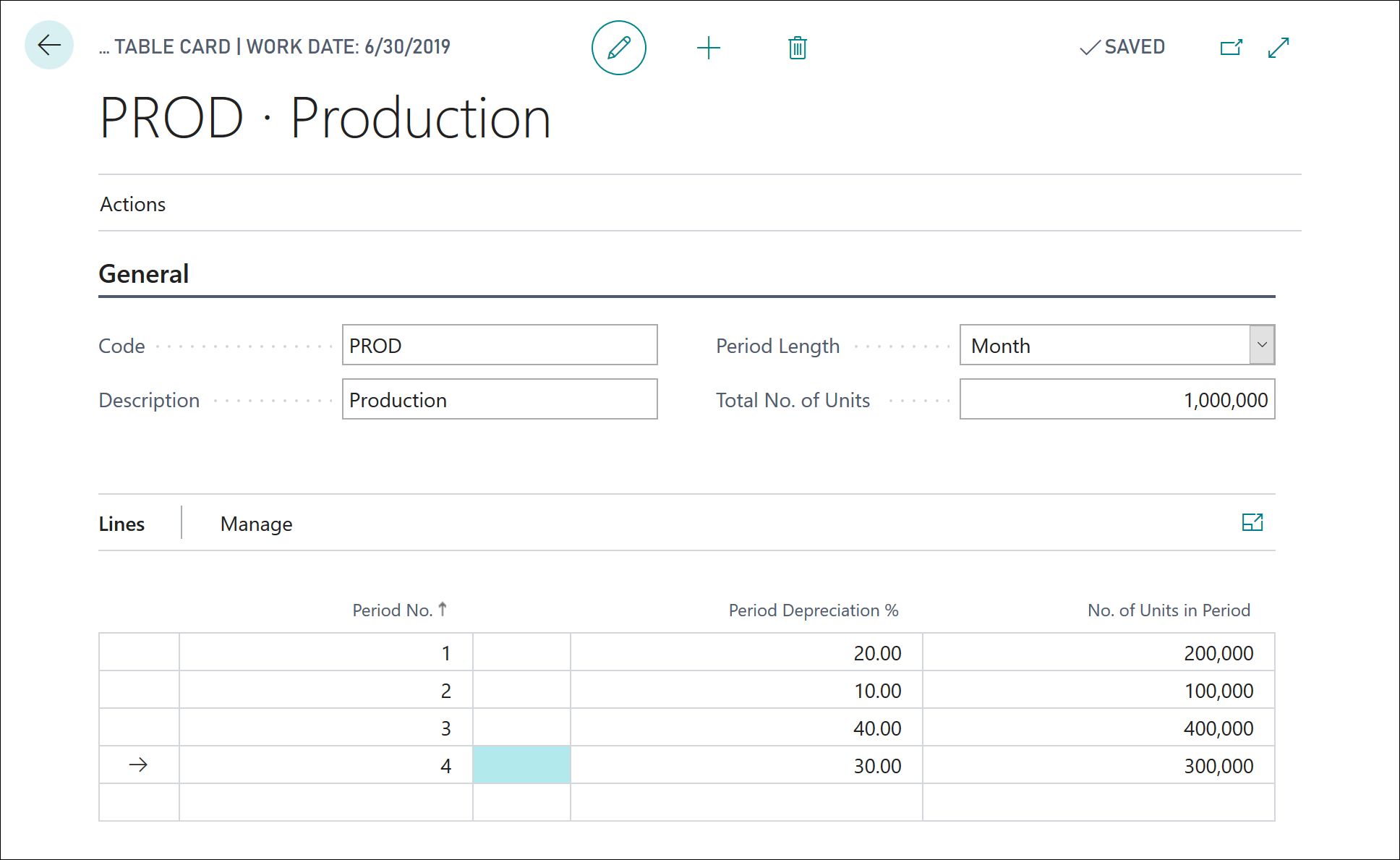

The User-defined depreciation method gives you the option to create a customized depreciation method by using the depreciation tables. You can create depreciation tables in the Depreciation Table List window.

To open the Depreciation Table List window and create a new depreciation table, follow these steps:

Select the Search for page icon in the upper-right corner of the page, enter depreciation tables, and then select the related link.

Select New.

Fill in the fields, as necessary.

Either use a percentage for allocation or specify the number of units. When you are using the Period Depreciation % field, the number of units is entered automatically.

The program uses the following formula for calculating the depreciation in user-defined methods:

Depreciation Amount = Depreciation % * Number of Depreciation Days * Depreciation Basis

Most often, the user-defined depreciation methods can't be used for statutory financial statements. However, they could be useful for analysis purposes.

Manual method

The Manual method of depreciation requires you to manually enter the depreciation expense in either the FA G/L journal or the FA journal. The Calculate Depreciation batch job doesn't calculate depreciation for any assets for which you have selected the Manual depreciation method. You can use this method for assets that are not subject to depreciation, such as land.