Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

- Go to Accounts receivable > Sales orders > All sales orders.

- Create a sales order, and define value-added tax (VAT) tax groups.

- Select the record, and then select Tax information.

- In the Tax information field, select a value that has a Tax Identification Number (TIN) associated with it.

- Select the GST FastTab.

- Select the Customer tax information FastTab.

- Select OK.

- On the Action Pane, on the Sell tab, in the Tax group, select Sales tax.

- Select Close.

Post the invoice

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Quantity field, select All.

- Select OK, and then select Yes to acknowledge the warning message that you receive.

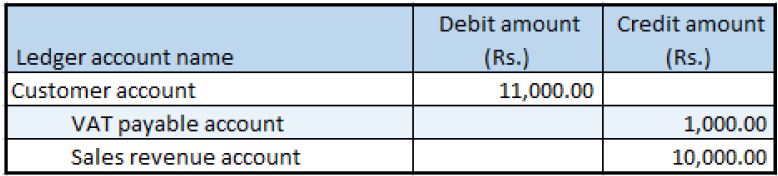

Validate the voucher

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

- Select Voucher.