Financial analytics

Businesses capture a tremendous amount of data during daily activities that's supports valuable business intelligence (BI) for decision makers:

- Sales figures

- Purchases

- Operational expenses

- Employee salaries

- Budgets

Business Central contains many features to help you gather, analyse and share your organisation's finance data:

- Financial reporting (for financial statements and KPIs)

- Power BI reports for finance

- Ad-hoc analysis on lists

- Ad-hoc analysis of data in Excel (using open in Excel)

- Built-in finance reports

Each of these features has its own advantages and disadvantages, depending on the type of data analysis and the role of the user. To learn more, go to Analytics, business intelligence, and reporting overview.

This article introduces you can use these analytical features to provide financial insights.

When thinking of analytics needs in finance, it might help to use a mental model based on personas described on a high-level and their different analytics needs.

People in different roles have different needs when it comes to data, and they use the data in different ways. For example, people in finance interact with data differently than people in sales.

| Role | Data aggregation | Typical ways to consume data |

|---|---|---|

| CFO / CEO | Performance data | KPIs Dashboards Financial reports |

| Finance Management | Trends, summaries | Built-in managerial reports Ad-hoc analysis |

| Bookkeeper | Detailed data | Built-in operational reports On-screen task data |

A key performance indicator (KPI) is a measurable value that shows how effectively you’re meeting your goals. In finance, people often use the following KPIs to monitor their organisation's financial health:

- Net Profit Margin

- Gross Profit Margin

- Current/Quick/Cash Ratio

- COGS (Cost of Goods Sold)

- Debt-to-Equity Ratio

- Current/Payroll/Longterm Liabilities

- Operating Profit - EBIT

- EBITDA

- Average Collection Period (Days)

These financial KPIs, and more, are available in the Power BI Finance app for Business Central. To learn more, go to Power BI finance app.

The following table describes the reports in the Power BI Finance app, and how you can use them.

| To... | Open in Business Central (CTRL+select) | Learn more |

|---|---|---|

| Explore a snapshot of the organisation's financial health and performance. This page displays key performance indicators that give stakeholders a clear view of revenue, profitability, and financial stability. | Financial Overview | About Financial Overview |

| Analyse and compare income statement accounts on a monthly basis. Use the Income Statement by Month report to gain a comparative view of net changes over time. | Income Statement | About Income Statement |

| Analyse and compare balance sheet accounts on a monthly basis with the Balance Sheet by Month report. Get a comparative view of balance at date over time. | Balance Sheet | About Balance Sheet |

| Compare G/L budgets to actuals on a month-to-month basis and quickly identify variances. | Budget Comparison | About Budget Comparison |

| Analyse your company's liquidity position and track current ratio, quick ratio and cash ratio over time. | Liquidity KPIs | About Liquidity KPIs |

| Analyse your company's gross and net profits over time. Get detailed insights into net margins, gross profit margins, and the underlying revenue with the cost and expense figures that drive them. | Profitability | About Profitability |

| Analyse liability account balances as of a specific date. The report also shows key performance metrics influenced by liabilities, such as the debt ratio and debt-to-equity ratio. | Liabilities | About Liabilities |

| Analyse the EBITDA and EBIT profitability metrics. These figures reveal trends, while also showing operating revenue and operating expenses to provide context for both measures. | EBITDA | About EBITDA |

| Analyse how many days it takes to collect accounts receivable. Find trends in the average collection period over time. Details such as the number of days, accounts receivable, and accounts receivable (average) provide context and enhance the analysis. | Average Collection Period | About Average Collection Period |

| Categorise customer balances into ageing buckets and see a breakdown by payment terms. Age by document date, due date, or posting date, and customise the ageing bucket size by specifying the number of days. | Aged Receivables (Back Dating) | About Aged Receivables (Back Dating) |

| Categorise vendor balances into ageing buckets and review a breakdown by payment terms. Age by document date, due date, or posting date, and customise the ageing bucket size by specifying the number of days. | Aged Payables (Back Dating) | About Aged Payables (Back Dating) |

| Analyse general ledger entries in detail, and slice G/L entries by all eight shortcut dimensions. | General Ledger Entries | About General Ledger Entries |

| Analyse entries posted to the Vendor Ledger and Detailed Vendor Sub Ledger. | Detailed Vendor Ledger Entries | About Detailed Vendor Ledger Entries |

| Analyse entries posted to the Customer Ledger and Detailed Customer Sub Ledger. | Detailed Customer Ledger Entries | About Detailed Customer Ledger Entries |

Tip

You can easily track the KPIs that the Power BI reports display against your business objectives. To learn more, go to Track your business KPIs with Power BI metrics.

