Assign fixed asset depreciation books

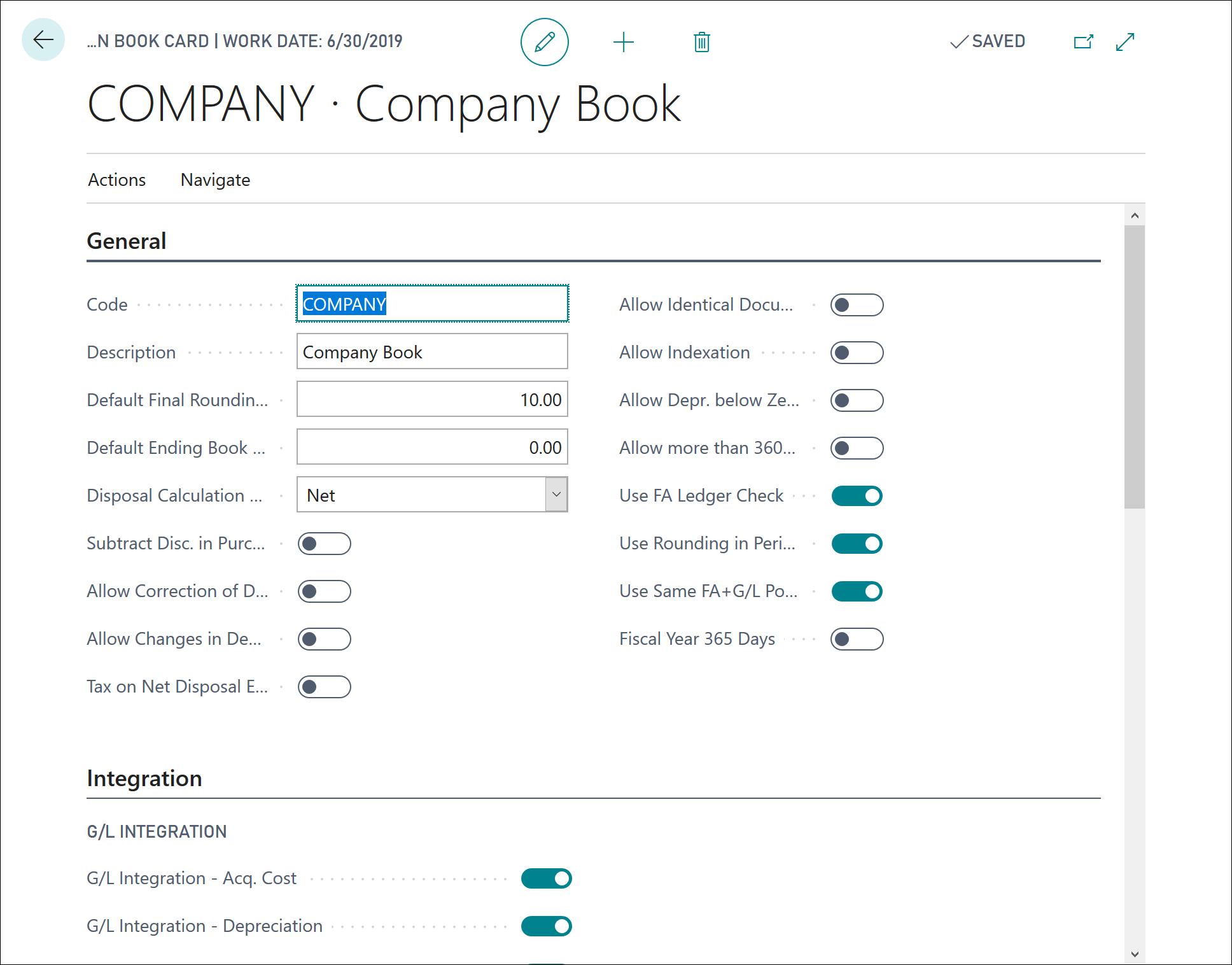

A depreciation book contains settings, such as G/L integration, that are used to manage a fixed asset.

Each fixed asset must have at least one depreciation book, but it can also have multiple depreciation books. Multiple depreciation books are useful when you want to configure multiple depreciation methods for one fixed asset. For example, you can have one method for legal bookkeeping and one for financial reporting purposes.

Most often, when you use multiple depreciation books, only one has the G/L integration setting enabled. You can set a default book on the Fixed Asset Setup page.

Watch the following video to see how to set up and assign depreciation books and other depreciation related information to a fixed asset.