Analyze workflow in cost accounting

Unlike the general ledger, in cost accounting, effective operational costs are captured and evaluated. The goal is to exactly analyze the costs for each cost center and cost object and, with that analysis, create a dependable foundation for cost accounting.

Cost centers are most often departments and profit centers that are largely responsible for costs and income.

Cost objects are products, product groups, or services of a company; in other words, the finished goods of a company that carry the costs.

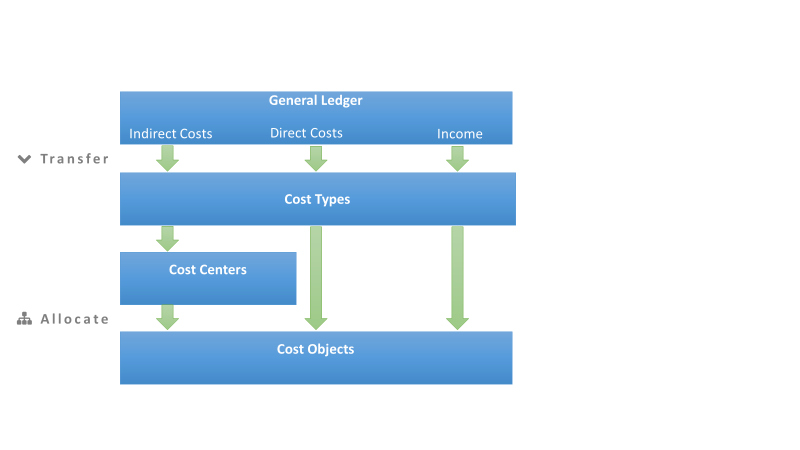

Operational costs can largely be transferred from the general ledger. Pure operational costs, internal charges, and allocations are recorded and posted in cost accounting.

Overhead costs are first posted to cost centers and then later charged to cost objects. For example, this practice might be done in a sales department that sells several products at the same time.

Direct costs can be directly allocated to a cost object, such as a material purchase for a specific product.

The general ledger chart of accounts and the chart of cost types frequently have similar structures.

The allocation base used and the exactness of the allocation definition have an important influence on the results of cost accounting. The allocation definition is used to allocate costs first from so-called pre-cost centers to main cost centers and second from cost centers to cost objects. In the cost distribution sheet, the results from the cost centers and cost objects are contrasted. The allocation entries are especially revealing when you contrast the two.