Intercompany trading

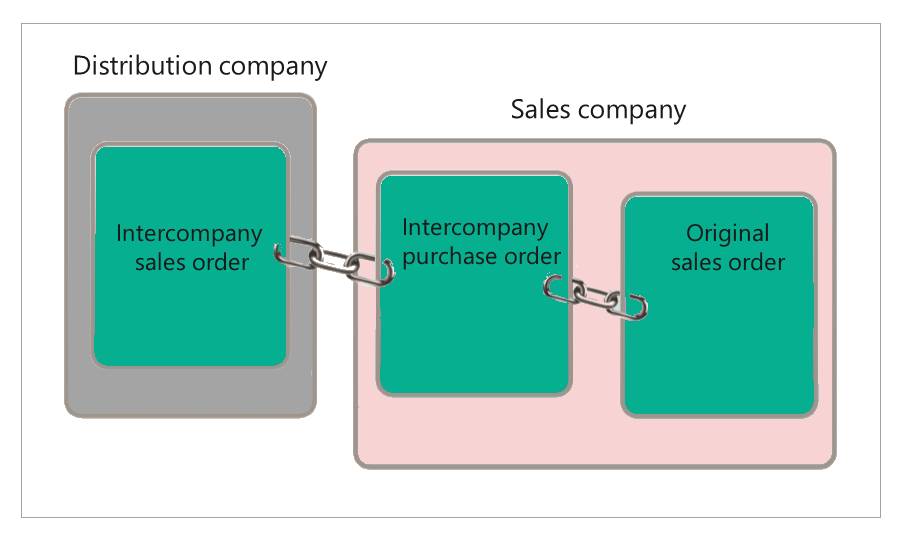

When you create an intercompany order chain, Supply Chain Management traces all related purchase orders and intercompany sales orders.

This feature is helpful if, for example, you want to view the status of the corresponding sales or purchase order if it has already been picked, delivered, or received.

The following are different types of intercompany chain orders:

Purchase order initiated intercompany chain (two-legged) - An Intercompany chain in which the initiating order is a purchase order.

Sales order initiated intercompany chain (two-legged) - An Intercompany chain in which the initiating order is a sales order.

Sales Order Initiated Intercompany chain Intercompany with an external customer facing sales order - Also called the "Original sales order" (three-legged).

When an intercompany sales order is created, Supply Chain Management automatically creates a corresponding purchase order in the appropriate legal entity.

Similarly, when you create an intercompany purchase order, it triggers the automatic creation of a corresponding intercompany sales order.

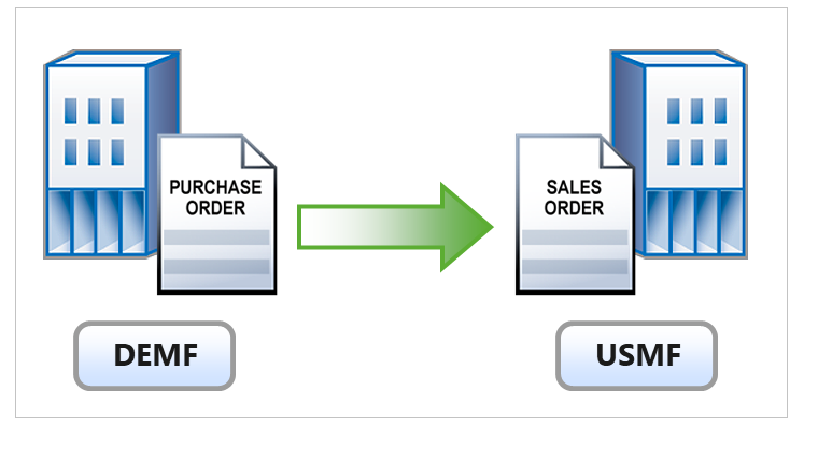

In the example above, DEMF acts as the selling company. They need to buy goods to fulfill their customers' demands. USMF is the company from which DEMF purchases those goods. This concept is modeled in the intercompany relationship as USMF selling to DEMF, and DEMF buying from USMF.

In the intercompany relationship in Supply Chain Management, USMF is the selling company.

When DEMF creates a purchase order and the vendor is USMF, a purchase order-initiated intercompany sales order is created automatically in USMF.

When USMF creates a sales order and the customer is DEMF, a sales order-initiated Intercompany purchase order is created automatically in USMF.

DEMF creates a purchase order because they have demand from their customers. Therefore, DEMF is the actual selling company who sells to external customers. However, DEMF needs to procure the goods to sell and deliver externally from USMF.

Therefore, DEMF is a selling company for their external customers. Through Intercompany trade, DEMF will procure from USMF so that USMF will be selling to DEMF.

In business relations, such as intercompany trade, the trading partners must find a common base for their company data. The two legal entities in the Intercompany relationship must set up a common language to communicate with each other and to ensure that data is shared consistently between the legal entities.

To set up a common language, you must set up intercompany value-mapping parameters. Intercompany value-mapping allows different legal entities to logically share master data to support Intercompany processes.

Value-mapping is required for data that is not shared. Products are shared; therefore, value-mapping is not required. However, other information, like modes of delivery, are not shared, hence value mapping is required.

After value-mapping has been set up for the data that is not shared, it can be synchronized between legal entities.

Managing shared data is integral in the processes that involve Intercompany transactions. This shared data is synchronized between Intercompany sales orders and Intercompany purchase orders.

In an intercompany chain, certain information must be transferred, for example, the customer information or prices and discounts.

You can also determine whether the customer, vendor, or both in the intercompany chain can update prices and discounts.

Intercompany goods in transit

Products that have been dispatched from a legal entity's shipping location, but have not yet arrived at the delivery location, can be traced through intercompany reporting.

Intercompany reports are based on the following assumptions:

Goods in transit are owned by the buying company.

Only packing slips on the shipping side can issue in transit.

Order lines that are return transactions are excluded. This means that sales order lines and purchase order lines with negative quantities do not count as in transit.

Only product receipts can deduct in transit.

The Inventory management > Inquiries and reports > Inventory value reports > Intercompany goods in transit totals report displays a period beginning balance, period ending balance, and net change within period.

The balances and net change will be grouped by vendor, which allows users to manually enter general ledger data entry directly from the report totals. The report also displays inventory value, liability, and variance to standard cost.

The Inventory management > Inquiries and reports > Inventory value reports > Intercompany goods in transit transactions report displays all shipments and receipts from in transit in a given period. The report shows calculated inventory value, liability, and variance to standard cost. You can reconcile each report total.

Intercompany billing and payments

After intercompany orders are processed, you can use intercompany accounting, accessed through General ledger > Posting set up for subsidiaries or branch offices. With intercompany accounting, you can create a single entry that posts to multiple companies.

Supply Chain Management provides features that help you set up intercompany financial accounts that can be used with intercompany orders. Intercompany accounting provides ledger transactions for companies that transact with one another, including the appropriate due to and due from transactions.

For more information regarding intercompany accounting, refer to Intercompany accounting in Dynamics 365 Finance.