The Financial Reporting feature gives you insights into the financial data shown on your chart of accounts (COA). You can set up financial reports to analyse figures in general ledger (G/L) accounts, and compare general ledger entries with budget entries. The results display in charts and reports on your home page, such as the Cash Flow chart, and the Income Statement and Balance Sheet reports.

Dimensions play an important role in business intelligence. A dimension is data that you can add to an entry as a parameter. Dimensions let you group entries that have similar characteristics so they're easier to analyse. For example, customers, regions, products, and salespersons. Among other purposes, use dimensions when you define analysis views and create financial reports. Learn more at Work with Dimensions.

Tip

As a quick way to analyse transactional data, you can filter totals in the chart of accounts and all entries in Entries pages by dimensions. Look for the Set Dimension Filter action.

The following table describes a sequence of tasks in financial reporting, with links to the articles that describe them.

| To | See |

|---|---|

| Create new financial reports to define financial statements for reporting or to display as charts. | Prepare Financial Reports with Financial Data and Account Categories |

| Use statistical accounts to supplement information in financial reports. Statistical accounts let you add metrics that are based on nontransactional data. You can add the nontransactional data as number-based units, such as employee headcount, square footage, or number of customers with overdue accounts. | Analyse data with statistical accounts |

| Learn how to set up a new financial report through examples. | Walkthrough: Use financial reporting to make a cash flow forecasts |

| Analyse your financial performance by setting up key performance indicators (KPIs) based on financial reports, which you then publish as web services. The published financial reports KPIs can be viewed on a web site or imported to Microsoft Excel using OData web services. | Set Up and Publish KPI Web Services Based on Financial Reports |

| Set up views to analyse data using dimensions. | Analyse Data by Dimensions |

| Create new analysis reports for sales, purchases, and inventory, and set up analysis templates. | Create Analysis Reports |

Some organisations use Business Central in multiple business units or legal entities. Others use Business Central in subsidiaries that must report into parent organisations. Business Central gives accountants tools that help them transfer general ledger entries from two or more companies (subsidiaries) into a consolidated company.

To learn more, go to Company consolidation.

Sometimes, you just need to check whether the numbers add up correctly, or quickly confirm a figure. The following features are great for ad-hoc analyses:

- Data analysis on ledger list pages

- Open in Excel

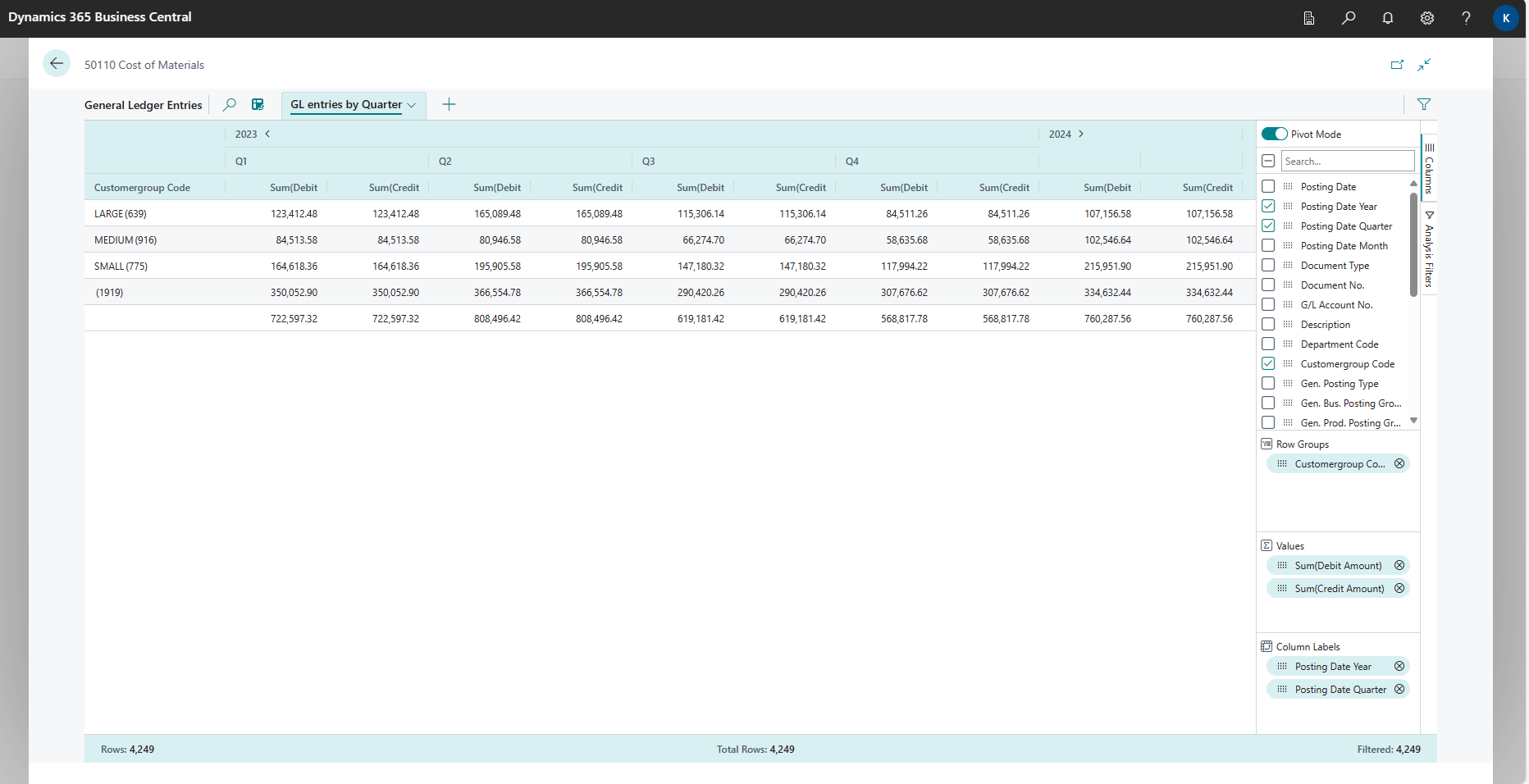

The Data analysis feature lets you open almost a list page, such as General Ledger Entries, Fixed Asset Ledger Entries, Cheque Ledger Entries, or Bank Account Ledger Entries, enter analysis mode, and then group, filter, and pivot data as you see fit.

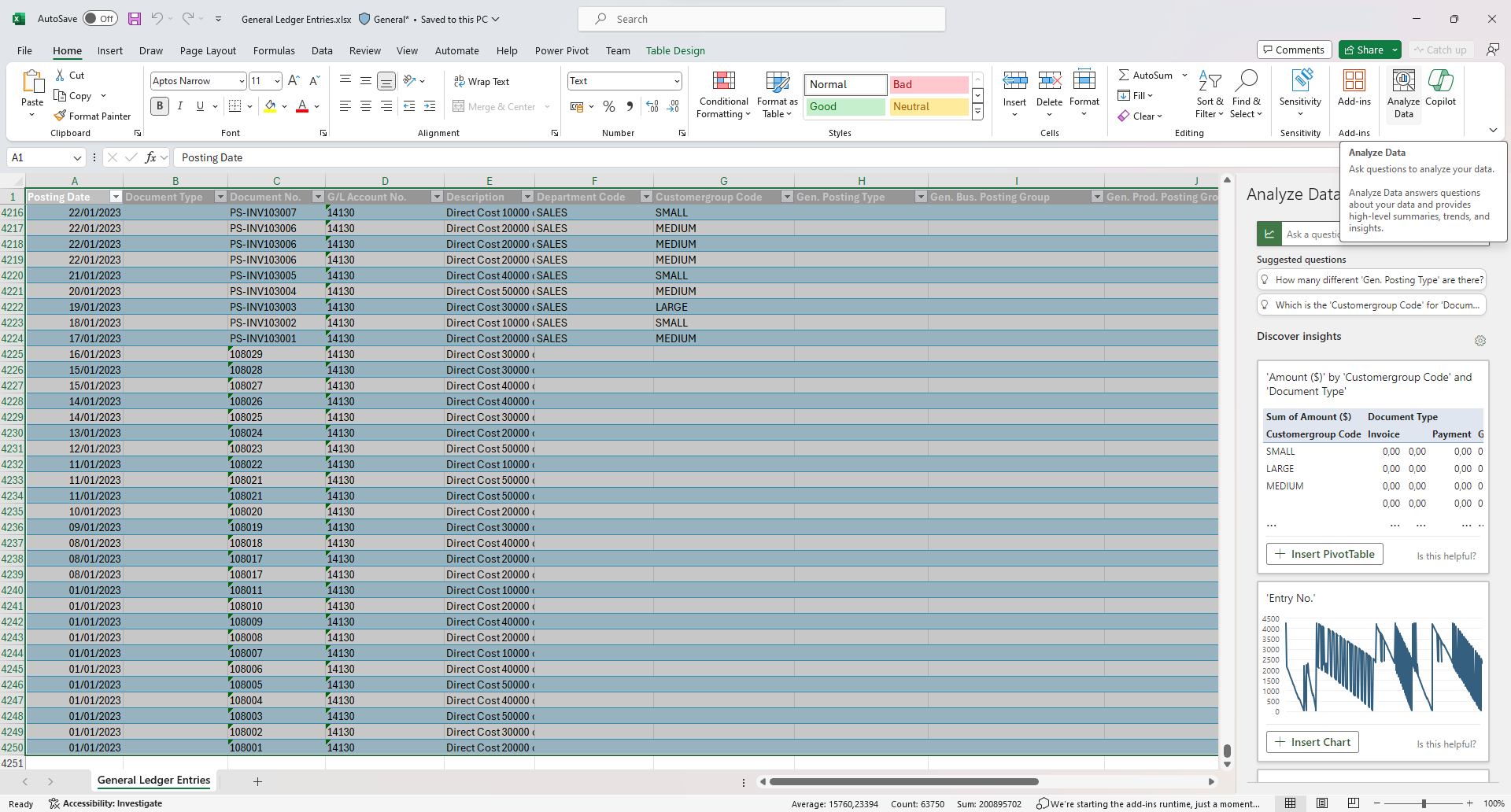

Similarly, you can use the Open in Excel action to open a list page for ledger entries, optionally filter the list to a subset of the data, and then use Excel to work with the data. For example, by using features such as Analyse Data, What-If Analysis, or Forecast Sheet.

Tip

If you configure OneDrive for system features, the Excel workbook opens in your browser by using Excel for the web.

For more information on how to do ad-hoc analysis on ledgers, see Ad hoc analysis on finance data.

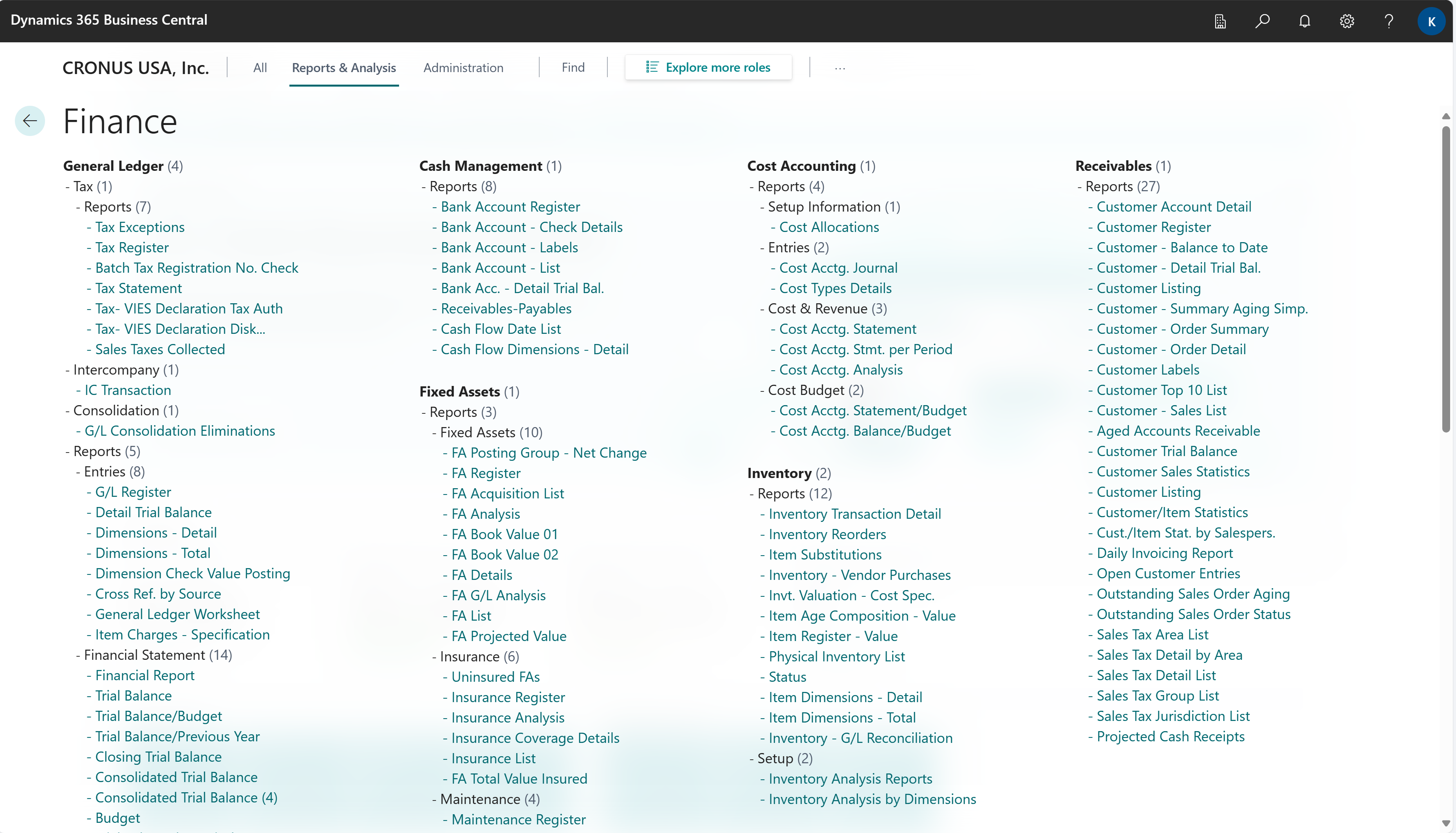

Business Central includes several built-in reports, tracing functions, and tools to help auditors or controllers who are responsible for reporting to the finance department.

To get an overview of available reports, you can choose All reports on the top pane of your home page. This action opens the Role Explorer, which is filtered to the features in the Report & Analysis option. To learn more, go to Finding Reports with the Role Explorer.

Built-in reports come in two flavors:

- Designed for print (pdf).

- Designed for analysis in Excel.

For more information, see these overviews for reports that are relevant for finance.

- Built-in finance Excel reports

- Built-in key finance reports

- Built-in fixed assets reports

- Built-in accounts receivable reports

- Built-in accounts payable reports

Business Central has several pages that give you financial overviews and tasks to do.

The Chart of Accounts page shows all general ledger accounts with aggregated numbers posted to the general ledger. From this page, you can do things like:

- View reports that show general ledger entries and balances.

- Review a list of posting groups for that account.

- View separate debit and credit balances for a single account.

To learn more, go to Understand the Chart of Accounts.

As a part of gathering, analysing, and sharing your company data, you might want to view actual amounts compared to budgeted amounts for all accounts and for several periods. You can make this comparison from the Chart of Accounts page, by choosing the G/L Balance/Budget action.

To learn more, go to Analyse Actual Amounts Versus Budgeted Amounts.

Dimensions are values that categorise entries so you can track and analyse them on documents, such as sales orders. Dimensions can, for example, indicate the project or department an entry came from.

So, instead of setting up separate general ledger accounts for each department and project, you can use dimensions as a basis for analysis and avoid having to create a complicated chart of accounts structure.

In financial analysis, a dimension is data you add to a G/L entry as a kind of marker. This data is used to group G/L entries with similar characteristics, such as customers, regions, products, and salesperson, and easily retrieve these groups for analysis. You can use dimensions on entries in journals, documents, and budgets. For more information, see Analyse Data by Dimensions

On the Accountant home page, under Finance Performance, the Cash Cycle, Cash Flow, and Income & Expense charts offer ways to analyse cash flow:

- Review figures for a period by using the timeline slider.

- Filter the chart by choosing the source in the legend.

- Change the length of the period, or go to the previous or next period, by choosing options on the Finance Performance drop down.

To examine the forecast, in addition to forecast entries, you can also look at the cash flow worksheet. For example, you can see how the forecast:

- Handles confirmed sales and purchases.

- Subtracts payables and adds receivables.

- Skips duplicate sales orders and purchase orders.

To learn more, go to Analysing Cash Flow in Your Company.

Handling finance reporting across business units or legal entities

Power BI finance app

Prepare Financial Reports with Financial Data and Account Categories

Ad hoc analysis on finance data

Understand the Chart of Accounts

Built-in finance Excel reports

Built-in key finance reports

Built-in fixed assets reports

Built-in accounts receivable reports

Built-in accounts payable reports

Finance overview

Analytics, business intelligence, and reporting overview

Work with Business Central